Can Equity Markets Keep Defying Gravity?

Equity markets stayed strong in Q3 2025, driven by AI investment and favorable policy developments. The S&P 500 Index posted a return of 8.1% last quarter and 35.1% since the April low following the tariff-driven liberation day sell-off. Positive factors included the TCJA extension, and reduced tariff uncertainty through new trade deals with the EU, Japan, South Korea, and an extended US-China truce. The Fed cut rates by 25 basis points in September amidst a slowing economy, cooling job markets, and worsening consumer sentiment. However, investors focused on positive catalysts like the possibility of further rate cuts, benefits of deregulation, and strong corporate earnings to power markets higher. The quarter closed amid concerns over a potential government shutdown.

Going forward, policy shifts ranging from tariffs and fiscal spending to evolving immigration and labor dynamics will shape the trajectory of costs and corporate margins. Yet, with macro stability improving and the possibility of modest rate relief, risk assets may extend their rally in the near term. While large caps may continue to be favored by investors given their resilience during periods of slower economic growth, selective exposure to small and mid-sized firms, especially those tied to AI-driven structural trends offers diversification and the potential for attractive, overlooked growth. U.S. valuations have staged a full recovery, but shifting correlations across gold, oil, Treasuries, and the dollar suggest a changing investment regime. In this environment, investors should balance exposure between the structural tailwinds of AI and the cyclical vulnerabilities of an economy still walking a fine line between expansion and slowdown.

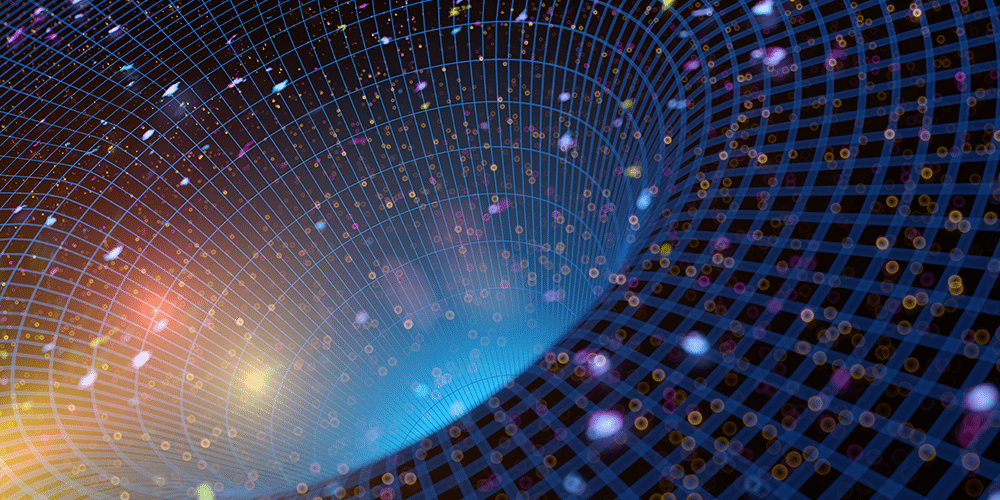

Economic Growth Expectations Stable (For Now)

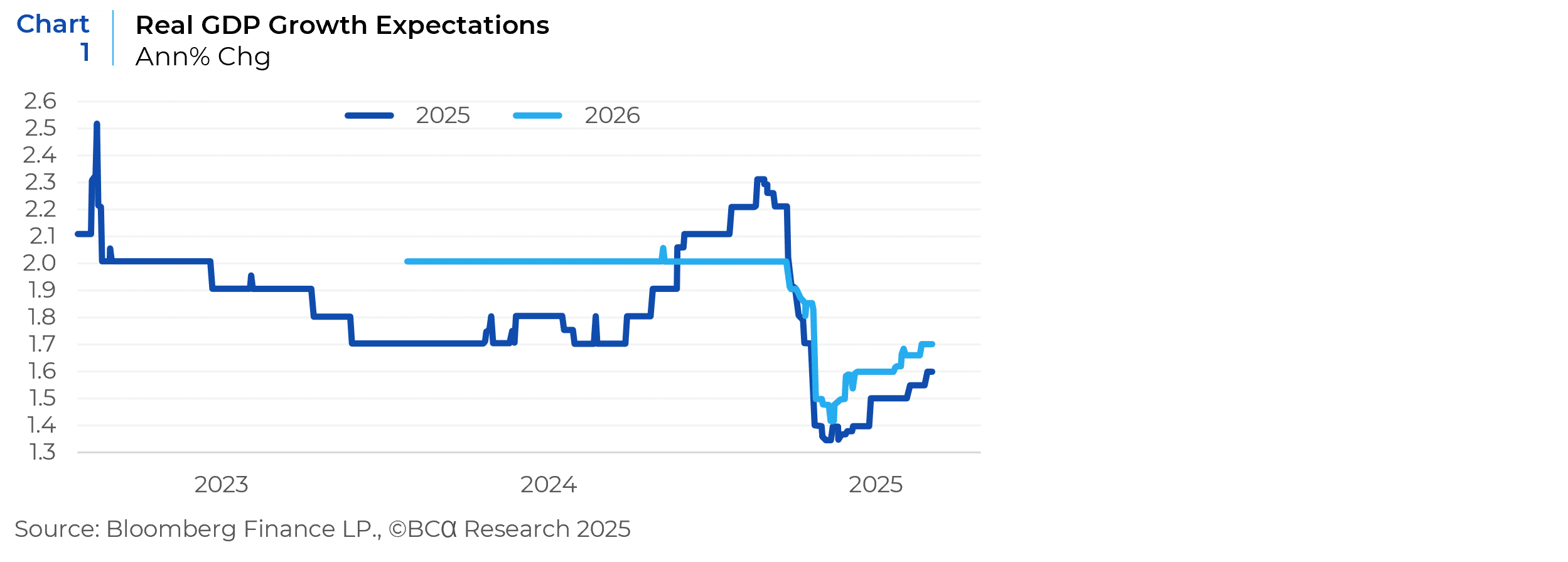

GDP growth expectations (Chart 1) appear optimistic for now as reflected in final sales to private domestic consumers, which is GDP excluding trade and government spending. This measure had slowed as economic uncertainty, and tariffs weighed on demand. However, the most recent data indicated unexpected strength (Chart 2). In addition, the CITI Economic Surprise Index has turned positive (Chart 3), as data releases exceeded expectations.

