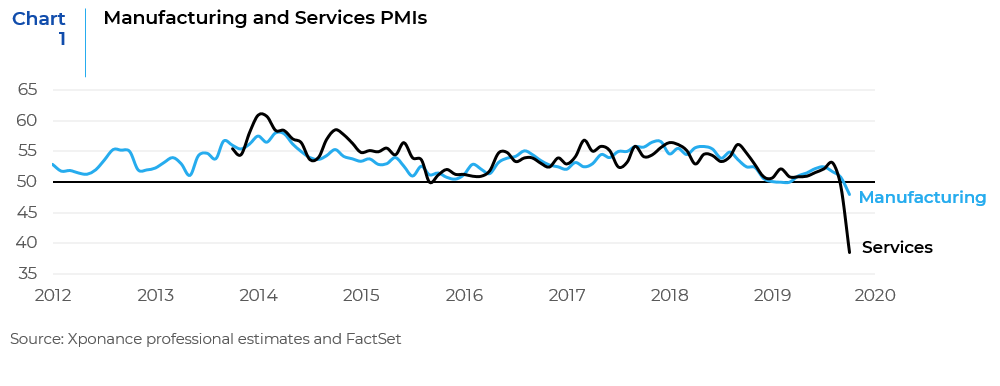

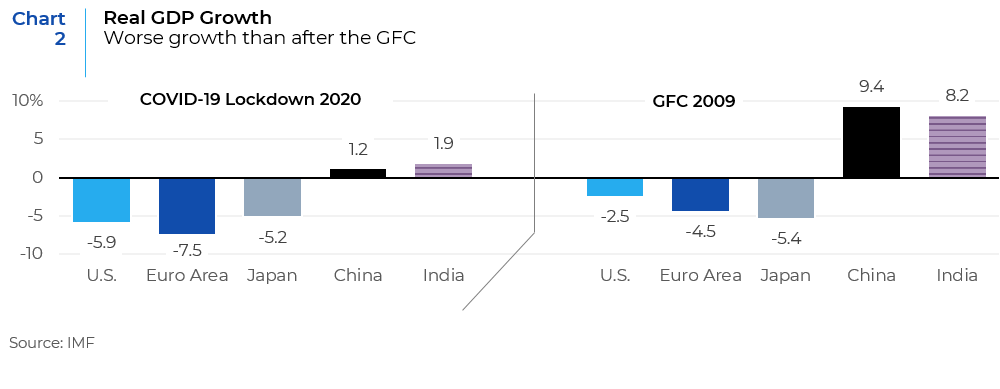

Widespread social distancing has been akin to emergency sedation of global economic activity while the extensive fiscal and monetary stimulus has provided life support. In March, the global services PMI dropped to its lowest level on record (Chart 1). Moreover, March’s 5.4% m/m plunge in U.S. industrial production represented the sharpest monthly fall since 1946, portending a significant downturn in the manufacturing sector as well. Recent IMF forecasts project a 3% contraction in global GDP in 2020, which is a much deeper and more widespread contraction than the 0.1% recorded in the wake of the Great Financial Crisis (GFC) (Chart 2).

The IMF predicts that the global recession will be so severe that the global output gap will remain deeply negative until at least 2022, despite a sharp economic rebound of 5.8% in 2021. This implies that inflation will stay muted; giving policy space for monetary authorities to continue to support global financial markets. However, unlike the GFC when financial seizure and its associated liquidity strains were the primary issues; this year’s market seizures were mere symptoms of the underlying concern over the global pandemic, whose mitigation is exacerbating solvency risks. Despite unprecedented fiscal and monetary policy support, we could still face nasty second-round effects. Therefore, the key risks facing investors are both the success of the virus’ containment and whether massive fiscal measures can allay a solvency crisis.

We recommend portfolio strategies that embed optionality with overweights to defensive growth sectors for equity portfolios and for bond portfolios, investment grade credit that are being back-stopped by monetary authorities. For asset allocators that can withstand intermediate term volatility, value and small cap stocks, as well emerging markets are likely beneficiaries once markets establish a bottom and a recovery ensues.

Many patients whose illness requires forced and prolonged intubation face life changing consequences. We believe that the long-term implications of both COVID-19 and measures to contain it will change the world at least as profoundly as did the 1970s inflation, 9/11, and the GFC; and will discuss them in a forthcoming paper.

