America – or at least the Trump Administration – and Europe are clearly seeing the world differently these days. Europe sees a direct threat to its hard-fought peace and security from its Russian neighbor. The Trump Administration sees a potential ally to woo in Putin. Europe sees the historical context of Russia’s current aggression in Ukraine as ending in long-term occupation (like the Baltics or Czechoslovakia), partition (like East Germany), and/or outright annexation (like Königsberg/Kaliningrad or Finnish Karelia). The Trump Administration sees a waste of America’s time and money. The Trump Administration sees a continent of weak woke “pathetic freeloaders” who can be pressured into submission. Europe sees an arrogant bully. These divergent perspectives are fraying the 80+ year-old trans-Atlantic marriage. As with most divorce proceedings, it doesn’t matter whether one party is “right” or “wrong”, just that they can’t agree on how to live together. It also doesn’t matter whether Trumpism is an aberration or a trend. Europe has realized that it cannot leave itself vulnerable to American political instability any longer. In the short term, markets have already begun to reprice the near-term effects by buying European defense stocks. But we think this re-orienting of Europe’s economic outlook should yield materially higher return expectations for European risk assets over the coming decade. Here we will highlight specific medium and long-term investment opportunities we believe U.S. allocators should pay attention to, with particular focus on the changing environment for European private equity and secondarily in segments of European public equities.

How to Lose An Ally in 14 Days

Initially, European leaders adopted a wait-and-see approach to Trump 2.0. After all, they survived Trump 1.0 without having to bear much more than a few years of awkward meetings, speeches, and press events. But things began to quickly change after Vice President JD Vance delivered a stunning speech in Munich on February 14. which skewered European democracy, freedom of speech, governance, values, and even the very purpose of the U.S.-European alliance.1 ” For the first time since World War II, a new U.S. Administration went to Western Europe as an adversary. And JD Vance made it clear that to stay in a relationship with the U.S., Europe would have to change its values to align with the Trump Administration’s beliefs. The terms of the divorce had been served.

Two weeks later a second bomb dropped on the trans-Atlantic alliance when Ukrainian President Volodymyr Zelensky was publicly reprimanded at a White House press event. This followed a series of pro-Russian statements from the White House, public remarks that implied Ukraine started the war with Russia, and bilateral talks between Trump and Putin over Ukraine that removed both Ukraine and Europe from the discussion.

If there was any belief that these public admonishments of Europe were merely a strongman façade for the Trump Administration’s political base, that fantasy was further dispelled in mid-March amid the Signalgate fiasco which underscored that the national security team of the United States assigns little value to its post WW2 allies and views any U.S. global military interventions as requiring immediate and quantifiable compensation. The disdain for Europe was nakedly obvious with missives such as: “…we absolutely [must add this to the list] of horribles on why the Europeans must invest in their defense” (National Security Advisor Michael Waltz), “I just hate bailing out Europe again” (Vice President JD Vance), and most obviously “I fully share your loathing of European free-loading. It’s PATHETIC” (Secretary of Defense Pete Hegseth). What is particularly ironic about these statements is that the very attack under discussion was in fact carried out with support from British refueling aircraft and that British troops have long been fighting the Houthis alongside the US in the Red Sea.

If Europe was previously in denial about “the new sheriff” in Washington, they are no longer. New German Chancellor Friedrich Merz said on Feb. 23, “The Americans … are indifferent to the fate of Europe.” French President Emmanuel Macron said on March 5, “Overall, our prosperity and security have become more uncertain.” “I want to believe that the United States will stand by us. But we have to be ready if that is not the case.” And even Polish President Donald Tusk – who was called a “model ally” by Defense Secretary Pete Hegseth as recently as Feb. 14, 2025 – is no longer sanguine. On March 27, President Tusk said, “since we have been hearing frequent statements from across the Atlantic that suggest a lack of fondness for Europe… the only conclusion is that Europe must be the one to assume responsibility for the survival of the transatlantic relationship.” Europe has received America’s divorce papers and agreed that the couple has irreconcilable differences.

Talk is Cheap, Now What?