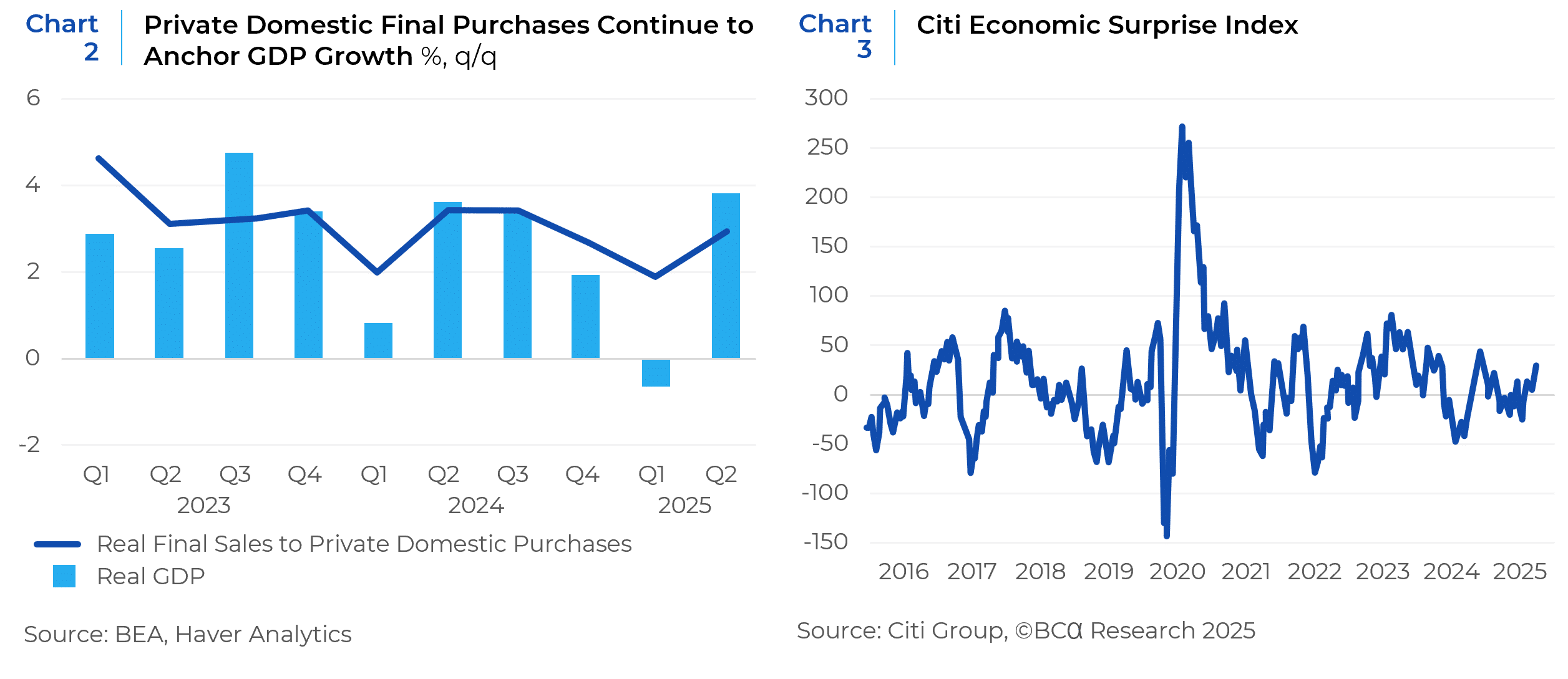

Nevertheless, elevated inflation risks and slowing growth remain ongoing concerns. U.S. economic expansion has been predominantly supported by robust consumer activity, which accounts for approximately two-thirds of total economic output. The consumer sector has benefited from a massive fiscal transfer during the pandemic and stable labor markets, with both income and wealth effects particularly reinforcing high-income groups. Looking ahead, U.S. economic growth is expected to moderate as consumer spending exhibits signs of softening (Chart 4). Additionally, services and manufacturing PMIs have trended downward since the start of the year, indicating weaker performance in both sectors (Chart 5).

