Poised for Lift-Off or Facing Turbulence – A Midyear Check-In on the Economy and Markets

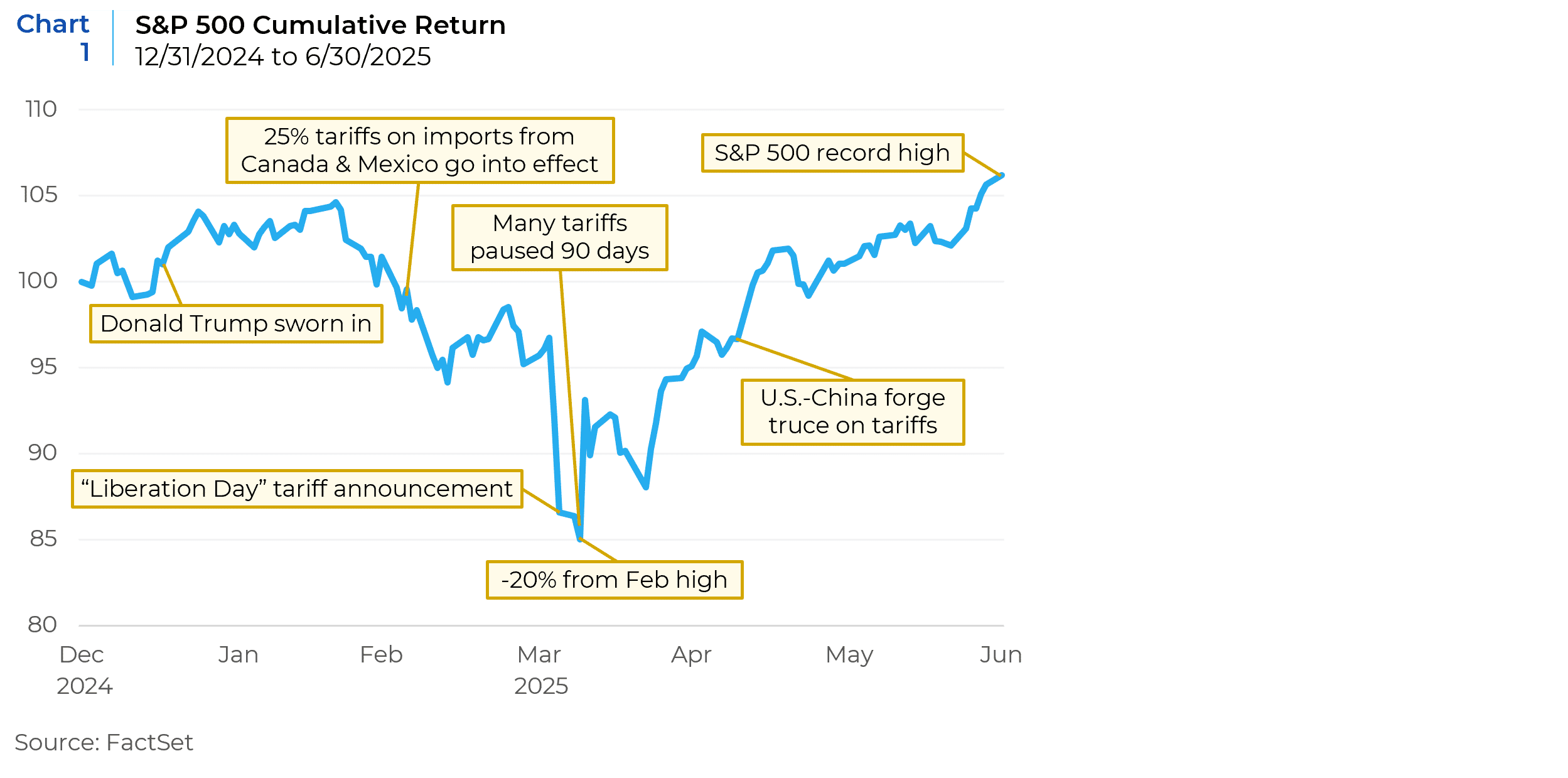

The turbulent first half of 2025 was characterized by a sharp reversal in investor sentiment and equity market performance from the first quarter to the second (Chart 1). Despite significant volatility earlier in the year, the S&P 500 rallied in Q2 to end up +6.2% year-to-date at the mid-year mark, after recovering from a steep correction in March-April. This turnaround was fueled by easing trade war fears and the market’s growing confidence that the Fed’s tightening cycle is over. The rally from the April lows to new highs represents one of the quickest recoveries in recent memory. As we enter the second half of 2025, the next six months are expected to be defined by a slowing global economy, tariff uncertainty, and market volatility. While a recession is not widely predicted, growth is expected to moderate, with the labor market cooling and the possibility of Federal Reserve interest rate cuts later in the year.

