“If someone, a year ago, described January 6, 2021 (and events attending it) & asked you to guess the stock market behavior, admit you would have gotten it wrong. Just so you understand that news do not help you understand markets. Now, work on having a good 2021”

– Nassim Nicholas Taleb1

On January 6, 2020, the world watched in astonishment as a mob stormed through the U.S. Capitol to reject the legitimacy of the democratically elected candidate’s presidential victory. This mob was incited by the incumbent president’s allegations of widespread election fraud, even though they had been resoundingly and repeatedly debunked in the multiple courts and the U.S. Supreme Court. In addition to the violation of political leaders’ private offices and the defacement and theft of iconic property, 5 people died. On that day, the S&P 500 Index jumped by 0.57%, and ended the week unscathed (up 0.55%), despite record setting increases in cases, hospitalizations and deaths waged by the global coronavirus pandemic.

Once again, we were reminded that it is policy, and not politics, that drives risk asset performance. From the market’s perspective, the transfer of presidential power, however tempestuous, was always going to occur. The dual electoral upsets in Georgia the prior day had yielded Democratic control of the Senate and a razor thin blue sweep; ensuring continued fiscal and monetary policy accommodation to buoy risk assets.

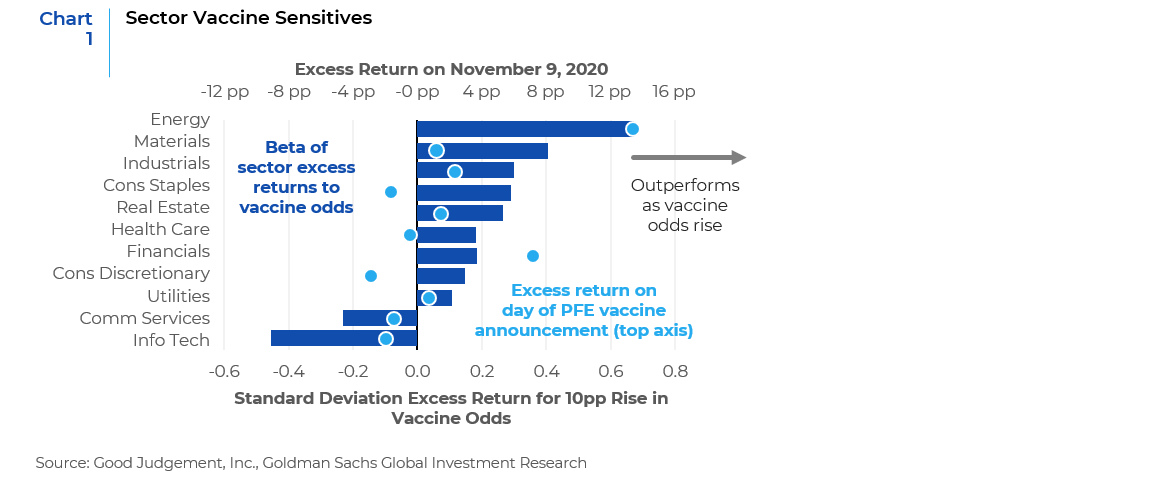

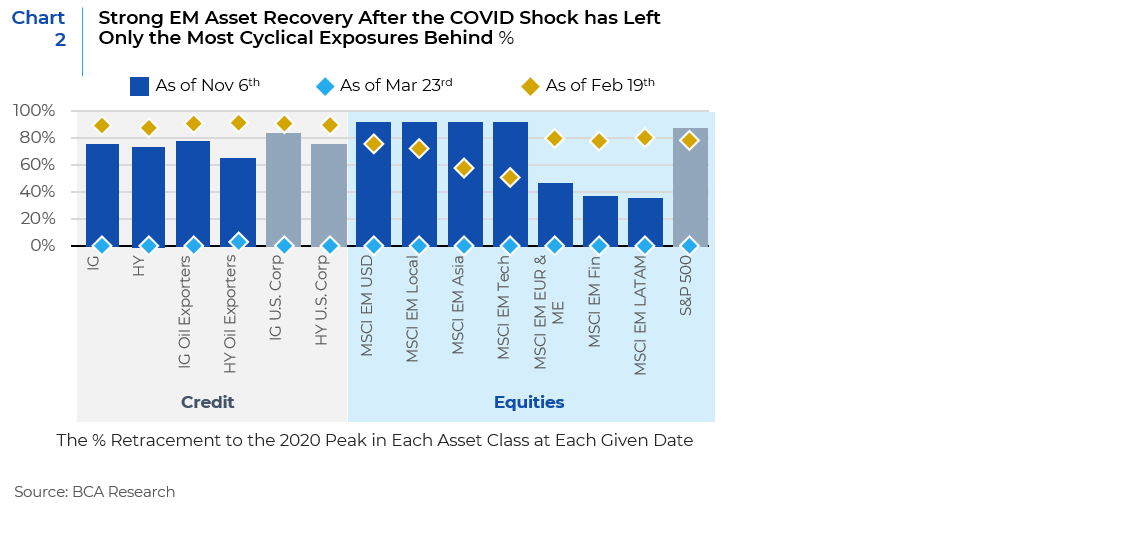

In our Q4 2020 Market Outlook, we posited that the market would transition into a reopening trade, whereby physical economic sectors would rebound relative to digital sectors that had thrived during the global pandemic, particularly if a COVID-19 vaccine gained approval. (Chart 1). This view has subsequently become the consensus for 2021. In 2021, more stimulus, a lower dollar and higher inflation breakeven rates will flatter industrials, materials, commodities and financials and hurt a tech industry which is also facing increasing bi-partisan regulatory scrutiny. Healthcare is likely to face some regulatory uncertainty as a revival of Obamacare will be a priority for Democrats. These sectoral views favor small-cap equities and value stocks over large-cap and growth stocks. With the Democrats controlling both the executive and legislative branches, one would expect a bumping up of the stimulus checks of individuals to $2000 from $600 and the implementation of the remaining $2.5 trillion of the Democrats’ proposed HEROES act. This will enlarge the deficit, weigh further on the U.S. dollar, but significantly boost spending and flatter corporate earnings. For U.S companies, the likely repeal of some portion of the 2017 tax cuts, will however neutralize the net earnings impact. Because U.S. equities are less dominated by traditional cyclical sectors, a resurgent global economy would favor non-U.S. developed and particularly emerging markets, whose valuations are also more compelling. (Chart 2).

