The Only Certainty Is Uncertainty

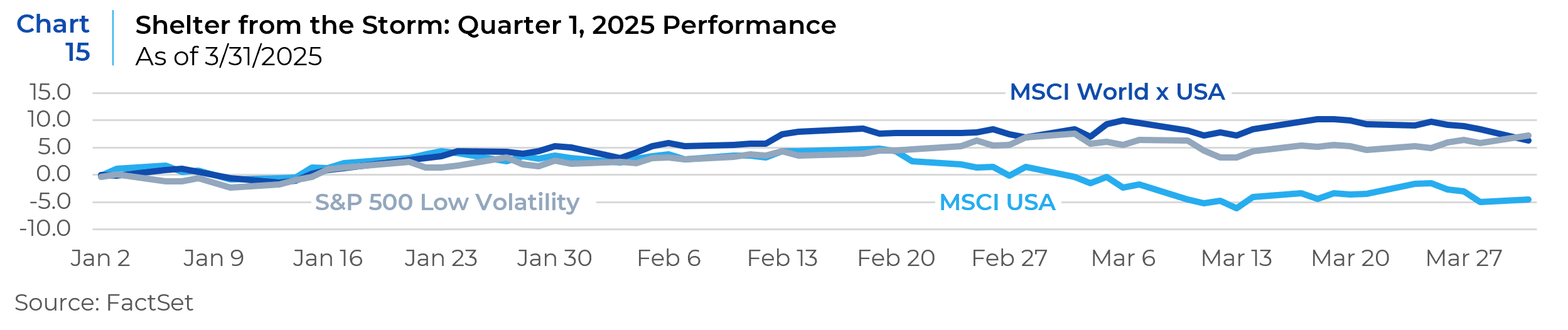

The opening quarter of 2025 was a roller coaster ride for investors, beginning with optimism but ending with considerable turmoil. From January through mid-February, markets extended the strong momentum from 2024, with the S&P 500 experiencing a 5.7% rally through February 19th. This initial enthusiasm resulted from investor focus on the pro-growth elements of the Trump administration’s agenda. However, the situation deteriorated significantly in the latter half of the quarter. Escalating uncertainty surrounding tariff policies triggered a substantial market correction, with the S&P 500 declining 10% from its February highs. By the end of the quarter, the broad market index had registered a 4.27% decline, with March alone witnessing a 5.63% drop. This marked the S&P 500’s worst quarterly performance since the third quarter of 2022.

The Economic Picture

Economic indicators paint a picture of a slowing economy combined with sticky inflation. Stagflation, recession, and even depression, are scenarios being discussed by investors and economists.

