A Time for International Small Cap Stocks to Shine Again?

Small caps have enjoyed a structural size premium (Chart 1 and Chart 2). Moreover, we have long maintained that high active share strategies are best deployed in less efficient market segments such as…

The Xponance® Point of View: ESG and COVID-19

Our employee-owned firm, Xponance®, is led by an experienced team of women and diverse professionals with a shared passion to act in good conscience for our clients, communities and each other. As part of this mission, we take environmental, social and governance (ESG) issues seriously.

Small Cap Core

Small Cap Core Q2 2025 | June 30, 2025 Read PDF Version Read Commentary Annualized Returns (%) QTD YTD 1 Year 3 Years 5 Years 7 Years 10 Years Since Inception1 Gross of fees 7.80 3.77 11.21 11.81 14.39 8.57 9.02 9.21 Net of fees 7.62 3.48 10.64 11.21 13.73 7.97...Protected: Emerging Markets Webinar Series

Password Protected

To view this protected post, enter the password below:

U.S. Fixed Income: Q1 2020 Update

As we ponder what has transpired since the beginning of 2020, and as we look back at the first quarter, we are struck by a plethora of thoughts given the monumental difference between how the year began and the quarter ended. To begin, the economic situation in which we find ourselves is…

Systematic Global Equities: Q1 2020 Update

The new decade of 2020 began in an unprecedented way. There were two distinct phases to the first quarter of the year. The first was characterized by an equity market surging to all-time highs despite concerns about a manufacturing slowdown, geopolitical tensions, and US political uncertainty.

Q2 2020 Market Outlook: Global Financial Markets are on Policy-Induced Life Support – What’s Next?

Widespread social distancing has been akin to emergency sedation of global economic activity while the extensive fiscal and monetary stimulus has provided life support.

The Role for Credit In Short Duration Portfolios

Topic Overview This short piece describes our analysis of historical return patterns for short duration fixed income assets and an assessment of the benefits and drawbacks of investing with an inherent bias towards spread products over a range of market cycles....

FIS Group Rebrands to Xponance®

PHILADELPHIA, PA – FIS Group and its wholly owned subsidiary, Piedmont Investment Advisors, announced today that, effective April 1, 2020, they are rebranding into a newly formed combined corporate entity, Xponance®. The company has $9.5 billion* in assets under management, remains 100% employee owned, and maintains the existing ownership structure…

What’s Driving ESG Returns – A Look Under the Hood

Interest in environmental, social, and governance oriented investing, or ESG investing has increased substantially in the past few years. More and more asset owners and asset managers are embracing the idea of focusing on investments with better ESG profiles and this...Webinar

COVID-19 Is a Stress Test Exposing Structural Hurdles in Both Our Financial System and Society

We are in strange and scary times. We are at war with a virus which is all the more deadly in that it cannot be easily discerned but it is metastasizing geometrically. Moreover, COVID-19 and the measures required to contain…

Tracy Cao

Tracy Cao, CFA* Vice PresidentTeam Lead Manager Research, Multi-Manager Strategies Tracy Cao is Vice President, Team Lead for Manager Research, Multi-Manager Strategies at Xponance and joined the firm in 2013. In this capacity, Tracy identifies and evaluates...Omaar Poitevien

Omaar Poitevien Lead Manager Operations Research Specialist Omaar Poitevien is Lead Manager Operations Research Specialist for Xponance’s multi-manager solutions business. He reports jointly to the Director of Portfolio Operations and Reporting and the Senior...

The Sweet Spot in the US Equity Markets – Part 3

In the last post in this series, we update and expand on our analysis to explore the impact of rising and falling interest rates on the performance of various capitalization tranches. Finally, we now look at the performance of the “Sweet Spot” in different interest rate regimes.

Adam Choppin

Adam Choppin, CFA*, APFI Assistant Portfolio Manager, Multi-Manager Strategies Adam Choppin is Vice President and Assistant Portfolio Manager, Multi-Manager Strategies at Xponance®. Adam joined the firm in May 2013 and he is the Assistant Portfolio Manager for...X Test Areas

Think Globally, Invest Locally Regional Emerging Markets Fund allows investors access to institutional quality investment managers domiciled in the region of their investment focus Offers clients greater diversification and minimal overlap relative to large emerging...

Will U.S. Equities Continue to Trounce Non-U.S. Equities?

For global equity investors, the decade ending on December 31, 2019 was undoubtedly the American decade. The performance of U.S. equities more than doubled and in many cases tripled other countries and regions such as emerging markets…

2020 Outlook for Emerging and Frontier Markets

While the U.S. continued its decade-long run, surging ahead another +31% in 2019 to lead all major developed markets (except Switzerland, +32.5%), three emerging markets did even better last year. Taiwan gained +36% as investors reevaluated the “moat” of its market champion, …

Microbes, Markets, and the Dragon

The coronavirus outbreak in China, named COVID-19 by WHO, is understandably dominating news coverage and depressing Chinese risk plays. Since 12/9/2019 when the first coronavirus case was announced from the City of Wuhan, confirmed cases have risen rapidly to over 40,000 as of this report.

The Sweet Spot in the US Equity Markets – Part 2

In our previous post, we sought to identify and quantify the investment opportunity or edge within various market capitalization segments. We found that the top 1000 names in the Russell 2500 benchmark constitute a sweet spot across the entire Russell 3000.

Impacts of a Rejuvenating Workforce

As the secular bull market in long term treasury bonds approaches its 40th year, the consensus around falling interest rates has morphed from a shared opinion to an accepted reality. Reputations and fortunes have been made and lost by adherents and skeptics respectively.

Contact Us

Get In Touch Email Us General Inquiries info@xponance.com Client Services ClientServices@xponance.com Careers Careers@xponance.com Media Inquiries PR@xponance.com Manager Research ManagerResearch@xponance.com Follow Us FollowFollowFollow Contact Us Inquiry...

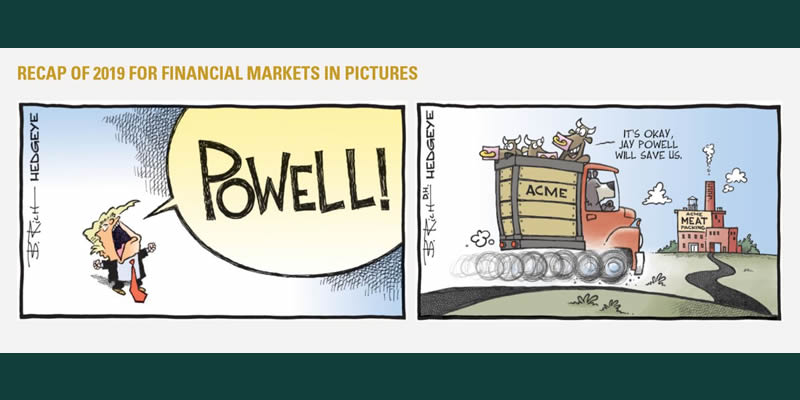

MARKET OUTLOOK Q1 2020: Saved by Jerome: A Second Wind for the Late Cycle Rally

During the second half of 2019, the late cycle bull market for financial risk assets sprinted to the finish line despite lackluster global growth. Global markets ended the year on a bullish note, with the U.S. S&P 500 climbing to another record close.