Unveiling Insights from Changes in Active Risk Exposure, Sectors, and Companies During the Annual Style Rebalance

The S&P Style indices employ three distinct factors to evaluate a company’s exposure to growth and value. These factors are presented in Table 1 below.

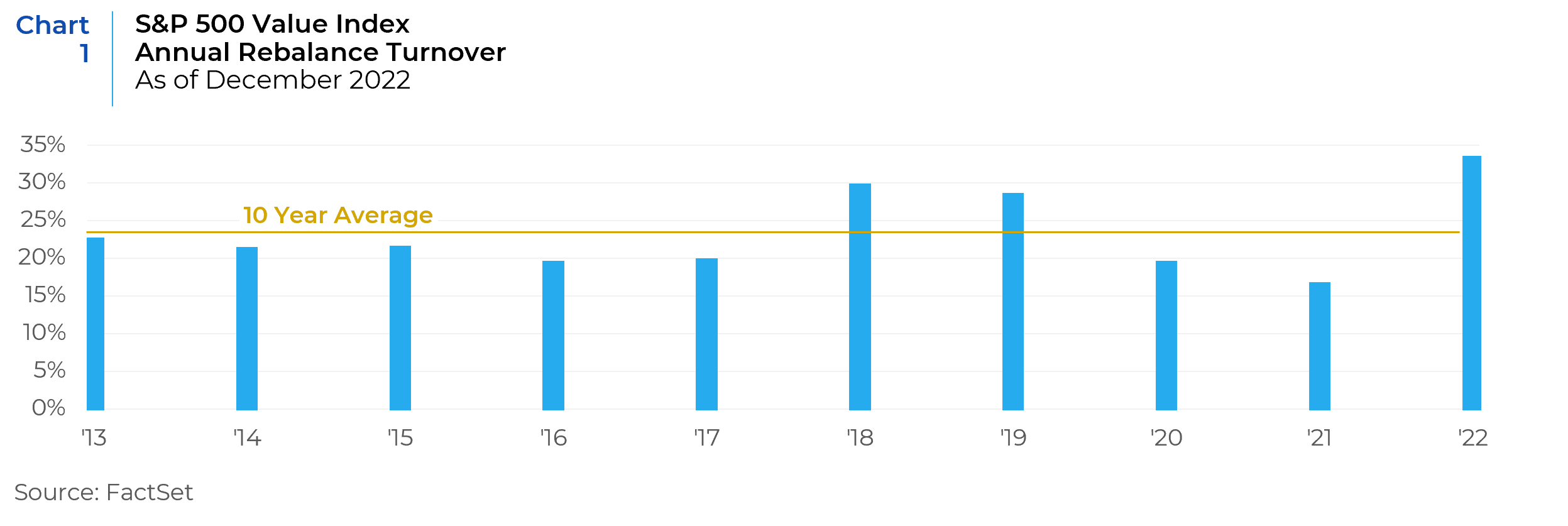

Chart 1 highlights a substantial increase in turnover within the S&P 500 Value index during the most recent annual style index rebalance in December 2022.

The significant surge in index turnover during 2022 prompted an investigation into the underlying catalysts. By examining alterations in active exposure, sector dynamics, and the most notable movements of companies, valuable insights can be gleaned regarding the evolving nature of the index. Furthermore, the impact of the index’s high turnover on investment managers utilizing the index in passive or active strategies is also considered. This analysis delves into the reasons behind the heightened turnover observed in 2022 while considering the index’s exposure to the Value, Earnings Yield, Growth, and Medium-Term Momentum factors.