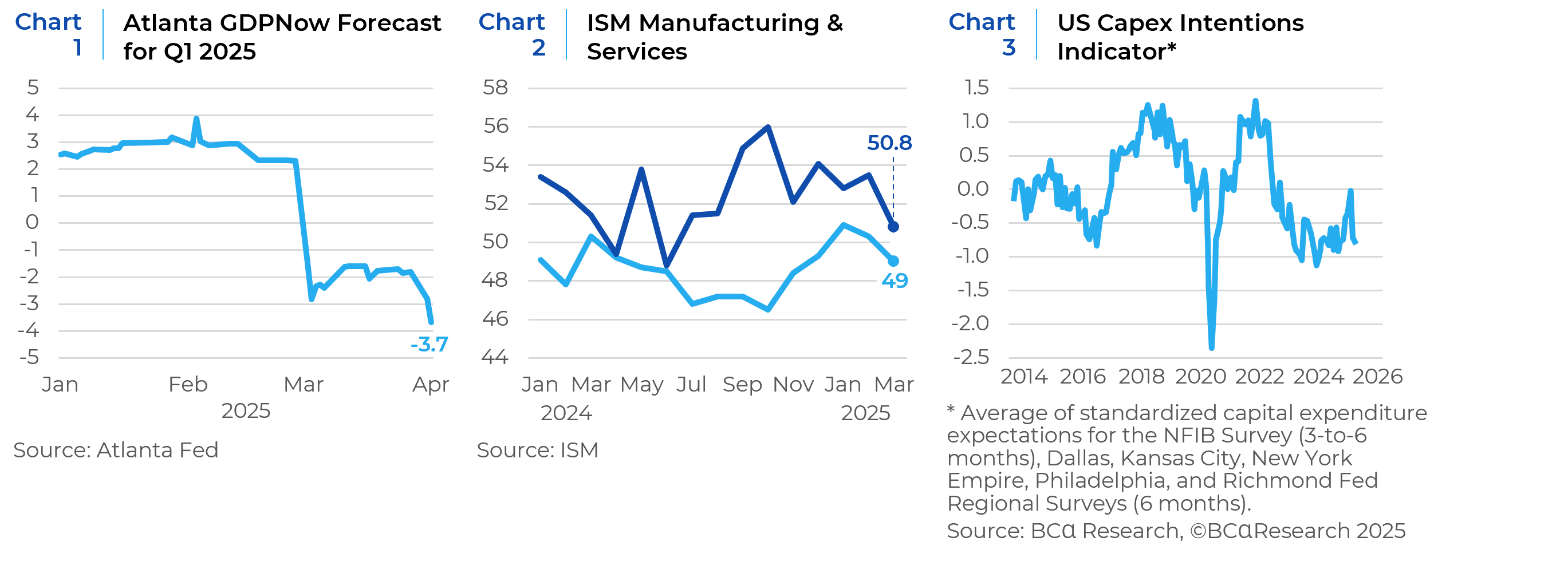

The economic confusion associated with the current administration’s policies has led to sharp revisions in GDP forecasts. The Atlanta Fed’s GDPNow projection indicated a potentially severe contraction, suggesting GDP could drop to -3.7% for Q12025 (Chart 1) based on economic indicators available in early April. This marks a substantial decline from earlier projections and represents a stark contrast to the optimistic forecasts made at the beginning of the year. Both ISM Manufacturing & ISM Services appear to be declining with ISM Manufacturing in contraction mode – another indicator of slowing growth (Chart 2). Capex intentions are trending down reflecting companies’ skepticism about their growth prospects (Chart 2).

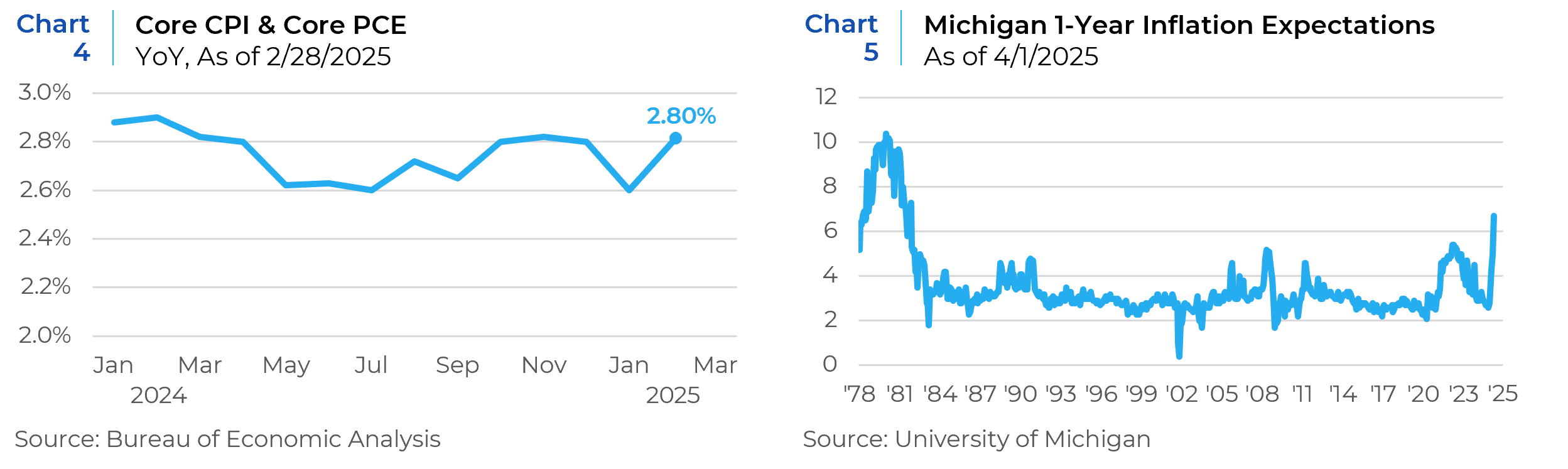

In the meantime, inflation appears to be sticky and remains stubbornly above the Fed’s 2% target (Chart 4). This persistent inflation has limited the Federal Reserve’s ability to implement rate cuts that might otherwise have supported economic growth during a period of increasing uncertainty and volatility.

Consumer inflation expectations have also increased sharply, hitting their highest levels since 1981 (Chart 5).