Slowing Momentum in Economic Growth

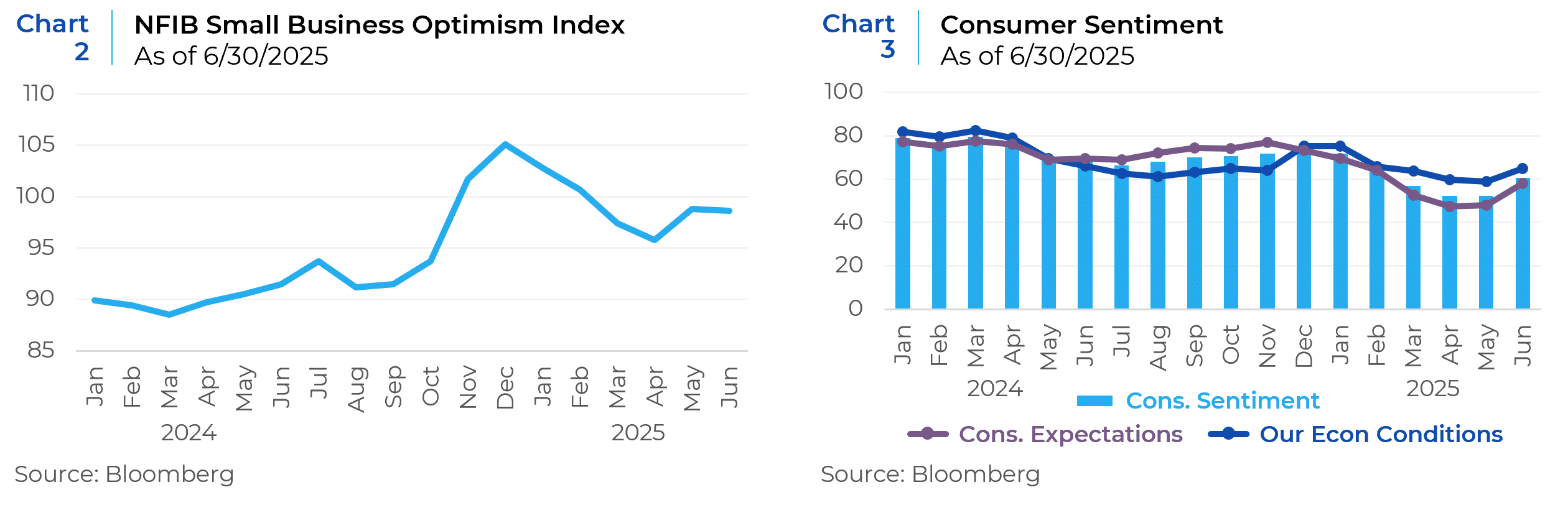

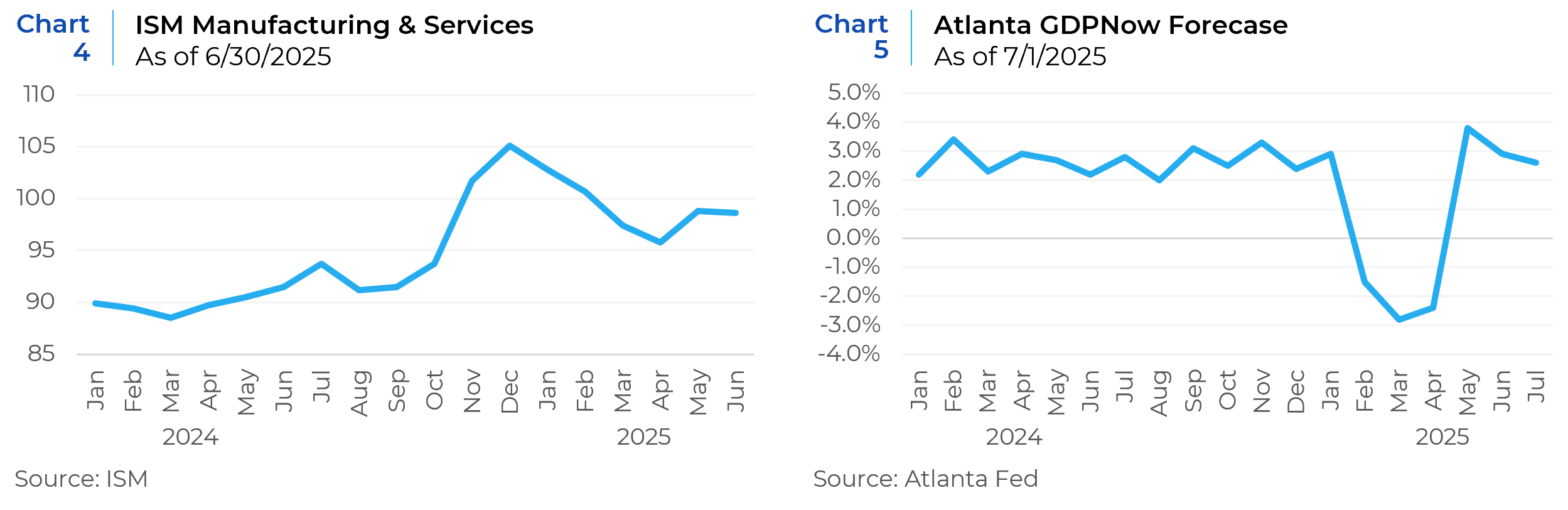

U.S. GDP growth is projected to downshift in the second half of 2025 after a resilient 2024. In fact, the economy contracted slightly in Q1 2025, with real GDP at –0.5% annualized – the first quarterly decline since 2022. Looking ahead, most forecasts anticipate subdued growth in the second half of 2025. On the positive side, the absence of any major financial stress should prevent a sharp contraction. The Fed’s baseline forecast for full-year 2025 GDP growth is +1.4% – essentially a slow-growth, no-recession outcome. This is reflected in the Small Business Optimism Index (Chart 2) and consumer sentiment data (Chart 3), both of which have improved recently. Services and Manufacturing ISMs (Chart 4) have not improved significantly or deteriorated sharply. The Atlanta Fed GDPNow (Chart 5) forecasts have also moderated after dipping sharply in March and April. While the risk of a mild recession is not fully off the table, it appears less acute than feared earlier in the year.

