Tariffs, Tensions, and Opportunities

Understanding the interplay of policy, market sentiment, and regional dynamics is critical for successful investment positioning in this era of renewed protectionism and global economic realignment.

Understanding the interplay of policy, market sentiment, and regional dynamics is critical for successful investment positioning in this era of renewed protectionism and global economic realignment.

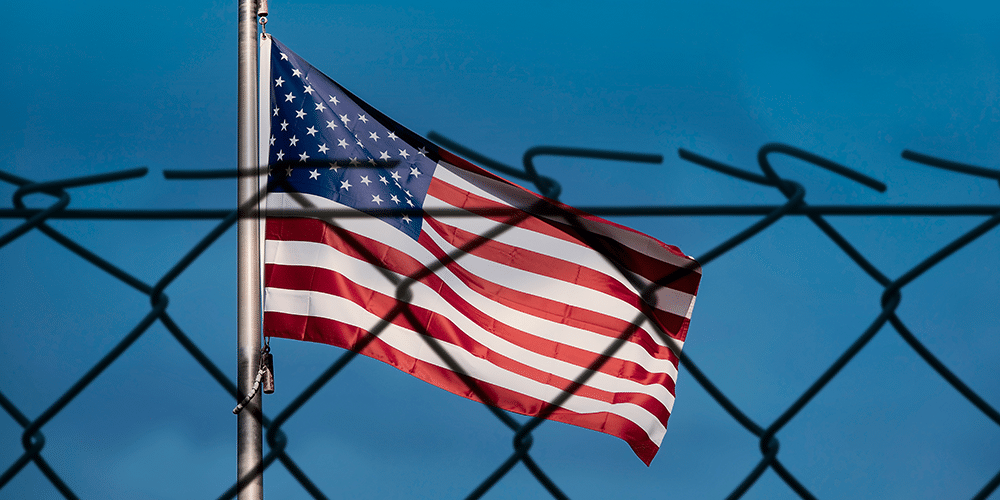

This is the second of a three-part series on the two issues that led to 2024’s anti-incumbent party backlash. This paper evaluates salient macroeconomic, demographic, and social factors that have or should inform immigration policy, as well as the policy solutions put forward by the incoming administration to address unauthorized workers in America.

As risk-on traders take a victory lap amid surging equity markets and now renewed monetary policy accommodation, the expectations for a soft landing in the U.S. economy now form the base case scenario for a preponderance of U.S. investors.

As we approach the end of 2024, market volatility persists, with the market narrative frequently shifting in response to new economic data releases. But what does this mean for fixed income markets and portfolio decisions in the fourth quarter of 2024 and beyond?

Market narratives have shifted significantly this year—from excitement surrounding artificial intelligence (AI) to apprehensions about big tech expenditure, and from recession worries to confidence in the resilience of the U.S. economy

The summer of 2024 threatens to ignite transnational conflict with an unprecedented array of flashpoints never seen in the modern world.