Executive Summary

FTSE Russell introduced issuer‑level concentration caps to the Russell U.S. Style indexes in March 2025 to temper mega‑cap dominance while preserving benchmark utility. We compare the capped “Index” and uncapped “Benchmark” at the March review and the June annual reconstitution. In March, small trims lowered the ≥4.5% group with little effect on concentration, turnover, or tracking. In June, membership and style changes—especially a smaller Growth allocation for Amazon and Alphabet—left the ≥4.5% group at the 45% threshold, so capped and uncapped weights matched. Taken together, the cap has operated as a guardrail: adjustments have been small, and the index remains highly concentrated in its largest names and tech‑tilted sectors.

What Changed in 2025?

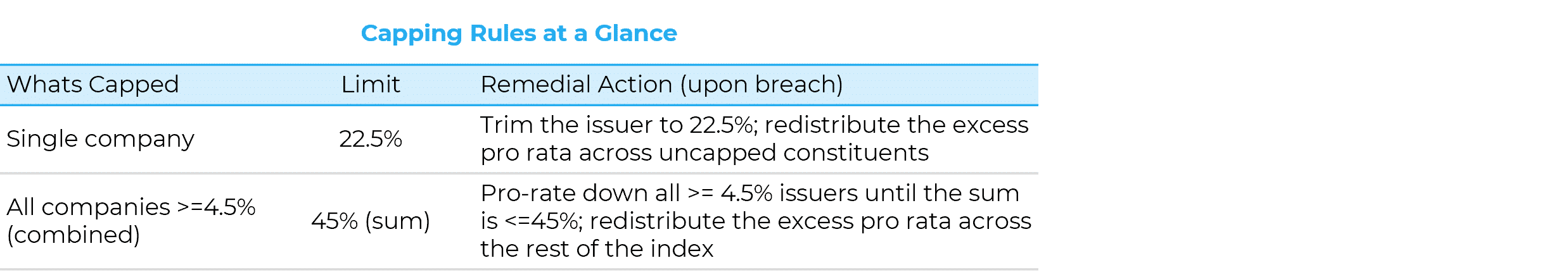

In March 2025, FTSE Russell added a concentration‑capping framework to the Russell U.S. Style indexes. At each quarterly and annual review, no single company may exceed 22.5% of the index, and the combined weight of all companies at or above 4.5% may not exceed 45%. If either limit is breached, those weights are trimmed and the surplus redistributed across the rest of the index. Multiple share classes of the same company are tested together.

Caps are calculated using closing prices on the second Friday of the review month and implemented after the third‑Friday close, with the issuer‑level test combining share classes. FTSE now publishes two series: the capped “Index” (benchmark default) and an uncapped “Benchmark” for analysis and continuity.

Early Impact Assessment: Capped vs. Uncapped Russell Large Growth Index

We assess impact across the March 2025 review and June 2025 reconstitution using an issuer‑level comparison that isolates the effect of the changes. Our focus is concentration (maximum issuer, ≥4.5% group, Top‑10 weight), sector mix, turnover, and any post‑event performance dispersion.

March 2025 Quarterly Review

Quarterly reviews now apply float/share updates, routine corporate actions, and—beginning March 2025—the 22.5/4.5/45 concentration-cap test. Because they do not reset index membership (unlike the June reconstitution), these events typically produce minimal changes and low turnover.