Change in Active Risk Exposures

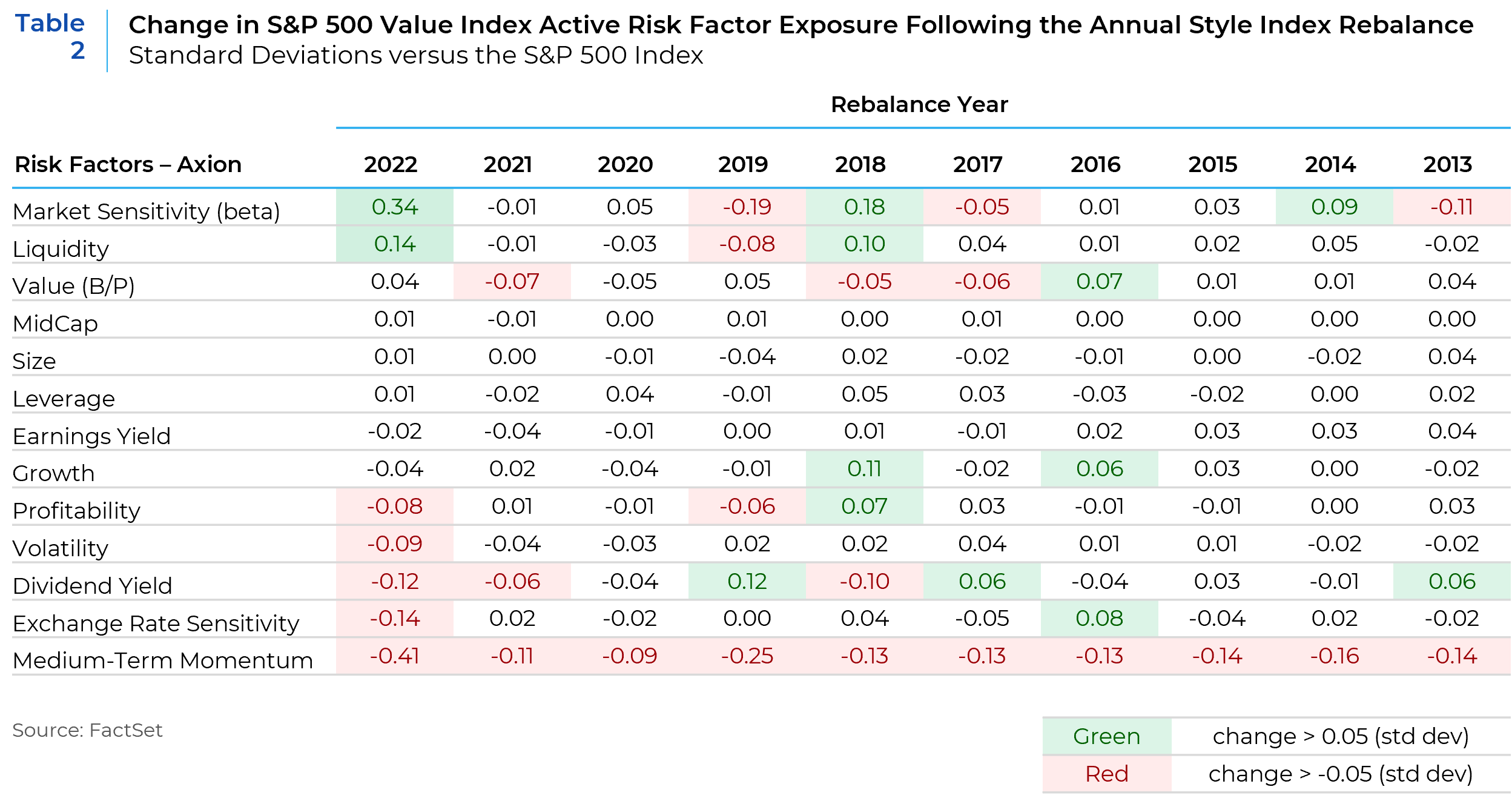

To comprehend the shifting landscape of the S&P 500 Value Index, the changes in active risk factor exposures relative to the standard S&P 500 index during the most recent style rebalance versus the preceding ten years are analyzed. Particular attention is given to changes in the Value (B/P), Earnings Yield, Growth, and Medium-Term Momentum factors, as these serve as the primary metrics employed by S&P to assess a company’s value and growth exposure (Table 2).