Obvious risks to this forecast include:

- A more virulent strain of the virus which evades the hoped-for protections provided by approved vaccines.

- Potential geopolitical flareups. Whilst America remains the most dominant nation-state, its reputation as a beacon of democracy has been tarnished in a more multi-polar world where regional actors have become increasingly emboldened. The Biden administration is likely to pursue a more rules-based foreign policy which reengages in international agreements. However, they are also likely to undertake a more muscular approach towards Russia and an equally aggressive, though less bellicose prosecution of America’s strategic rivalry with China. Regardless of which president occupies the White House, the fundamental challenge for China is that its GDP per capita is low by DM-standards. “Made in China 2025,” a flashpoint for U.S. policymakers, is therefore critical for boosting China’s productivity, value-added growth, and lifting incomes to DM-levels. In sum, China is trying to get wealthy before it gets old. U.S. policy is aimed at making sure China gets old before it gets wealthy.

- Overheated markets. The market has aggressively discounted the positive impact of the global rollout of the COVID-19 vaccines on the economy and is therefore vulnerable to earnings disappointments.

For investors, the real question is what, if any, are the long-term implications of the national disintegration and fragmentation of America’s body politic that manifested in mob insurrection on January 6th? This question could give rise to lengthy papers well beyond our scope. Below we briefly provide our perspective.

Trouble Ahead for the Greenback?

The U.S. dollar’s reserve status is arguably the primary financial symbol of U.S. global hegemony. Maintaining reserve currency status is a function of economic and financial dominance as well as political stability in order to engender global confidence. On the former, whilst China is gaining ground, America still maintains the largest economy with the deepest financial markets. On the latter, although the attempted insurrection on January 6th further eroded confidence in our political stability, America’s historical stability and rules-based system still has few rivals. Moreover, as a bulwark against competing reserve currencies, the U.S. has aggressively turned to regulatory decree to ensure that U.S. Treasuries and by extension, the greenback, retains their centrality to global finance. For example, mandatory margin rules for the over $700 trillion (according to BIS estimates) OTC derivatives coming into effect in Sept 2021 will secure USTs as the de jure lifeblood of the global financial system.2