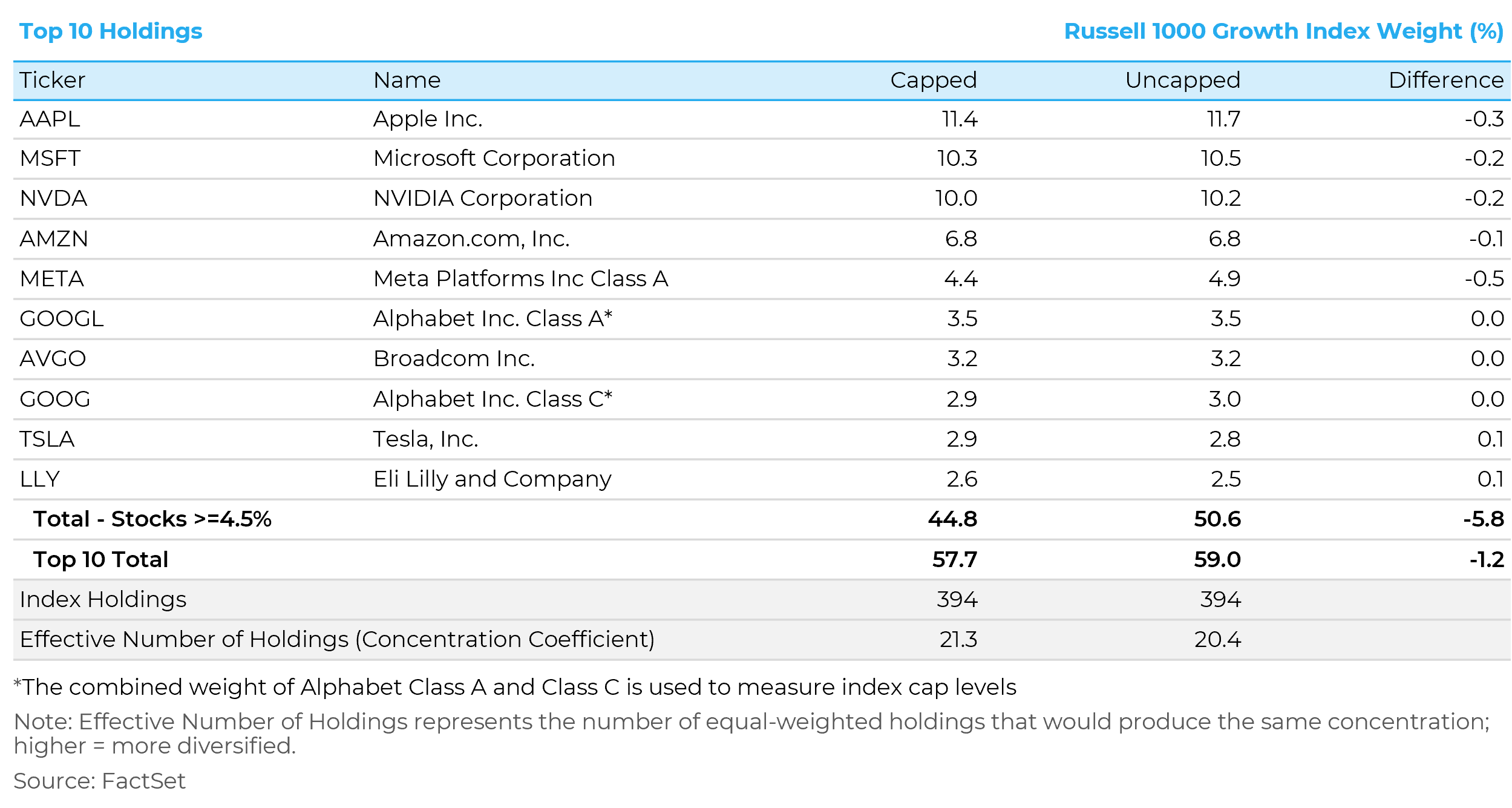

At the March review, the combined weight of issuers at or above 4.5% breached 45% once Alphabet’s share classes were combined. Under FTSE’s methodology, those issuers were pro‑rated down until the ≥4.5% group summed to 45% or less, with the excess distributed across the rest of the index.

Post‑March, the Top‑10 comparison shows only slight shifts: the cap trimmed the largest names, but total Top‑10 weight moved little. The effective number of holdings rose only marginally, signaling a very small decrease in concentration. Implementation effects were modest: estimated turnover for the capped series was 1.5% versus 0.9% for the uncapped and predicted post‑rebalance tracking error between them was 0.2%.

