#derisking #leveraged loans #equities #long duration #growth stocks # yield# profits # negative yields # high yield#covenant lite #private equity#LBO#leveraged buyout funds

- It is difficult to build a case that equity markets won’t contract in a slow-down.

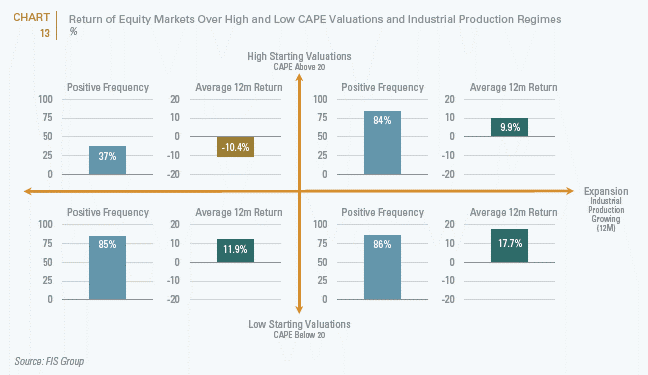

Since 1950, whenever CAPE valuations were above 20 and industrial production declined in the previous 12 months, the 12-month return of the stock market was -10.4%, with only 34% of periods having positive returns. Currently, the CAPE ratio at 30.3 exceeds all of the three prior downturns analyzed in this paper with the exception of the peak of the dot com bubble.

- High duration equity assets are vulnerable.

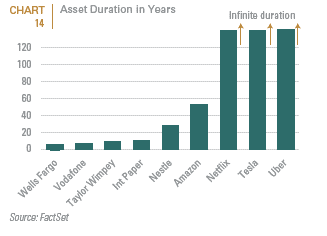

With ultra-low interest rates and the comfort of a central bank “put”, investors have favored high duration assets and often cash-flow burning companies (such asTesla, WeWork and Uber) that are perceived to have very high residual values because of their “next-gen” business models. Conversely, they have shunned companies in sectors with near term cash-flows (such as energy, autos, electric utilities, mass-produced consumer goods)—where residual values were perceived to have limited value. Going forward, we believe that high duration equity assets will be especially vulnerable.

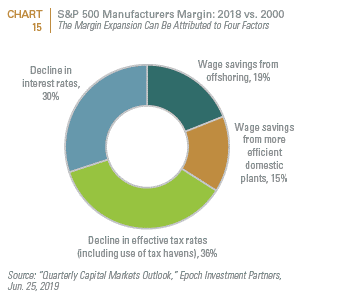

- The structural and cyclical factors that propelled 50-year highs in U.S. corporate profit margins (particularly for growth stocks) over the last 20 years have likely peaked, and in many cases are at serious risk of reversal.

These structural factors include declining corporate tax rates, offshoring and light touch regulation; all of which are at risk of reversal in the current political environment.

- Private equity’s focus on high organic growth companies or the use of operating and/or financial leverage to flatter earnings and returns could also be vulnerable.

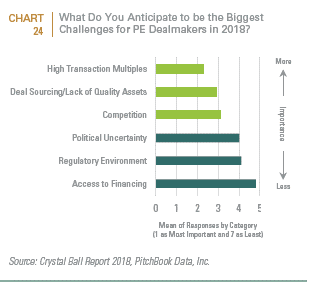

According to Prequin, as of the end of 2018, private equity GPs “dry powder” had climbed to around $2 trillion dollars! We suspect that this is why private equity GPs cite high transaction multiples as an increasing concern. Moreover, leveraged buyout funds, the largest segment within the asset class, has employed increasing amounts of leverage to execute transactions at higher multiples. By the end of 2018, 85% of all leveraged loans were “covenant-lite”, rendering them more vulnerable in periods of distress or constrained liquidity.

You can read our 2019 analysis of institutional investor derisking trends, Battening Down the Hatches, Part 2