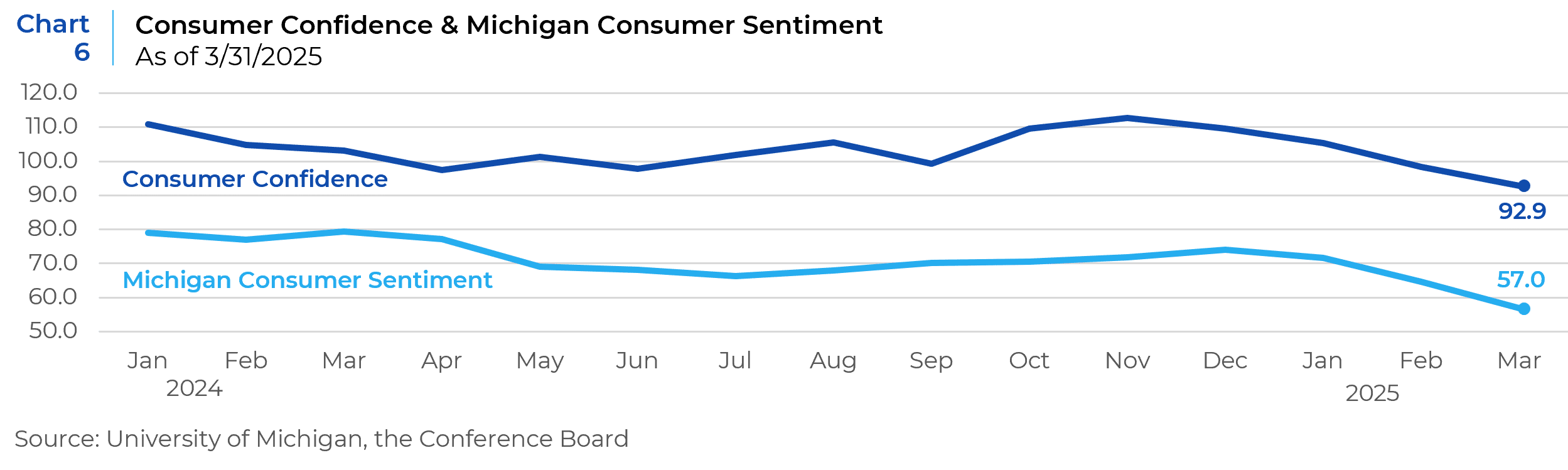

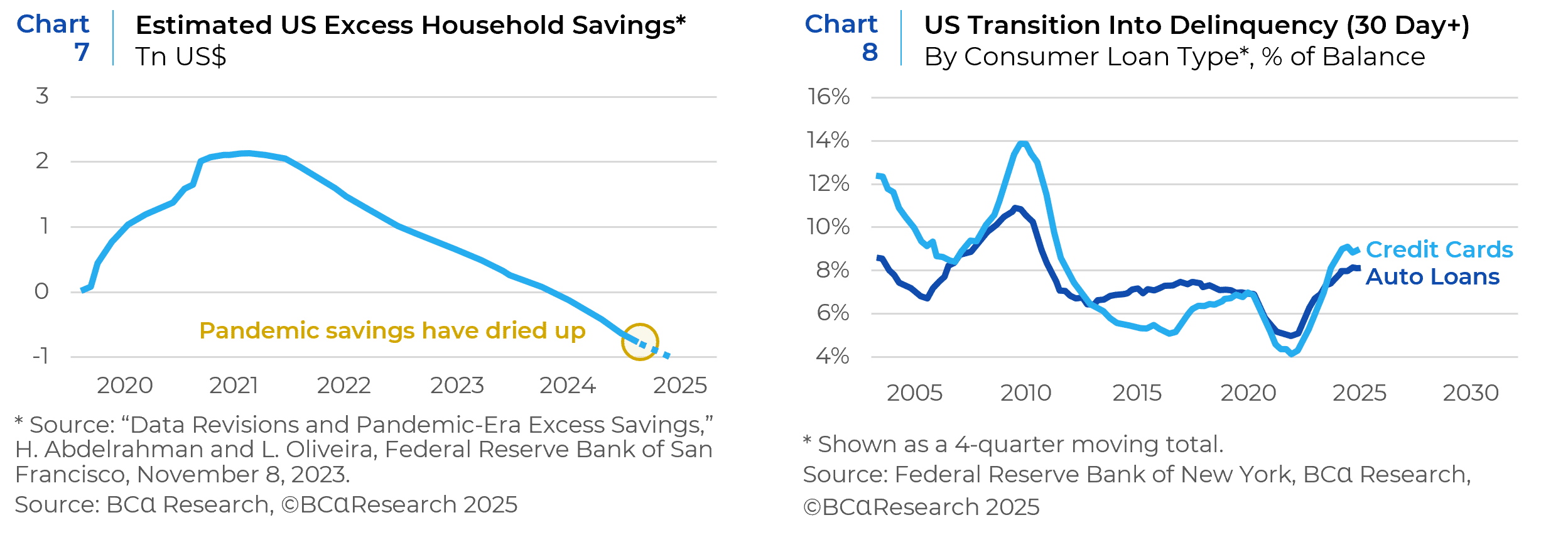

The U.S. consumer’s vulnerability appears to be increasing as reflected in the worsening Conference Board Consumer Confidence and Michigan Consumer Sentiment numbers (Chart 6). The excess savings that were racked up during the pandemic years have now been depleted (Chart 7) and delinquencies have started to rise (Chart 8). These trends do not bode well for future economic growth.

