In the third quarter, both of the leading anglo-liberal democracies lurched towards the political abyss and even potential constitutional crises, while global growth continued to decelerate on the back of trade policy uncertainty and the end of an aberrantly long economic expansion. Against this backdrop, the USD rose, gaining +4.3% against the Euro, +3.2% against the GBP, and even +2.2% against the Swiss Franc. The JPY was broadly flat against the USD and Japanese equities were the leading performer of major economies gaining +3.1% in USD terms.

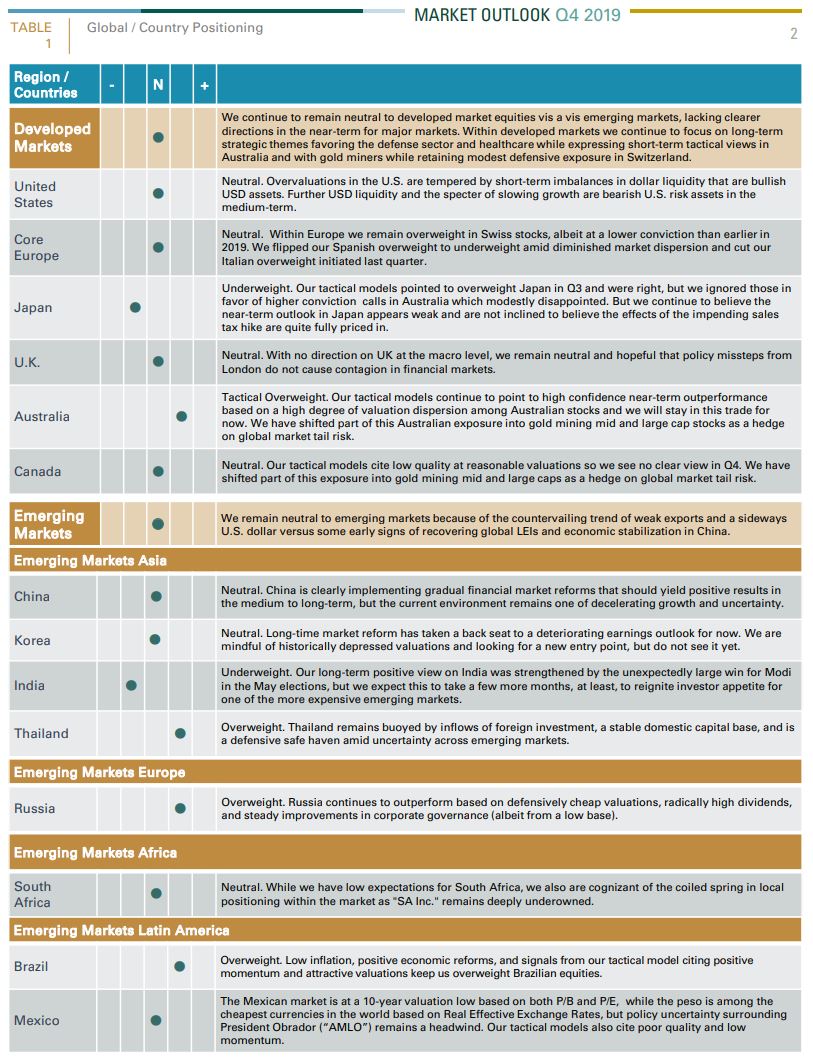

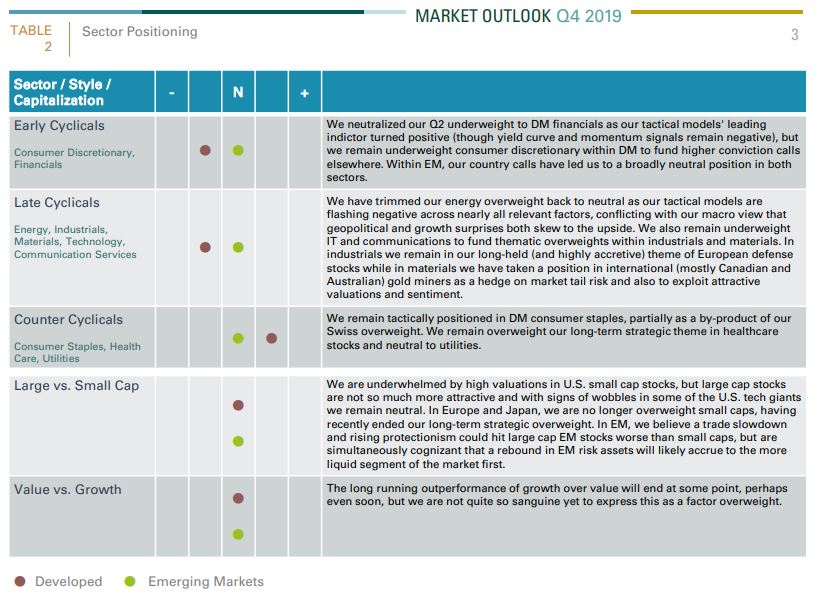

Looking ahead to Q4, we see some niche tactical opportunities, which we cover in detail in our Q4 country and sector outlook (see Table 1 and Table 2), but the longer term direction of the market remains at an apparent crossroads. This has prompted many investors to ask whether we are at the precipice of further risk off events that necessitate a rethink of portfolio allocations or whether monetary or even fiscal policy could keep the long bull market going. We seek to answer these questions and more in our three-part series on de-risking. You can access each section below:

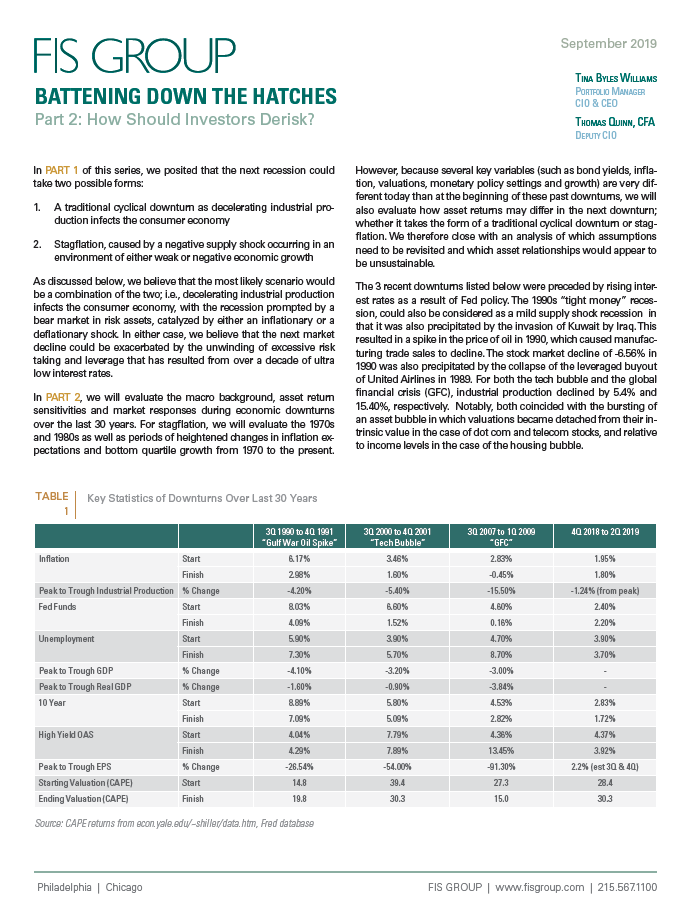

BATTENING DOWN THE HATCHES