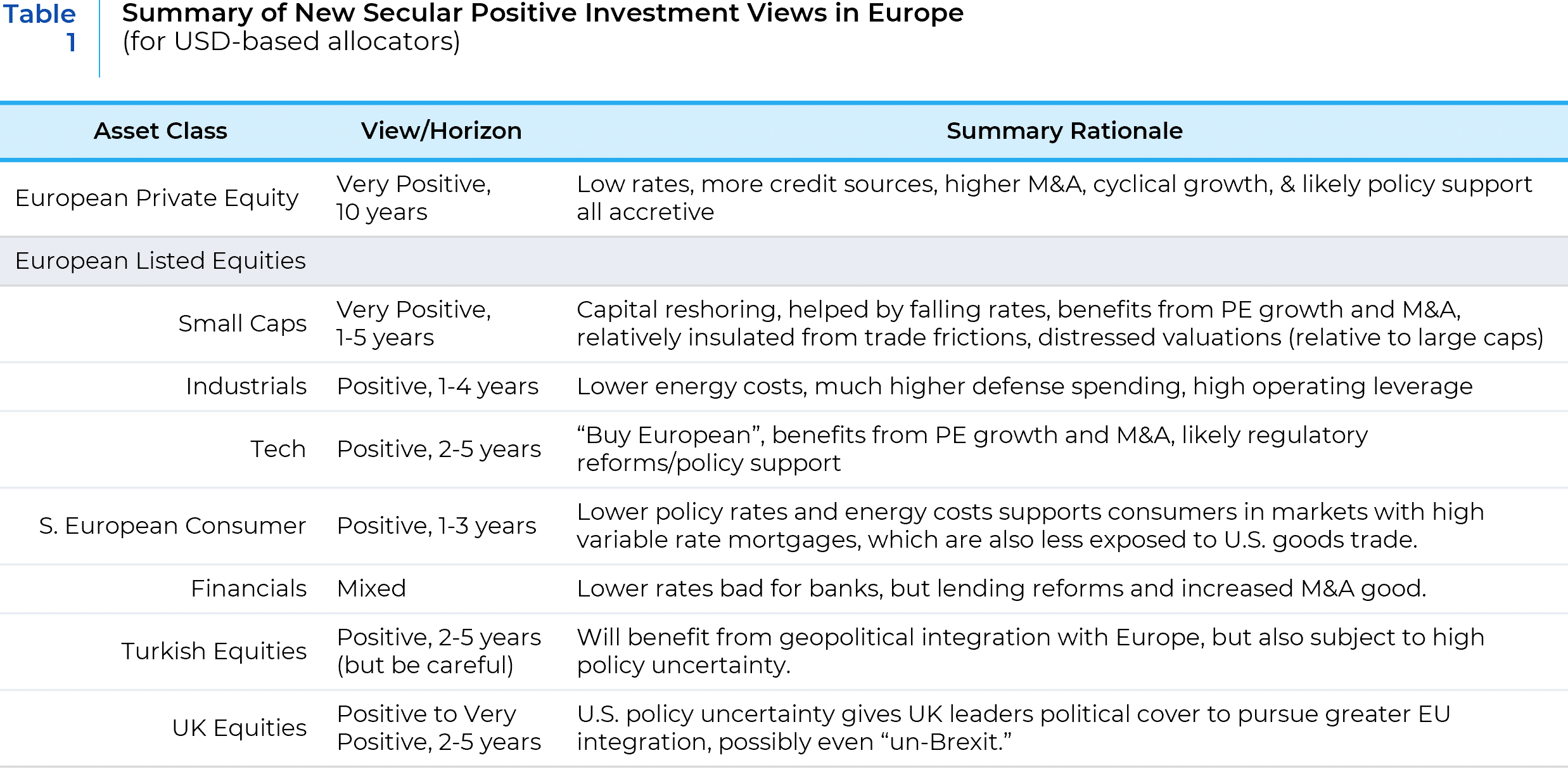

Much like the pandemic spurred an accelerated adoption of digital commerce and remote work arrangements, we think the trans-Atlantic schism will spur greater European integration on a myriad of fronts. The most obvious first order effects for investors were a dramatic repricing of European defense stocks. The largest European defense companies all surged by 30-90% in price in just a few short weeks (see Chart 1) amid the expectation of much higher defense spending by European governments. While the rally in European defense stocks could be ripe for a tactical pullback, the significant repricing of these companies’ future revenues feels substantially sound at this juncture. Beyond buying more weapons and war materials (including buying less American weaponry in favor of European-made products)2, we also expect Europe to make substantial improvements to interoperability, joint action capability, intelligence sharing, and general military preparedness.

