A Decade of Returns, the Influence of AI, and Strategies for 2026

2025 Fixed Income Recap and 2026 Implications

The year 2025 was a strong year for fixed income returns, so what are the implications for 2026. In this research note, we:

- Evaluate the returns from select bond market sectors and categories over the past decade—a period distinguished by major shifts including the end of the Zero Interest Rate Policy (ZIRP), the impact of a global pandemic, and the resurgence of inflation.

By evaluating the performance of various bond market sectors in response to significant economic events, to shed light on both the challenges and opportunities that have shaped fixed income investing.

- As AI and AI adjacencies increasingly dominate the stock market and economic growth, fixed income investors face new and evolving risks. This piece evaluates the rising risk exposures within the fixed income space as AI’s role expands.

- With tight credit spreads, a K-shaped economy, and an uncertain monetary policy outlook, we offer our perspective on navigating these challenges, focusing on practical approaches for managing fixed income portfolios in the evolving landscape.

Return Patterns and Credit Sector Differentiation: A Decade in Review

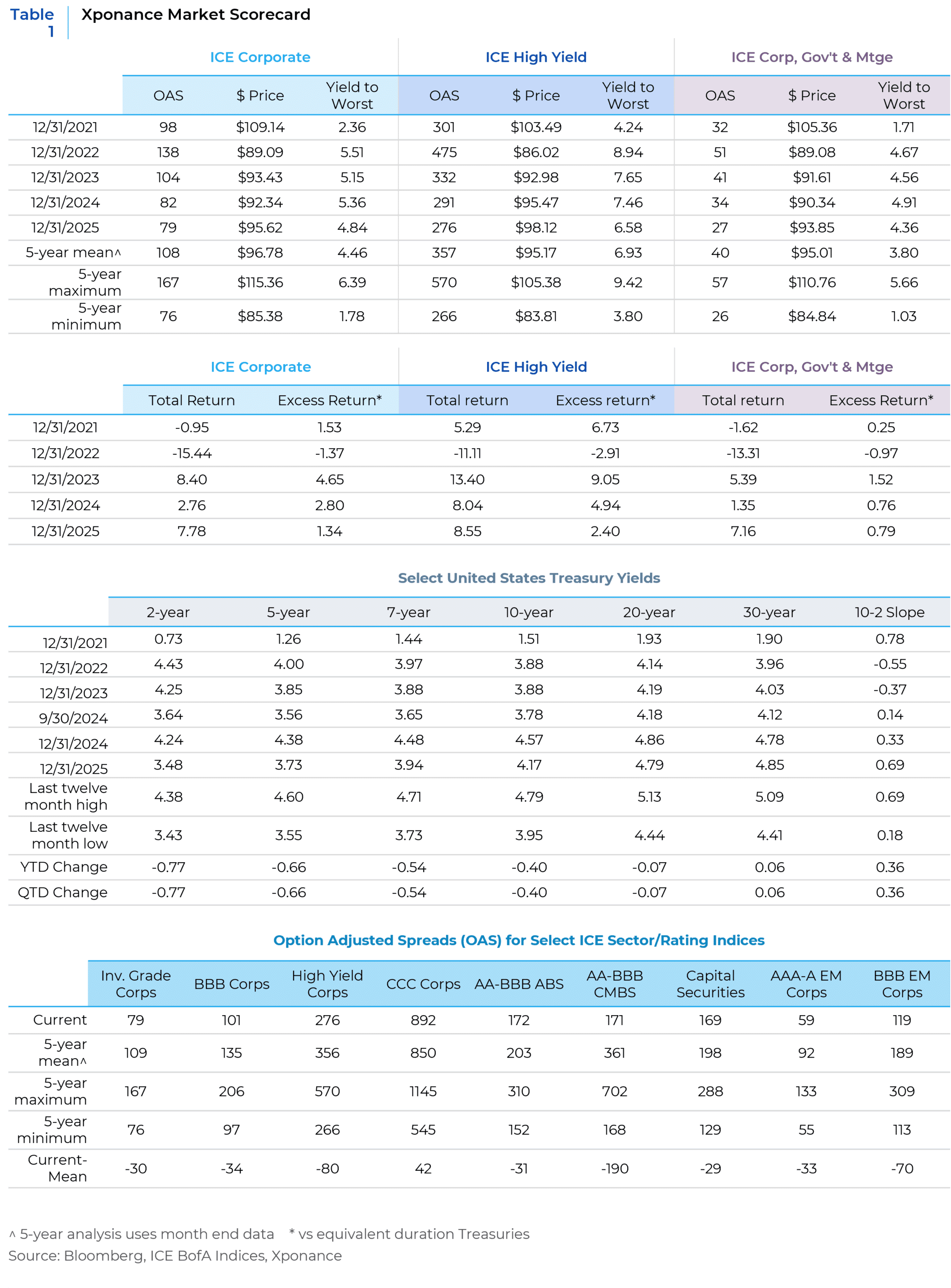

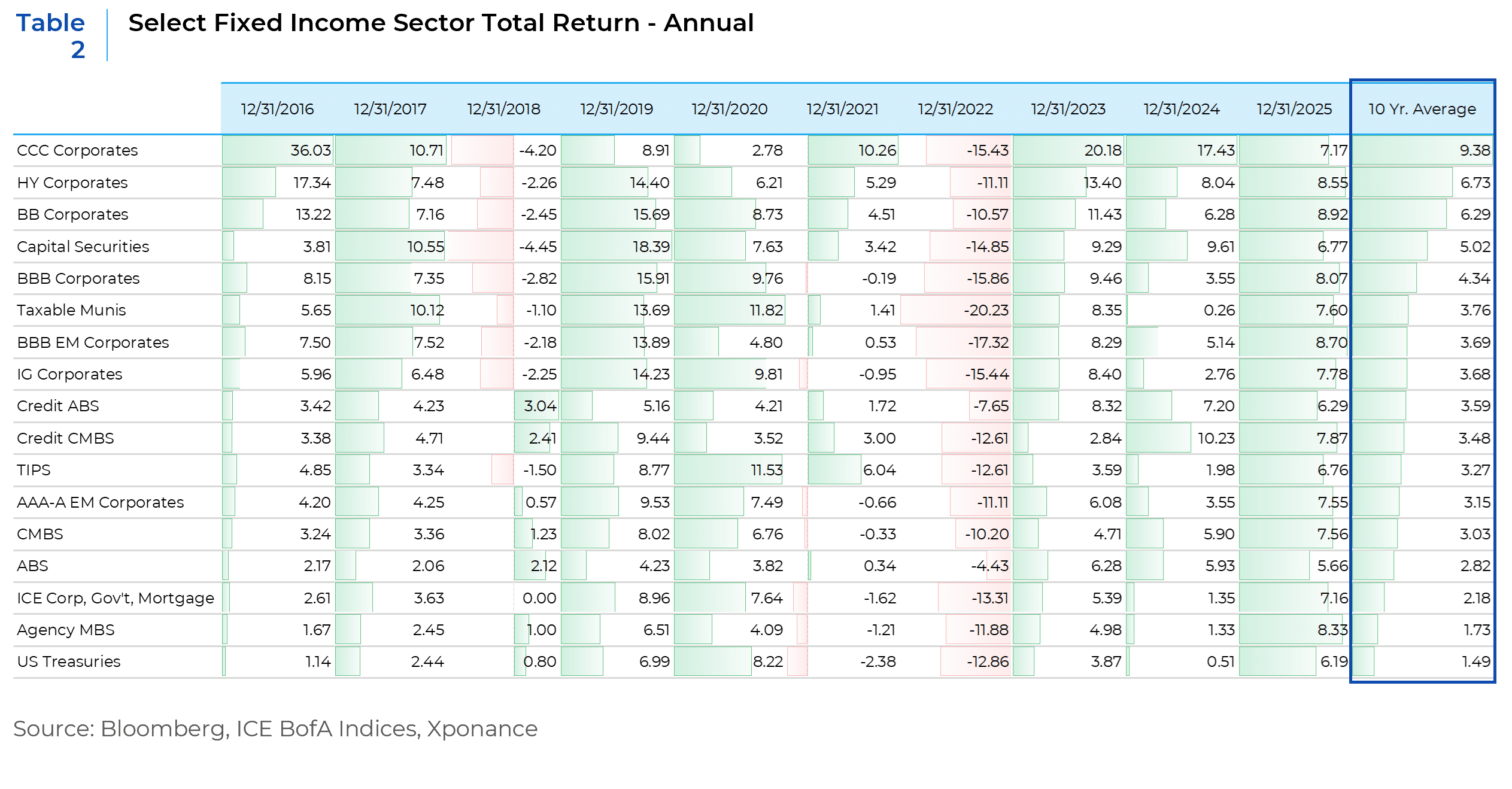

