Systematic

Global

Equities

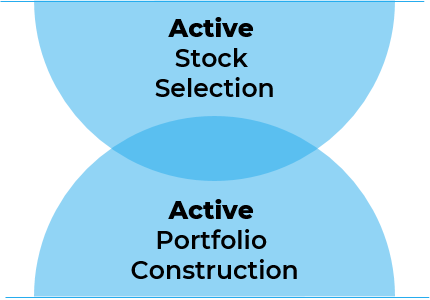

Active Strategies use disciplined stock selection and portfolio construction methods for generating alpha.

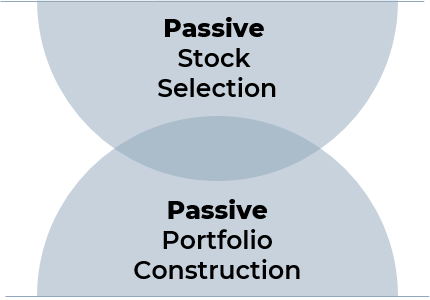

Passive Strategies offer exposure to market beta through index replication.

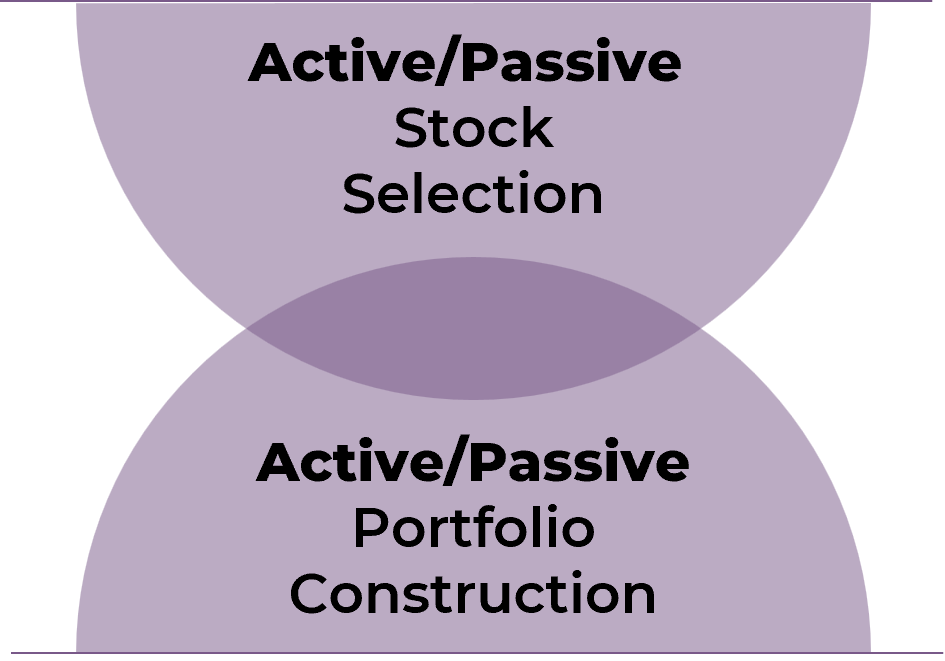

Customized Equity Strategies offer clients the ability to express their values in their portfolios in a direct and transparent manner

Active

Investing

Quantitative Stock Selection

Risk Aware Portfolio Construction

Passive

Investing

Index

Replication

Variance

Minimization

Customized Investing

Customized

Factor Selection

Intentional

Portfolio Tilts

Systematic Global Equity Strategies

Active Strategies

Passive Strategies

Index Replication Strategies