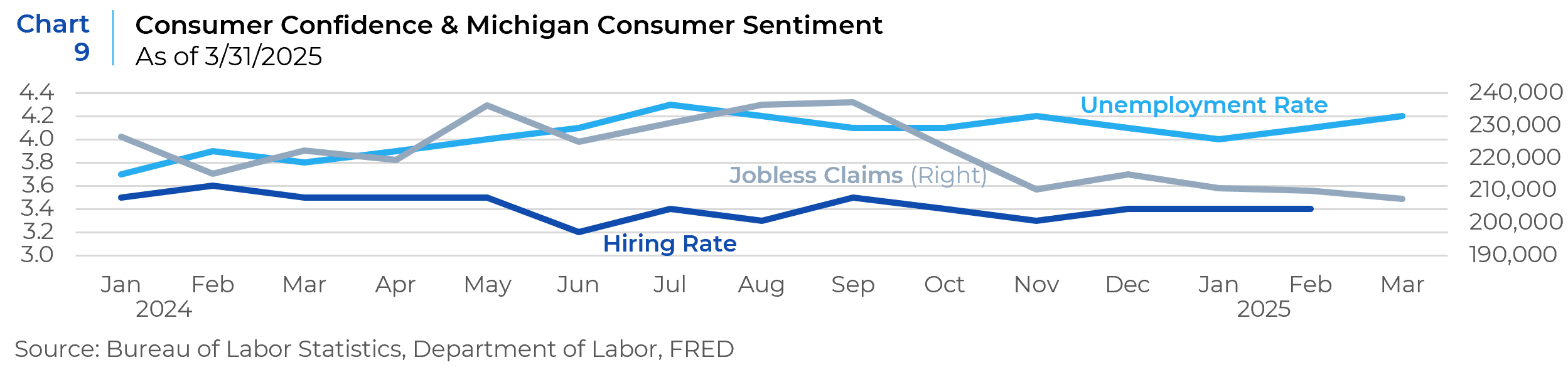

Despite the economic headwinds, the labor market has shown remarkable resilience (Chart 9). The unemployment rate remains low, indicating that the job market continues to be a bright spot in the economy. However, signs of softening are expected to appear in the second quarter as federal workforce reductions start showing up in the numbers. Moreover, the impact of uncertain economic policy on labor markets remains unknown at this point.

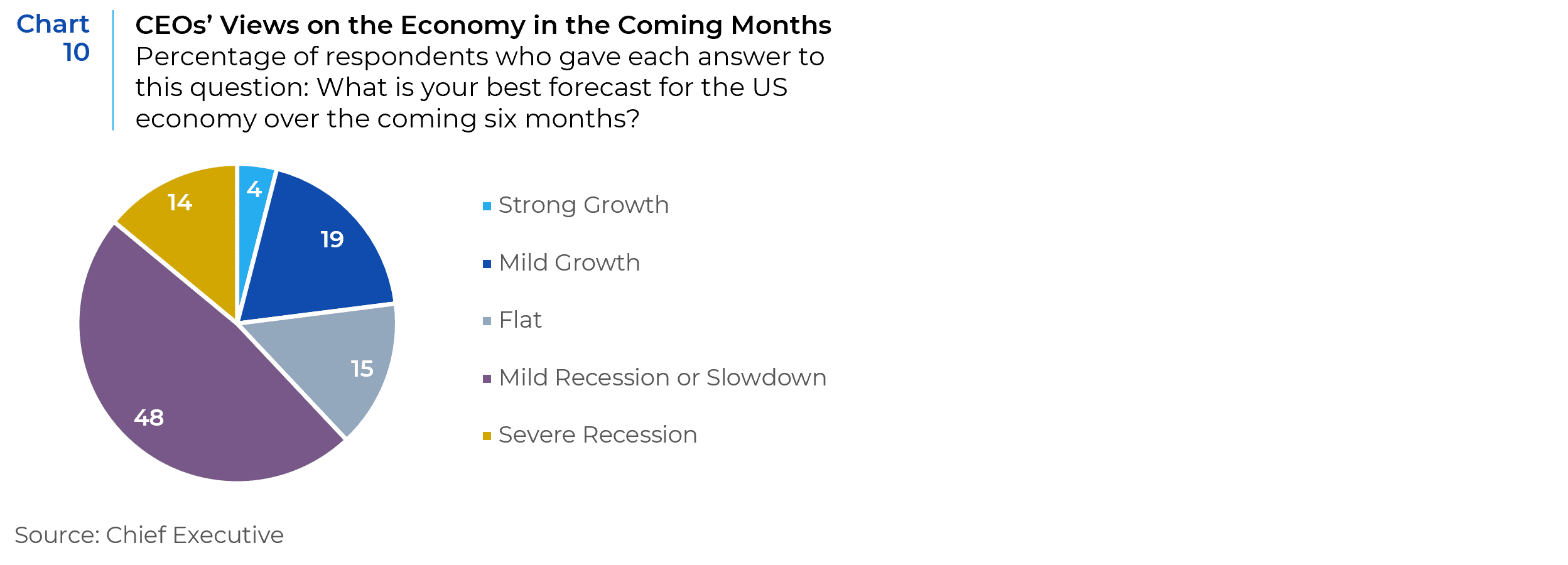

Corporate CEOs are also beginning to raise concerns with more than 60% of respondents to a recent CEO survey indicating that they are expecting a slowdown or recession in the next six months (Chart 10) – a warning sign for investors regarding economic growth.