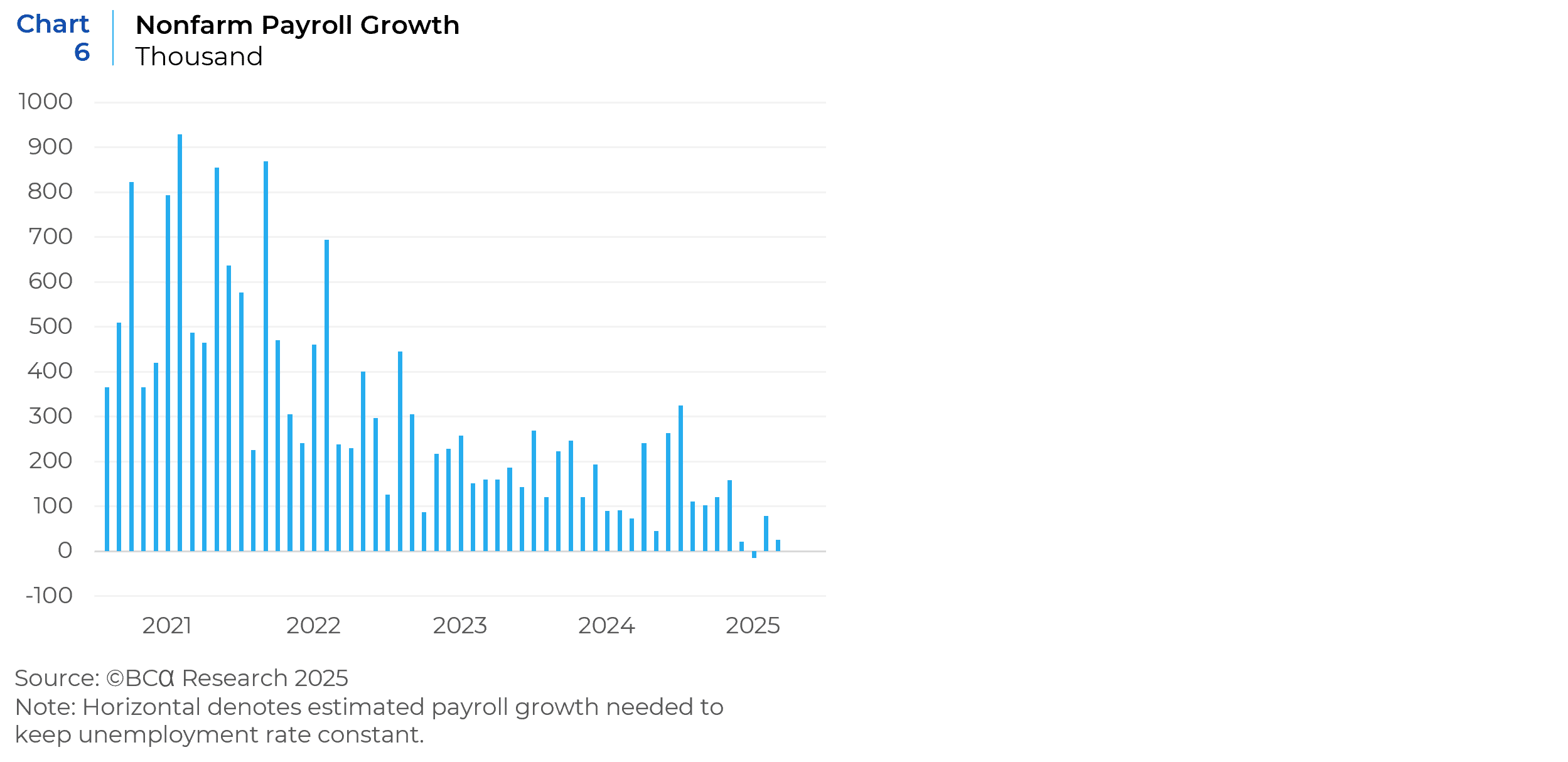

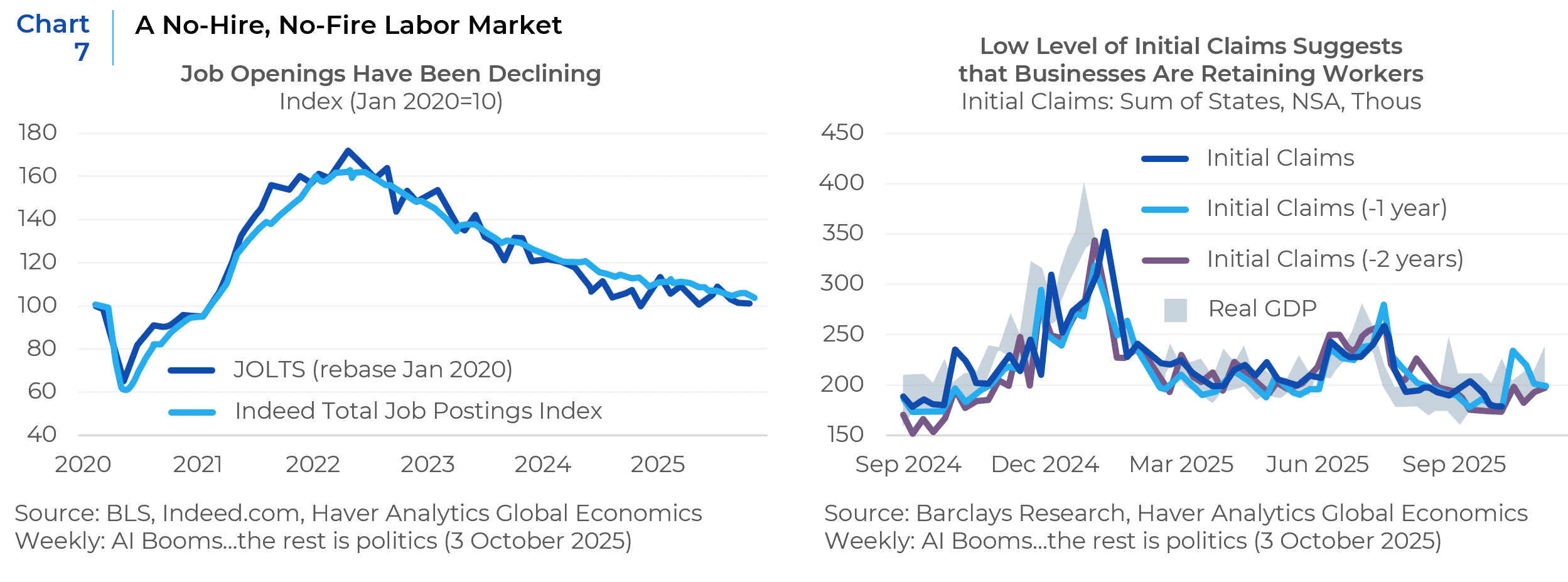

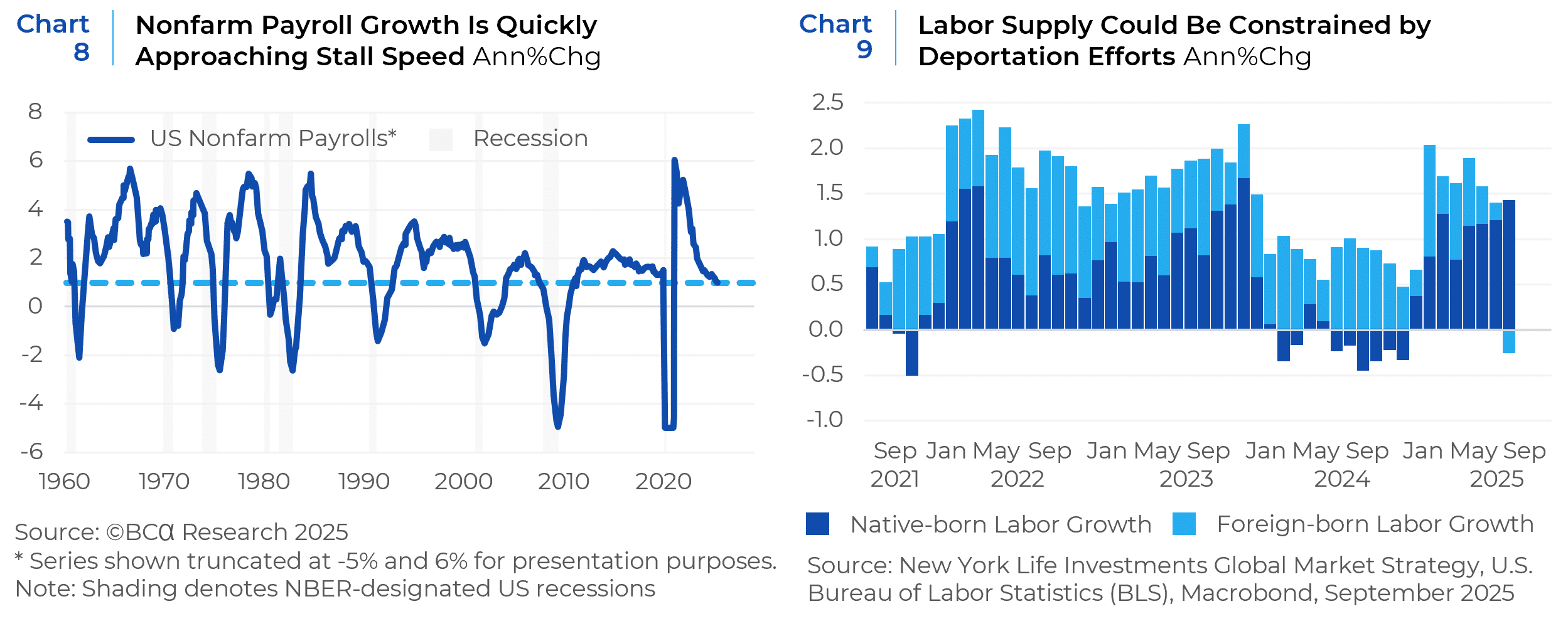

Cooling Labor Markets

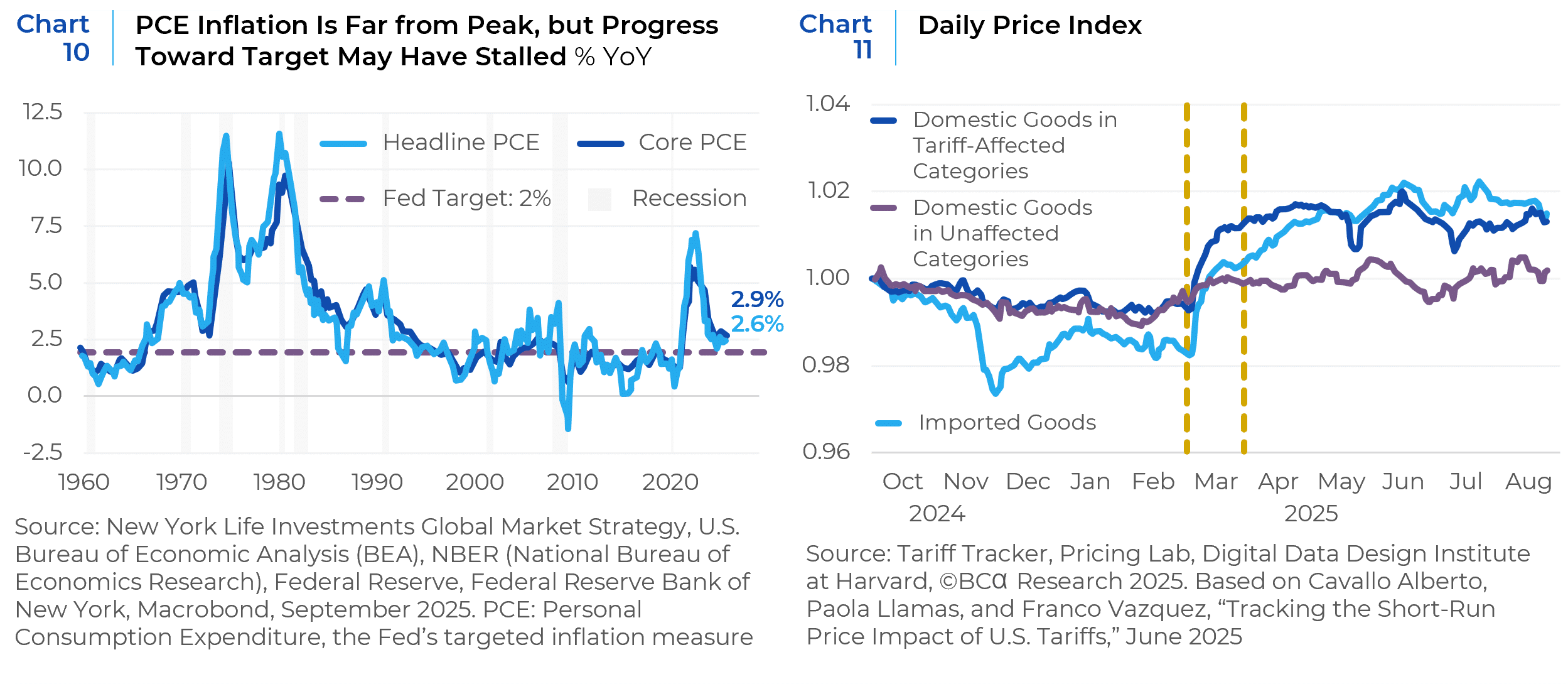

The labor market is exhibiting signs of softening, as demonstrated by Nonfarm Payrolls growth (Chart 6). Historically, firms tend to reduce headcounts only after profitability declines. Consequently, while hiring has slowed, widespread layoffs would likely require an economy-wide contraction in profits. Currently, the labor market is characterized by minimal hiring and firing activity (Chart 7). Since the 1960s, when year-over-year nonfarm payroll growth drops below 1%, the economy has either