The U.S. dollar’s reserve currency status has been a mixed blessing. On the plus side, it has facilitated the liquidity and pricing of financial assets as well as access to capital for U.S. firms. However, it has also given rise to a classic Triffin paradox.3 That is, as the reserve currency, the U.S. must be willing to supply the world with an extra supply of its currency to fulfill global demand for its foreign exchange reserves. If the Federal Reserve doesn’t increase the supply of dollars, the price of dollars compared to other currencies, (i.e., the exchange rate) will increase, thus raising the relative price of U.S. goods to foreigners and reducing demand for U.S. exports. The resulting currency appreciation has impeded manufacturing competitiveness and jobs and ultimately, sustainable economic growth. During times of economic hardship and rising economic inequality (which is at historic highs today), this paradox has always been a convenient foil for protectionist currency and trade rhetoric and policies.

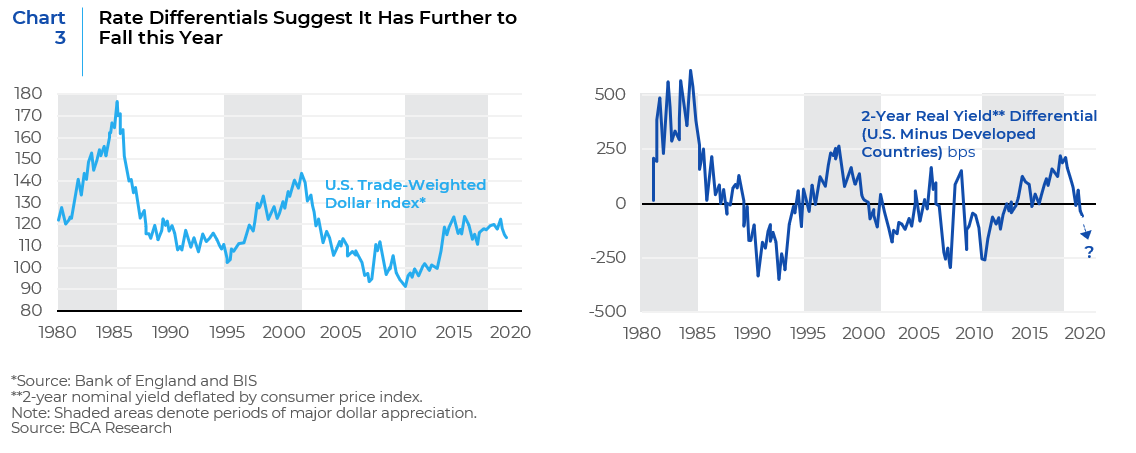

From a cyclical perspective, in 2020, we saw the gradual end of the decade-long U.S. dollar bull market, which benefited from a combination of favorable interest rate differentials on U.S. bonds (i.e., a positive carry trade); Chinese devaluation, the global oil crash, Trump’s tax cuts, the U.S.-China trade war, and COVID-19 lockdowns. The U.S. dollar is a counter-cyclical and momentum-driven currency that responds inversely to global growth trends. When U.S. real interest rates are high and rising, foreign investors will snap up U.S. liabilities and finance America’s twin deficit (the sum of the fiscal and current account deficits). If real rates are low and falling, then foreigners will demand a much cheaper dollar (which would embed higher long-term expected returns) to buy U.S. liabilities. In 2020, aggressive Fed accommodation to shore up financial markets after the February/March coronavirus lockdown reduced the yield advantage of U.S. treasuries. (Chart 3). Additionally, an exploding twin deficit has begun to weigh on an already overvalued greenback.

As we consider the secular outlook for the U.S. Dollar in the 21st century as both a global reserve currency and means of exchange, one might reflect on the rise and fall of the world’s previous (and first) truly global currency, the Spanish real de a ocho.4 The Spanish invasion and subjugation of the Aztec and Incan Empires in the 15th and 16th centuries, yielded the rich silver and gold mines of Bolivia and Mexico that lifted Spain from backwater to global power within a generation. By the end of the 16th century, the Spanish Dólar was the premier international currency of the world, and was the preferred means of international exchange with China for 200 years. It was also the official peg for the U.S. Dollar from its creation in 1792 and legal tender in the young United States until 1857.