In the wake of a particularly robust year for fixed income returns across sectors—with notably little differentiation between them—it is instructive to examine return patterns over the prior decade. Unsurprisingly, sectors delivering the highest income have generated the greatest total returns, and the pattern of excess returns relative to equivalent-duration Treasuries mirrors this trend.

The data reinforce a key observation about fixed income returns: though broad market indices often represent inefficient allocations of risk, there is a disconnect between perceived and actual risk versus return within fixed income markets. For example, the distinction between the average BB-rated corporate (top tier of below investment grade, or “junk”) and the average BBB-rated corporate (lowest tier of investment grade) is quite narrow. This convergence has become even more pronounced as the boundaries between “fallen angels” and “rising stars” have grown increasingly fluid. Yet investment guidelines often continue to draw a bright line between the two rating categories.

This narrowing of risk premia is logical, as the spread penalty for downgrading or upgrading between these two rating cohorts has diminished over time. While the penalty has lessened, there is still a meaningful spread pickup opportunity in crossover credit, which straddles the line between high yield and investment grade by at least one rating agency.

On a ratio basis, however, BB credit currently appears less attractive relative to BBB issuers, which can be interpreted as a haven trade—high yield managers may seek refuge in BB issuers due to their lower volatility within benchmarks. In contrast, single B corporates are comparatively inexpensive as compared to BB names, and CCC credits (the lowest rung of junk, with the highest default risk) appear even cheaper as compared to B-rated issuers. This relationship likely signals emerging (or ongoing) credit stresses in the macroeconomic environment, with the K-shaped economy exerting pressure on the lower tiers of corporate credit.

From a capital allocation standpoint, we remain underweight US Treasuries. Notably, as we can see when looking at index sector allocations, US Treasuries constitute the preponderance of market value across broad indices. Their share of the ICE BofA Broad Market Corporate/Government/Mortgage Index has risen from just under 41% at year-end 2016 to 47% at year-end 2025. Despite their reputation as “risk-free,” the long-term return profile and reduced yields of Treasuries underscore the importance of portfolio construction using other available market sectors, even though such sectors may experience rare but brief episodes of spread dislocation compared to Treasuries.

Is an AI Bubble Forming in Fixed Income?