The Tariff Picture

The opening quarter of 2025 was a roller coaster ride for investors, beginning with optimism but ending with considerable turmoil. From January through mid-February, markets extended the strong momentum from 2024, with the S&P 500 experiencing a 5.7% rally through February 19th. This initial enthusiasm resulted from investor focus on the pro-growth elements of the Trump administration’s agenda. However, the situation deteriorated significantly in the latter half of the quarter. Escalating uncertainty surrounding tariff policies triggered a substantial market correction, with the S&P 500 declining 10% from its February highs. By the end of the quarter, the broad market index had registered a 4.27% decline, with March alone witnessing a 5.63% drop. This marked the S&P 500’s worst quarterly performance since the third quarter of 2022.

Uncertainty regarding the Trump administrations’ trade policy, particularly as it relates to tariffs, was the dominant factor shaping both economic and market performance in the first quarter of 2025. This has continued as we have moved into the second quarter of the year. The quarter featured several tariff policy announcements that took investors on a rollercoaster ride. As tariff discussions intensified, they created significant market anxiety about potential impacts on economic growth, corporate profits, and inflation. While tariffs themselves pose inflationary threats, the uncertainty surrounding their implementation can create recessionary pressures, raising concerns about the unfavorable economic combination of stagflation—high inflation alongside weak economic growth. This uncertainty extends beyond financial markets to impact business investment decisions and consumer confidence. The tariff hikes also place the FOMC in a difficult position, with rising inflation and slowing growth.

