There’s a Pony in Here Somewhere

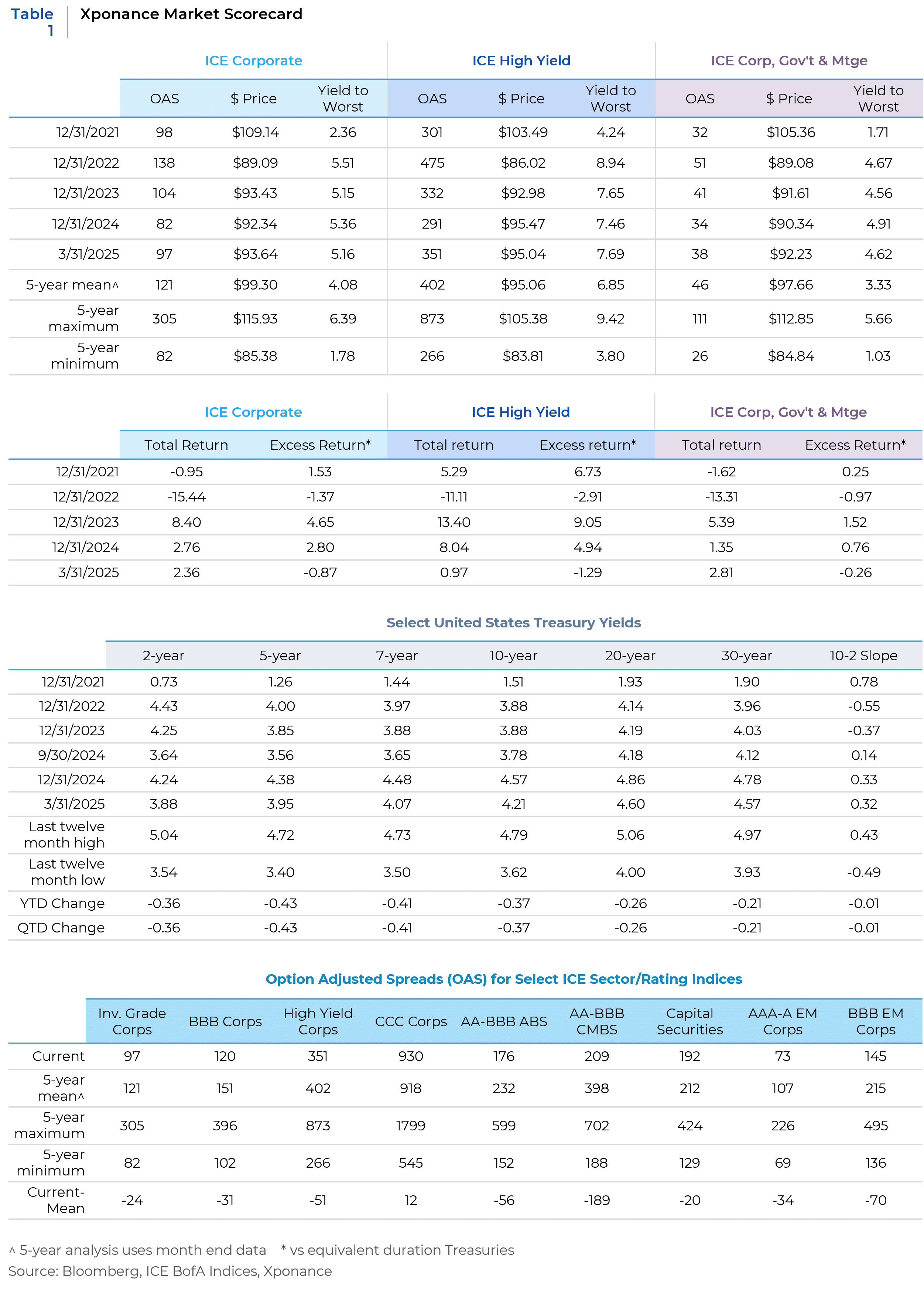

As we enter the second quarter of 2025, there is much to consider for fixed income markets and the broader economy. Volatility has increased across most asset classes, evident in heightened interest rate swings, intraday movements in Treasury securities, and the divergence between swaps and cash bonds, as well as rising measures of credit volatility.

While fixed income risk assets experienced some spread pressure during the first quarter, the widening was broadly in line with what we typically see during mid-cycle corrections. However, since quarter-end, risk assets have largely been in free fall — a trend we’ll explore further in next quarter’s review.