Cooling but Resilient Labor Markets

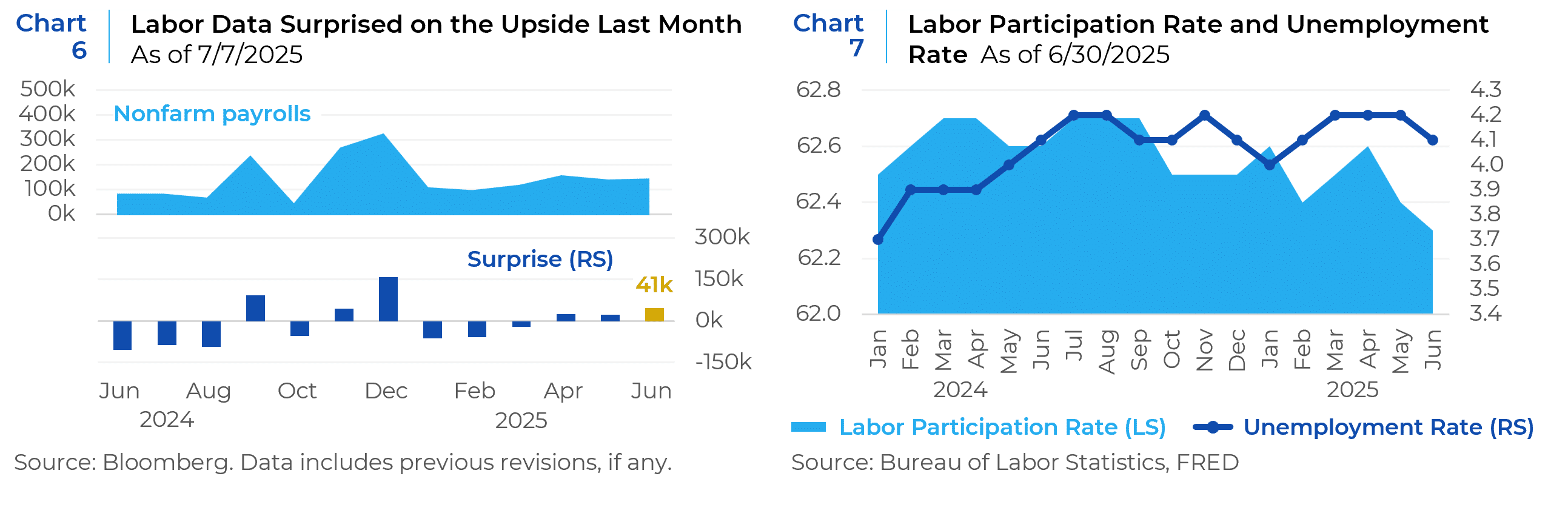

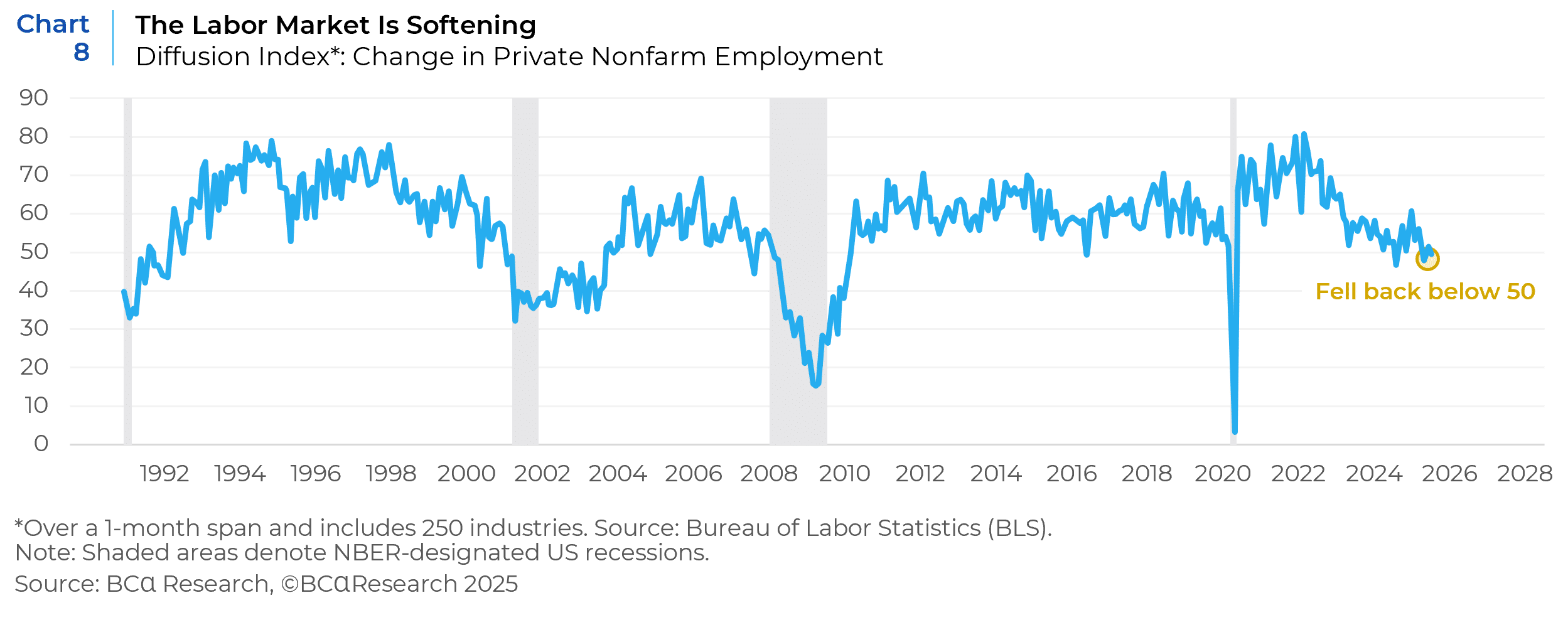

The U.S. labor market remains relatively robust, though signs of gradual cooling have emerged in 2025. Nonfarm payrolls have shown a recent uptick (Chart 6), and initial jobless claims have not trended up sharply, indicating no sharp deterioration in labor conditions even as economic growth slowed. However, beneath the stable headline rate, there are hints of softening: labor force participation has dipped, helping keep unemployment low (Chart 7), and the nonfarm employment diffusion index has fallen below 50 (Chart 8), indicating a softening labor market. Overall, the labor market in the second half of 2025 is expected to loosen slightly further: Crucially, the adjustment so far has been moderate and does not point to a deep downturn.