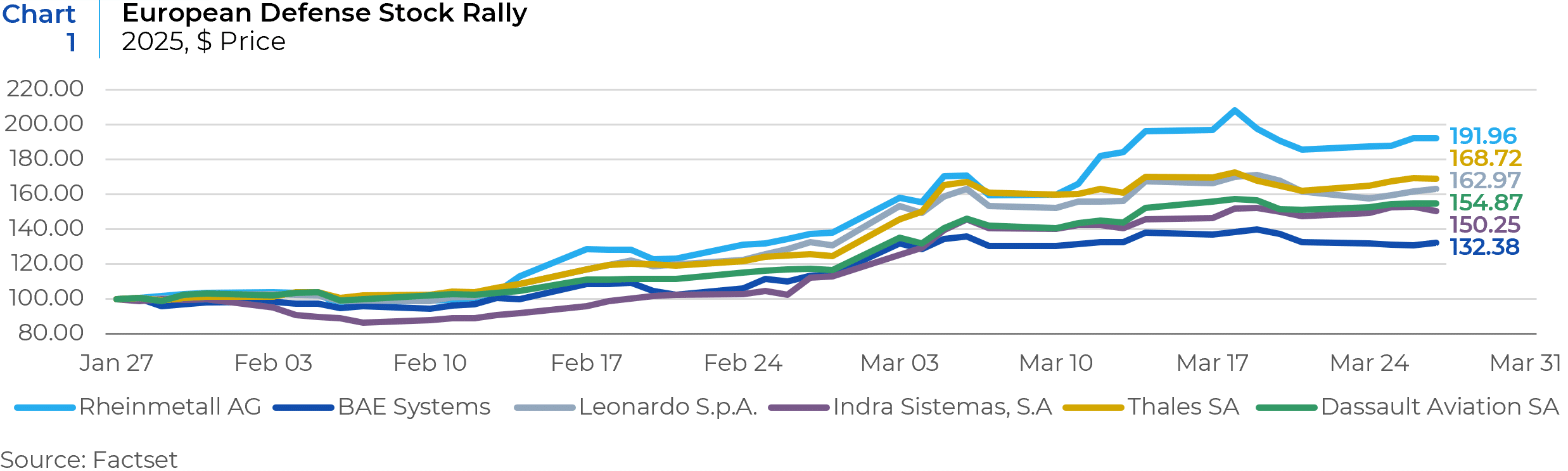

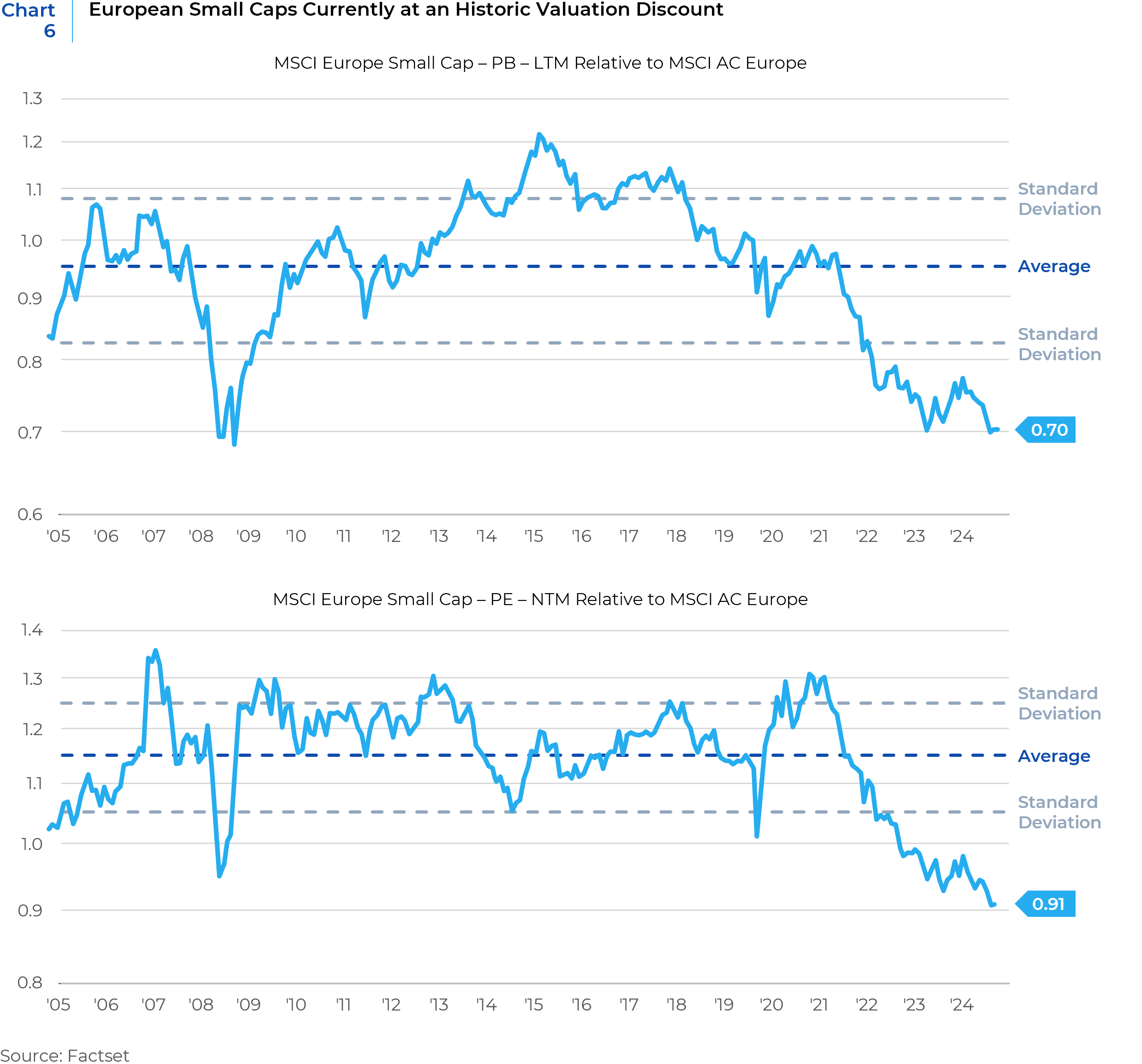

While greater intra-European military cooperation and investment has dominated the headlines, we believe this moment of geopolitical upheaval is also likely to prove a turning point for European economic and financial integration. Even before the Trump Administration’s assault on the alliance spurred greater European nationalism, Euro-positivity was already trending higher, fully recovering from the brief period of pandemic-induced Euro-skepticism (see Chart 2). European debt levels have been stable (see Chart 3), private sector financial assets are strong (see Chart 4), and European banks are in their best shape in decades (see Chart 5).

Towards a More Perfect Union

This relatively favorable financial backdrop in combination with the renewed enthusiasm for political cohesion provides the most favorable preconditions for further integration since the EU was established in 1992 under the Maastricht Treaty, which led to the eventual adoption of a single currency. Ironically, the U.S.’ geopolitical isolationism. has provided political cover to Europhile leaders while undercutting Euroskeptics. It has also given urgency to the European policy community to speed up reforms already in process.

There are a range of meaningful areas of reform that investors should now be on the look out for:

- Allowing more cross-border M&A in sensitive sectors like banking and telecommunications.

- Creating incentives for equity investments from both retail (tax, auto-enrollment, etc.) and institutional (prudential treatment) investors.

- Reducing administrative and regulatory burdens at the EU level.

- Further removing national barriers for intra-EU trade and cross-border business operations.

- Creation of a transnational venture capital fund (European Investment Fund).

- Lowering barriers to new firm formation and capital raising.

Two areas where there are already meaningful changes in process undergird our bullishness on Europe over the coming years:

- Capital Markets Reform/Integration

- Reordering EU Trading Relationships

Capital Market Reform/Integration

While the European market for goods is now largely homogenized, for financial services the job of integration remains a work-in-progress. EU-wide rules on cross-border investments and lending are already mid-change, with more substantial reforms afoot. While a full banking union or issuing a common sovereign bond still appears politically unacceptable, there is room for other meaningful areas of reform, such as EU-wide capital market reforms. New German Chancellor Friedrich Merz for example counseled in February 2025 “Let’s talk about the open capital market and how to bring companies from Europe to the capital market.” Additionally, the European Commission’s March 2025 strategy to “Foster Citizens’ Wealth and Economic Competitiveness in the EU.” included proposals to modernize trade execution and price formation on EU trading venues, eliminate certain administrative directives on trading, streamline rules for new IPOs, homogenize national taxation procedures on capital gains and dividends, introduce interval fund-like structures, and remove all remaining barriers to EU-wide investment fund distribution and client servicing.3

