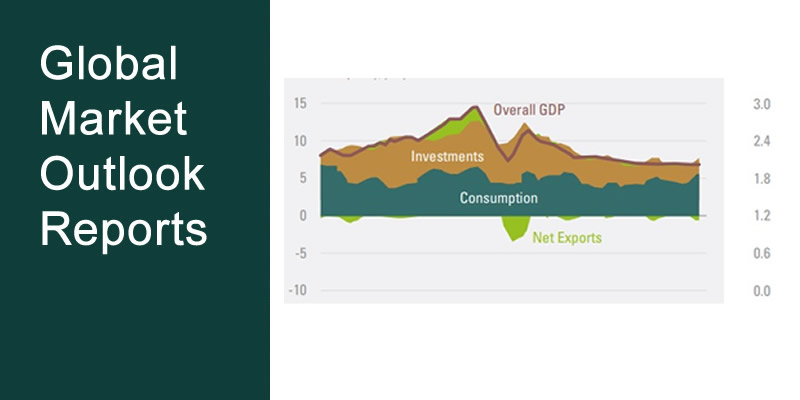

About Global Market Outlook Reports

Our CIO, Tina Byles Williams, publishes our market outlook on a quarterly basis, based on research that examines market conditions over a three- to six-month period. These quarterly analyses serve as key inputs to our fund construction process, which incorporates strategic tilts to the market segments we believe will outperform over a six- to 12-month time frame. For global equity portfolios, these tilts incorporate regional, sector, and capitalization strata as well as investment process and style factors. For U.S. equity portfolios, tilts include sector, capitalization strata, investment process, and/or style factors.

Our objective is to construct a portfolio of “best in class” investments with weightings consistent with our overall investment strategy.

FIS Group Global Market Outlook Reports

MARKET OUTLOOK Q2 2019 – Late Cycle Rally on Borrowed Time

Although global growth declined in Q1, as anticipated in our Q1 2019 Outlook, risk assets continued their December 2018 romp as a result of an apparent de-escalation of U.S.-Sino trade tensions and a decidedly dovish pivot by G10 Central banks (See Table One). Some US...

2019 Outlook for Frontier Markets

Frontier markets slumped in line with other non-dollar denominated markets in 2018; though outside of Argentina, frontier markets as a whole outperformed even the U.S. market. In our annual outlook we first look back to grade our calls from last year (spoiler: very...

Q1 2019 Market Outlook: Après moi, le déluge – A Late Cycle Rally as Part of a Protracted Market Topping Process

Each year we begin our Q1 market outlook by holding ourselves to account for the results of the previous year’s macro strategy calls. We then give a detailed overview of what we see as the chief headwinds…

Q4 Market Outlook: From A Trade War To A Cold War?

Following the imposition of a second round of tariffs on Chinese goods and China's concomitant imposition of retaliatory tariffs, we are - by nearly any reasonable definition of a trade war - in the heart of one at this time. There is good reason to be concerned for...

Q3 Market Outlook – A Final Melt-Up

At its half-way mark, 2018 has been a tough year to make money. Investors have lost money on US investment grade bonds, on emerging debt, on US Treasuries, on European bonds, and on pretty much every major global equity market. Towards the end of the second quarter,...

Whipsaws and Other Tradable Goods – Q2 2018 Market Outlook

So far, three of the four main themes for 2018 that we shared in January's report - more aggressive Fed rate hikes, mean reversion of low vol, and geopolitical risks from Trump's foreign and trade policy - appear on track and our Q1 positioning was accretive. On our...

Market Insights Alert

Papers: FIS Group Proprietary Research

What is the most likely source and impact of the next downturn on asset prices?

As a backdrop to our portfolio derisking recommendations, we evaluate the macro background, asset return sensitivities and market responses during economic downturns over the last 30 years.

Battening Down The Hatches Part Two

View PDF version Battening Down The Hatches Part Two Part 2: How Should Investors Derisk?In Part 1 of this series, we posited that the next recession could take two possible forms:A traditional cyclical downturn as decelerating industrial production infects the...

Will Rising Populism = Stagflation?

#derisking #asset allocation #equities #bonds #geopolitical #negative yields #yield curve # stagflation # inflation # stock and bond correlation # populism #income inequality #Brexit #Donald Trump Populism is on the rise and it has historically led to increased...

Stagflation: A Lower Probability, but More Worrisome, Recession Scenario

Read our blog post here: #derisking #asset allocation #equities #bonds #geopolitical #negative yields #yield curve # stagflation # inflation # stock and bond correlation # populism Stagflation would most likely be prompted by a negative supply shock caused by either...

Negative Bond Yields Could Suggest Two Opposing Conclusions and Asset Allocations

#derisking #assetallocation #equities #bonds #geopolitcal #negative yields #yield curve #cyclically adjusted earnings The world faces an economic meltdown, or There is a buying panic in safe assets and thus a buying opportunity in risk assets. For allocators, if the...

Slowing Global Growth and Heightened Geopolitical Uncertainty Are Prompting Allocators to Reduce Their Public Equity Exposure

The dynamics that warrant reduction in equity risk exposures include: Late cycle dynamics leading to marked global growth slowdown Bearish signals from the bond market More constrained reflationary policies from China that will be a less potent for jump-starting...

Videos And Webinars

Market Outlook and Research Webinars

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.