Inflation and Fed Policy

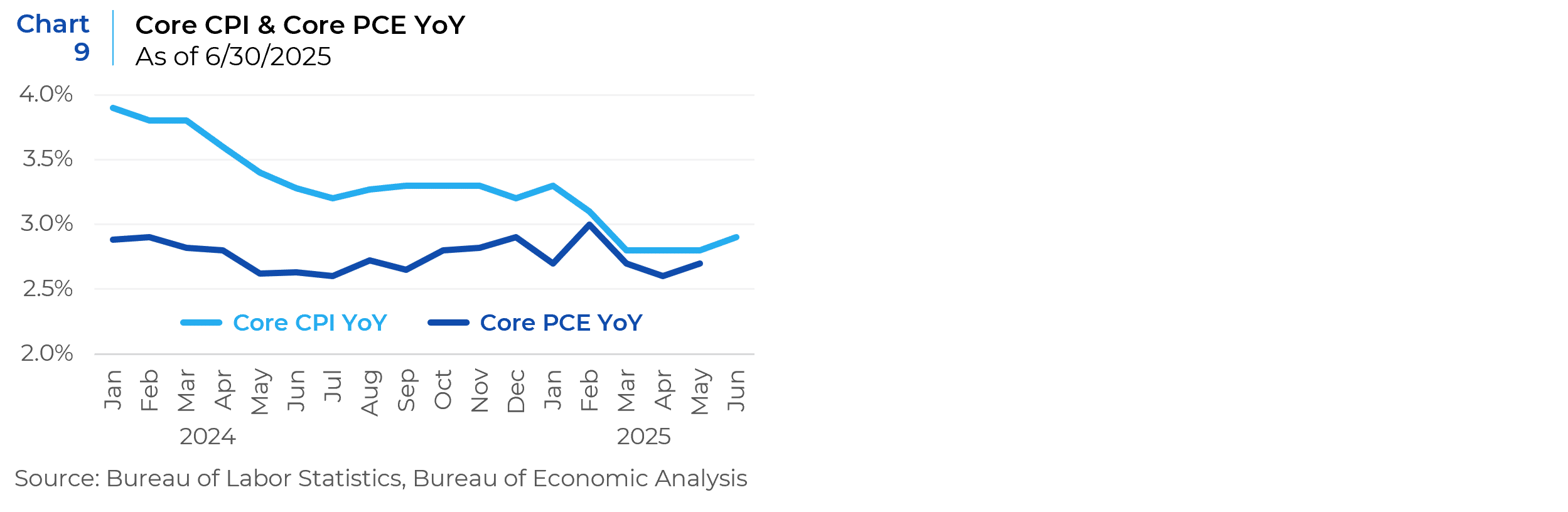

Following a peak increase of approximately 9% year-over-year (YoY) in mid-2022, U.S. inflation has decreased significantly over the past year (Chart 9), representing notable progress toward the Federal Reserve’s 2% target. Nonetheless, potential changes in trade and tariff policies can generate additional inflationary effects later this year. The Fed’s preferred measure—core PCE inflation—is still above target levels and therefore policymakers continue to exercise caution.

