by Bin Cheng, Serena Li, Sumali Sanyal, Cameron McLennan | Oct 6, 2023 | Xponance® Insights

The ensemble approach, in a broad sense, refers to combining multiple units (which could be models, methods, or components) to work together to achieve more accurate and reliable outcomes than any individual unit could achieve alone. This is akin to making a decision based on the collective wisdom of a diverse group, rather than relying on a single opinion.

by Marc Poitevien | Sep 5, 2023

Sneha Malakar Junior Quantitative Analyst, U.S. Fixed Income Sneha serves as a Junior Quantitative Analyst in U.S. Fixed Income at Xponance. She is responsible for supporting the portfolio managers with ongoing market surveillance and monitoring weekly economic macro...

by Sumali Sanyal and Cameron McLennan | Aug 29, 2023 | Market Outlooks, Xponance® Insights

In this update we review the results of the most recent Russell 1000 Large Cap Value annual Style Index rebalance that occurred on June 23rd. We also compare the exposures of the Russell 1000 Value index versus the S&P 500 Value index at 06/30/23 and consider the potential impact of factor and sector differences between the indexes on investors targeting large cap value exposure.

by Thomas Quinn | Jul 27, 2023 | Market Outlooks, Xponance® Insights

In a paper entitled Generative AI – Hope, Hubris, or Harrowing, our CIO, Tina Byles Williams, explored the medium to long-term effects of Generative AI on the economy, financial markets, and broader society. The task for investment managers now lies in navigating this promising yet unpredictable future, particularly as the market has priced in substantial premiums for those perceived to be the primary beneficiaries of this emerging technology.

by Charles Curry Jr and Noel McElreath | Jul 19, 2023 | Xponance® Quarterly Reports, Xponance® Insights

As we embark on the second half of 2023, we find a market in conflict. Despite the continued (relative) hawkishness by the Federal Reserve Open Market Committee (FOMC) and its members, most risk assets have continued to perform well.

by Sumali Sanyal and Cameron McLennan | Jul 19, 2023 | Xponance® Quarterly Reports, Xponance® Insights

The second quarter of 2023 saw US equities climb higher powered by large cap growth companies leveraged to the AI (Artificial Intelligence) theme. A pickup in soft-landing expectations seemed to be among the more powerful tailwinds for equity markets.

by Tina Byles Williams | Jun 26, 2023 | Xponance® Insights

Generative Artificial Intelligence (AI) models such as ChatGPT represent a transformative leap in the ability of machines to exhibit human-like behavior and to learn autonomously. AI can now surpass humans in a wide variety of cognitive tasks. Accordingly, a recent paper out of the University of Pennsylvania concluded that large language models could displace at least 10% of work tasks, affecting 80% of the US workforce.

by Adam Choppin | Jun 26, 2023 | Xponance® Insights

Unless you’ve been on an island without cell phone coverage for the past several days (in which case, good for you!) you are certain to have heard of the non-coup, coup attempt in Russia over the weekend.

by Sumali Sanyal and Cameron McLennan | Jun 8, 2023 | Xponance® Insights

Unveiling Insights from Changes in Active Risk Exposure, Sectors, and Companies During the Annual Style Rebalance | The significant surge in index turnover during 2022 prompted an investigation into the underlying catalysts. By examining alterations in active exposure, sector dynamics, and the most notable movements of companies, valuable insights can be gleaned regarding the evolving nature of the index.

by Tina Byles Williams | May 25, 2023 | Xponance® Insights

In a report presented to Congress in 1790, Treasury Secretary Alexander Hamilton described the “punctual performance of contracts”—that is, meeting all financial commitments on time—as a matter of national honor. It was also critical, Hamilton argued, to build confidence in a financial system and a national currency that could underwrite his fledgling country’s industrial development and provide “security against foreign attack”.

