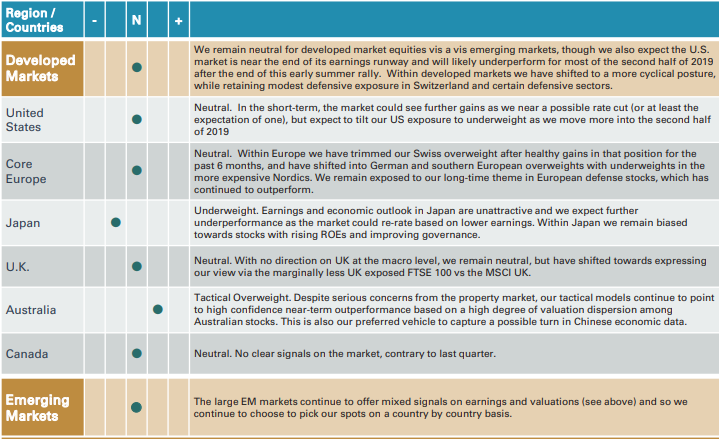

For Q3 2019, we are moving the dial towards cyclical sectors and markets.

US: We maintain our neutral position to U.S. equities.

Developed Non-US:

- We have reduced our overweight to the defensive Swiss market in favor of an increased weight to core European markets, which are more exposed to China reflation.

- Despite the expected increase in the VAT, we maintain a neutral weight to Japan because of a more attractive earnings profile; Japan would also benefit from Chinese reflation.

- Additionally, we have put on overweight to Australia, which should benefit from both monetary accommodation and China reflation.

Emerging Markets: We are neutral.

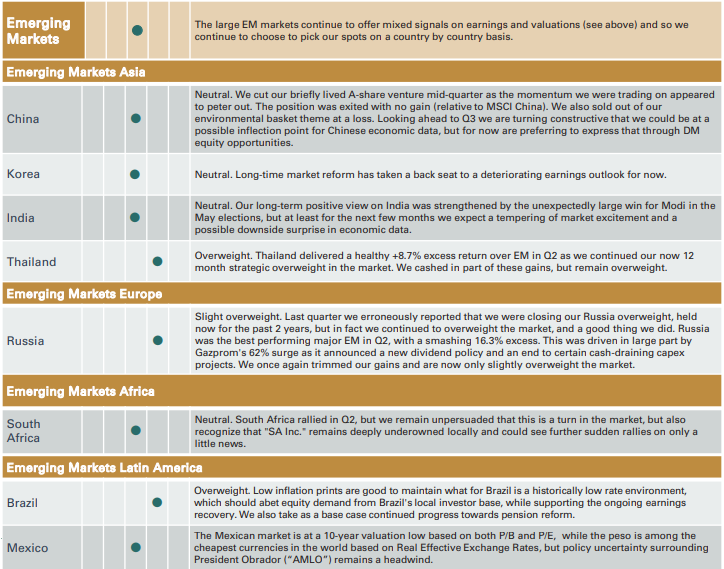

- Within emerging Asia, we remain neutral to China. Despite our incrementally constructive view on Chinese economic activity, we prefer to express that through DM equity plays.

- We have reduced our overweight to Korea amid a bearish earnings outlook and maintain a neutral weight to India from our long-time strategic overweight as the market settles into a post-election trading range and near-term economic data could surprise to the downside.

- We retain an overweight to Thailand whose financial profile is less exposed to U.S. dollar liquidity and also trimmed further our long-time overweight to Russia.

- With respect to LatAm, we cut our overweight to Mexico and shifted to an overweight in Brazil as favorable inflation dynamics continue to lower the cost of capital in Brazil that should accrue to corporate earnings. We expect continued progress on pension reform in Brazil, though we could look to exit the trade at signs of overexuberance in the market.

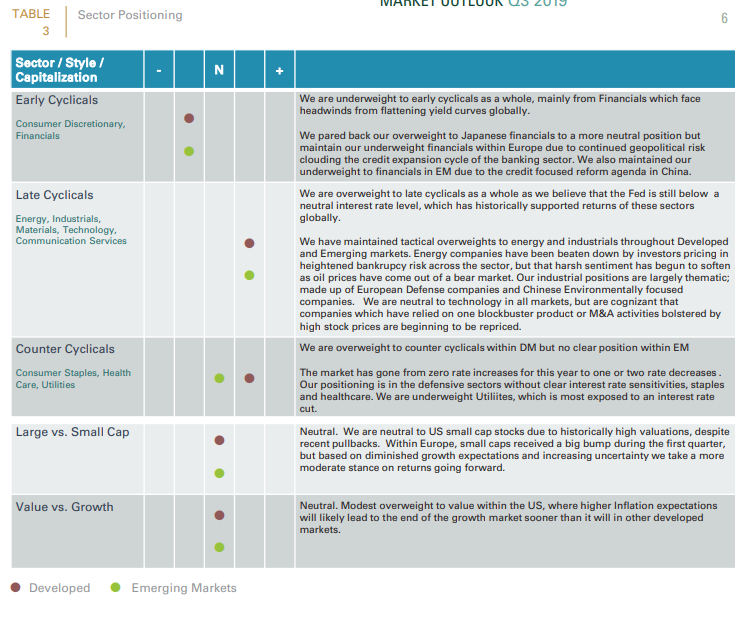

Global Sector Positioning: Although there are precious few signs of improvement in global trade and manufacturing, we retain a more balanced allocation between Defensive Sectors and Cyclical Consumer Discretionary and other Late Cycle sectors. We continue our overweight to Energy and Industrials. Our perspective on oil prices was discussed in our Q3 2019 Market Outlook. The industrial positions are largely thematic; made up of European Defense companies (a play on increased geopolitical uncertainty) and Chinese environmentally focused companies. Please See TABLE 3 on PAGE 6 for our sector and style positioning).