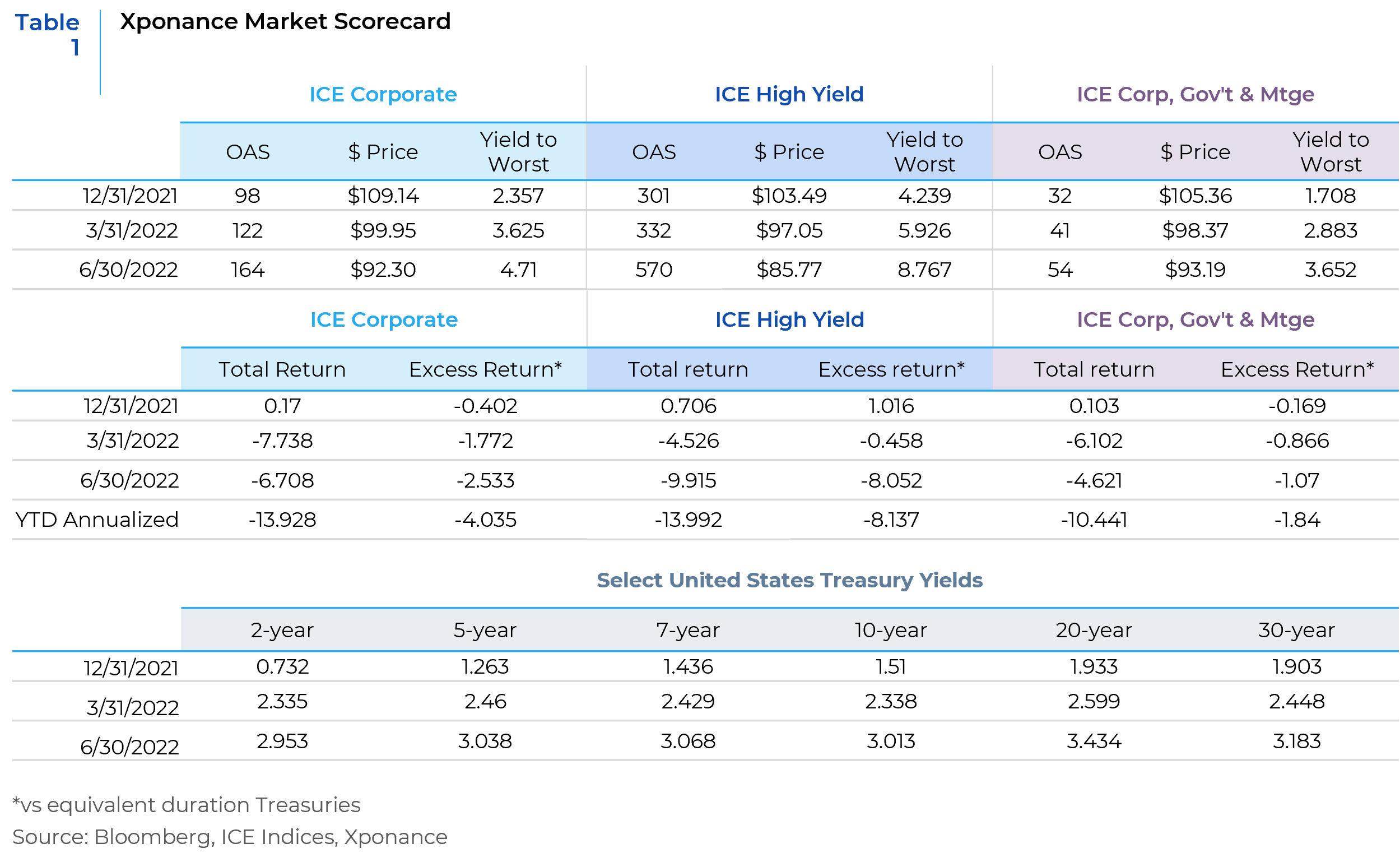

We open another quarterly commentary with a discussion of just how bad the quarter was for fixed income markets (see our Market Scorecard below). At the same time, however, a host of metrics suggest that many fixed income valuations are as attractive as they have been in several years. While we think caution and patience are the operative words in the spread sectors, we note some extreme dollar price drops given the movement in both rates and risk premia over the course of 2022. Clearly, uncertainty reigns since inflation seems to be much more stubbornly entrenched than the Federal Reserve or market participants anticipated coming into 2022 and we are in uncharted territory with few useful historical allegories.

The questions that we believe need to be answered in order to successfully navigate fixed income markets for the remainder of the year are what the terminal Federal Funds rate will be, and will the Fed lose its nerve before it gets there. Secondarily, we also wonder if the FOMC will pause or stop quantitative tightening earlier than originally envisioned in response to the slowing of the economy and the tightening of financial conditions. Clearly, inflation no longer gives markets the comfort of the “Fed put”, and pausing the process too early runs the risk of letting markets run with a persistent inflationary theme (and the bane of all central banks, unanchored inflation expectations). In our opinion, these questions potentially merit very different portfolio construction scenarios and timing. Duration stance and positioning along the yield curve will be paramount.

