Multi-

Manager

Platform

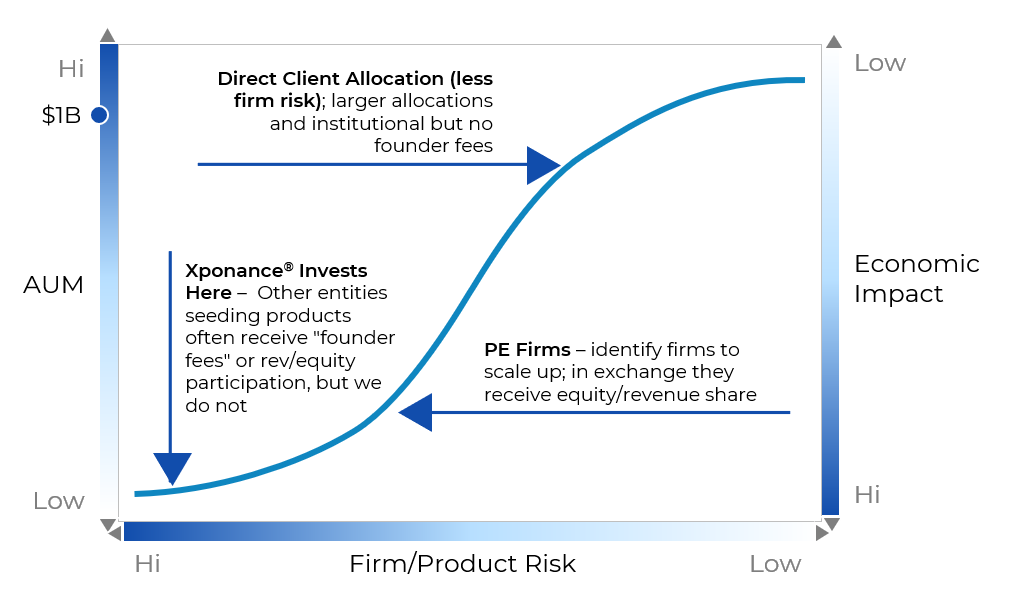

We believe that small, entrepreneurial managers have a performance edge in capacity constrained strategies that can be a vital source of portfolio management innovation. Our philosophy is to:

- Engage innovation via small, entrepreneurial firms

- Vet investment edge through thorough due diligence

- Prioritize high conviction managers (active/opportunity share)

- Invest early to lock up capacity for our clients

Research Supporting Our Investment Thesis 1,2,3,4

Source: FactSet Research Systems Mutual and Institutional Fund Database

Byles Williams, T. (2013). Is Active Management Alpha on Temporary or Permanent Disability?

Manager Selection – Criteria for identifying Entrepreneurial Managers

Constructing portfolios for our clients begins with identifying high quality entrepreneurial managers. We consider four key factors when identifying these managers

People

- Talented and experienced professionals with high integrity

- Culture and decision-making context encourage rigorous analysis and diverse perspectives

- Compensation and/or ownership aligned with desired performance outcomes and team stability

Process

- Well-articulated and repeatable investment “edge” supported by credible research

- High-conviction and insight in both their stock selection and portfolio construction

