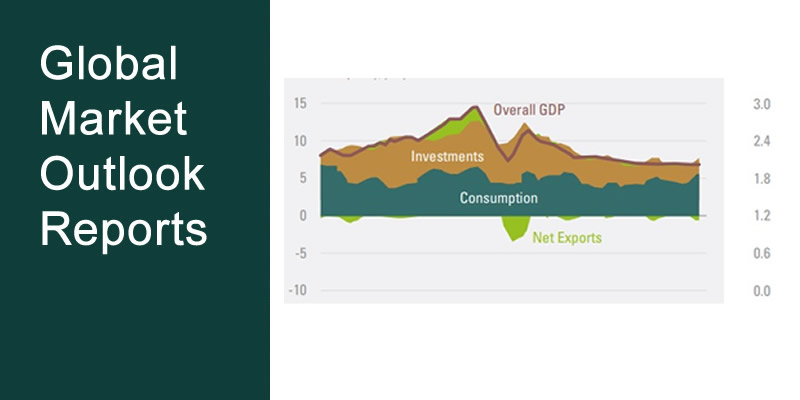

by Tina Byles Williams | Oct 23, 2018 | Market Outlooks

Following the imposition of a second round of tariffs on Chinese goods and China’s concomitant imposition of retaliatory tariffs, we are – by nearly any reasonable definition of a trade war – in the heart of one at this time. There is good reason to...

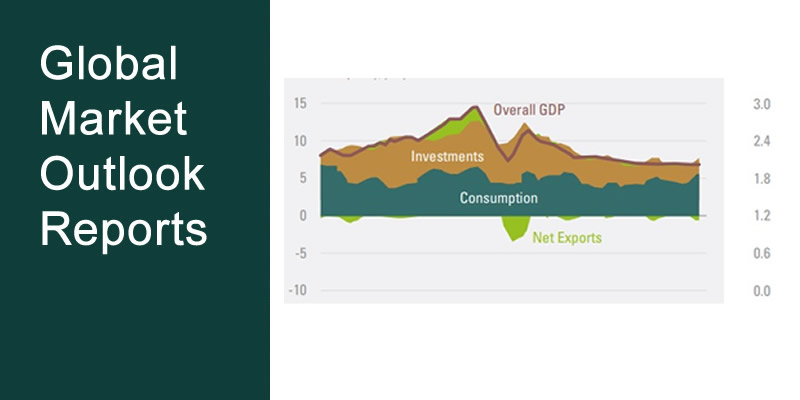

by Tina Byles Williams | Jul 20, 2018 | Market Outlooks

At its half-way mark, 2018 has been a tough year to make money. Investors have lost money on US investment grade bonds, on emerging debt, on US Treasuries, on European bonds, and on pretty much every major global equity market. Towards the end of the second quarter,...

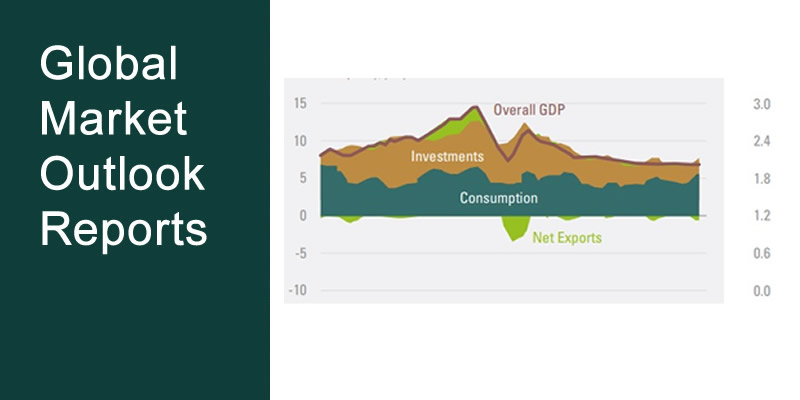

by Tina Byles Williams | Apr 30, 2018 | Market Outlooks

So far, three of the four main themes for 2018 that we shared in January’s report – more aggressive Fed rate hikes, mean reversion of low vol, and geopolitical risks from Trump’s foreign and trade policy – appear on track and our Q1 positioning...

by Tina Byles Williams | Feb 1, 2018 | Market Outlooks

The 2018 frontier markets outlook provides predictions for frontier markets in the year ahead, including Argentina, Vietnam, frontier Europe, the Middle East and sub-Saharan Africa. Frontier markets surged in 2017, mostly driven by a PE re-rating in the market.We...

by Tina Byles Williams | Jan 31, 2018 | Webinars

Video and Webinar | Outlook https://xponance.com/wp-content/uploads/2018/01/FIS-Group-2018-Q1-Market-Outlook-LQ.mp4 ...

by Tina Byles Williams | Jan 11, 2018 | Market Outlooks

Market Outlook As we turn the page to 2018, there are a few obvious clouds on the horizon for the world economy; however, we expect 2018 to be a transition year. Stretched valuations and extremely low volatility imply that risk assets are vulnerable to the consensus...