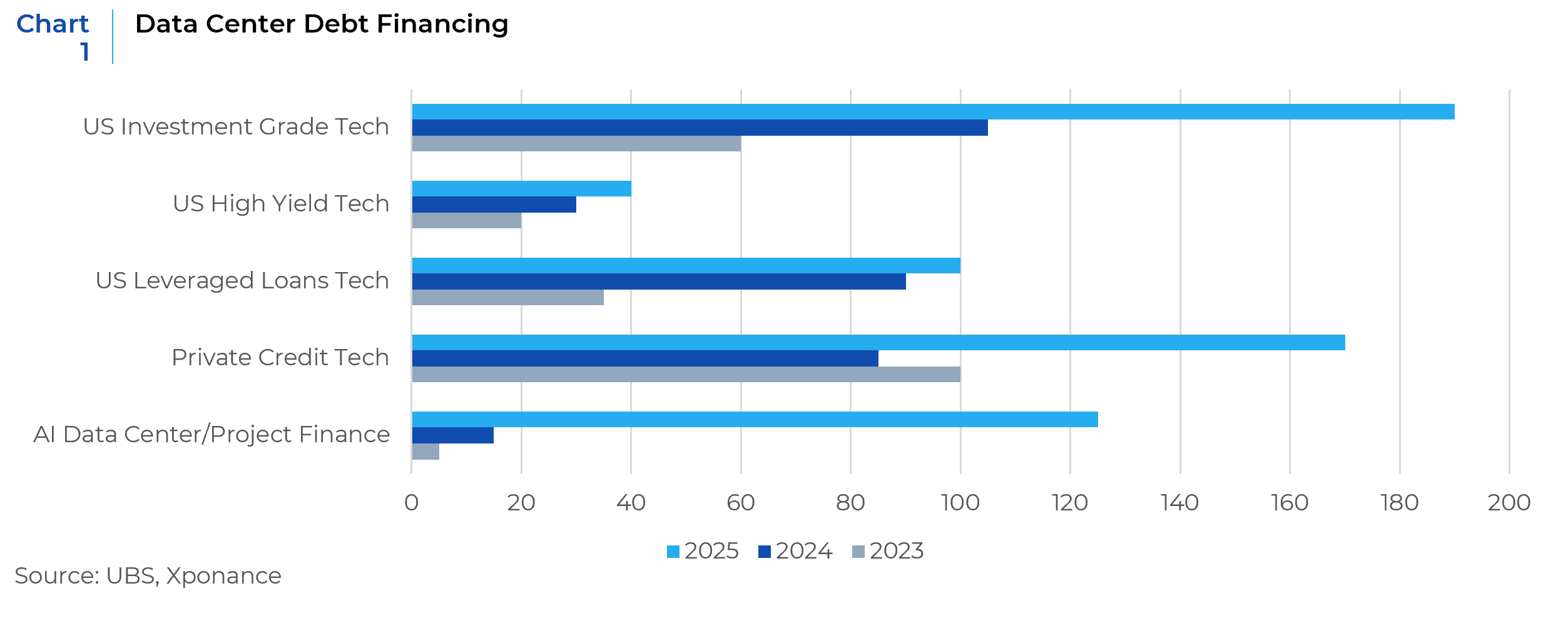

While equity markets debate whether AI is a “bubble,” the more relevant question for fixed income investors is whether credit markets are being adequately compensated for a combination of construction risk, tenant concentration, refinancing risk, and technological obsolescence. The rapid expansion of AI data‑center driven investment is shifting from being primarily equity‑ and cash data‑flow‑funded by hyperscalers toward a broader mix of corporate debt, project finance, private credit, and structured product.

We have seen a barrage of AI-related debt coming to market through different mechanisms and market sectors. The AI data-center buildout is colliding with a market regime that is far less forgiving than the prior decade. Higher real rates and a still-elevated term premium increase the cost of long-duration capex, while tight credit spreads leave limited cushion for execution missteps. At the same time, financing is increasingly migrating from transparent IG balance sheets into private credit, off-balance sheet Special Purpose Vehicles (SPVs), and structured formats. These structured securities are largely Asset Backed Securities (ABS) currently but could also be structured as Commercial Mortgage-Backed Securities (CMBS). Price discovery is slower in these sectors—and repricing, when it happens, can be abrupt. With a meaningful share of projects underwritten to near-term refinancing and optimistic utilization assumptions, even a modest capex moderation by hyperscalers or a tightening in liquidity conditions could transmit quickly into wider spreads and higher dispersion across data-center operators, power infrastructure, and credit vehicles exposed to single-asset/single-tenant risk.

Based on recent research from the BIS, CreditSights, S&P Global Ratings, and our own industry and economic analysis, a consistent theme emerges: risk is migrating outward from mega‑cap balance sheets toward less transparent corners of credit markets, particularly private credit and securitized structures. Spreads remain tight relative to the uncertainty embedded in long‑dated AI cash‑flow assumptions, leaving the sector vulnerable to repricing if capex expectations moderate or refinancing conditions tighten.