been in recession or approaching one. In June, July, and August 2025, year-over-year payroll growth was recorded at 0.97%, 0.96%, and 0.93% respectively, indicating a notable warning signal (Chart 8). Despite the weakening labor market, changes in immigration-related labor supply may reintroduce upward pressure on wages, potentially complicating efforts to control inflation (Chart 9).

Risk of Inflation Reacceleration

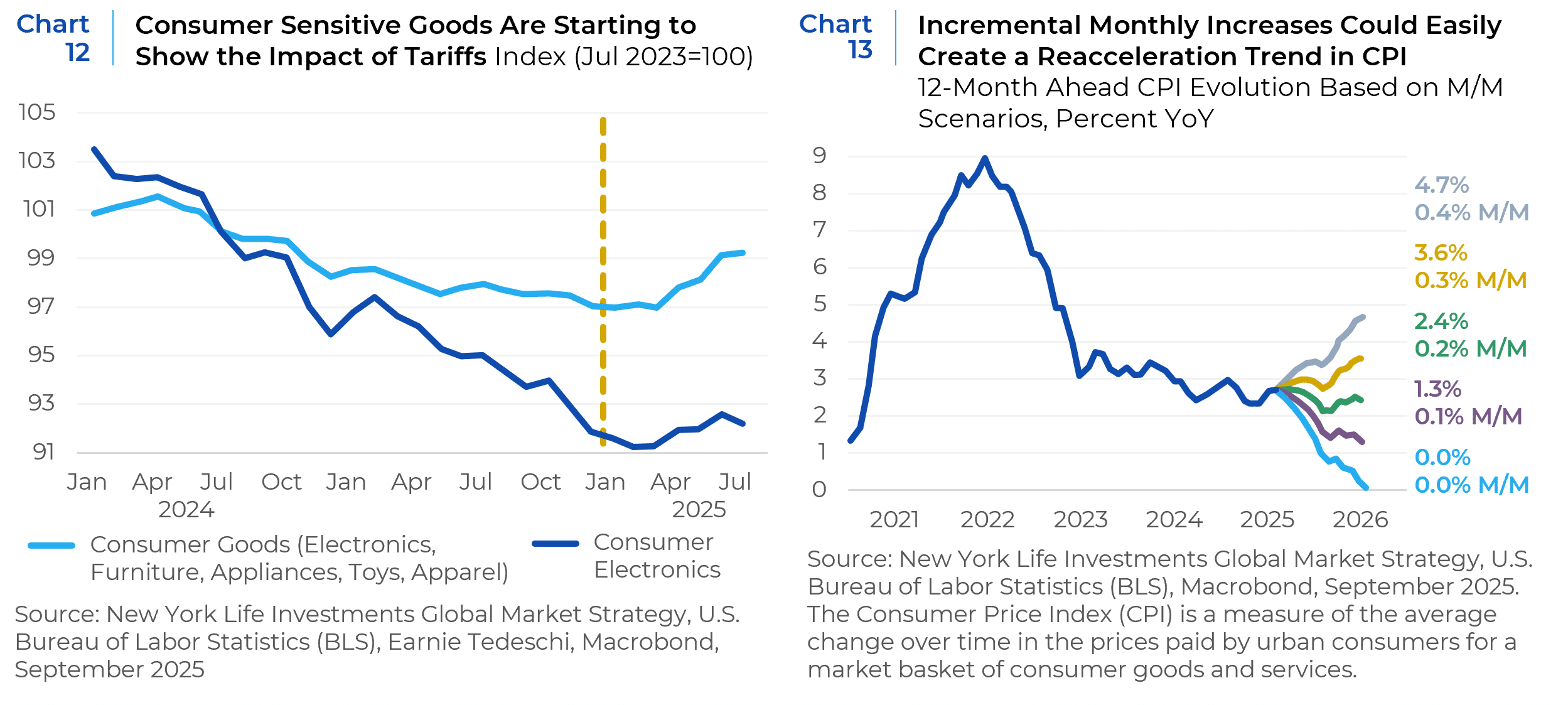

Inflation is starting to pick up again as policy changes take effect. Although U.S. inflation has eased since mid-2022, progress toward the 2% PCE target has stalled (Chart 10), due to structural demographic trends (as a decreasing working age population unmitigated by net migration or productivity improvements, is on balance, inflationary), and partly due to tariff impacts. Retail prices in tariffed categories are rising (Chart 11), and durable goods inflation is accelerating—especially for imports like household furnishings and electronics (Chart 12). Tariffs present ongoing inflation risks as they affect markets and inventories, though the full impact may take 6–9 months to appear. Thus, monthly increases over 0.2% will raise concern (Chart 13). Tariffs and reduced labor supply from immigration changes are challenging for the Fed, as interest rate policy may not address these supply-side shocks.