- Disciplined execution of investment process

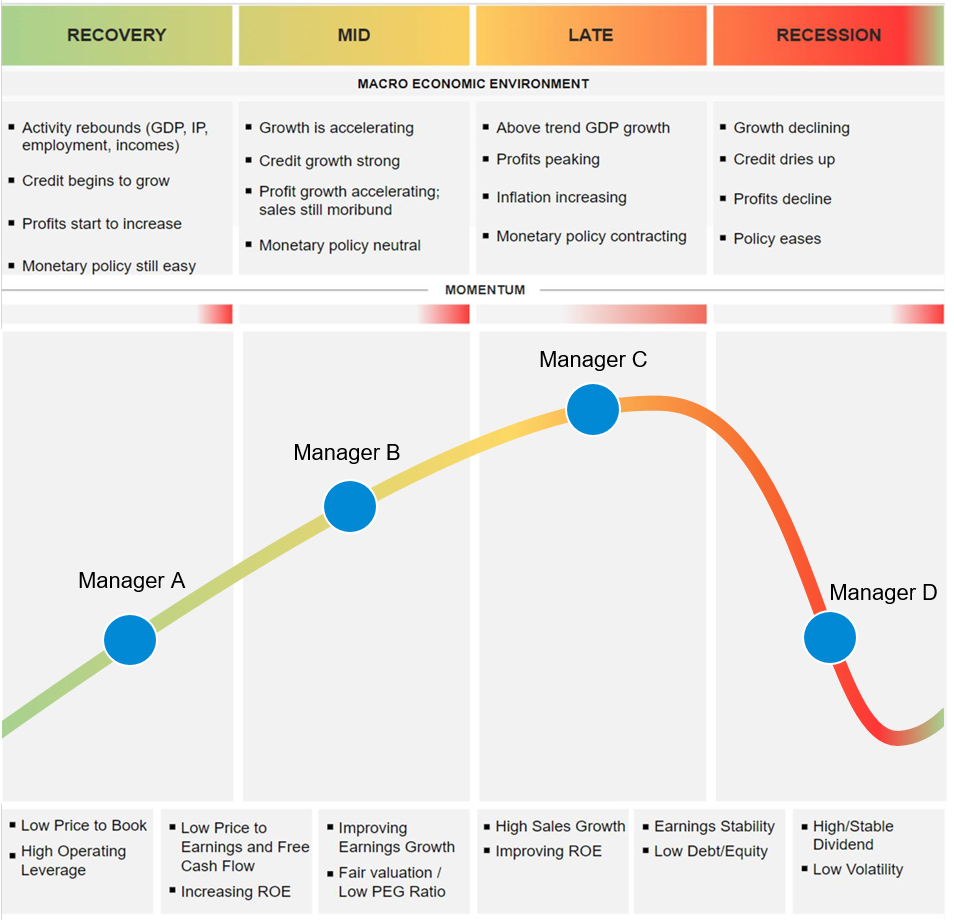

- Clear process for identifying “blind side(s)” or the impact of a changing market environment

Infrastructure

- Institutional quality back office

- Allocation of organizational resources consistent with manager’s investment edge

- Financial resources sufficient to sustain business

- Passing grade for Operational Due Diligence Visit

Performance

- Active Opportunity Score

- “True” excess return (raw return minus return of style “clone” or passive factor replication portfolio

- Stock selection and/or factor rotation edge and/or consistency

- Key Risk Characteristics

Xponance® Is a Leader in Sourcing, Seeding and Providing Early Institutional AUM to Entrepreneurial Firms

Constructing Value Added Portfolios

Account Parameters

Incorporate client guidelines.

Portfolio Optimization

Buy listed managers based on conviction score. Conviction score comprised of:

- People/culture

- Process

- Infrastructure

- Aapryl alpha forecast

Risk Mitigation

Control uncompensated portfolio allocation relative to:

- Sectors

- Countries/regions

- Fundamental factors (broadly classified as style and capitalization)