Pending areas of reform to securitization and private credit lending, which together could substantially stimulate credit growth across the continent are particularly promising. Following the GFC, the substantial tightening of standards for securitizations in both the U.S. and Europe led to a collapse in new issuances in both economies. But whereas the U.S. market has seen a substantial recovery, Europe has seen no significant change in issuance in over 10 years, with recent levels at a mere third of those seen in the U.S. Last year, the European Commission opened up a “Targeted Consultation on the Functioning of the EU Securitisation Framework,” soliciting detailed comments from industry participants. Proposals from the consultation are expected in Q2 2025, but the initial consultation document already hinted at the possibility of modifying the prudential treatment of securitization for banks and insurance companies and loosening certain stringent standards of transparency and issuance requirements to bring European markets closer in line with global norms. Greater take-up of securitizations in the European market could boost investment and credit growth by allowing banks to transfer risk and free up capital, while also injecting capital into debt markets from asset owners and investors.

Additionally, impending implementation of recent private credit reforms should also boost credit activity by facilitating a single EU market for private credit lenders. . National governments have until April 2026 to codify the new Alternative Investment Fund Managers Directive 2 (AIFMD 2.0) rules into local regulatory regimes, the most significant of which is the so called “cross border loan origination passport”, which allows private credit fund managers to lend on a cross-border basis into any other EU jurisdiction, irrespective of their own fund or HQ domicile. European asset managers are already expecting substantial growth in private credit with some estimates projecting a quintupling of AUM growth over the next 5 years.

Reordering EU Trading Relationships

A trade war with the U.S. would obviously stymie trade growth between Europe and the U.S. and may cast a chilling effect on their trading relationship for years. But elsewhere in the world, globalization of trading networks continues to grow. For its part, the EU remains not only committed to global trade but has recently changed its own priorities to further accelerate it.