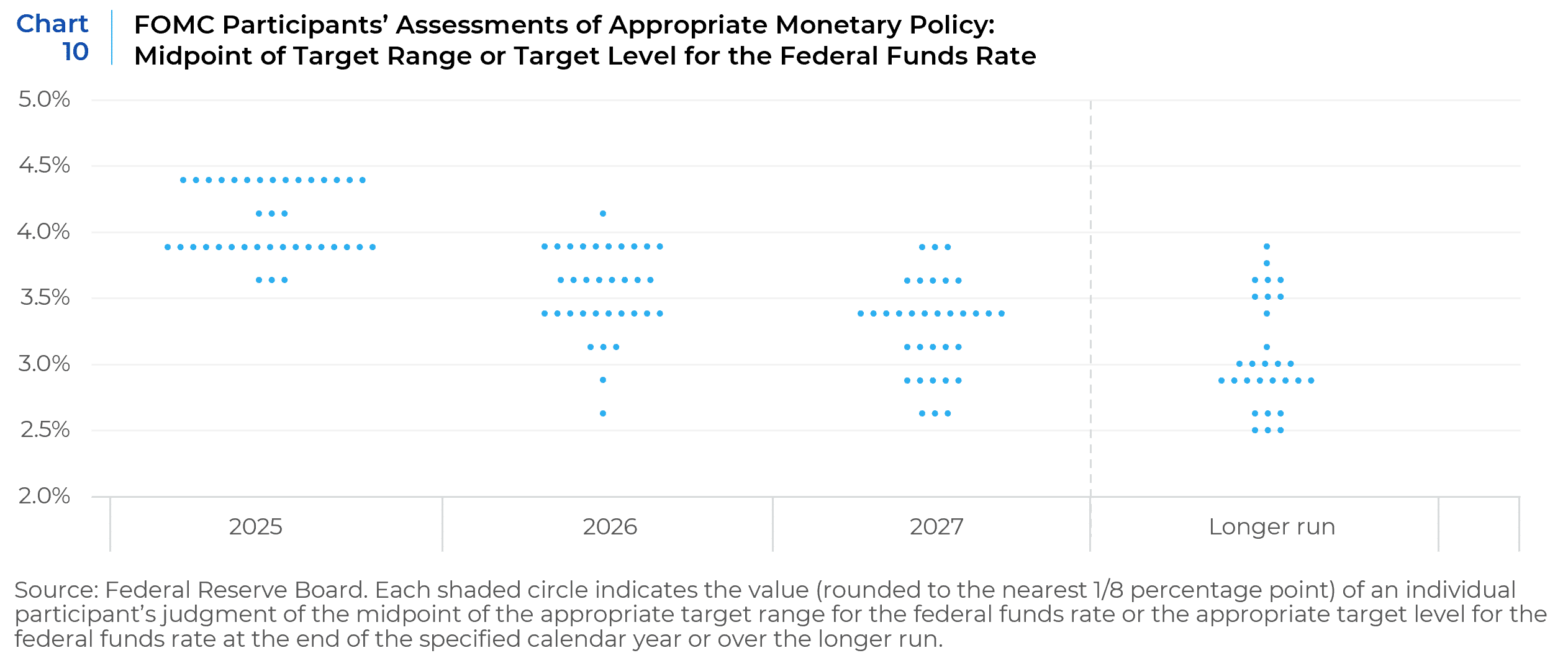

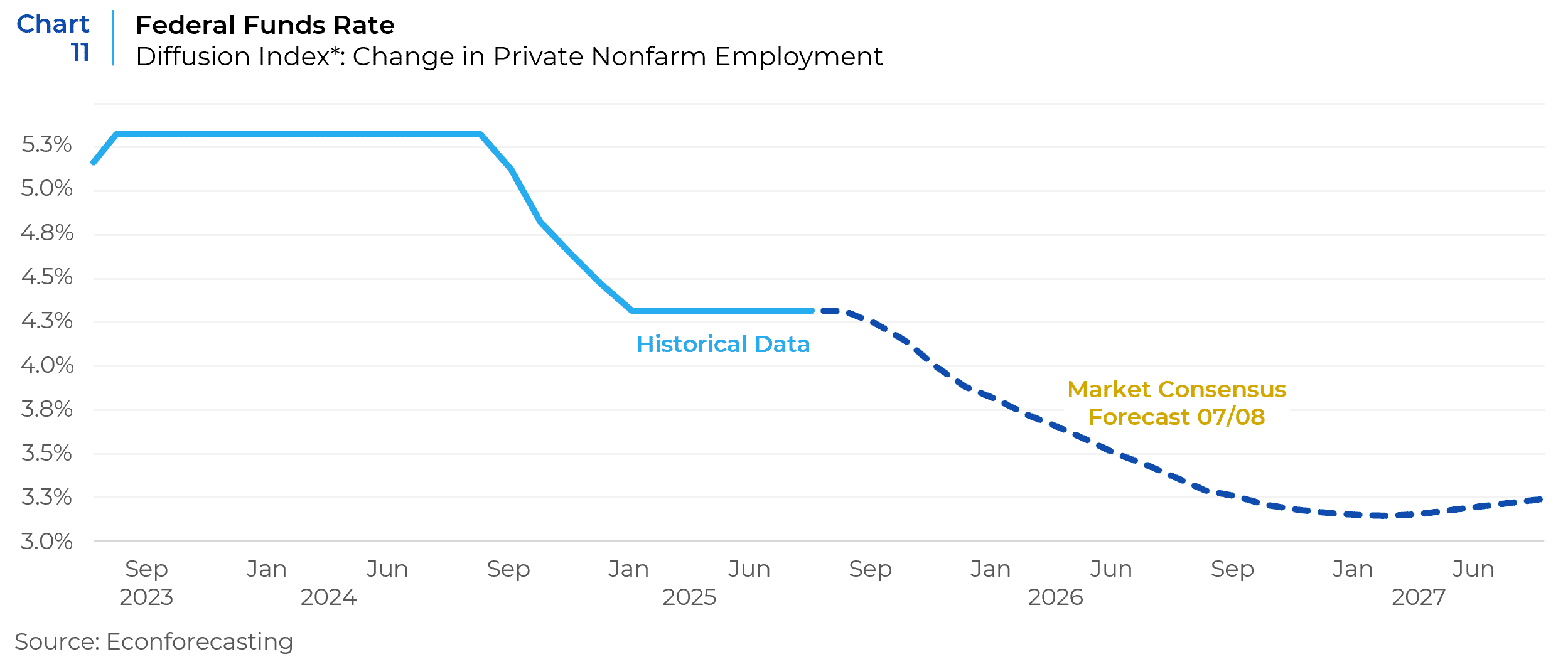

With moderating inflation and slowing growth, the focus has shifted toward the prospect of rate cuts in the second half of 2025. According to the Fed’s June projections, the median forecast for the federal funds rate is 3.9% by year-end 2025 (Chart 10). The Fed has indicated that it may remain on hold until the fourth quarter of 2025 should inflation be reignited by tariff measures, highlighting that any renewed price pressures could postpone easing actions. In the absence of such shocks, markets expect initial rate cuts by late 2025 and more significant easing in 2026 as inflation converges toward the 2% goal (Chart 11). Consequently, investors may observe a gradual shift toward a more accommodative monetary policy heading into 2026, historically supportive of equity valuations and economic growth; however, the pace of policy adjustments will remain closely tied to inflation data trends.