Global Equities fared relatively better than corporate credit risk

Despite a much worse economic environment, at quarter end, global equities have fallen by less than one-half of their slide during the last two recessions (-23% vs. -50% to -60%), and valuations (particularly in the U.S.) are also less compelling. For example, the S&P 500 index trades at 17.3-forward earnings, which is above its October 2007 level at the peak of the bull market preceding the GFC. Moreover, today’s forward P/E ratio is based on stale earnings estimates, which will come down over the coming weeks. While we are early in the earnings reporting season, overall S&P 500 companies Q1 earnings growth has been slashed from 4.4% coming into the year, to -5.4% vs. Q1 last year.

Fixed income markets were pricing in widespread solvency and liquidity risks in early March. Solvency fears have diminished but remain prevalent across a wide swath of sectors, not least because of the widespread increase in leverage across corporate America over the past decade. March 2020 investment grade credit returns relative to similar duration U.S. treasury bond were the worst on record since their inception in roughly 1997. In addition, high Yield bonds posted negative excess returns that were only eclipsed by October 2008.

Going forward, volatility will remain high, sentiment fragile with financial markets driven more likely by the medium-term outlook for economic reopening, rather than Q1 growth and earnings. We expect markets to follow a 3-phase roadmap – (1) the initial decline which peaked on February 19th, 2020; (2) the rebound that we are currently undergoing since March 23rd, 2020 as a result of massive monetary and fiscal stimulus; and lastly (3) a slow drift and increased volatility that will usher in an eventual bottom before markets recover and gradually climb back to their pre-crash levels. This roadmap and the length of the second and third phases will be dependent on the duration and direction of the COVID-19 crisis. If the containment measures prove successful by the summer, the global economy will be awash with much stimulus, which will be fertile ground for pro-cyclical risk assets. However, if we receive indications of a more malignant outcome, we could retest March lows as the risk of a full-blown solvency crisis is realized. The recent relapses in Singapore and Hong Kong—which, until now, had been the “gold standards” of virus containment—illustrate how hard it is to sustainably suppress case growth. There are likely to be challenges, false starts, and adjustments, even when containment is executed well. While testing ability in major Western economies is up, we don’t see most countries following anything nearly as robust as we have seen in Asia. In many countries, reopenings may take place followed by a resurgence of cases. The major emerging economies are even further behind: testing is nonexistent, and reported deaths suggest that the outbreak is still spiraling.

In the interim, optionality will be key to portfolio construction. If history is any guide, we will first need to see a peak in infected cases globally before we can call a true bottom in risk assets. While global equity risk premiums suggest that stocks provide a better risk/reward payoff than bonds, in long equity portfolios, we recommend a “minimum volatility” strategy, which overweights the low-beta U.S. market, and sectors that will likely continue to weather near term volatility or that can benefit from changing consumption patterns as households undergo social distancing, such as Consumer Staples, Health Care, and Technology. Within bond portfolios, Investment Grade credit, given the Fed’s backstop of U.S. investment grade corporate bonds with maturities of less than five years, provide better value than government bonds. We believe that value remains in sectors that will survive and even thrive as the recovery takes hold. Credit spread dispersion has recovered from the March highs, but remains elevated relative to most historical observations, providing an opportunity to differentiate between the winners and losers. In short, fundamental analysis should begin to matter again, rewarding companies with prudent balance sheets, strong management teams, and solid growth prospects. In tactical portfolios, cash and gold remain useful hedges against further market turbulence.