In December 2024, just weeks after Trump’s election win, European Commission (EC) President Ursula von der Leyen signed a trade deal with the four founding members of the Mercosur bloc—Argentina, Brazil, Paraguay, and Uruguay. She also restarted talks with Malaysia and visited India with her entire team. The newly expansive trade agenda comes amid a fresh sense of realpolitik at the EC, with a substantially less ambitious extraterritorial agenda that once sought to dictate regulatory standards with their trading partners and instead accepting a more pragmatic approach to lower trade frictions. For example, the Mercosur agreement had previously been stuck as European leaders sought to impose EU environmental and labor standards on South American beef and other agricultural products. Once the EU dropped these issues, the agreement moved ahead. In exchange, the agreement will lower tariffs on European cars and machinery. Similarly, prior efforts to open greater trade with India were stuck on environmental and labor standards with Indian steel and cement production.

While Trump-imposed tariffs on European exports to the U.S. would obviously raise prices on European goods, likely lowering trading volumes, the adversarial approach of the Trump Administration has conversely freed up Europe from even discussing further trade concessions. Under the Biden Administration, most of the ongoing trade disputes with Europe were in areas where the U.S. was seeking EU concessions, including restrictions on GMOs/food labels (which hurts U.S. food exporters), the digital services tax (which hurts U.S. tech), and aerospace subsidies (which hurts Boeing). The most significant area of concern for the EU regarded parts of the Inflation Reduction Act, which Trump has already frozen funding for.

Moreover, Trump’s assault on the global norms of free trade have already provided political cover in this moment for Europe to “Buy European”. In a move that would have been unthinkable just a few years ago, a coalition of more than 90 European companies issued an open letter calling for the European Union’s leadership to take “radical action” to reduce the continent’s reliance on foreign technology and dependency on U.S. Big Tech on March 16. As one of the CEO signatories to the letter put it, “Trump switched off access to vital infrastructures because Ukraine was not ready to cede its land and hand over its minerals…Europeans need sovereignty in critical infrastructures and those do not only consist of energy and health, but certainly also digital ones.”4

The Market Implications of a Geopolitically Independent Europe

For U.S. allocators, we think this reorienting of Europe’s economic outlook should yield materially higher return expectations for European risk assets over the coming decade, first and foremost in European private equity and secondarily in segments of European public equities.

European Private Equity – Reduced intra-continental barriers to business, more favorable political and regulatory environment to M&A, benign inflation and thus low rates, as well as reforms to private credit and securitization markets should yield more avenues of credit availability to GPs. This backdrop should substantially favor private equity over the coming cycle. Tech-focused specialist managers in particular should benefit as Europe gradually reorients itself away from U.S. tech dependence, whether through regulatory impetus or pure market preference.

European Listed Equity – Reforms that yield greater European growth and corporate efficiency, change investors’ preferences, or increase access to equity investments, clearly would benefit broader European risk assets. But there are several sub-segments of the market where this new wave of European integration changes the outlook:

