The Precariat Are Still Mad! Part III – How Should Investors Play the Next 4 Years? It Depends!

This piece is the third in a three-part series on the issues that led to 2024’s anti-incumbent party backlash. Here, we evaluate the trade and other fiscal proposals put forward by the incoming Trump administration, as well as their investment implications.

Change at the Top: Economic and Equity Market Implications: Systematic Global Equities Q4 2024 Update

U.S. stock markets experienced positive performance in 2024, and that trend is expected to continue in 2025. However, 2025 also has the potential to experience increased market volatility and shifting trends due to policy changes from the incoming administration combined with uncertainty about inflation and global economic conditions.

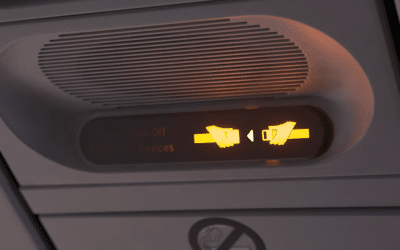

The Captain Has Elected to Keep the Fasten Seatbelt Sign Illuminated: Q4 2024 Fixed Income Update

Given the substantial price action in rate markets, we consider what outcomes the market is currently pricing, the risks to this “consensus” view, and what we think will or will not occur as the new administration begins its term.

Tariffs, Tensions, and Opportunities

Understanding the interplay of policy, market sentiment, and regional dynamics is critical for successful investment positioning in this era of renewed protectionism and global economic realignment.

The Precariat Are Still Mad! Real Talk on Immigration – Part II

This is the second of a three-part series on the two issues that led to 2024’s anti-incumbent party backlash. This paper evaluates salient macroeconomic, demographic, and social factors that have or should inform immigration policy, as well as the policy solutions put forward by the incoming administration to address unauthorized workers in America.

The Precariat Are Still Mad! An Analysis of 2024’s Incumbent Party Shellacking – Part I

The electorate is in a foul mood. Not just in the U.S., but globally, where incumbent parties have faced unprecedented levels of reversal. In each of the 10 major countries tracked by the Financial Times’ ParlGov global research, incumbent leaders were either given the boot or a painful thrashing.