In this update, we begin by examining the pattern observed during the recent sell-off in spread products, drawing comparisons to prior periods of market stress. We then delve into the feedback loop between policy uncertainty, market behavior, and economic sentiment. Finally, we share our outlook on spread sectors and highlight areas where we see potential opportunities amid the turbulence.

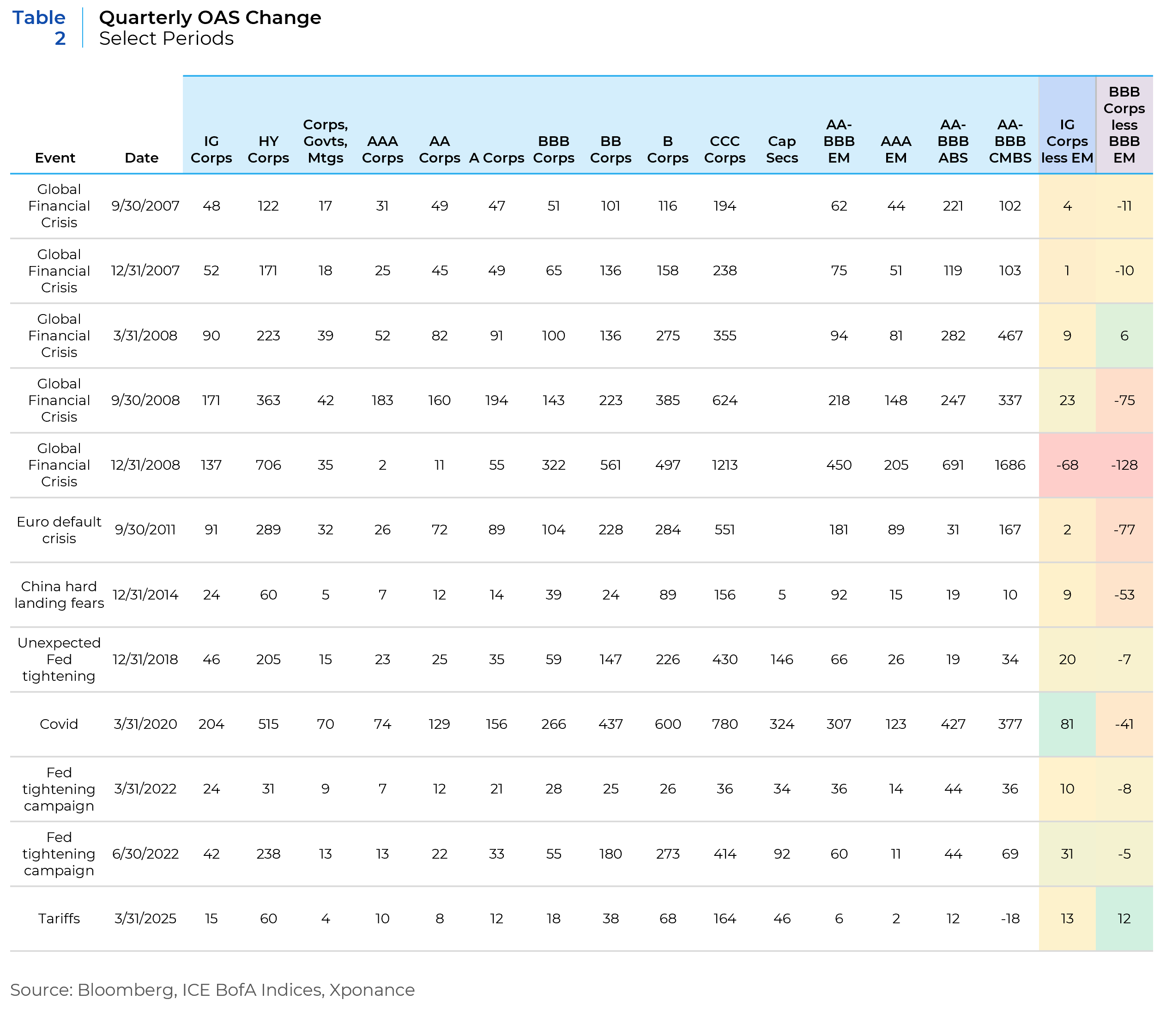

Financial markets are exhibiting a markedly different tone compared to the initial period following the election. While some fixed income sectors are responding as expected to weaker economic data and rising policy uncertainty, others are behaving in less predictable ways. As is typical during market unwinds, lower credit quality sectors have seen more pronounced spread movements—BBB-rated corporate bonds, in particular, led the widening trend within investment grade during the first quarter.