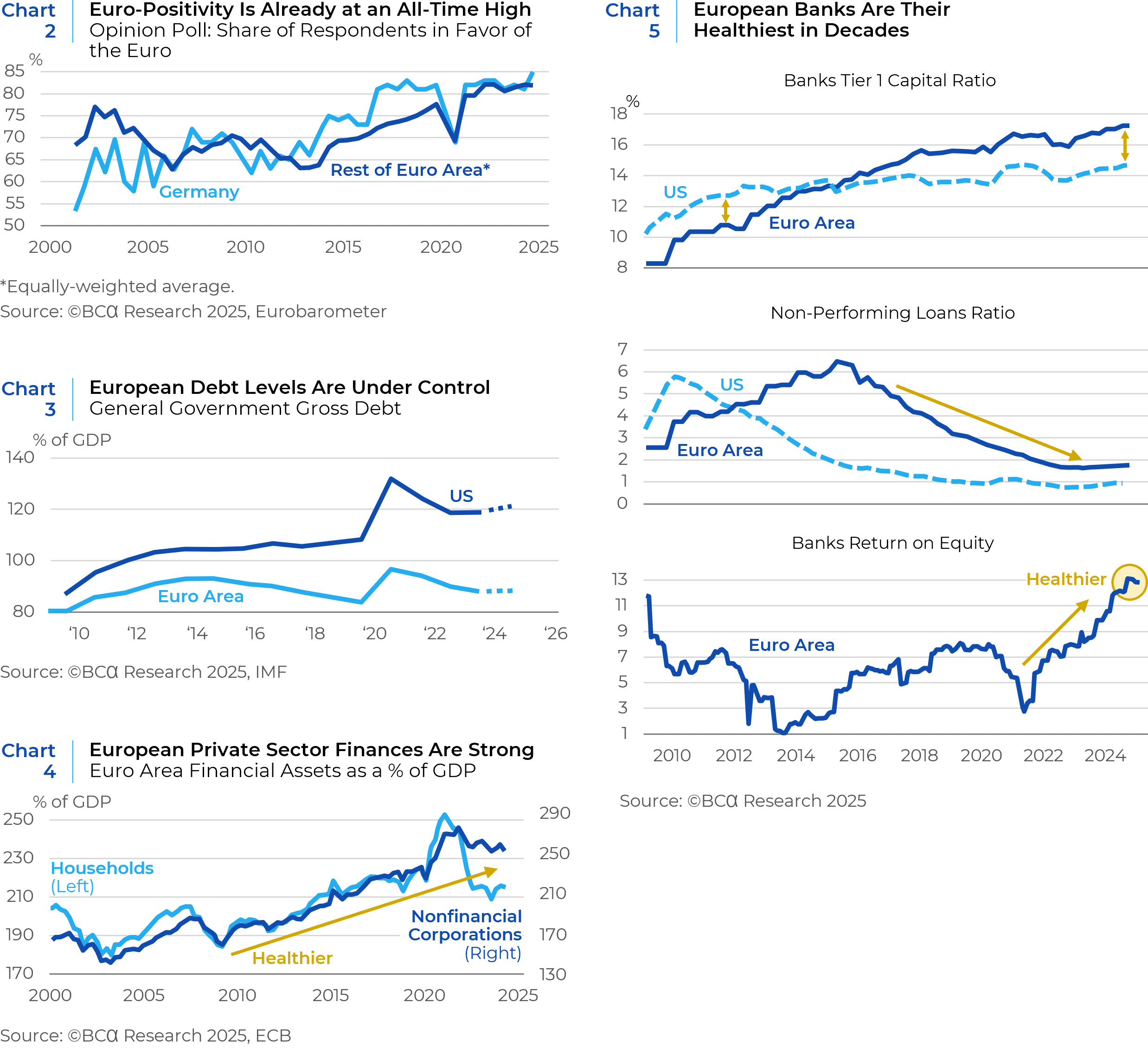

Small Caps – What is good for private equity buyouts is also good for small caps. Against a backdrop where European small caps were already at an historically wide discount compared to their large cap counterparts (see Chart 6), small caps do not need much of a catalyst to have a substantial re-rating over the medium-term, in both relative and absolute terms. Additionally, multiple trends favor European small caps in the coming years, including the prospect for greater M&A, potential reforms to ease regulatory and trade burdens, and much lower exposure to the U.S. market vs their large cap counterparts. Perhaps most poignantly, however, is the comparably weak market outlook in the U.S., which in turn leads to European investors keeping more capital a home.5