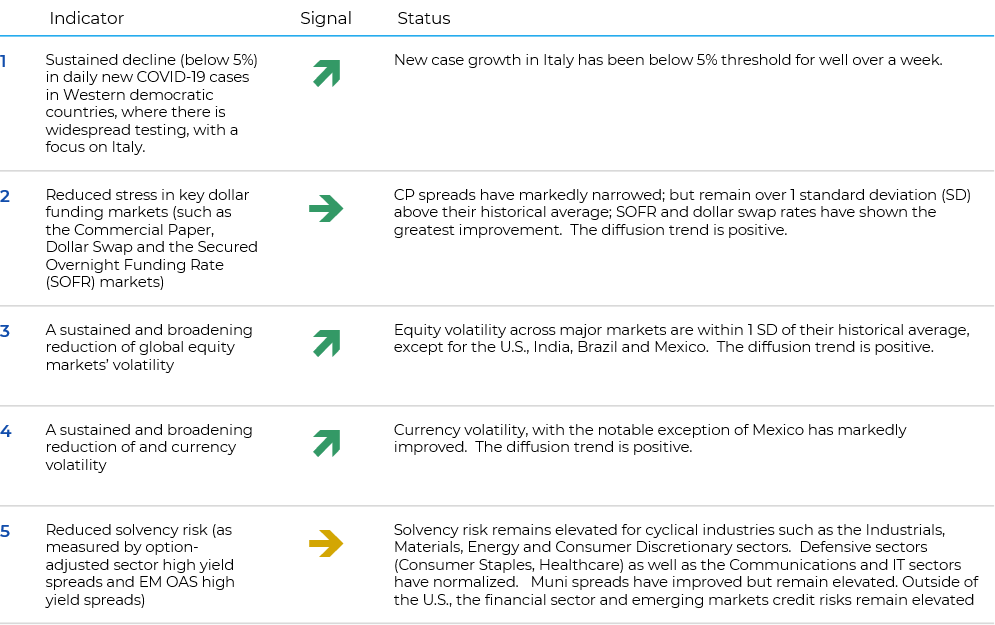

In Mid-March we developed a dashboard to identify turning points in the systemic environment for risk assets (which was introduced in our March 20 note). For each indicator, we evaluate the daily prints relative to their historical averages and then gauge the trend of multiple data points (using diffusion indexes). As of April 15, 2019, the key indicators and their status are:

The first four indicators have been improving since March 30th, suggesting that the vast array of monetary and fiscal measures around the world have successfully reduced systemic risks in financial markets. Given the severity of the recession, central banks are likely to maintain accommodative monetary policies for the foreseeable future. Markets will remain flush with liquidity for an extended period; which should continue to depress risk premia and prop up risk assets performance.

However, the fifth indicator appropriately cautions investors that solvency risk remains elevated for cyclical industries within the Industrials, Financials, Materials, Energy and Consumer Discretionary sectors and outside of the U.S., the Financial sector and emerging markets credit. While the U.S. financial sector and household’s balance sheets are in better shape than in early 2009, non-financial corporate debt and default risks are materially higher. With interest rates across the curve near or below zero and diminishing benefits to quantitative easing when asset prices are not historically depressed, monetary policy measures are reaching their limit. This time around, financial seizure and its associated liquidity strains are a symptom, not the primary problem. The primary societal issue is an exogenous health care crisis whose mitigation is exacerbating solvency risks. Moreover, despite unprecedented monetary and fiscal policy support, we could still face nasty second-round effects. For example, while the litany of Federal Reserve programs are large in scope, they are not unlimited and there are limitations by security type and per issuer. Some sectors continue to trade at distressed or even recovery values (primarily those that are dependent on foot traffic including travel, leisure, hospitality, consumer discretionary, etc.).This includes securities and issuers that remain investment grade. The oil price collapse has further depressed those fixed income sectors that derive earnings from the oil patch, whether directly or indirectly. In Europe, the banking sector remains poorly capitalized with high non-performing debt levels left over from the last recession and will likely be hit by a new wave of bankruptcies. We would argue, and this is evident in the large number of announced distressed credit fund launches, that there is likely another leg down for risky assets as economic damage translates to their income statements and balance sheets.

For long term allocators that can withstand significant near-term volatility, markets like this provide an opportunity to identify assets that are trading at deep discounts relative to both their own history, and/or are trading at discounts that are not coordinate with their risk of insolvency. Small cap stocks and Value stocks are two such candidates that are worth considering. Value stocks, whose fourth quarter 2019 cyclical rally was cut short by COVID 19, are trading at historically steep discounts that are now in uncharted territory at a level that exceed the depths of the Internet bubble period (Chart 3). The performance advantage of large cap stocks relative to small cap stocks are just shy of their mid to late 1990s extremes (Chart 4).

In the U.S., Value stocks could also become a good candidate for outperformance once economic reopening occurs because their significant exposure to the financial sector should benefit from pent-up consumer demand in a low interest rate environment. However sustained outperformance over Growth stocks would await a more durable pickup in cyclical growth and inflation. Financial sector stocks have understandably been severely punished by a flattening yield curve, concerns over higher net charge-offs in their C&I loan books, as well the substantial income shock to households due to surging unemployment and stalling wages. However, massive stimulus measures to mitigate the fallout from COVID-19 have already steepened the yield curve and over time, are likely to blunt the income shock. Unlike their European peers, U.S. banks are relatively well provisioned. Relative to the aftermath of the GFC, U.S. households’ financial obligation ratio are at historic lows, and therefore are less likely to suffer a long wave of financial weakness, especially as government support is growing increasingly generous. While banks that are heavily dependent on earnings from their C&I loan books remain an open question, their retail book should be more resilient as households become more capable of taking advantage of low interest rates.