Multi-Manager Platform

International Equity

Emerging Markets Equity

EAFE

Regional Emerging Markets Fund

International Small Cap Equity

Global Equity

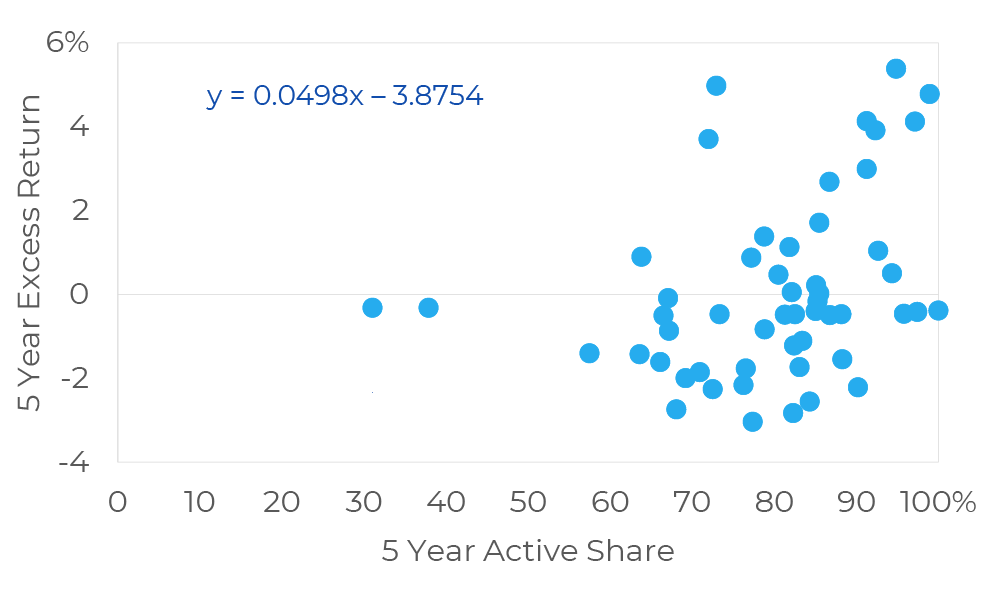

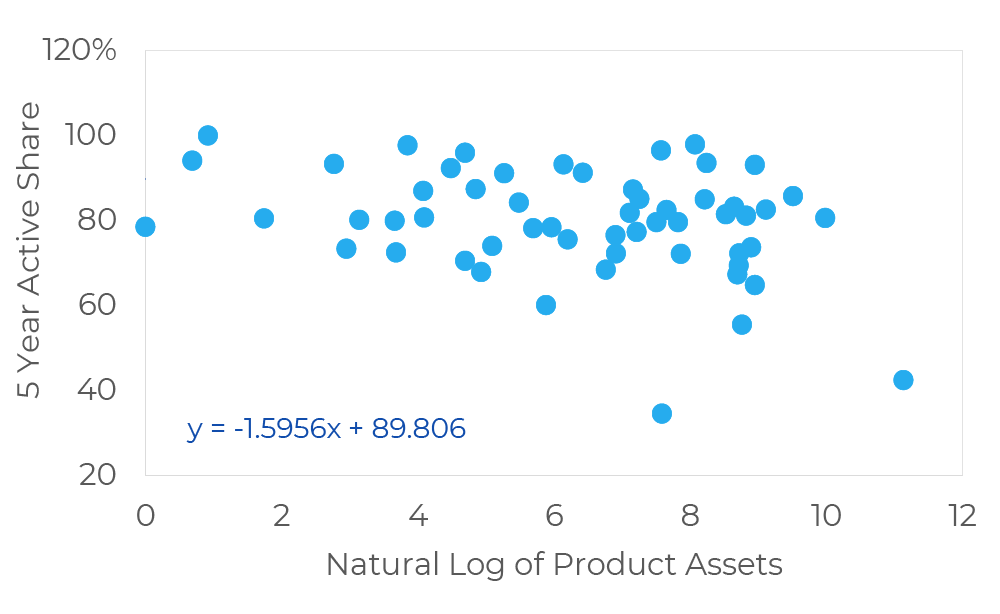

1. Kacperczyk, Sialm & Zheng (2004). [More concentrated funds outperform.]

2. Petajisto, A. & Cremers, M. (2006); Petajisto A. (2012). [The most active stock pickers outperform; closet indexers underperform.]

3. Jian, Verbeek & Wang (2011). [Managers’ highest-conviction stock holdings outperform.]

4. Byles Williams, T. (2013). Is Active Management Alpha on Temporary or Permanent Disability? [Affirms positive long-term positive relationship between Active Share and excess return, negative relationship between Active Share and AUM growth and examines the cyclical weakening of the benefits of high active share holdings for US Large Cap managers during the 5 years following the 2008 crash.]

2. Petajisto, A. & Cremers, M. (2006); Petajisto A. (2012). [The most active stock pickers outperform; closet indexers underperform.]

3. Jian, Verbeek & Wang (2011). [Managers’ highest-conviction stock holdings outperform.]

4. Byles Williams, T. (2013). Is Active Management Alpha on Temporary or Permanent Disability? [Affirms positive long-term positive relationship between Active Share and excess return, negative relationship between Active Share and AUM growth and examines the cyclical weakening of the benefits of high active share holdings for US Large Cap managers during the 5 years following the 2008 crash.]