Current expectations, both market-based and the FOMC members projections (the “dot plot”) suggest continued upward pressure on the Fed Funds rate, but with somewhat different terminal rates and timing. The dot plot, based on the 6/15/22 Fed meeting suggests a central tendency for the rate to be at 3.375% at year-end 2022 (with the highest dot at 3.875%) and a central tendency of 3.625% for year-end 2023 with a high of 4.375%. 2024 year-end projections envision the rate reverting to 2022 levels but with a wider range from top to bottom (4.125% at the high-end and 2.875% at the low-end). Market expectations (which are notoriously unreliable into the future but offer an interesting comparison between market sentiment and Fed officials’ guidance) currently anticipate a peak in the Fed Funds rate of 3.58% by February 2023 with rate decreases starting shortly thereafter. These futures-based expectations anticipate the Fed Funds rate falling below 3% by year-end 2023. It is worth noting that trimmed-mean inflation, which is a means to try to get at persistent underlying inflation as opposed to the headline and core series of measurements, looks like it could potentially be running above either estimate of the terminal rate. It is a similar concept to core CPI, but it excludes the most volatile components, not specifically food and energy. Other measures that look at breadth of inflation paint a similar picture. Lastly, Kevin Lansing of the Federal Reserve bank of San Francisco conducted a recent study of inflation persistence and found it to be higher now than it has been for much of the post-Volcker era. The result is that these relatively low levels for the terminal rate will be hard pressed to contain inflation. There are other moving parts in the inflation calculus, obviously, but as we noted last quarter real rates must be positive in order create the conditions for a return to price stability (and they are not). We would note, however, that forward inflation as measured by TIPS break-evens is expected to be well contained. Given how far these indicators have moved down they now look like a reasonably priced hedge especially with positive yields across nearly the entirety of the TIPS curve.

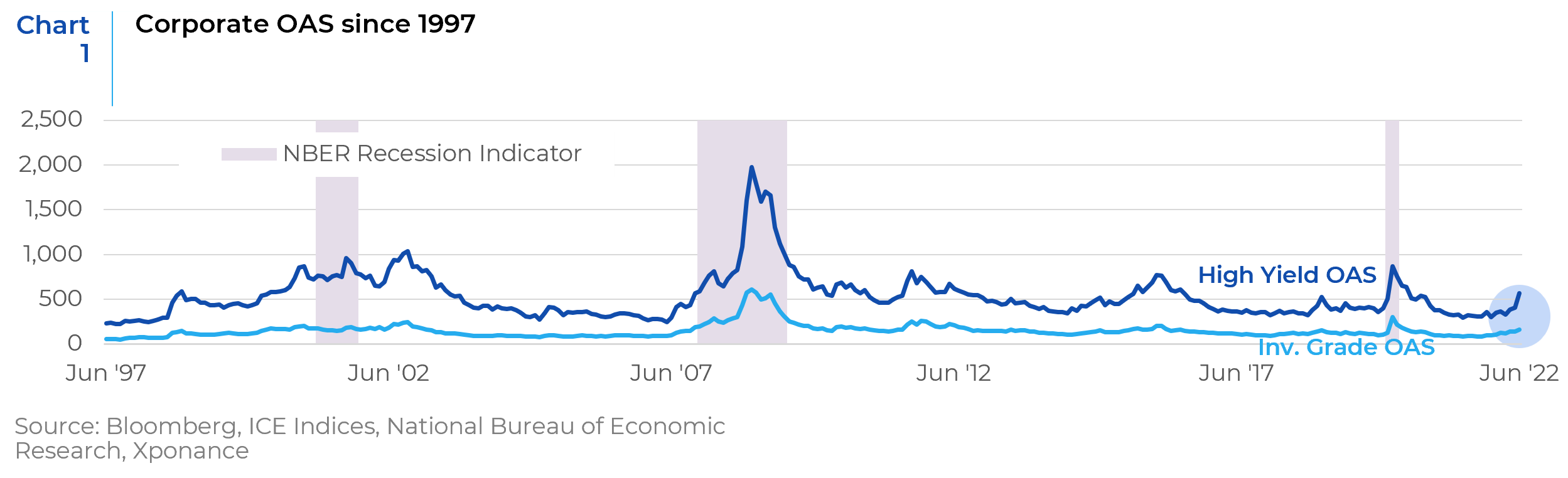

When we think about valuation in corporate bonds, we believe that credit spreads have more room to widen, as they currently reside at a level that tends to predict further expansion in risk premia in both investment grade and high yield. The same could be said for other risk assets with a similar beta profile (like lower quality CMBS). Typically, spreads peak during the recession and begin to recover before the downturn is “officially” over. The trick is knowing when you are in a recession and the ultimate duration of the contraction. Unfortunately, the National Bureau for Economic Research (NBER, the arbiter of the dating of recessions) only lets us know after the fact as their crystal ball is as ineffective as ours.

