Topic Overview

This short piece describes our analysis of historical return patterns for short duration fixed income assets and an assessment of the benefits and drawbacks of investing with an inherent bias towards spread products over a range of market cycles.

Background

Typical short duration benchmarks largely consist of US Treasuries and Agencies, corporate and sovereign bonds, and a much smaller allocation to sectors like asset-backed securities. Treasuries dominate the short indices more so than in intermediate or longer-term indices. Whereas the broad bond market has exposure to a broader array of sectors, largely as a function of longer or shifting duration profiles in more esoteric asset classes like CMBS and RMBS, the intermediate to short duration benchmarks are much less varied. The heavy Treasury exposure is largely a function of the short tenor maturity schedule the US Treasury favors when issuing debt. As a result, short duration benchmarks have a majority of exposure to Treasuries and this exposure has decreased and more recently increased given the debt binge of the US Government.

Hypothesis

Whereas a typical core portfolio will use Treasuries as a duration anchor, when viewed through a short duration prism, Treasuries could be used to play defense while using credit investments as an effective offensive position and diversifying addition to the portfolio.

Analysis

Basic bond math suggests that the much lower rates in a normally shaped yield curve environment make Treasury yields unattractive relative to the alternatives. The inherent yield advantage of spread product in short duration instruments lead to very high spread breakevens (i.e. the spread widening that would have to occur to underperform an equivalent-duration Treasury). Again, this implies a more persistent overweight to credit than might be the case in a different yield curve setting.

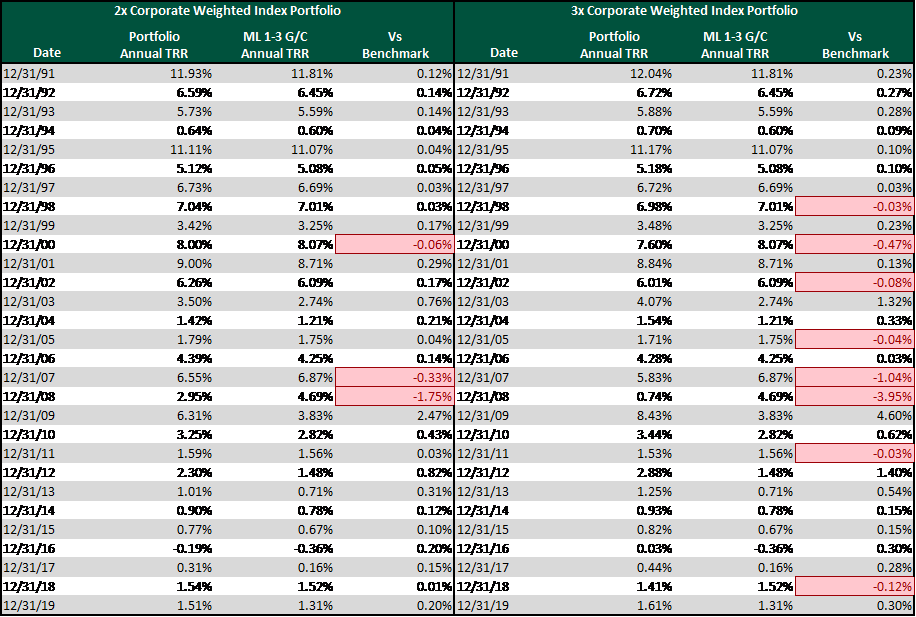

To test this thesis in varied market environments, we constructed a back-test using data spread over multiple market cycles. To do this, we broke down the BAML 1-3 Year Government/Credit index into its constituent parts in order to reconstitute it in a way that reflects various styles and biases. We chose this index because it is often used to benchmark short duration accounts and its fairly simplistic structure allows for uncomplicated analysis of the constituent parts.

