by Tina Byles Williams | Feb 14, 2020 | Market Outlooks

While the U.S. continued its decade-long run, surging ahead another +31% in 2019 to lead all major developed markets (except Switzerland, +32.5%), three emerging markets did even better last year. Taiwan gained +36% as investors reevaluated the “moat” of its market champion, …

by Tracy Cao | Feb 14, 2020 | Market Insights Alerts

The coronavirus outbreak in China, named COVID-19 by WHO, is understandably dominating news coverage and depressing Chinese risk plays. Since 12/9/2019 when the first coronavirus case was announced from the City of Wuhan, confirmed cases have risen rapidly to over 40,000 as of this report.

by Sumali Sanyal | Feb 12, 2020 | Market Insights Alerts

In our previous post, we sought to identify and quantify the investment opportunity or edge within various market capitalization segments. We found that the top 1000 names in the Russell 2500 benchmark constitute a sweet spot across the entire Russell 3000.

by Isaac Green | Feb 10, 2020 | Market Insights Alerts

As the secular bull market in long term treasury bonds approaches its 40th year, the consensus around falling interest rates has morphed from a shared opinion to an accepted reality. Reputations and fortunes have been made and lost by adherents and skeptics respectively.

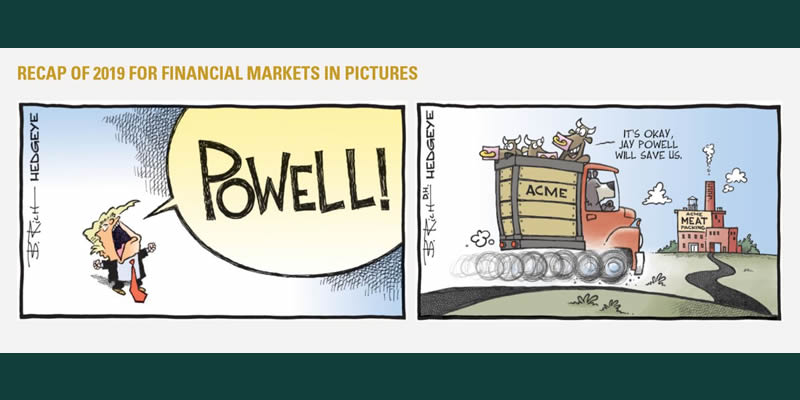

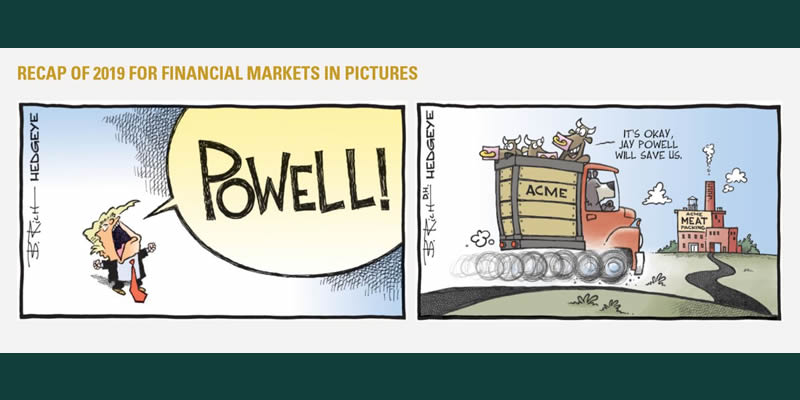

by Tina Byles Williams | Jan 22, 2020 | Market Outlooks

During the second half of 2019, the late cycle bull market for financial risk assets sprinted to the finish line despite lackluster global growth. Global markets ended the year on a bullish note, with the U.S. S&P 500 climbing to another record close.

by Sumali Sanyal | Jan 14, 2020 | Market Insights Alerts

The US equity markets exhibit observable biases over time, alternately favoring one group of stocks over others: large cap vs. small cap; value vs. growth; defensive vs. dynamic; sector rotation, etc. We questioned whether there was a longer term benefit to favoring one group of stocks over the others.