Easing Monetary Policy

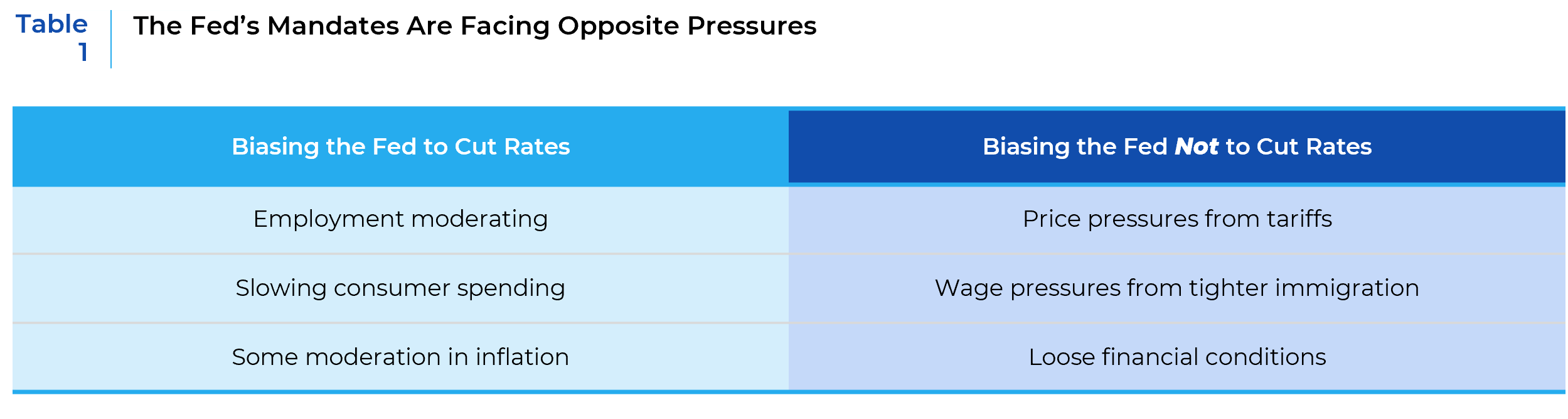

The Fed is prioritizing employment over tariff-driven inflation. Chairman Powell recently stated that risk factors are shifting. The Fed faces opposing pressures: slow job growth and late-cycle trends support rate cuts, but rising inflation from tariffs and tighter immigration suggest caution (Table 1). Inflation risks include tariffs, corporate margins, and shrinking labor supply. Current strong financial conditions—robust equities, tight credit spreads, and high liquidity—make rapid easing hard to justify. Additionally, if the Fed appears politically motivated, interest rates may increase due to doubts about its credibility. In the Summary of Economic Projections (SEP) released after this week’s meeting, Fed officials anticipate two more 25-point rate cuts this year and another in 2026. Yet the same SEP projections concede that inflation is proving more persistent than anticipated and PCE inflation is expected to hit 2.6% next year. The Fed’s target inflation rate of 2% is not expected to be reached until 2028. So, rate cuts are being considered even as inflation is expected to rise.