The Financing Shift: From Cash Flows to Credit

AI‑related capital expenditure—especially for hyperscalers and colocation data centers—is now large enough to exceed even strong internal cash‑flow generation at the margin. As a result:

- External financing is rising, including unsecured bonds, project‑level loans, sale‑leasebacks, and private credit facilities.

- Private credit exposure to AI‑adjacent sectors has expanded rapidly, particularly for non‑hyperscaler developers and infrastructure operators.

- Financing increasingly occurs through SPVs and off‑balance‑sheet structures, which can be efficient but reduce transparency during stress.

For fixed income investors, this marks a transition from a world where AI risk sat largely with equity holders of cash‑rich technology firms to one where credit investors absorb duration, refinancing, and residual‑value risk.

The central credit distinction is hyperscalers vs. the marginal borrower.

- Hyperscalers (IG tech): Strong balance sheets, diversified revenue, and strategic flexibility. Credit risk is second‑order and mainly manifests through incremental leverage or capex discipline.

- Non‑hyperscalers / developers: Heavily reliant on external financing, often backed by single‑asset projects and concentrated tenant bases.

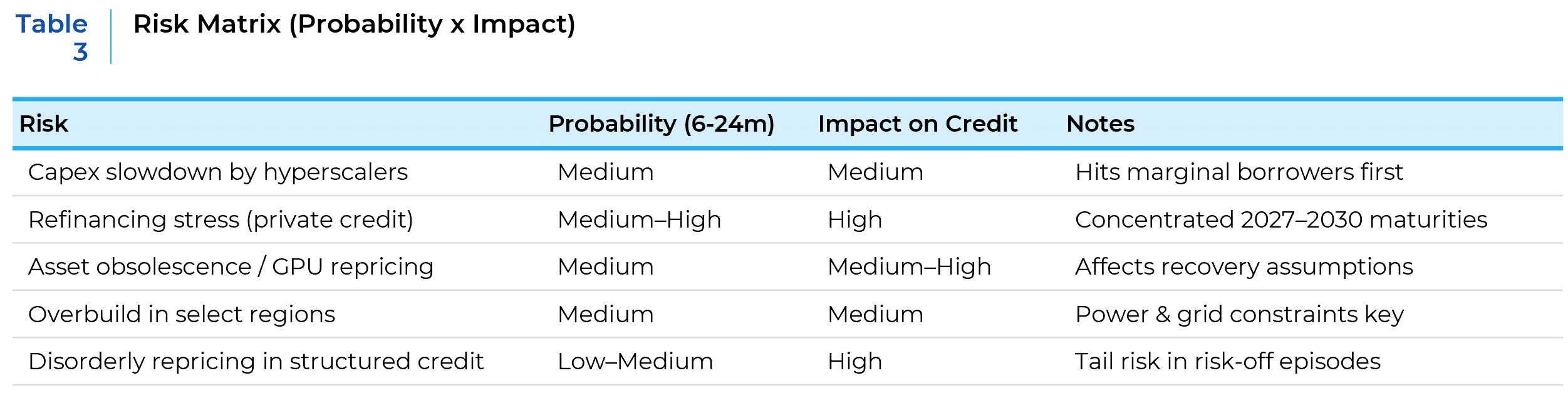

Several structural risks have become apparent:

- Tenant concentration & contract durability – Take‑or‑pay contracts help, but termination clauses, repricing risk, and counterparty quality matter far more than headline lease length.

- Refinancing risk – Many projects rely on refinancing within 3–5 years, leaving them exposed to higher rates or tighter credit conditions. This issue has already presented itself in certain stressed/distressed ABS structures currently in the market.

- Collateral uncertainty – GPU and server equipment depreciate quickly, raising questions about recovery values in downside scenarios.

- Opacity – Private credit and securitized structures may delay price discovery but tend to amplify spread moves once risk is reassessed.