A notable outlier this quarter has been BBB-rated emerging market bonds, which exhibited minimal spread widening. This is atypical, as these bonds usually move in tandem with—or underperform—BBB-rated U.S. corporates during risk-off periods. Historically, the broad BBB corporate index has outperformed EM during every major market dislocation over the past two decades, with the exception of 1Q25 and 1Q08 (though the latter reversed as the Global Financial Crisis unfolded). The global scope of current trade tensions may be influencing this divergence, and it will be important to monitor this relationship as a broader gauge of market sentiment.

Another area of interest is the credit asset-backed securities (ABS) index, which includes subordinated tranches rated between AA and BBB across various structures—ranging from auto loans to more esoteric cash flows like data center receivables and aircraft leases. Despite typically exhibiting spread behavior aligned with crossover corporate credit (BBB/BB-rated), credit ABS spreads were notably resilient this quarter, showing only minimal movement. While additional spread pressure cannot be ruled out, macroeconomic fundamentals across much of this sector appear more robust than in other recent dislocations, such as the COVID-19 downturn or the 2022 monetary tightening cycle.

Also surprising was the performance of credit commercial mortgage-backed securities (CMBS), rated below AAA. Contrary to past periods of volatility—where CMBS spreads often lead the widening—this sector actually tightened during the quarter. This likely reflects its idiosyncratic profile and primarily domestic exposure. Despite ongoing market volatility, spread moves across CMBS remained relatively muted compared to prior episodes of market stress over the past two decades (see Table 2, below). That said, the second quarter has begun with a meaningful uptick in spread widening, and we will continue to provide updates as we approach mid-year.