Robust Corporate Earnings and Capex Trends

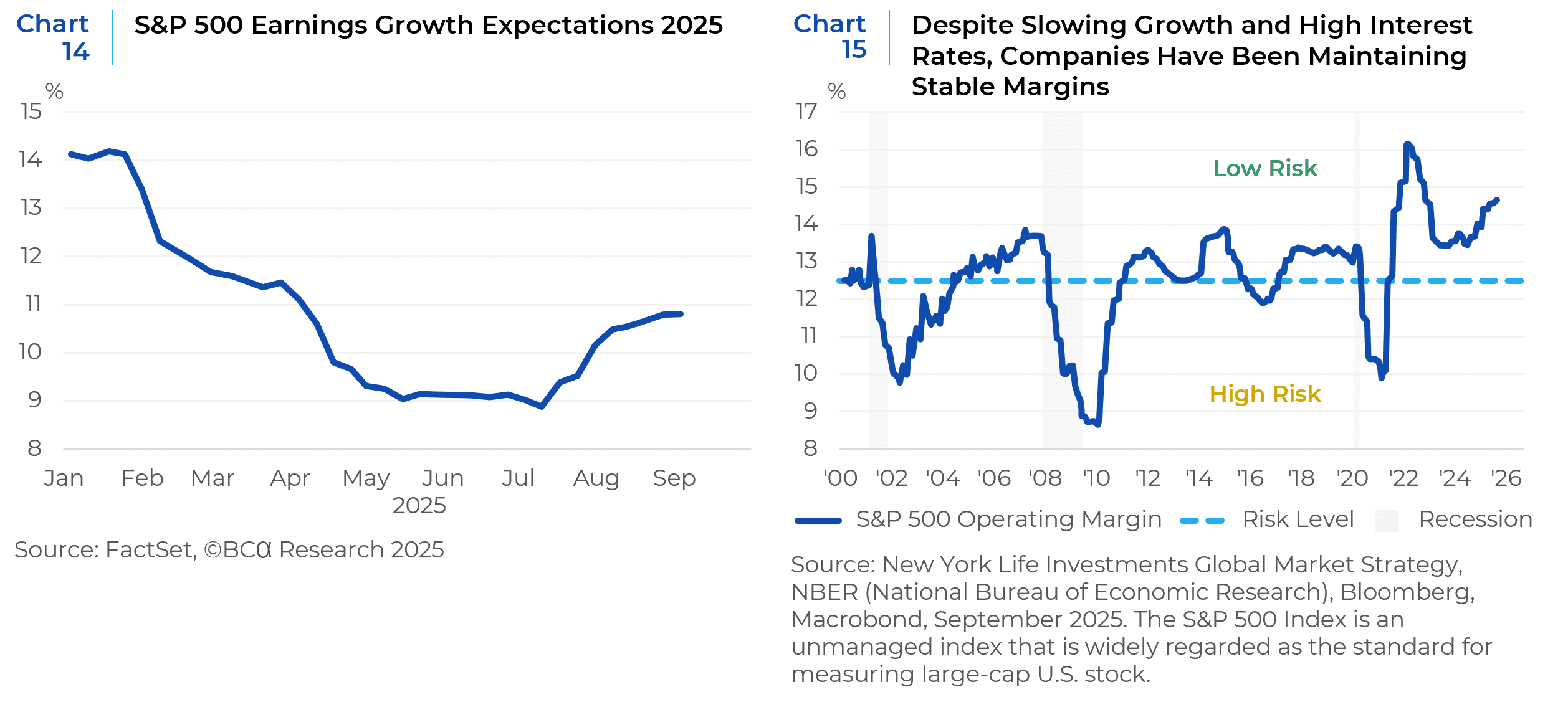

Corporate earnings have shown unprecedented resilience, and earnings growth is expected to reaccelerate in the second half of the year (Chart 14). Companies have maintained healthy margins and S&P 500 operating margins are well above 12.5% (Chart 15), the level at which falling margins have historically become a concern. Stable corporate earnings have provided support for equity performance.

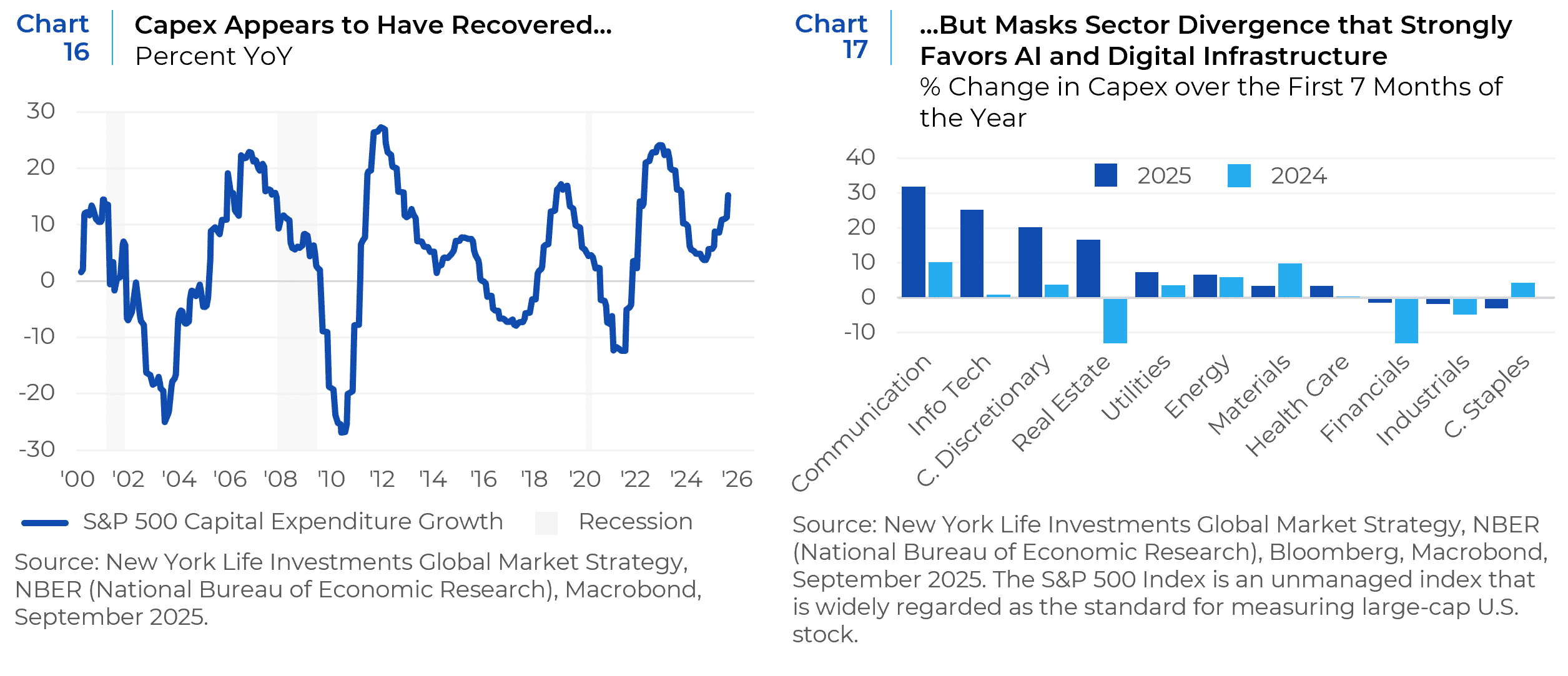

At an economy-wide level, capex continues to be solid and even accelerating (Chart 16), but this masks meaningful sector differences (Chart 17). Many companies are delaying new investments due to a complex business environment, especially in energy, materials, consumer staples, and industrials, where capex has slowed. Meanwhile, sectors like AI and digital infrastructure are seeing increased investment, supported by government spending on semiconductors and strong corporate and consumer demand.