Similarly, American confiscation of Spanish, Mexican, and Native American lands, yielded the American gold rush of the mid-19th century that, together with the subjugation of African slaves, financed the rise of American industrialization. This in turn financed the direct displacement of the remaining Spanish hegemony in the Americas and SE Asia following the U.S. Civil War. Concomitant American growth and expansion put America in the unique position of financier and ultimately military hegemon amid the infighting of European powers in the early 20th century. The post-World War II Breton Woods system formally placed the U.S. Dollar at the center of global finance for the next century. Today, the U.S. Dollar remains the premier international currency of the world, facilitating more than 90% of documented forex transactions and an estimated 60% of global central bank reserves. Sixty-six countries are pegged to the USD and several others, including China, are partially pegged to the USD.

Yet the decline of the Spanish Dólar as a reserve currency remains instructive. Whilst the Spanish Dólar remained as a global means of exchange for nearly 300 years, its status as a reserve currency ebbed with the mismanagement of Spain’s windfall. Flush with the riches of gold and silver forcibly plundered from the Andes and Mesoamerica, Spain failed to develop a sufficiently robust domestic economy. Spanish bullion ultimately did more for the artists of Amsterdam than the merchants of Madrid. Spanish (or Andean) silver delivered global military hegemony to Spain for a century, but imperial overreach, serious outbreaks of plague throughout the 17th century, alongside xenophobic expulsions of minorities led to inflation, economic stagnation, rising inequality, and ultimately internal division and secessionary conflict. Weakening of central Spanish authority ultimately led to a decline in naval power and eventual subjugation by Napoleonic forces. While the polity of Spain has survived to this day, it has long been usurped by a parade of better managed, faster growing economies and is now the 36th richest country in the world per capita, behind Lithuania and Slovenia, and it no longer has sovereignty over its own currency.

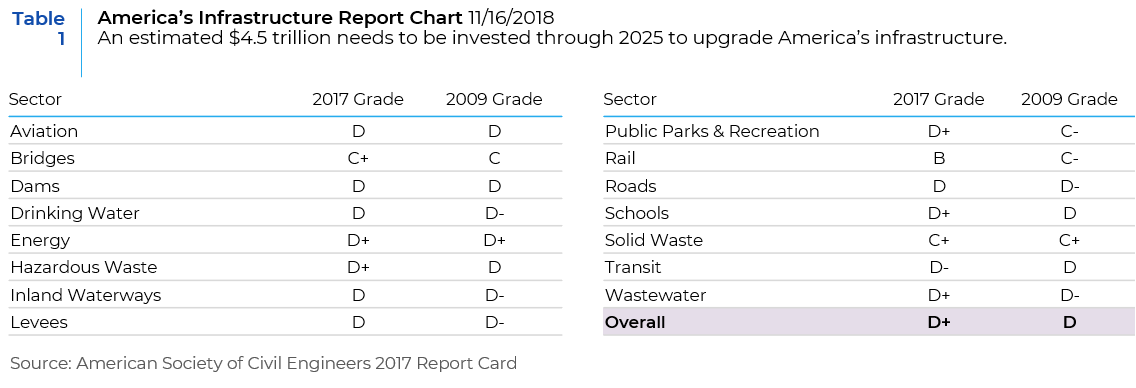

American economic and military primacy has similarly delivered to it the luxury to overspend on empire building and underinvest in the productivity of its human and capital stock for the past 50 years. America has over 500 military installations on foreign soil in over 80 countries worldwide; but a 2017 report by the American Society of Civil Engineers, America’s infrastructure continued to give America’s infrastructure, including its schools, a dismal grade (Table 1).

The cumulative socio-economic impact of decades of national underinvestment has in part fueled the rising disaffection that has undergirded fealty to a demagogic populist leader, whose waning weeks were fittingly capstoned by the January 6th insurrection on a bastion of our democracy. Like 17th century Spain, amid our own plague, we have printed trillions in debt, expelled foreign students amid a rash of other xenophobic policies, witnessed the violent repression of ethnic minorities, looting and political violence from citizens across the political spectrum and an increasingly militarized population of revolutionary militias.