Why This Matters for Spreads (Not Equity Valuations)

From a fixed income perspective, the key risk is not whether AI adoption continues long term, but whether near‑term expectations are priced too optimistically into credit spreads.

Transmission channels to spread widening include:

- Capex moderation by hyperscalers, which disproportionately impacts smaller developers and operators.

- Refinancing walls coinciding with a less accommodative macro or higher real rates.

- Reassessment of residual values for data‑center assets and AI hardware.

- Liquidity shocks in private credit or structured credit markets, forcing repricing.

Historically, credit markets struggle most when growth narratives remain intact, but cash‑flow timing shifts, pushing leverage metrics higher than expected. This exact situation has already occurred in a handful of data-center ABS deals. The data centers are leased and payments are current, but the original deal terms have encountered refinancing risk as current yield and spread levels make even fully leased data centers uneconomic for the sponsor when the refinancing window opens.

Risk Matrix (Probability × Impact)

What are the practical portfolio implications?

IG Technology

- Favor higher‑quality hyperscalers with balance‑sheet flexibility.

- Be cautious on issuers using incremental leverage to fund aggressive capex.

Data‑Center Operators (IG / crossover)

- Prefer operators with diversified tenant bases and long‑dated contracts.

- Avoid structures reliant on near‑term refinancing or aggressive leverage assumptions.

Utilities & Power Infrastructure

- Relative beneficiary of AI demand, but regulatory lag and capex execution risk are extremely important to watch.

- Selectivity matters; power availability is a binding constraint.

Private Credit / Direct Lending

- Focus on documentation quality, covenants, and sponsor support.

- Be wary of loans implicitly underwritten to optimistic exit or refinancing assumptions.

CRE / CMBS / Infrastructure ABS

- Avoid single‑tenant or single‑region data‑center projects.

- Expect higher dispersion rather than uniform sector stress.

Fixed Income Strategy in 2026

Opportunities and Risks in AI-Related Investments

For equity investors, selecting the right AI names could deliver substantial upside. In contrast, credit investors should temper their expectations, as current market conditions offer limited spread tightening opportunities and carry significant downside risks. Our preferred approach to participating in the AI investment theme is to focus on companies that benefit tangentially from AI advancements. These businesses typically exhibit robust business models and minimal direct exposure to assets that could become obsolete or stranded. Additionally, we advise steering clear of peripheral market players who may be at risk of distressed financial positions.

Sector Positioning and Economic Outlook

We maintain a cautious stance toward consumer-facing companies such as credit card issuers, regional banks, and those in the consumer discretionary sector. Similarly, we view certain lending structures, particularly subprime auto-lending, with skepticism due to the uneven—K-shape—economic dynamics. Our concern is heightened by the fact that the bulk of consumer spending now originates from the highest income decile. Should there be economic instability in 2026, we anticipate that more attractive investment opportunities may arise

Tactical Opportunities in Capital Securities and Hybrids

Capital securities and hybrid instruments currently trade as if they will be called in the short term, but they could become highly appealing if spreads widen and extensions occur. Although the steepening of the Treasury curve largely unfolded in 2025, we continue to expect additional bull steepening ahead. Moreover, credit curves remain flatter than warranted. If credit spreads widen and the curves steepen, long-term credit instruments may become increasingly attractive.

Current Portfolio Positioning

Our portfolio remains overweight in corporate credit and credit assets more broadly. By positioning ourselves in the intermediate segment of the curve, we are well-prepared to capitalize on market dislocations as they arise, allowing flexibility and resilience in our fixed income strategy for 2026. In light of the strong returns fixed income markets enjoyed in 2025, our return expectations for 2026 are more muted. While some further mark to market appreciation could occur given the potential for one or two more reductions to the Federal Funds rate, we do not expect monetary policy to be a major story, except as it pertains to drama regarding the future make-up of Federal Open Market Committee decision makers. As such, earning the coupon on the index (and for our portfolios, the inherent yield advantage we earn) is likely to reflect the total return expectation for 2026.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.