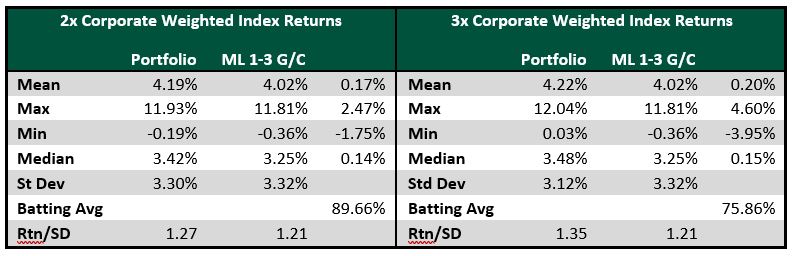

We chose two standard credit overweight strategies, 2x and 3x overweight (relative to the underlying composition of the BAML 1-3 G/C), with the Treasury portion of the hypothetical portfolio reduced in equal amount to the corporate market value overweight. For the purposes of the simulation, we held US Agencies and Sovereigns static. The study period goes back to 1991 and now also looked at a 1-3 Year Treasury only portfolio relative to the broader benchmark, to test our hypothesis that a Treasury only portfolio is an unattractive alter- native.extends to year-end 2019. We shown by their return/standard deviation. Both batting averages (89% 2x and 76% 3x overweight) supports this thesis as well. The major drawback to investing this way is the potential for fairly significant underperformance during extended downturns for corporate credit. That being said, the ability to weather periods of volatility is increased given the ability to hold the assets to maturity. Given the short average life and diminished interest rate risk, one could reasonably assert that book yield is an appropriate context to consider those periods of volatility. Additionally, despite the negative relative performance during these volatile periods, absolute return was positive. We would also note that active credit management and fundamental analysis also helps to dampen volatility, as we discuss in the portfolio construction section.

The ultimate finding of our research was that additional credit exposure can be applied to short duration mandates providing the potential for better results over time than either a broadly indexed strategy or a high-quality but high volatility Treasury only strategy.

Findings

The results confirmed our thesis that the Risk/Return relationship seems favorable when increasing exposure to credit and limiting exposure to Treasuries. As noted above, we also analyzed the BAML 1-3 Treasury index to test the opposite view. While the performance of the ML 1-3 Government/Credit relative to the overweight scenarios implies credit outperforming, the statistics make the case for credit versus Treasuries, with the BAML 1-3 Treasury index posting lower mean return (0.31%) over the study period with a higher standard deviation of returns (at 45%). This makes intuitive sense, given that Treasuries are extremely sensitive to underlying economic data and provide relatively lower income (i.e. lower absolute returns and lower returns per unit of risk over the study period).

Even though the thesis held up overtime, the basic premise of implementing a credit overweight is more nuanced and less absolute (i.e. Treasuries are a useful placeholder depending on market conditions). As noted in the table above, most statistics for each strategy are similar, but the 3x overweight provides greater upside potential with essentially equal return per unit of risk. Both overweight strategies outperformed the index on a risk-adjusted basis as

Summary

The result of this analysis has informed our investment philosophy in the short duration space and added intelligence as to what we might expect from our portfolio during differing market environments. Clearly, this strategy should be tailored to each client’s risk tolerance. The research, however, presents the benefits of advocating for a credit intensive portfolio. Despite the seemingly defensive nature of Treasuries, the asset class actually introduces MORE volatility into the portfolio, while simultaneously providing lower income and total return. While the practical implementation of the strategy will vary based on one’s view of the business cycles and risk premia, and the other major short maturity sectors (Agencies and Sovereigns) come into play, the primary takeaway is that income/spread should win over time. The credit intensive portfolios add significantly more income (the primary component of fixed income return, especially for short duration assets) which not only acts as a buffer against rate moves or spread widening but also allows for advantageous reinvestment during periods of rising rates. When credit modeling, macro-economic analysis and risk modeling are added to the portfolio construction process, downside risk may be curtailed as well.

FOOTNOTE: *Index portfolio is the BAML 1-3 G/C Index with Corporates overweighted 2x the actual Corporate weight of the index, and Treasuries underweighted by the exact amount of the corporate overweight. **Index portfolio is the BAML 1-3 G/C Index with Corporates overweighted 3x the actual Corporate weight of the index, and Treasuries underweighted by the exact amount of the corporate overweight. During any period when the Corporate overweight would drive the Treasury allocation below 0%, the corporate overweight is reduced to keep the Treasury allocation at 0%. Study observations are monthly, and this condition occurred in less than 3.5% (9 months) of observations during the period 12/31/91 to 12/31/19 (324 observations).