by Thomas Quinn | Apr 28, 2023 | Xponance® Quarterly Reports, Xponance® Insights

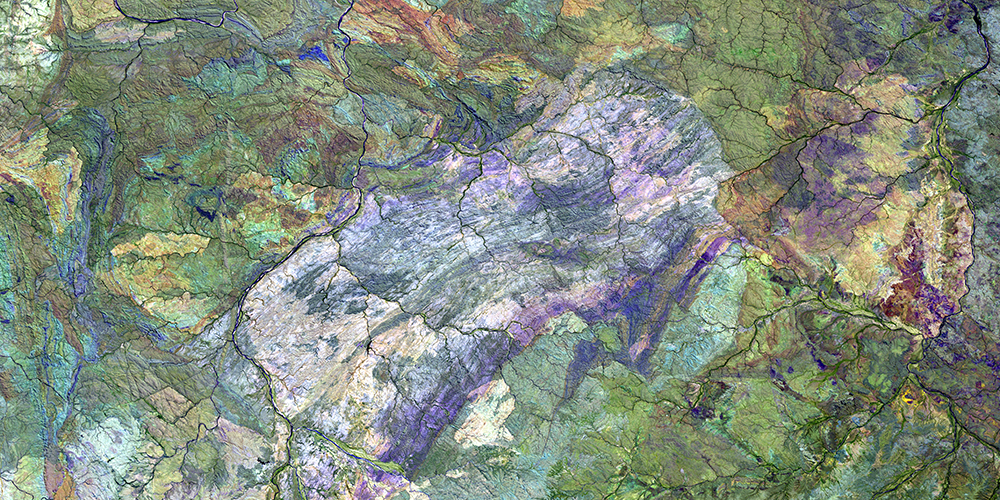

In an ever-evolving investment landscape, the success of active managers extends beyond traditional fundamentals and analyst outlooks. Macro and geopolitical risks have taken center stage, transforming manager evaluation and portfolio construction.

by Adam Choppin | Apr 26, 2023 | Market Outlooks, Xponance® Quarterly Reports, Xponance® Insights

The graveyard of once legendary business franchises has just added one more new member to its ignominious fraternity. The hastily arranged acquisition of Credit Suisse by its chief Swiss rival UBS in March 2023, ended the 166-year run of the global symbol of Swiss banking largesse. Credit Suisse was once the 15th largest bank in the world with offices in 50 countries and assets of over $1 trillion USD.

by Sumali Sanyal and Cameron McLennan | Apr 20, 2023 | Xponance® Quarterly Reports, Xponance® Insights

US equities were generally higher in the first quarter of 2023, but intra-quarter performance was mixed. The S&P 500 gained for a second straight quarter and got off to a strong start with over 6% returns in January, its best January since 2019.

by Charles Curry Jr and Noel McElreath | Apr 20, 2023 | Xponance® Insights

For fixed income markets, volatility remains the recurring theme across fixed income markets. We have discussed this for more than a year, and we are once again left to contemplate volatility around the market direction narrative versus realized volatility in fixed income markets.

by Editor | Mar 17, 2023

James C. Rhee Independent Board Member James Rhee is an acclaimed impact leader, entrepreneur, educator, investor, and goodwill strategist. He transforms people, brands, and organizations by identifying and unleashing purpose through the systemic union of mathematical...

by Marc Poitevien | Mar 2, 2023 | Xponance® Press Release 2023

Press Release Philadelphia, PA – March 2, 2023 – Xponance, Inc., a leading, diverse, and 100% employee-owned multi-strategy investment firm, announced today that Marcy Rappaport has joined the firm as Director of Business Development and Consultant Relations. Marcy is...

by Marc Poitevien | Mar 2, 2023

Marcy Rappaport Director | Business Development & Consultant Relations Marcy Rappaport joined Xponance® in February 2023 and serves as Director, Business Development and Consultant Relations. She is responsible for new business development and managing consultant...

by Jeremy Roman | Feb 1, 2023

Extend Xponance’s long track record of sourcing, supporting and seeding Diverse & Emerging Managers to the private markets. We seek to partner with GPs that manage alternative asset strategies across multiple fund types

by Thomas Quinn | Tracy Cao | Sharna Dobney | Jan 20, 2023 | Xponance® Quarterly Reports, Xponance® Insights