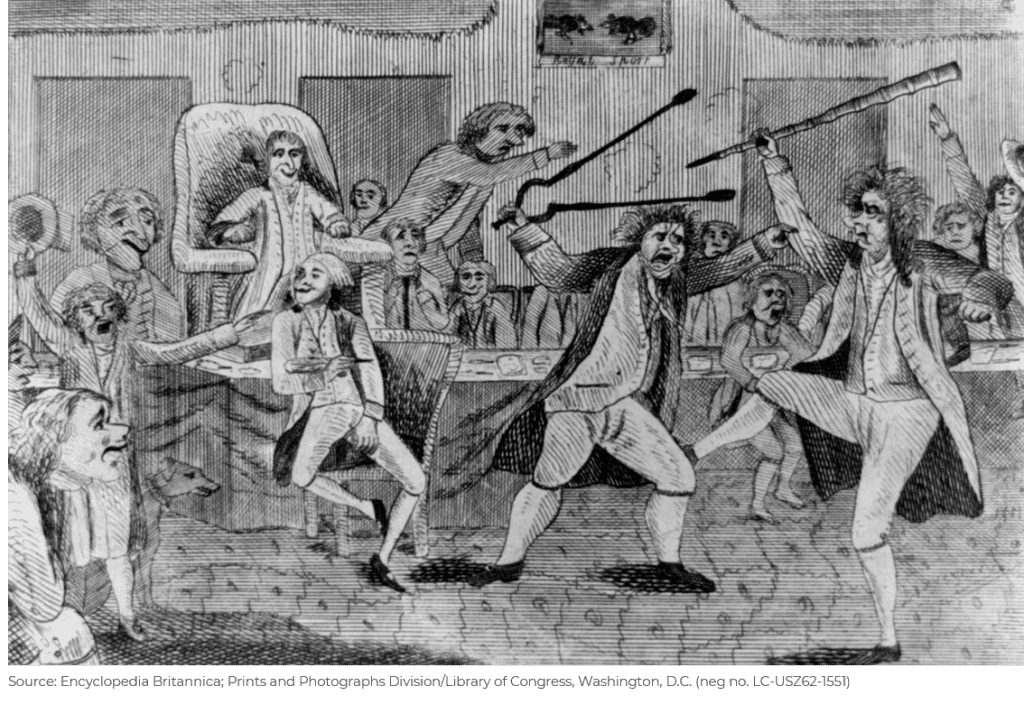

Finally, during periods of national distress, it is worth remembering that from its founding, America has always undulated between periods of confounding reaction and revanchism, only to return to periods of magnificent advancement. The image below depicts Congress under the Presidency of John Adams when the Alien and Sedition Acts of 1798 made it more difficult for immigrants (who overwhelmingly supported the opposition) to attain citizenship and mandated the deportation of those who came from “hostile” states. Another law allowed for the prosecution of those who openly criticized his administration, such as newspaper publishers. Like today, political polarization was at an extreme. Federalists and Republicans largely resided in different neighborhoods and attended different churches. The Federalists, centered particularly in New England, prized their Anglo-American origins whilst the Republicans disdained Great Britain and cherished the Enlightenment ideals of liberty and equality enshrined by the French Revolution. Fights and mob violence often followed.

Americans (and the world) then (and now) likely worried that the experiment in self-government might be permanently damaged. The early republic was by no means a fully realized democracy. Notably, the bold democratic ideals of equality enshrined in the nation’s founding documents belied governing practices that repudiated them, most notably in the legal sanctioning of slavery. The brandishing of the Confederate flag in the halls of the Congress on January 6th (see image below) recalled an earlier insurrection in the post-civil war Reconstruction period, when White mobs overtook several southern state governments, murdered and expelled duly elected Black legislators, and subsequently circumscribed the rights of Black citizens. This incursion rendered the election of a Black senator and a Jewish senator in deep-south Georgia the prior day all the more remarkable; and a signal that ultimately, each period of ignominy will be answered by even stronger resilience and determination to achieve a more perfect union.

1 Nassim Taleb tweet. Twitter.com, January 6, 2021

2 High-quality government bonds carry the lowest haircuts, so they are the cheapest to deliver collateral. Because the bulk of derivative transactions are denominated in USD, USTs are the cheapest form of collateral. In short, regulatory decree will turn USTs into the de jure lifeblood of the global financial system.

3 This dilemma was identified in the 1960s by Belgian-American economist Robert Triffin.

4 Pieces of eight” aka “peso de ocho” and eventually “peso” more colloquially known globally at the time in the non-Hispanophone world as the “Spanish Dólar.”

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.