About Global Market Outlook Reports

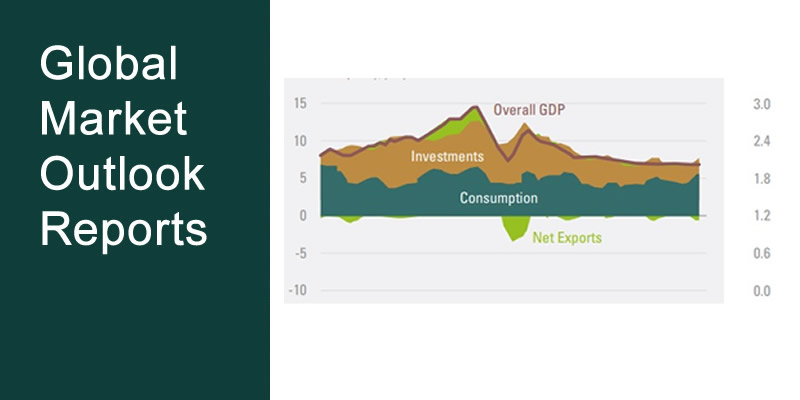

Our CIO, Tina Byles Williams, publishes our market outlook on a quarterly basis, based on research that examines market conditions over a three- to six-month period. These quarterly analyses serve as key inputs to our fund construction process, which incorporates strategic tilts to the market segments we believe will outperform over a six- to 12-month time frame. For global equity portfolios, these tilts incorporate regional, sector, and capitalization strata as well as investment process and style factors. For U.S. equity portfolios, tilts include sector, capitalization strata, investment process, and/or style factors.

Our objective is to construct a portfolio of “best in class” investments with weightings consistent with our overall investment strategy.

FIS Group Global Market Outlook Reports

Q3 Market Outlook: A Late 2019 Performance Pivot to Non-US Markets?

Despite a rocky mid-point, precipitated by the infamous "tweet heard around the world" on May 5th, when President Trump once again pivoted to a more bellicose stance in the trade war with China, global equities eked out a solid gain of 3.6% during 02. Coincidentally,...

MARKET OUTLOOK Q2 2019 – Late Cycle Rally on Borrowed Time

Although global growth declined in Q1, as anticipated in our Q1 2019 Outlook, risk assets continued their December 2018 romp as a result of an apparent de-escalation of U.S.-Sino trade tensions and a decidedly dovish pivot by G10 Central banks (See Table One). Some US...

2019 Outlook for Frontier Markets

Frontier markets slumped in line with other non-dollar denominated markets in 2018; though outside of Argentina, frontier markets as a whole outperformed even the U.S. market. In our annual outlook we first look back to grade our calls from last year (spoiler: very...

Q1 2019 Market Outlook: Après moi, le déluge – A Late Cycle Rally as Part of a Protracted Market Topping Process

Each year we begin our Q1 market outlook by holding ourselves to account for the results of the previous year’s macro strategy calls. We then give a detailed overview of what we see as the chief headwinds…

Q4 Market Outlook: From A Trade War To A Cold War?

Following the imposition of a second round of tariffs on Chinese goods and China's concomitant imposition of retaliatory tariffs, we are - by nearly any reasonable definition of a trade war - in the heart of one at this time. There is good reason to be concerned for...

Q3 Market Outlook – A Final Melt-Up

At its half-way mark, 2018 has been a tough year to make money. Investors have lost money on US investment grade bonds, on emerging debt, on US Treasuries, on European bonds, and on pretty much every major global equity market. Towards the end of the second quarter,...

Market Insights Alert

Papers: FIS Group Proprietary Research

Performance Drivers For Emerging Managers

The purpose of this study is to determine whether there are significant relationships between asset levels that traditionally determine a manager’s status as emerging and various measurements of risk-adjusted return. Those measurements include the Information Ratio, Sharpe Ratio and Sortino Ratio. Additionally, the study attempts to evaluate the impact of certain salient characteristics of the firm universe, such as portfolio concentration (as measured by average number of portfolio securities), degree of trading activity (as measured by portfolio turnover) and number of research analysts and portfolio managers.

Videos And Webinars

Market Outlook and Research Webinars

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.