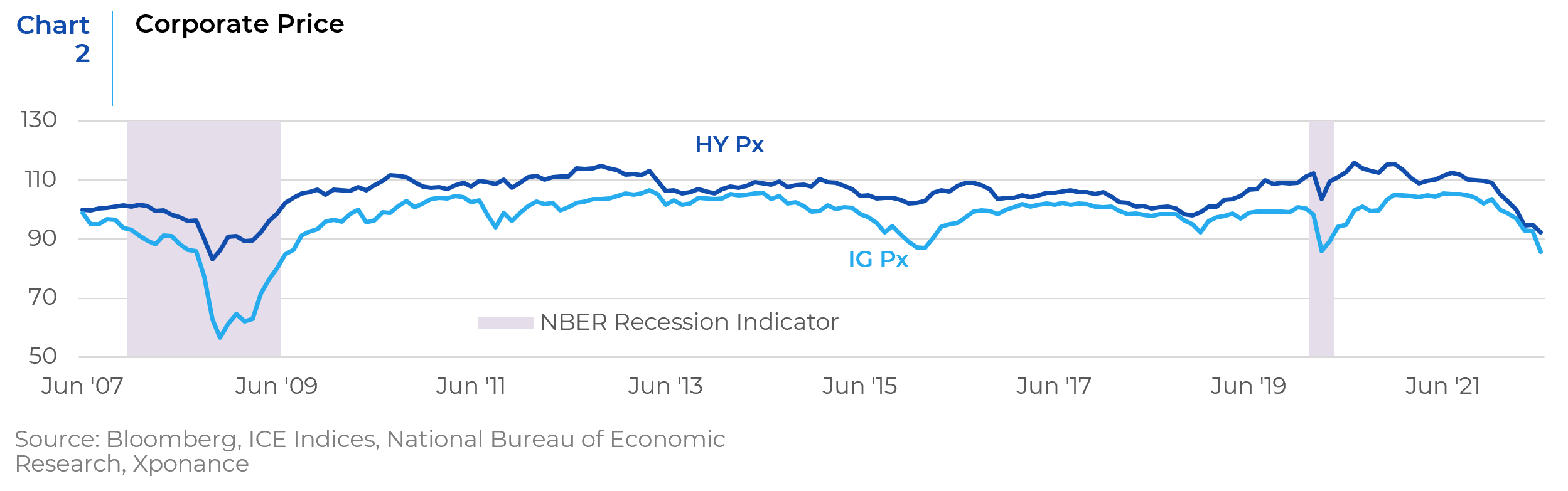

Despite the foregoing, we have also been presented with an unusual opportunity for investment across the liquid spread sectors early in the recession. As noted above, the dollar prices for the various fixed income indices and their constituent parts are at very low levels by historical standards. And, this condition usually occurs as a result of spread widening, whereas much of the damage this time around has been due to interest rate moves. This dynamic has presented a case where the duration and convexity profiles of the indices have made them more defensive ahead of further deterioration in risk premia.

Away from rates and inflation, we are concerned with market dynamics against a backdrop of the withdrawal of liquidity by the Fed in addition to years of regulatory and market structure changes after the Great Financial Crisis (GFC). Not only is liquidity challenged even in the Treasury market, but we are concerned about the mismatch between dealer balance sheets relative to the bloated size of the corporate market. As we have discussed in previous editions of this outlook, corporate bond inventories on dealer balance sheets have decreased in absolute terms since the run-up to the GFC, while the broad bond market (using ICE indices as a proxy) is more than 3x larger as compared to 12/31/1996. Moreover, some dealers have backed away from positioning bonds as a risk mitigation measure. This is undoubtedly a short-term negative for spreads (and Treasury valuations for on-the-run vs off-the-run securities). We believe this will ultimately present a buying opportunity when nimble investors can become liquidity providers and be well paid to do so.

Given the cross currents in both the economy and markets now, we can see a much wider range of investment opportunities coming into view but many of these are not yet ready to be implemented. With the Fed set to make a large move at the meeting on July 27th (possibly even 100bps, though this is not our base case) we do not see adding further to risk positions in this environment. With coupons on the major indices running well below yields, reinvestment rates will continue to a bright spot. And the combination of higher coupon new issue debt in both spread sector markets and Treasuries with deeply discounted existing paper allows investors to express individual security views in ways that are unique and appropriate for the risk profile of a given instrument. Lastly, while we continue to believe that short duration positioning is appropriate, we also know that the market will ultimately flip to a stance that rewards high quality duration, which will come from adding to the long-end for both the Treasury curve as well as high quality risk exposures.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.