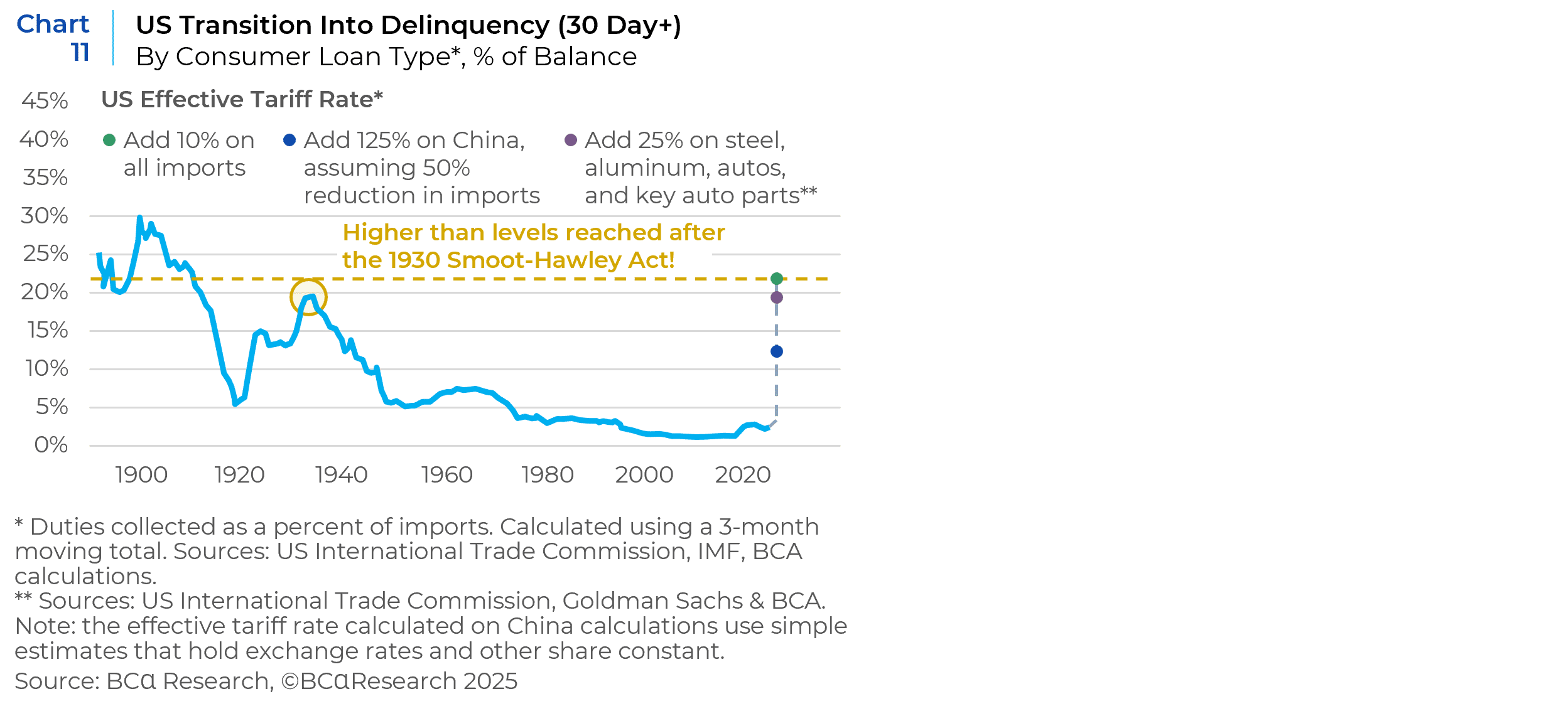

As of the time of this writing, effective tariff rates are projected to be the highest they have been in a century (Chart 11).

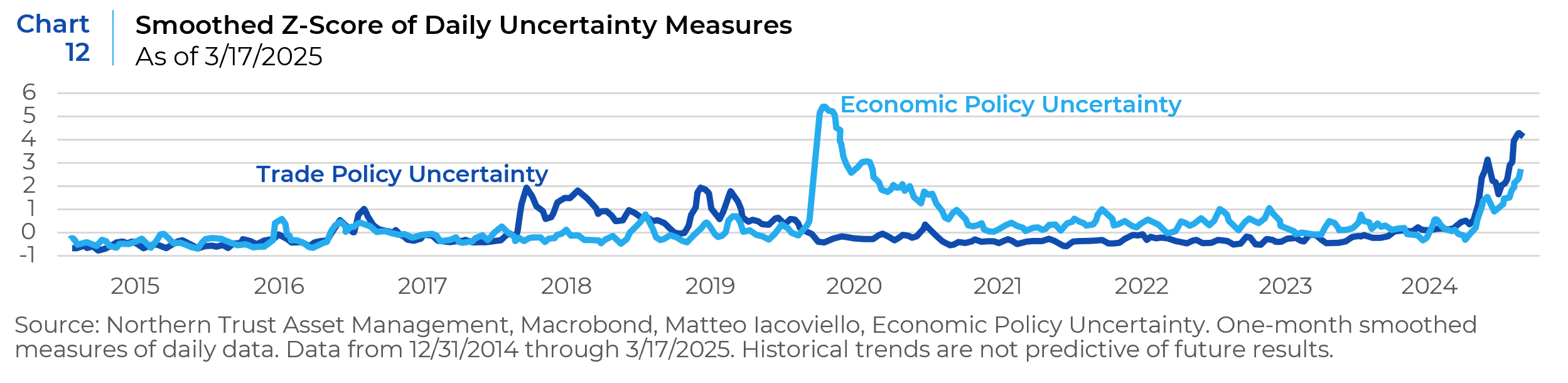

The policy uncertainty (Chart 12) remains very high and continues to keep equity markets on edge. While computers, tablets, Apple watches, monitors, semiconductor equipment and other electronics received a temporary reprieve from tariffs on Chinese products and a 10% tariff on all U.S. imports, they are expected to face separate levies in a month or two.

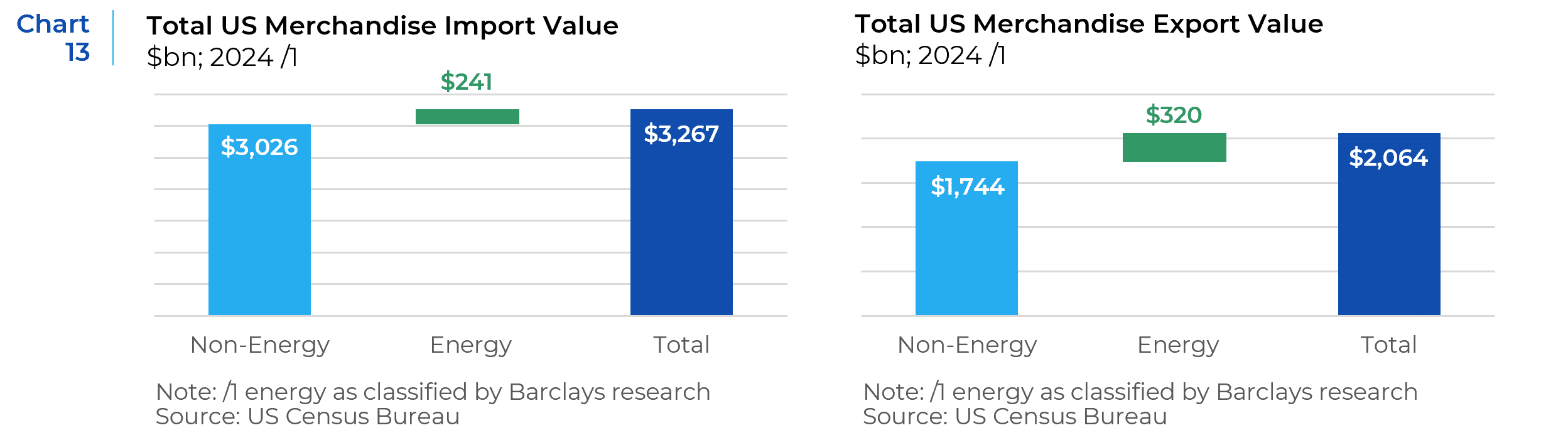

Chart 13 gives us an idea of US imports and exports in total and excluding energy. The estimated trade-weighted tariff rate on all US imports is expected to increase to about 23%. However, given the events of the past few days and a 90-day pause for negotiations with individual countries, there is uncertainty regarding where the new trade-weighted tariff rate will settle.