We delve into this opportunity by dissecting the fundamental differences between large and small-cap indices to see if this appears to be a buying opportunity or a fair repricing given the current environment.

by Tina Byles Williams and Adam Choppin | Jan 18, 2023 | Xponance® Insights

The investment ocean is roiling. The steady ship of 60/40 had its worst year in a generation and many investors are left feeling either adrift in the storm or run aground on a deserted isle.

by Sumali Sanyal and Cameron McLennan | Jan 18, 2023 | Xponance® Quarterly Reports, Xponance® Insights

As we move forward into 2023, what happens in financial markets will be determined by the interplay of two primary factors – inflation and economic growth.

by Charles Curry Jr and Noel McElreath | Jan 18, 2023 | Xponance® Quarterly Reports, Xponance® Insights

For each of the first three quarters of 2022, we spent the opening paragraph of this piece finding new and interesting ways to describe just how bad fixed income performance was, across all sectors and tenors. Yet despite capping one of the worst years for fixed income historically, 4Q22 managed to provide positive total and excess returns.

by Sumali Sanyal and Cameron McLennan | Dec 19, 2022 | Xponance® Insights

This post explores the reasons behind the growing popularity of Artificial Intelligence (AI) and Machine Learning (ML), the opportunities that are available in using these techniques for ESG investing and the challenges encountered in using them.

by Tina Byles Williams | Dec 12, 2022 | Xponance® Press Release 2022, Xponance® Press Release

Press Release Philadelphia, PA (Dec. 12, 2022) – Xponance, Inc., a multi-strategy investment firm, has been named one of the 2022 Best Places to Work in Money Management for firms with 20 to 49 employees, announced today by Pensions & Investments. The...

by Sumali Sanyal and Cameron McLennan | Nov 14, 2022 | Xponance® Insights

While it is intuitively easy to understand that quality companies outperform in the long run, factors that fall in the Quality category often get less attention than the more popular Value and Growth factors. As we head into a slowing economy and possibly a recession amidst an inflationary environment, quality factors once again deserve the attention of investors.

by Tina Byles Williams | Oct 17, 2022 | XAlts Specific News, Xponance® Press Release 2022, Xponance® Press Release

Philadelphia, October 17, 2022 – Xponance, Inc., a multi-strategy investment firm, announced today that Michael A.B. Orr has joined the firm as Managing Director & Chief Investment Officer of the firm’s Alternatives subsidiary, Xponance Alts Solutions, LLC (“XAlts”).

by Charles Curry Jr and Noel McElreath | Oct 14, 2022 | Xponance® Quarterly Reports, Xponance® Insights

Three quarters of 2022 are in the books, and it is certainly three quarters fixed income investors would all like to forget. As has become our custom, we present a Market Scorecard to document what has occurred across fixed income markets. The numbers are breathtakingly bad and putting them (once again) in a historical context, the bond vigilantes have delivered on the worst three quarter stretch (for some sectors) ever. The broad corporate market, for example, has seen its worst three quarters in succession since inception of modern corporate indices. The same can be said for the broad US Treasury market. At this point, however, we are beginning to see the light at the end of the tunnel.

by Thomas Quinn | Adam Choppin | Oct 13, 2022 | Xponance® Insights

Geopolitical uncertainty, war, and commodity price shocks have been the headline talking points for the industry in 2022. These certainly contributed to the current stagflationary pressures in the market, however, …

by Tina Byles Williams | Oct 13, 2022 | Xponance® Insights

As I write this research note, (October 13, 2022) annual core inflation has hit a 40-year high at 6.6% from a year ago (8.2% for overall inflation), guaranteeing another punishing rate hike by the FOMC. Market commentators are prognosticating about …

by Sumali Sanyal and Cameron McLennan | Oct 13, 2022 | Xponance® Quarterly Reports, Xponance® Insights

Equity markets fell sharply for a third straight quarter in Q3, 2022. The big story for the quarter was the tightening of financial conditions driven by expectations for a more aggressive global rate hike cycle.