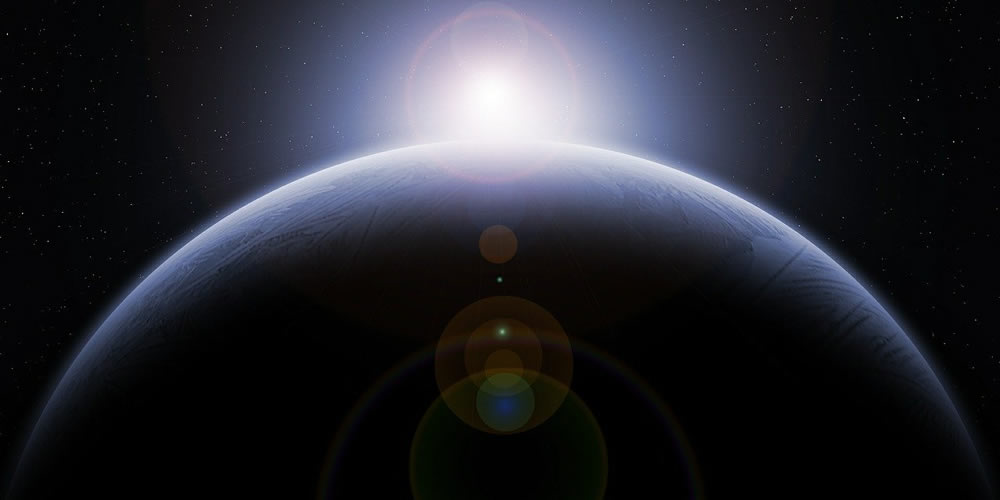

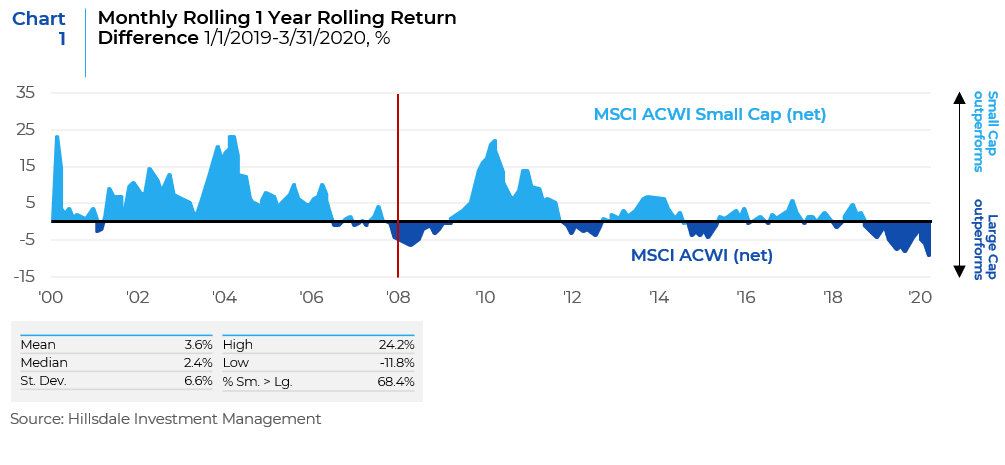

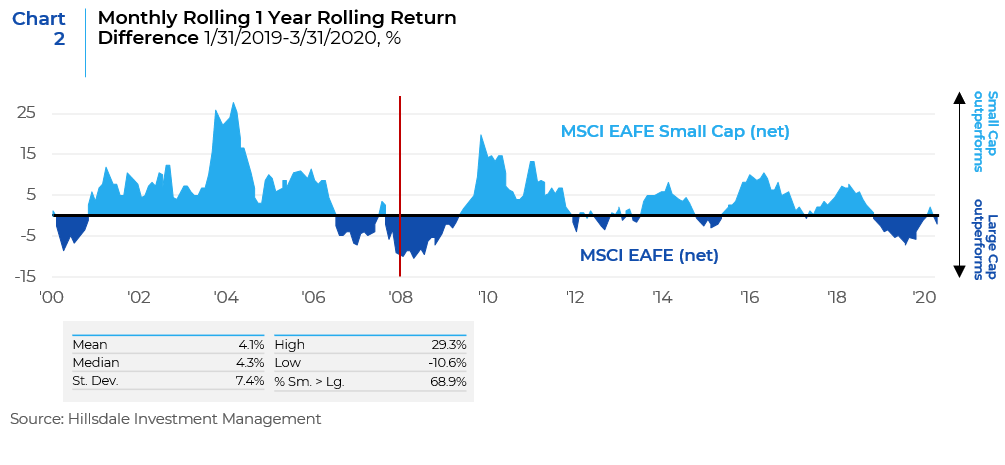

- Small caps have enjoyed a structural size premium (Chart 1 and Chart 2). Moreover, we have long maintained that high active share strategies are best deployed in less efficient market segments such as global small cap stocks, which are not as widely covered as large cap stocks by research analysts. One way of measuring the opportunity for stock selection is through stock return dispersion, which currently is at a secular high (Chart 3).

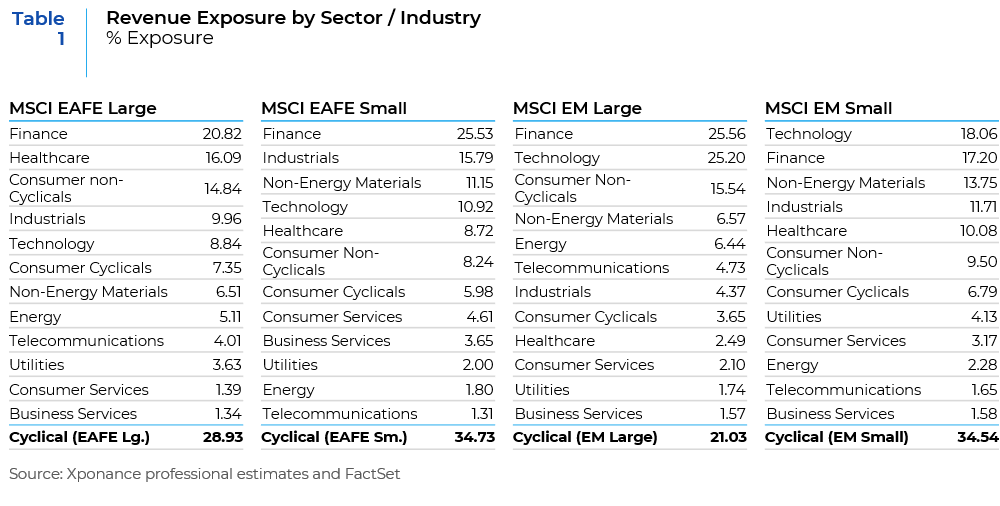

- International small cap stocks’ greater exposure to cyclical sectors (Table 1), has historically boosted their performance during post-recession, early cycle rallies, whereas large cap international stocks typically outperform in late expansion markets, such as mid-2007 to mid-2008 during the GFC, and from early 2018 until now. In light of the extraordinary global policy support to combat the economic fallout from COVID-19, small cap stocks should therefore disproportionately benefit from a cyclical rally.

- Small cap stocks are attractively valued. (Chart 4). M&A activity could turbo charge the performance of small cap stocks that tend to be the “targets” and enjoy a bid premium.

- COVID-19’s likely acceleration of de-globalization would be expected to impair mega-cap companies that have most benefitted from global supply chains and customers. Small cap stocks are by their very nature domestic, especially in Europe. European small caps generate 85% of their revenues domestically vs. 30% for the region’s large cap names.

- However, both solvency and deflationary concerns associated with COVID-19 uncertainty could undermine a durable rally in global small cap stocks in the near-to-medium term future. Cyclical stocks have underperformed defensive equities by their greatest extent since the great recession of 2008. A key driver of their underperformance has been the expanding deflationary fears engulfing the global economy. With rates already at rock bottom levels, it is unclear whether households will ramp up discretionary spending activity, even if their incomes have been sustained by fiscal support. In China and other countries that are ahead of the US in containing the virus, lingering concerns about public health risks have significantly limited households’ desire to restart spending again as consumers remain concerned about catching COVID-19, and apprehensive about their incomes.

- Bottom line — Global small caps (and value stocks) are poised to benefit from powerful cyclical and secular tail winds. The current level of stock dispersion among global small caps relative to large caps suggests an even greater alpha opportunity for active managers. However lingering deflation and solvency risks could lead to nasty air pockets in the near to medium term.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.