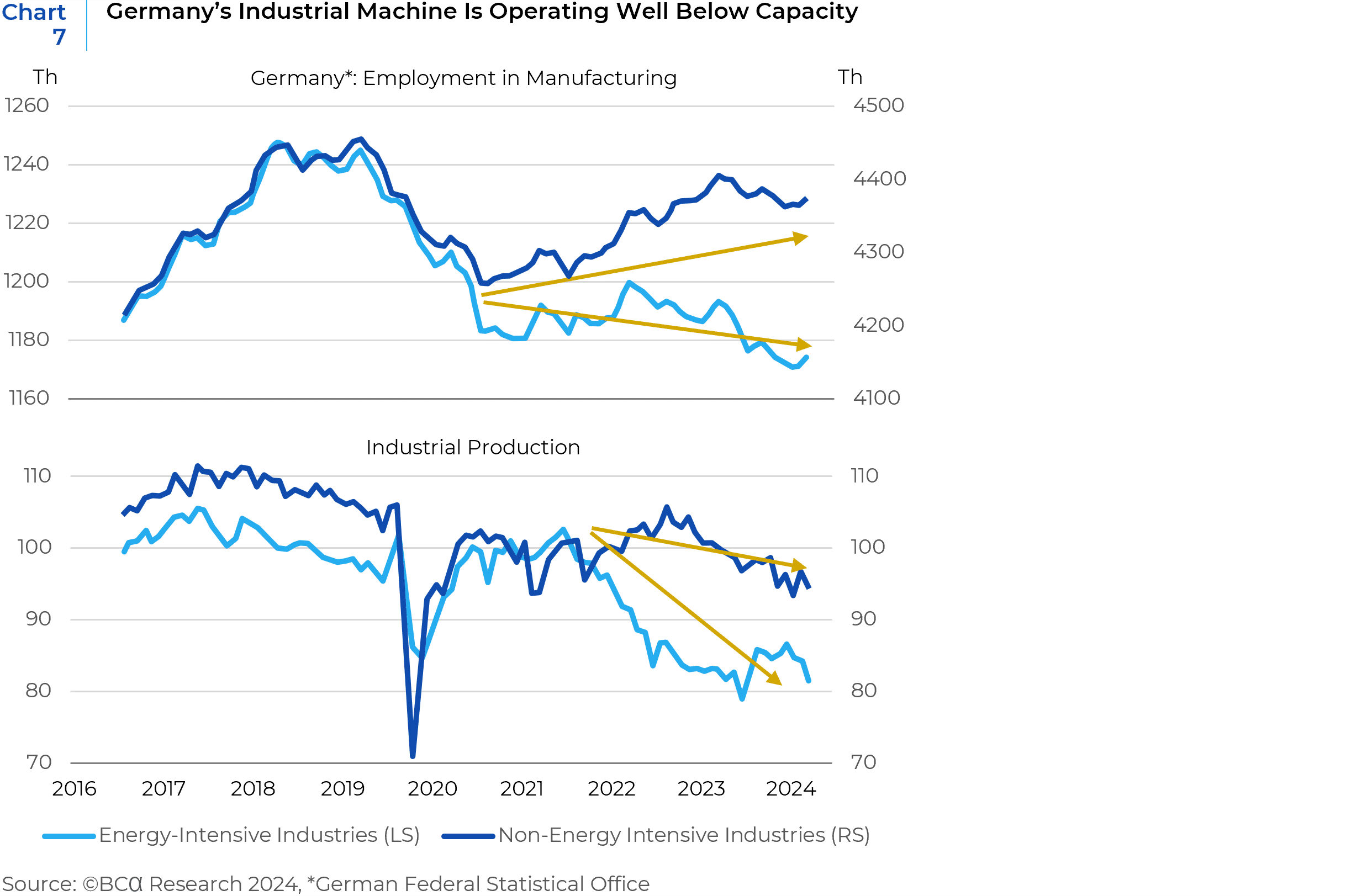

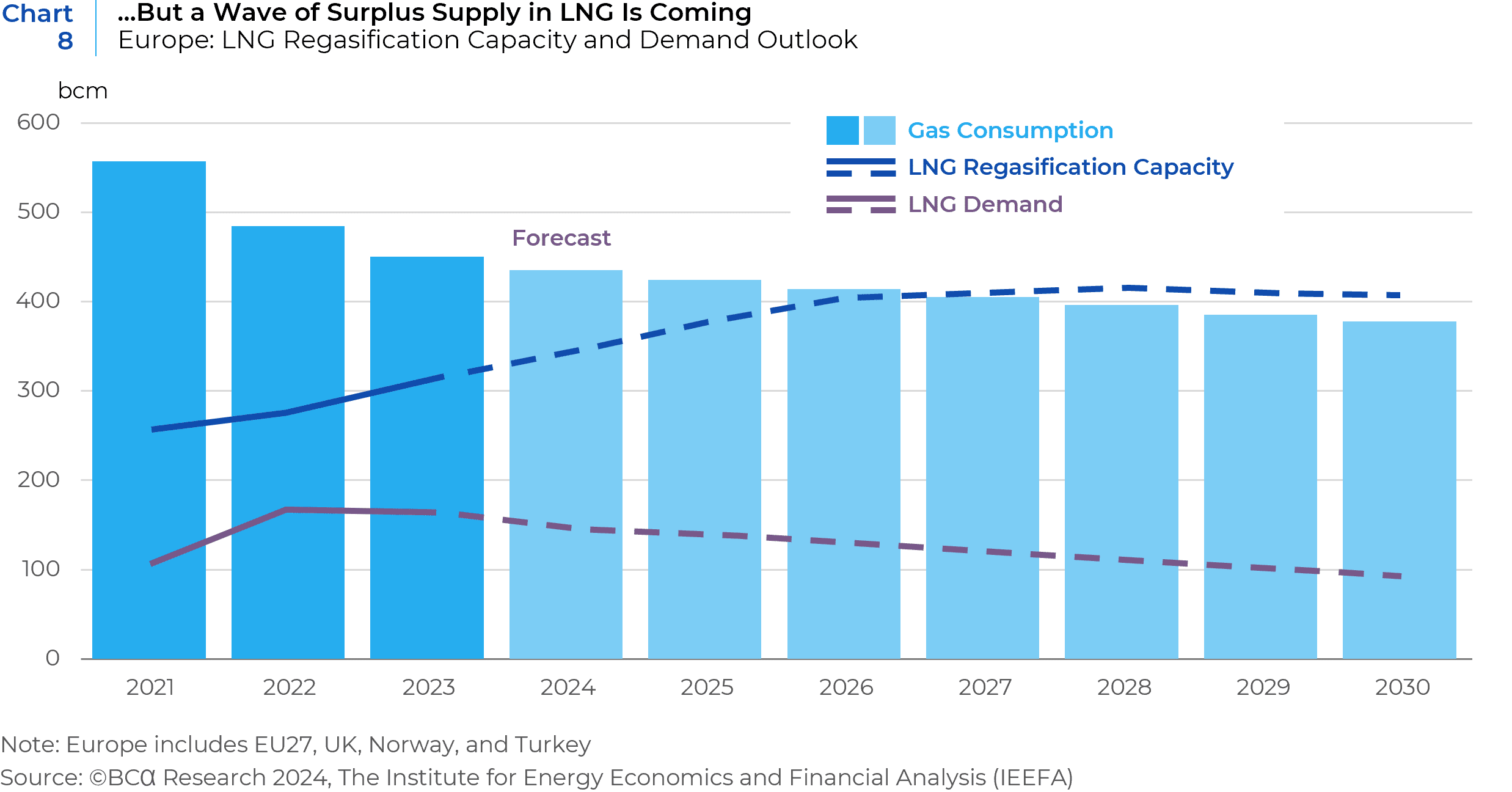

Industrials – After being battered by the surge in energy prices following Russia’s invasion of Ukraine, European industrials – and especially German energy-intensive industrials – reduced production levels and sector job growth never returned to pre-pandemic levels (see Chart 7). Though European companies did not lose global market share, their profitability lagged their global peers due to higher energy prices. Going forward, increased LNG regasification capacity (see Chart 8) is poised to reset the supply-demand relationship for industrial energy prices across Europe, but especially in Germany. Combined with the prospect for greater investment in defense manufacturing and the now high probability of regulatory and market reforms to increase productivity, we expect European industrials to also outperform in the coming cycle.

Tech – A new geostrategic priority to “Buy European” technology is clearly bullish for tech firms in Europe, as is the myriad of discussed reforms to promote greater access to capital markets for new firms, venture capital investments, and other potential catalysts. But Europe’s two largest tech firms (SAP and ASML), which account for almost 70% of the index weight, may or may not be winners in this new environment, and so active security selection by managers who are especially adept at underwriting changing growth prospects and identifying future growth champions should be favored.

Consumer – Several European countries have a majority of mortgage borrowers in variable rate loans, including Italy, Spain, Portugal, Greece, and Austria. While lower energy costs (see above) will help consumers across Europe, lower policy rates combined with the added downward pressure on rates from credit market reforms (see above) will also disproportionately support consumer spending in these southern European economies (plus Austria).

Financials – Financials, especially banking, are one sector where we feel the outlook is more mixed. On the one hand, further homogenization and simplification of the regulatory framework will benefit financials, especially in the asset management industry. However, falling interest rates and competition for credit provision is likely to put downward pressure on lending margins at banks, or at least dampen loan book expansion. On the other hand, most banks are exposed to the asset management business and would also benefit from loan growth facilitated by securitization reforms. [For more on the outlook for European banking, see our special report*]. Turkey – In an environment where Europe is left alone to contain Russia’s geopolitical revanchism, Turkey