Value (B/P) and Earnings Yield: Due to its construction, the S&P 500 Value index exhibits positive exposure to Value and Earnings Yield versus the S&P 500 index. Consequently, during the annual rebalance, a positive change in active exposure to these factors, indicating an increased tilt toward value, would be expected. However, over time, the direction of change in these factors has proven to be inconsistent. This suggests that traditional value-driven stocks may not be the primary drivers of index weight changes.

Growth: The negative change in exposure to the Growth factor in 2022 aligns with expectations, signifying a reduced exposure to Growth within the index. However, like Value and Earnings Yield, the direction of annual changes in this factor has exhibited inconsistency. Notably, there were substantial positive changes in the index’s exposure to the Growth factor in 2016 and 2018.

Medium-Term Momentum: The exposure to the Medium-Term Momentum factor in the S&P 500 Value Index offers an intriguing perspective. The negative change in active exposure to Medium-Term Momentum suggests that the index incorporates stocks that have recently underperformed. The consistent negative direction of change in exposure to this factor aligns with the contrarian nature of value investing, where investors seek opportunities in areas that may have experienced short-term weakness but possess the potential for a rebound. The magnitude of the change in exposure observed in 2022 was nearly three times higher than the average of the previous nine rebalances.

Change in Active Sector Exposures

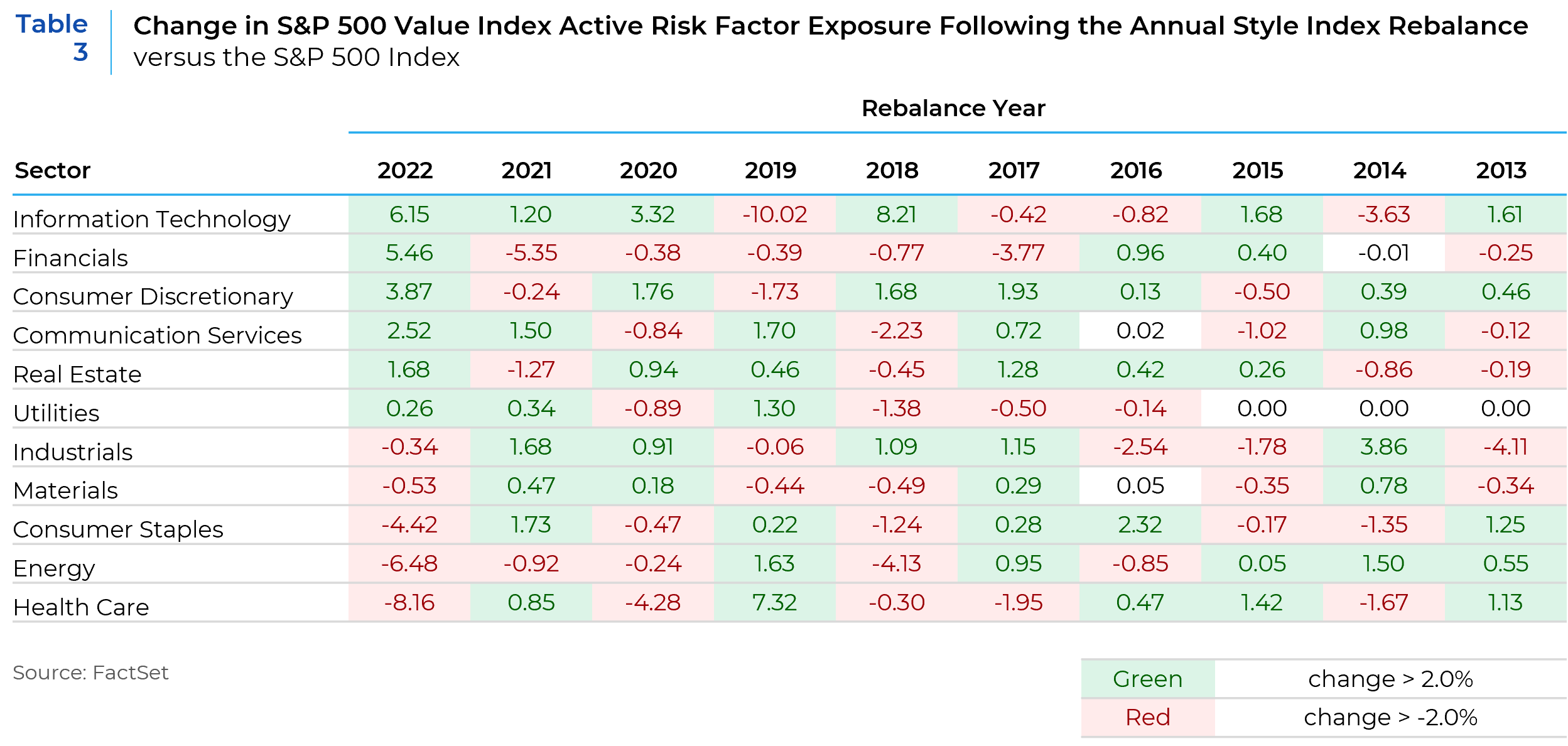

Gaining further insights into the dynamic composition of the S&P 500 Value Index necessitates a look at changes in active sector exposures. Table 3 illustrates the annual changes in active sector exposure relative to the S&P 500 index, sorted by the changes observed in 2022.

When analyzing changes in active sector exposures, it is imperative to consider their relationship with sector performance over the past 12 months. An increase in exposure to a specific sector within the value index indicates that the sector underperformed during the previous year, resulting in relatively lower valuations and potential value opportunities. Conversely, a decrease in exposure to a sector may suggest that it outperformed during the past 12 months, leading to higher valuations and reduced attractiveness from a value perspective. This phenomenon was evident in the 2022 rebalance, as there was a substantial increase in the weight of significantly underperforming sectors such as Information Technology, Consumer Discretionary, and Communication Services. The augmented weight of the Financials sector was driven by an increase in the weight of underperforming Banks. Simultaneously, the Health Care, Energy, and Consumer Staples sectors, which had demonstrated outperformance, experienced a notable decrease in weight.