The primary goals of the Trump administration’s tariff policy are: (1) Use tariffs as a negotiating tool to improve the trade deficit; (2) Use tariffs as a revenue source; and (3) Bring back manufacturing jobs to the United States.

Despite a growing trade deficit, the US economy has grown substantially in the past few decades to become the largest in the world. The US has transformed from an industrial economy to an innovative technology-driven services economy. Unfortunately, persistent trade deficits are an inescapable consequence of the dollar being the world’s reserve currency. The US dollar accounts for 60% of global foreign exchange reserves. Yet, the US economy only contributes about a quarter of global GDP. The US dollar is bought or sold in nearly 90% of global foreign exchange transactions. The largest export of the US is dollars that the rest of the world uses as central bank reserves, to invest in the US stock and bond markets, and for trade settlements. It is a mathematical certainty that the world’s reserve currency must run a deficit. The flipside of the US trade deficit is its capital account surplus. Rather than buying US goods, foreigners have bought US assets such as Treasuries and stocks, because they have seen the US as an attractive place to invest. It is true that the problematic aspects of a trade deficit such as a decline in domestic manufacturing and concerns about debt sustainability need to be addressed but perhaps the approach can be tailored by country and implemented less chaotically than what we are experiencing now.

While tariffs can be a source of revenues over the long term, US consumers will likely bear the brunt of higher tariffs by paying more for various goods. Businesses facing slimmer profit margins may begin to cut jobs. Tariff revenues will only be realized if US consumers keep purchasing imported goods at higher prices. It is more likely that US consumers will purchase fewer imported goods, which means less tariff revenue collected. And, if US consumers keep purchasing the same amount of imported goods at higher prices, it means that the US is not rebuilding domestic manufacturing capacity. That isn’t the desired outcome either. Collecting tariff revenues over the next decade would require US consumers to remain gainfully employed and buy the same amount or an increasing amount of imported goods at much higher prices. That may not be the most reasonable assumption.

The Trump administration also expects that more companies will choose to manufacture their goods in the US in response to higher tariffs. As a result, corporate tax revenues would rise as tariff revenues decline. But relocating manufacturing capacity does not happen overnight. It takes several years. There is also another question that needs to be answered – will the manufacturing jobs come back to the US even though many of these jobs have gone away because innovative technologies made manufacturing more efficient and consumer demand shifted. A trade surplus does not necessarily boost manufacturing employment. In an article published in The Wall Street Journal it was reported that between 2000 and 2024, Germany’s trade balance as a share of its gross domestic product grew from a deficit of 1.5% to a surplus of 5.8%. During this same period, the country’s share of factory jobs fell from 20% to 16%. Despite Germany’s growing trade surplus, manufacturing employment as a percentage of the labor force fell. Could the same thing happen in the US?

The other critical issue is the availability of manufacturing capacity. It will take several years to build capacity to satisfy a meaningful percentage of US demand while in the interim consumers will have to pay higher prices. Would companies be willing to commit to the investment of manufacturing infrastructure based on tariffs that may be subject to renegotiation or discontinuation when a new administration takes office? Then there is the question regarding the availability of labor. Does the US have enough skilled and reasonably priced labor to take the place of those in the developing world who are currently manufacturing goods sold in the US? The reason Americans have been buying imported goods all these years is because they are cheaper, and it is almost certain that prices will be higher for American made goods than what they have been for goods made more cheaply in developing countries. What impact would that have on the standard of living for US residents?

Essentially, these tariffs are likely to hit US consumers and businesses the hardest. While prices will rise in the near term, aggregate demand is likely to fall as consumers reduce spending in response to the tariffs. This certainly increases the risk of recession for every day that high tariffs are in force. Another risk is that continued uncertainty in trade policy results in a chilling effect on business investment and hiring in the US, which could also lead to a recession. Earnings uncertainty increases for each day that these high tariffs are in force.

One positive thread in this narrative is that there are staggered implementation dates, which supports the theory that tariffs are being used as a bargaining tool and are not expected to be long term in nature. As we see a mix of responses from retaliation to renegotiation, some countries have indicated they will reduce the tariffs they apply to US imports. Regardless, the best outcome for markets would be to gain visibility on the end-game as soon as possible.