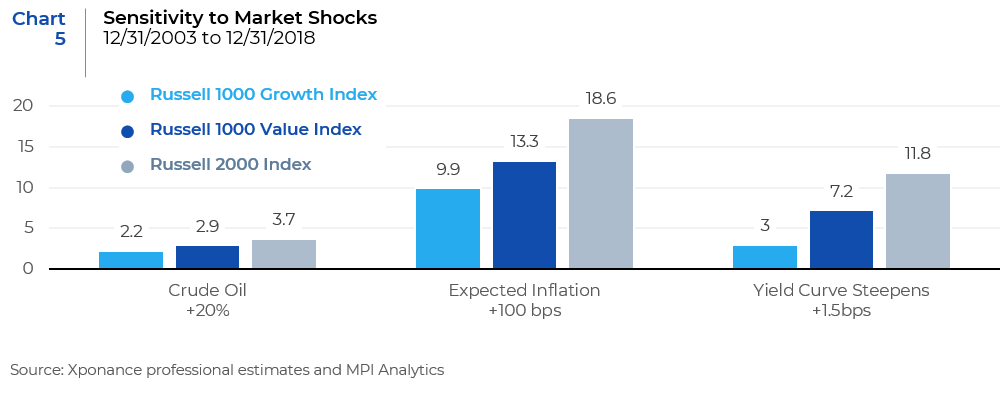

The second more long-term reason is that both small cap and value stocks tend to outperform during periods of rising inflation and/or stagflation (Chart 5). These relationships were evaluated in our previous study last year. The obvious and significant headwind to their outperformance is therefore that the greater intermediate term risk is deflation, not inflation, due to spare capacity created by the global recession. However, history suggests that over the long term, the combination of massive fiscal deficits to mitigate the economic fallout from COVID-19 combined with the likely monetization of the resultant debt levels by central banks would catalyze a high inflation regime. Moreover, globalization, which was already in decline pre COVID-19, will likely attract added skepticism as supply-chain interruptions caused by factory shutdowns in China will reinforce the view that shifting production to cheaper-cost countries overseas went too far. I.T., dominated Growth stocks, have been most advantaged by globalization and should be most impaired by its remission. Since globalization has been a major force behind disinflation as production shifted to low-cost producers, its decline will remove another impediment to high inflation. As in the 1970’s, aggregate demand will likely be anemic – this time due to demographics, which will constrain growth, and to some extent inflation, relative to 1970s levels. But we could easily face a new normal of anemic growth and robust inflation.

Emerging markets (EM) assets as well as industrial sectors and commodities are also likely beneficiaries of a reopening of the global economy. Cyclical sectors and EM have historically benefited from marked increases in China’s credit and fiscal impulse. In March, China’s total social financing surged to CNY5150 billion from CNY855.4 billion, and new loans jumped to CNY2850 billion from CNY905.7 billion. Financial institutions in China have also increased their transactions in the interbank market by 70%, which often precedes accelerations in lending to the real economy. Moreover, the effective exchange rate for EM now trades two sigmas below its long-term historical mean. In previous cycles, no matter how severe the downturn, this kind of undervaluation represented a buying opportunity. We have also observed that in many emerging markets such as China, India, Taiwan, Russia, and Vietnam (among others), local investors were net buyers, while outflows have been driven primarily by foreign liquidations. Should foreigners stay on the sidelines of EM risk assets, this market dislocation may hasten the broad trend of increasing local investor predominance in emerging markets, and thus a changing of the guard for increased intra-EM dispersions and market leadership. Should foreign investors maintain their pre-COVID-19 targets to EM, then their return would fuel a powerful rally. However, as with Value stocks, both EM and cyclical stocks could face significant near-term headwinds from elevated solvency risks. EM borrowers could struggle to service their almost $4 trillion of foreign-currency debt due to the rise in the dollar and wider credit spreads. This is why EM investments are best implemented through active management strategies that can navigate solvency and other risks.

Important Disclosures: This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.