Largest Company Index Weight Changes

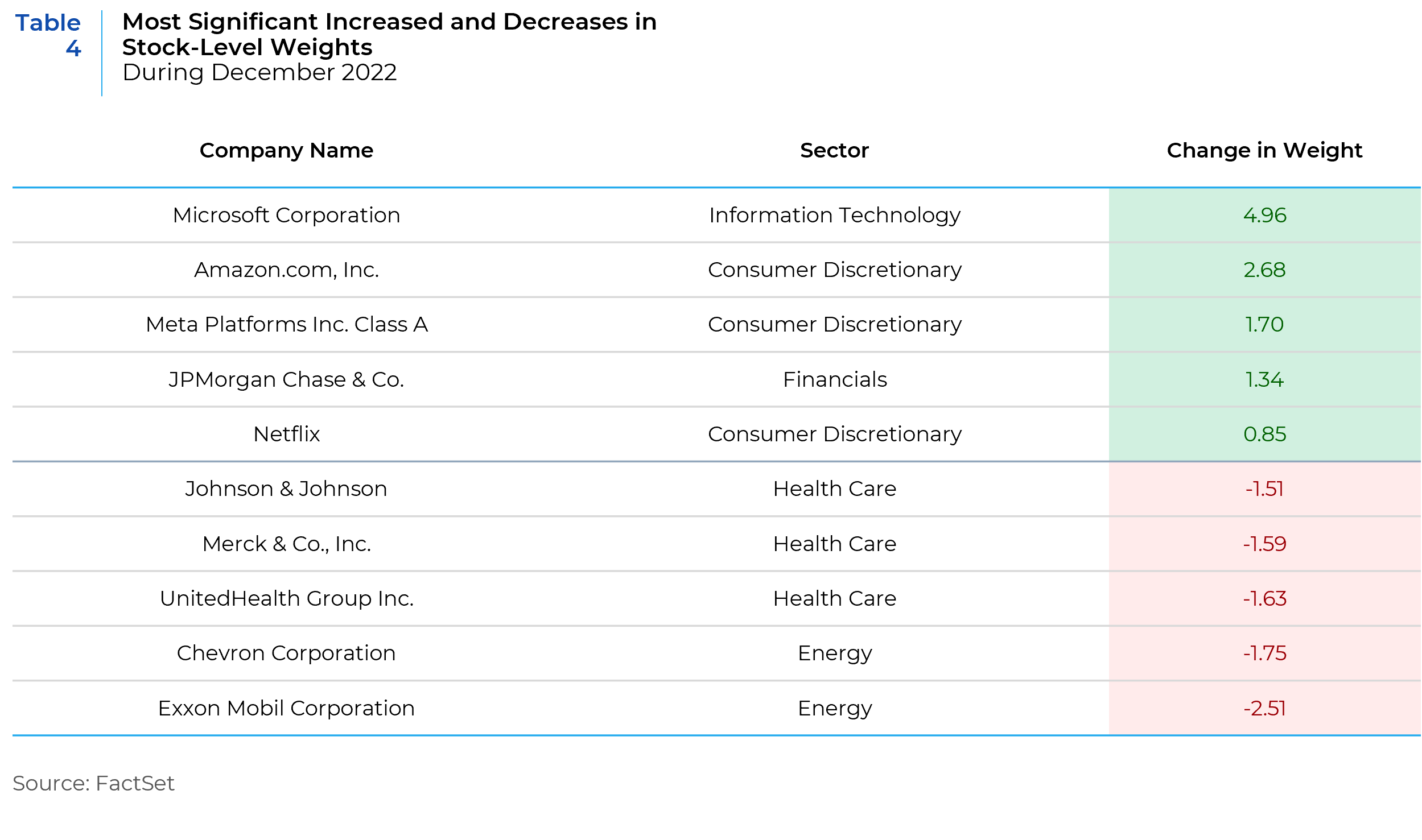

Table 4 displays the five most significant increases and decreases in stock-level weights during the 2022 annual S&P 500 Value Style index rebalance.

The increase in weight observed in companies typically associated with growth, such as the technology giant Microsoft Corporation, along with substantial increases in companies like Amazon, Meta Platforms, and Netflix, can be attributed to their relative underperformance (negative momentum) in 2022. Conversely, Chevron Corporation and Exxon Mobil Corporation, both belonging to the Energy sector, witnessed significant decreases in the S&P 500 Value Index in 2022 due to their exceptional performance throughout the year. The declining exposure to energy stocks reflects a shift away from traditional value drivers in favor of sectors with potentially greater growth opportunities.

The Impact of High Turnover and Considerable Changes on Investment Strategies

The high turnover and considerable changes in the S&P 500 Value Index pose challenges for investment managers employing passive or active strategies.

Passive Investment: The dynamic nature of sectoral composition within the S&P 500 Value Index necessitates frequent rebalancing for passive investment managers. High turnover rates increase trading costs and introduce the risk of tracking error. To accurately replicate the index, passive managers must continuously adjust their portfolios, potentially impacting their ability to passively track the index with precision.

Active Investment: The sectoral shifts in the index present both opportunities and challenges for active investment strategies. Active managers can capitalize on mispriced securities and potentially generate alpha by identifying undervalued stocks or sectors with favorable growth prospects. However, the evolving composition of the index requires active managers to stay agile, constantly reassessing their investment theses to adapt to changing market dynamics and sectoral trends.

Conclusion

The shifting landscape of the S&P 500 Value Index, as evidenced by changes in active risk exposures, sector dynamics, largest company movements, and turnover, challenges the conventional narrative that value alone drives index weight changes. The inclusion of stocks and sectors with recent underperformance, along with the contrarian nature of value investing, suggests a nuanced interplay of factors in shaping the constituents of the index. The importance of the Momentum factor in the reconstitution of the S&P 500 Value index implies a contrarian strategy of incorporating underperforming stocks and sectors into the index that perhaps results in some unexpected tilts that make the performance of this index deviate from value indices provided by other index companies.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.