The Investment Picture

The critical factors that will determine market performance in the coming quarters are tariff implementation and the associated economic impact, the Federal Reserve policy response, and corporate earnings resilience.

Looking forward, investors should prepare for continued volatility while remaining selective about opportunities. Downside risks have increased substantially and the Federal Reserve’s limited ability to provide monetary support amid persistent inflation creates a challenging backdrop that will require careful navigation. The coming quarters will test whether markets can stabilize amid policy confusion or if further adjustments are necessary as economic realities shift. The full set of international responses and country-by-country negotiations with the U.S. will take time, making it hard to have visibility on when and how this will settle. Major wealth destruction could hurt sentiment and spending.

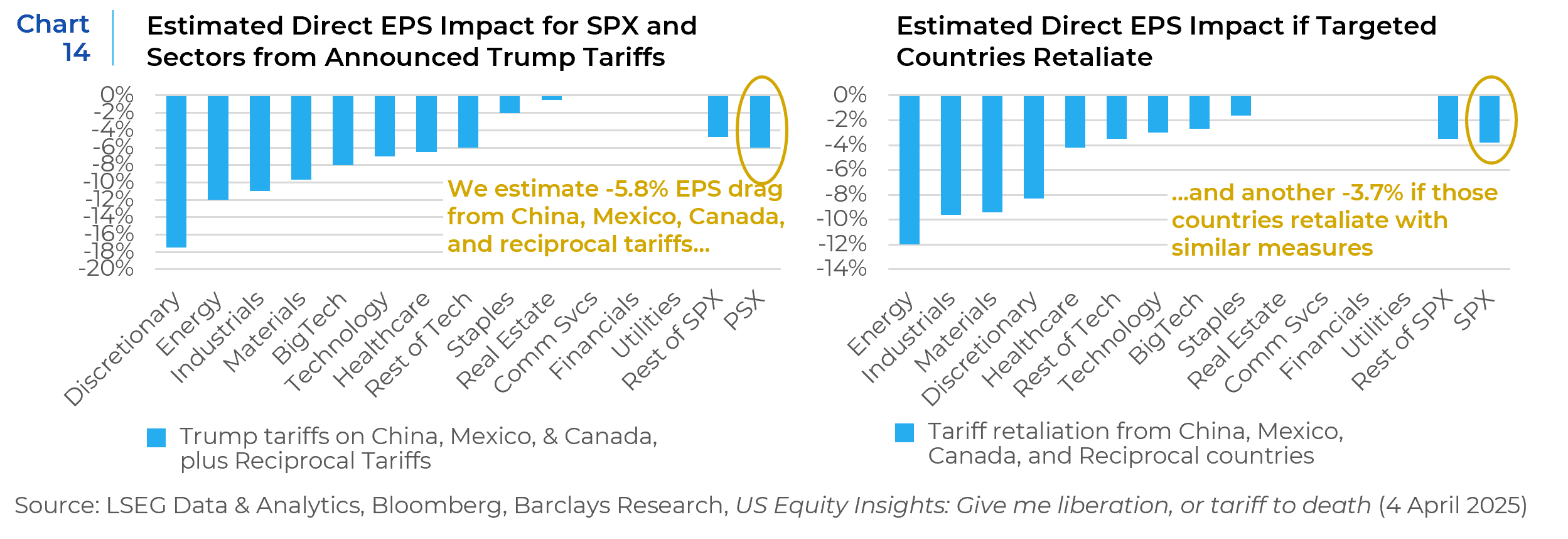

It is estimated that the direct impact of the latest tariffs, if implemented instead of negotiated down, could amount to a negative 9.5% drag on SPX EPS after combining US tariffs and likely retaliation from targeted countries (Chart 14).

To help position equity portfolios for this prolonged volatility, investors should consider lowering portfolio beta, investing in high quality and low volatility stocks that provide protection during the market downdrafts, and overweighting defensive sectors like Consumer Staples, Utilities, and Health Care. Investing in more services than goods, like Health Care Services or Insurance, rather than Autos and Semiconductors, may also be a defensive move. Focusing on dividend growers with stable earnings and solid balance sheets and broadening exposure beyond the “Magnificent Seven” technology stocks that dominated in previous periods may help stabilize performance. There may be worthwhile investment opportunities in AI adopters across various industries and in European markets that are starting to look more attractive as U.S. policy shifts are spurring fiscal spending globally.

Tariffs will prove a major disruption to the vast majority of US businesses, and it will cost them significant investments to retool their supply chains and bring them back to the US or more favorable tariff regime countries. The short-term outlook for the US economy is not encouraging. However, over an intermediate investment horizon, companies may be able to adjust. Hopefully, the damage will not be permanent, especially if the final tariff rates end up lower than announced. There are many unknowns involved in the current situation and investors would be well served by staying grounded in the enduring principles of diversification, discipline, and a long-term perspective.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.