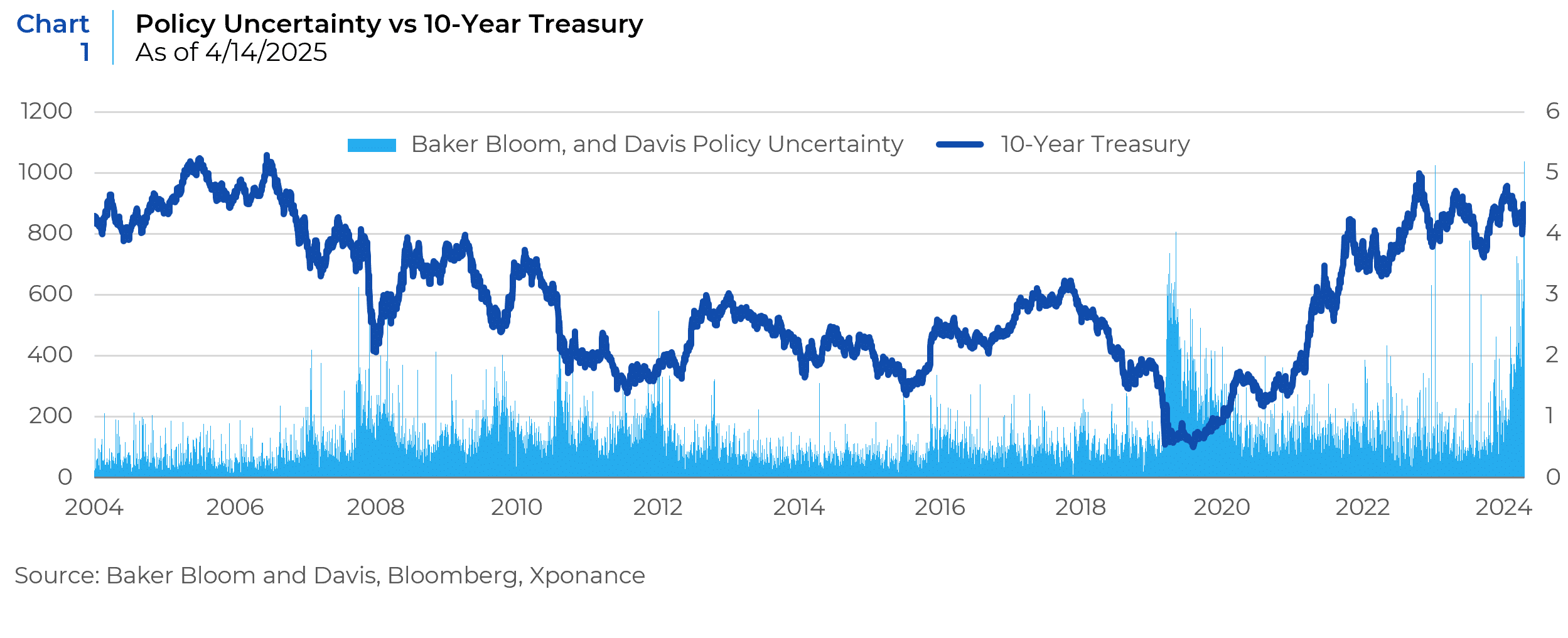

One key indicator we frequently monitor during periods of market stress is the Baker, Bloom, and Davis U.S. Economic Policy Uncertainty Index. Calculated daily using a broad array of news sources, the index quantifies the level of economic and political uncertainty reflected in public discourse. Historically, elevated readings have coincided with risk-off environments—characterized by declining equity markets and rising U.S. Treasury prices—and have often served as leading indicators of recessionary conditions.

In previous market cycles, spikes in uncertainty were often driven by ambiguous policy responses to external shocks, such as the COVID-19 pandemic or the Global Financial Crisis. Today, however, the landscape is different: global trade barriers are at their highest levels in nearly a century. While the specifics of tariffs and retaliatory measures remain fluid, the ongoing uncertainty is exerting pressure on both business sentiment and consumer confidence—trends that are now beginning to show up in the economic data.

What’s particularly notable in the current cycle is the divergence from historical norms: U.S. Treasury prices have not rallied meaningfully, even as the policy uncertainty index has reached and remained near record highs (since the index’s inception in 1985). Furthermore, the traditional negative correlation between equity prices and Treasury prices appears to be breaking down—suggesting that uncertainty is being processed differently by markets this time around.

While it remains too early to definitively pinpoint the drivers of this unusual market behavior, analysts continue to debate whether we are witnessing a fundamental shift in the perception of U.S. Treasuries as a safe haven—or simply a market reaction to the inflationary consequences of ongoing tariff policy. Adding to the uncertainty, several countries at the center of current trade disputes are also among the largest holders of Treasuries, sparking speculation around a potential “buyer’s strike.”

Despite persistent concerns about the growing federal deficit and the Treasury’s financing needs, a sudden mass liquidation by foreign holders appears unlikely. While overseas holdings have modestly declined since peaking on March 31, 2021, the change has had little to no observable impact on pricing. That said, if trade tensions persist and ultimately reduce U.S. imports, the associated decrease in reserve accumulation could naturally dampen foreign demand for Treasuries over time.

Amid persistent volatility, we continue to search for relative value across fixed income market sectors. Agency MBS still presents compelling opportunities when viewed through the lens of historical spread relationships. While the “agency” label inherently carries some policy risk in the current environment—given that these entities can be reshaped by regulatory or legislative action—we maintain confidence in the sector’s robust underwriting standards and strong credit quality.

We also remain constructive on esoteric asset-backed securities (ABS). One of the sector’s core advantages is the domestic nature of many of its underlying receivables, which helps limit exposure to global trade disruptions. Unlike individual corporate credits, many of these structures are built around cash flows that are better insulated from macroeconomic volatility. As we’ve highlighted before, the ability to tailor exposures within this sector makes it especially attractive in today’s environment.

Over the past six months, we have reduced our active credit curve exposure, a move that enabled us to lower sector beta without meaningfully altering overall spread duration. By “sector beta,” we refer to the volatility or dispersion in credit spreads within a given segment of the market. This tactical shift allows investors to maintain portfolio-level spread exposure while mitigating downside risk from more vulnerable credits.

This is a dynamic strategy—one that can be reversed as valuations evolve. Traditionally, portfolios are de-risked when spreads are tight and relatively uniform, then re-risked when the credit curve steepens and lower-rated sectors offer more meaningful compensation for risk.

At this point, quantitative spread analysis suggests that a broad-based rotation remains premature. While certain fundamentally sound issuers are trading at more attractive levels than at year-end, a wholesale shift in positioning is not yet justified. That said, higher all-in yields continue to present opportunities, especially as Treasuries have yet to reflect the full extent of economic and policy-related stress.

In light of these factors, a cautious but flexible approach remains essential. Maintaining optionality across core fixed income sectors should position portfolios for continued relative outperformance as market dynamics evolve throughout the cycle.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.