becomes substantially more important to Europe. Long critical to containing Russia in the Black Sea, Turkey also has a strong defense industry of its own that investors have already rewarded alongside European defense stocks in this year’s market repricing. However, President Erdogan’s authoritarianism at home will make this a more tense relationship than it otherwise would be, while creating substantial local market volatility, so selectivity and timing will be important.

UK – Among all the possible and most radical outcomes from this renaissance of pro-Europeanism, is the possibility of an un-Brexit…or at least a partial one. In December 2024 the EU and the Swiss government concluded negotiations on a series of agreements that could offer a practical roadmap for a degree of reintegration of the UK into the European economic framework. Importantly, the EU-Swiss agreements allowed for a piecemeal approach to combining those economies that had previously been politically unpalatable to European leaders. The America-first and isolationist impulses of the Trump administration could ironically provide British leaders sufficient political cover to call for a new “un-Brexit referendum” or at least make additional compromises toward reintegration with Europe that previous UK governments could not. While the road to any such agreement for the UK would likely be long and uncertain, this would be an unabashedly positive outcome for UK risk assets that is not currently reflected in their depressed valuations.

- “I’ve heard a lot about what you need to defend yourselves from, and of course, that’s important. But what has seemed a little bit less clear to me, and certainly, I think, to many of the citizens of Europe, is what exactly it is that you’re defending yourselves for. What is the positive vision that animates this shared security compact that we all believe is so important?” U.S. Vice President JD Vance. Munich Security Conference. February 14, 2025.

- Portugal waivers on plans to buy U.S. fighter jets: https://www.reuters.com/world/europe/portugal-wary-trumps-nato-policy-pick-fighter-jets-2025-03-14/ as does Canada: https://apnews.com/article/f35-canada-trump-0d3bf192d3490d87570d48475ff2c3a6.

- https://finance.ec.europa.eu/document/download/13085856-09c8-4040-918e-890a1ed7dbf2_en?filename=250319-communication-savings-investmlents-union_en.pdf

- https://techcrunch.com/2025/03/16/european-tech-industry-coalition-calls-for-radical-action-on-digital-sovereignty-starting-with-buying-local/

- Like investors everywhere else the world over, local investors have a higher marginal propensity to invest down the size spectrum.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.