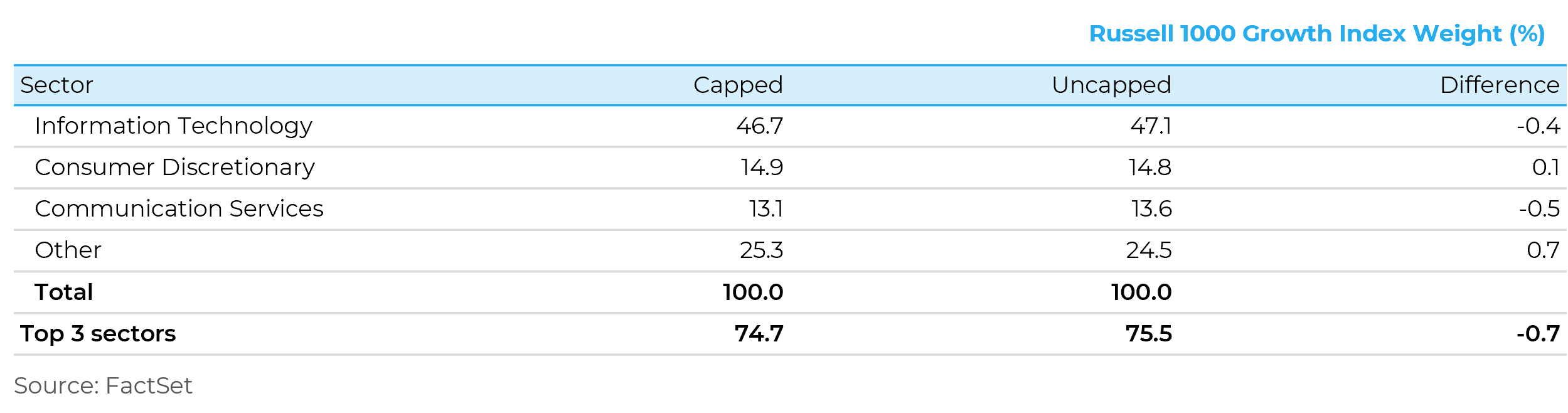

Sector weights were nearly identical, leaving overall sector concentration essentially unchanged.

Performance Impact

From Mar 21 to Jun 27, 2025, performance of the capped and uncapped Russell Large Growth series was very similar; the capped index lagged only marginally. Contribution shows the underweight in Apple helped, but this was more than offset by underweights in NVIDIA, Microsoft, and Meta. Concentration remained evident: the top ten holdings accounted for roughly two‑thirds of total return in this window.