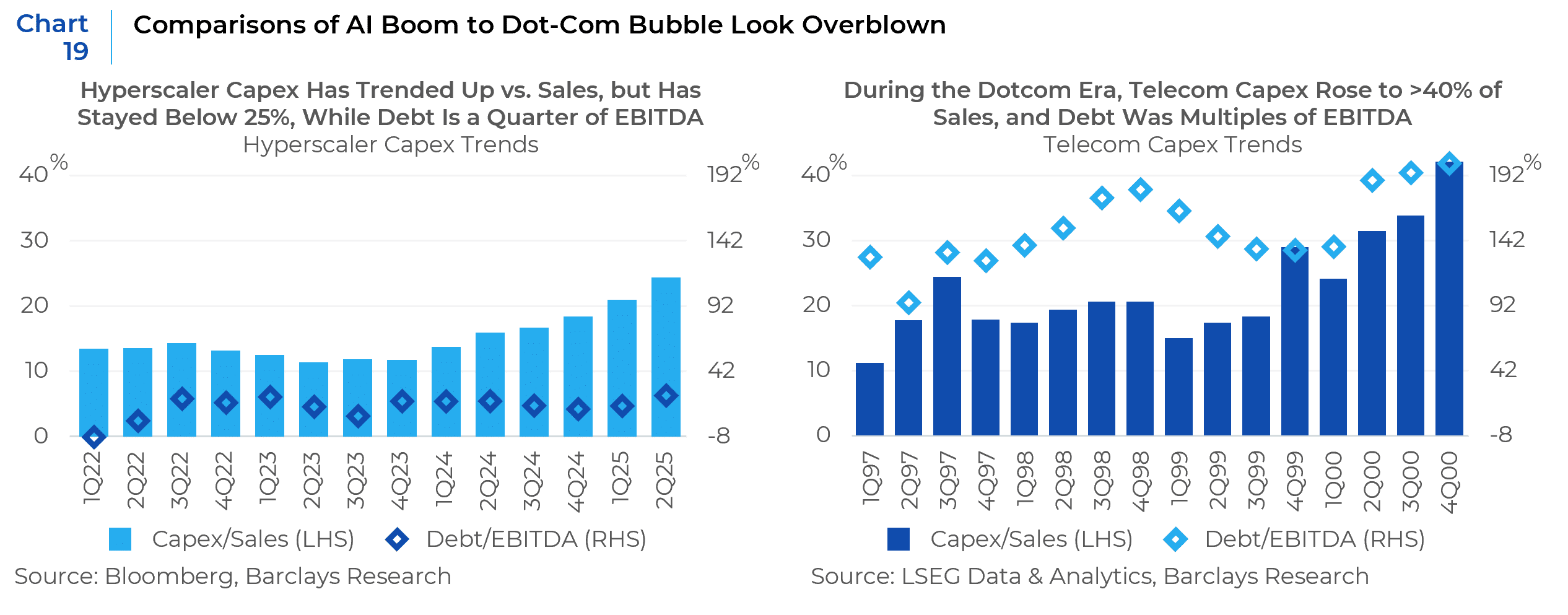

GenAI investment is driving markets higher, though AI adoption remains early with significant growth potential (Chart 18). The current scale of AI spending draws comparisons to the 2000 tech bubble, yet such parallels may be exaggerated (Chart 19). Unlike low-margin telcos in 2000, today’s hyperscalers have healthy margins; their capex/sales ratio is roughly 25%, much less than the dotcom-era telco rate of 40%. Despite rapid investment, computing demand exceeds supply, and revenue growth is outpacing operating costs. Crucially, AI utilization is progressing, in contrast to the untested business models seen in 2000.

Corporate profit margins have generally been resilient, supported by tech-driven productivity gains. However, with rising input costs, weaker growth, and growing uncertainty around investment and hiring, profit growth is expected to slow. Risks such as inflation and margin compression persist, so caution is warranted despite optimistic earnings forecasts. The greatest short-term threat to the AI sector is a sharp decline in capital spending, and related industries like power, network infrastructure, and electrical equipment also remain vulnerable.

Outlook: On a Knife’s Edge

The economy stands at a delicate crossroads, with data supporting both bullish and bearish interpretations. On one hand, resilient corporate earnings, easing energy costs, a softer dollar, and the prospect of rate cuts offer tailwinds for risk assets. Added to that are long-term drivers such as the expected productivity gains from GenAI adoption, elevated AI-related capital expenditures, and the potential for lower taxes and deregulation. Together, these factors reinforce the case for continued equity market strength—particularly if inflation continues to drift lower after a temporary tariff-related bump and if the U.S. economy maintains momentum despite labor and trade headwinds.

However, the outlook is far from one-sided. Several potential headwinds could quickly tilt sentiment such as rising bond yields in response to widening fiscal deficits, persistent inflation pressures, a hawkish pivot by the Federal Reserve, or the onset of recession or stagflation risks. Much of this year’s equity rally has been powered by large-cap technology stocks, where lofty valuations heighten the risk of disappointment. A high probability scenario will see growth moderate, labor market cracks widen, and inflation edge higher, testing investor complacency.

Postscript: Even as we write this update, there are two disruptive forces at work that can have a negative impact on markets – an ongoing government shutdown that shows no signs of ending soon and a possible escalation in the trade war between China and the U.S. President Trump has threatened to cancel his planned meeting with President Xi Jinping on October 31 in South Korea at the Asia-Pacific Economic Cooperation summit. Responding to the October 9 announcement by Beijing that it was imposing new restrictions on refined rare earth minerals – and technology used to refine them – President Trump suggested that a massive increase in tariffs on China may be coming. We will be monitoring these developments in the coming weeks.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.