The coronavirus outbreak in China, named COVID-19 by WHO, is understandably dominating news coverage and depressing Chinese risk plays. Since 12/9/2019 when the first coronavirus case was announced from the City of Wuhan, confirmed cases have risen rapidly to over 40,000 as of this report. The outbreak exploded shortly ahead of the Chinese New Year holiday; further expediting its rapid dissemination in China. The mayor of Wuhan announced that approximately 5 million people left Wuhan during the holiday period before the government blocked the city on 1/24; and soon after, infected cases were confirmed across the country, even abroad. Categorized in the same virus group as SARS in 2003, the coronavirus is already predicted to be more contagious but less severe than the SARS epidemic.

Over the past few weeks, our analysts contacted our local Chinese managers and relationships based in tier 1-3 cities. They observed that regular business activities across the country have been essentially shut down. One of the often-repeated phrases heard over the past few weeks in China are “staying at home is your best contribution to the society”. Indeed, life outside the home has come to a virtual standstill. All kinds of public events, outdoor activities and regular community engagements have been furloughed. Huge portions of the transportation system and most tourism are suspended. Restaurants, movie theaters, commercial education institutions, and department shopping centers are all closed. This is happening not just in the severely affected cities, but all over the country. Even in Dalian, a Northern city among the least affected, streets are empty (Picture 1). Restaurants are selling raw food materials on the street as this was supposed to be their busiest season of the year (Picture 2). People are even reluctant to purchase groceries as they are trying to avoid all physical contact with the outside; even to the point of being afraid to make contact with mail packages for fear of contracting the virus.

Over the past few weeks, our analysts contacted our local Chinese managers and relationships based in tier 1-3 cities. They observed that regular business activities across the country have been essentially shut down. One of the often-repeated phrases heard over the past few weeks in China are “staying at home is your best contribution to the society”. Indeed, life outside the home has come to a virtual standstill. All kinds of public events, outdoor activities and regular community engagements have been furloughed. Huge portions of the transportation system and most tourism are suspended. Restaurants, movie theaters, commercial education institutions, and department shopping centers are all closed. This is happening not just in the severely affected cities, but all over the country. Even in Dalian, a Northern city among the least affected, streets are empty (Picture 1). Restaurants are selling raw food materials on the street as this was supposed to be their busiest season of the year (Picture 2). People are even reluctant to purchase groceries as they are trying to avoid all physical contact with the outside; even to the point of being afraid to make contact with mail packages for fear of contracting the virus.

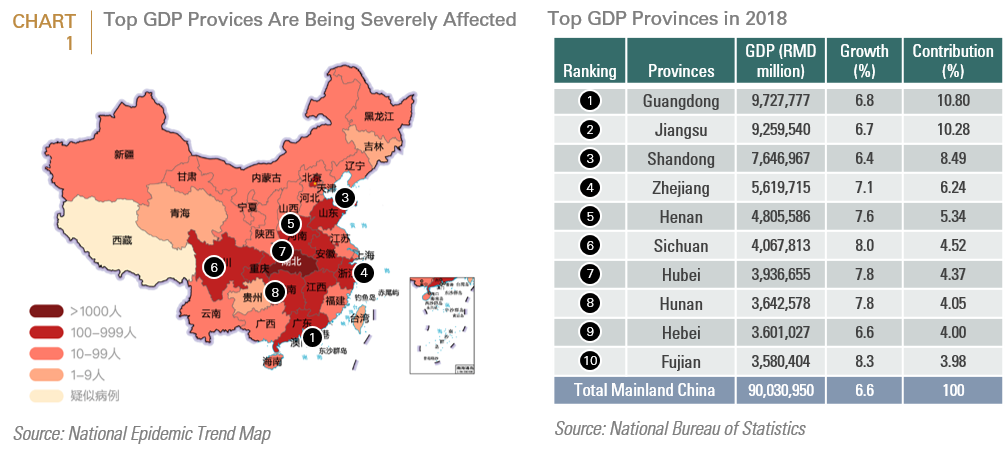

Industrial manufacturing and fixed-assets investment will unavoidably slide. Eight out of the top ten GDP provinces (in 2018) are being severely affected by the coronavirus, and most are major industrial bases, such as Hubei, Guangdong, and Henan (Chart 1).

Investment Implications

The coronavirus outbreak will yield meaningful near-term headwinds to the Chinese economy, which will be reflected in the Q1 and Q2 statistics. As of this report, the number of confirmed cases is over 5 times of SARS, with the peak not even coming yet. Even if the coronovirus outbreak follows the SARS trajectory and comes under control by the summer, its impact would be expected to be 6 to 8 times that of SARS. In the early 2000s China was growing at a faster pace, and its economy quickly recovered in the 2nd half of 2003 after SARS was controlled. Today, China’s economy is already facing headwinds with thousands of private companies lacking the ability to withstand a prolonged economic downturn. This outbreak will undoubtedly further undermine business earnings due to declining consumer demand and increasing labor disruptions. The Chinese government has already lowered its 7-day reverse repo rate by 10 bps and is set to further cut rates and lower taxes, particularly for small, private businesses. However, the government’s policy imperative to control debt growth is likely to yield a more muted response than in 2003.

Moreover, China is a much more significant player and is more deeply integrated into global commerce than it was in 2002. Today China’s GDP accounts for nearly 20% of world GDP, compared to 8% in 2002.Therefore, a protracted industrial shutdown would be more severe. Additionally, unlike the early 2000s, the bull market in equities today is more mature and therefore more vulnerable to negative exogenous catalysts that can meaningfully impact GDP and earnings. While we continue to expect a global cyclical recovery, the coronavirus outbreak is likely to lead to continued short term volatility. Investors are therefore well advised to employ hedging strategies through options or in our case, significant overweights in precious metals such as gold and silver.

Important Disclosures:

This report is neither an offer to sell nor a solicitation to invest in any product offered by FIS Group, Inc. and should not be considered as investment advice. This report was prepared for clients and prospective clients of FIS Group and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to FIS Group and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which FIS Group believes to be reliable, FIS Group does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from FIS Group upon request.

All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.