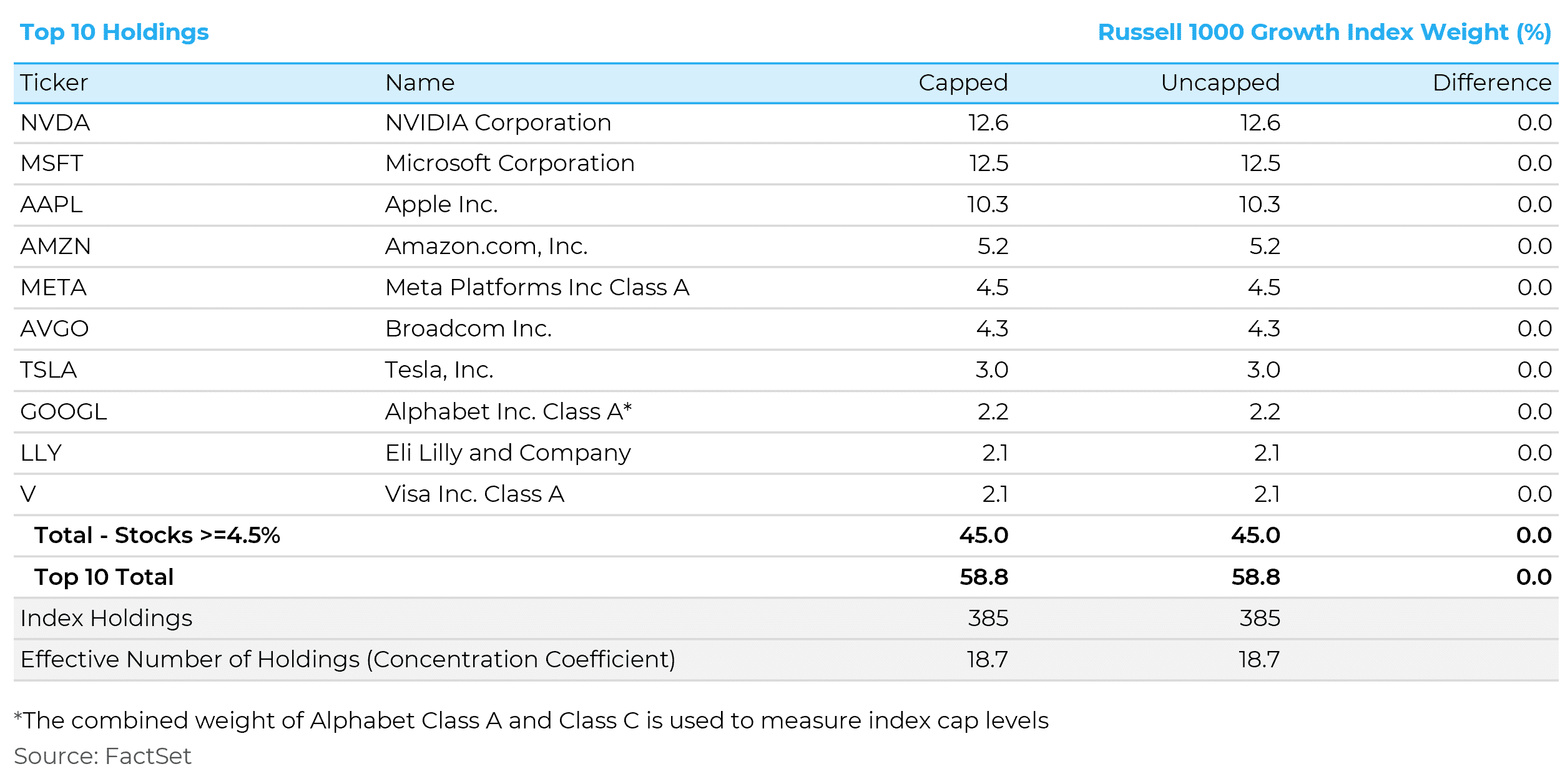

The Annual Reconstitution

The late‑June Annual Reconstitution re‑ranks the market, refreshes float‑adjusted market caps, and reassigns membership across size and style. Unlike the quarterly reviews—focused on share/float updates, corporate actions, and the cap test, the June event changes membership and typically has higher turnover. This year, membership and style updates—most notably a smaller Growth allocation for Amazon and Alphabet (Class A and C), reduced the uncapped ≥4.5% issuer group to 45%. Because the group no longer breached the threshold, the capped Index and uncapped Benchmark were identical on holdings and weights. Turnover was typical for a reconstitution and similar across series. Despite these resets, concentration remains elevated: the Top‑10 holdings still comprise about 59% of the index.

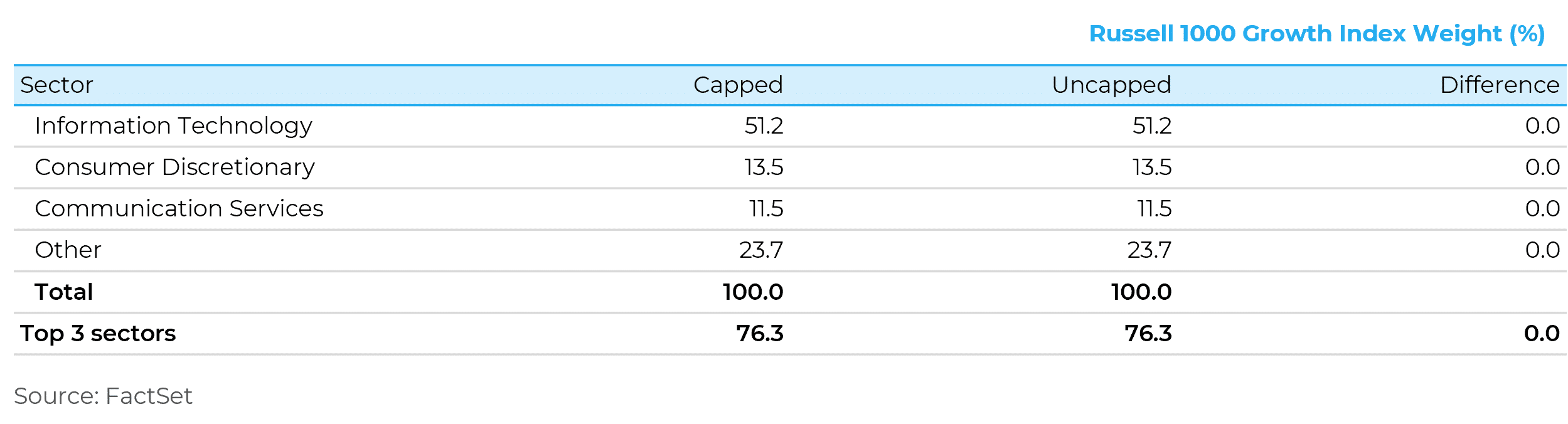

Sector concentration also remains elevated following the June reconstitution.

Upcoming Changes to the Russell Index Rebalance Timing

In 2026, FTSE Russell will move from one annual reconstitution to a semiannual cadence—June and a new November event. June remains the full membership and style refresh, while November adds a second membership reset; style indexes in November will update only for additions or membership moves, with the full style rebalance still occurring each June. The concentration caps are unchanged and will continue to be assessed at quarterly and annual reviews. The extra November reset should help prevent extreme concentration from building between Junes and spread turnover across the year; most style‑level relief will still come from cap trims when thresholds are breached and from the comprehensive June rebalance.

Conclusion

In this initial period, the capping rule acted as a guardrail: adjustments were small, and overall concentration remained high in both the largest holdings and the tech‑ and communication‑heavy sector mix. Turnover in the capped series was not meaningfully different from the uncapped version. For investors who expected a sizable redistribution away from mega-caps or a noticeable reshaping, that outcome did not materialize; the index’s risk/return profile is essentially unchanged. Looking ahead, impact is likely to be episodic, activating only when mega‑cap weights cross thresholds; otherwise, the capped and uncapped series should continue to track closely.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.