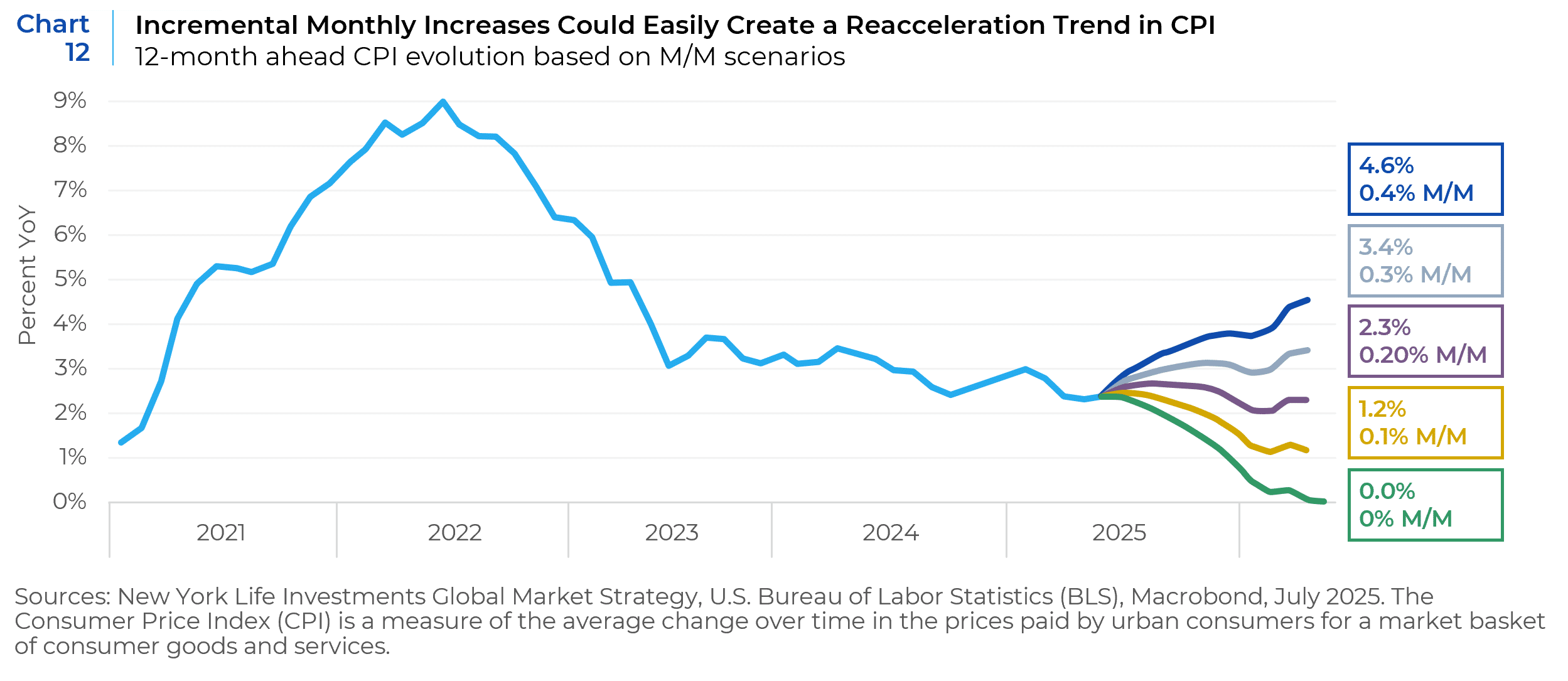

Amidst the current cooling, inflation reacceleration risk remains top of mind for the Fed and for investors. Monthly increases greater than 0.2% in inflation will likely keep the Fed on hold (Chart 12). Tariff-led inflation is a supply-side shock and is particularly worrying for Fed policy which impacts the demand side of the economy. Interest rate policy is unlikely to be effective in taming tariff-led price increases or arresting tariff-driven shocks.

Tariffs & Trade Policies

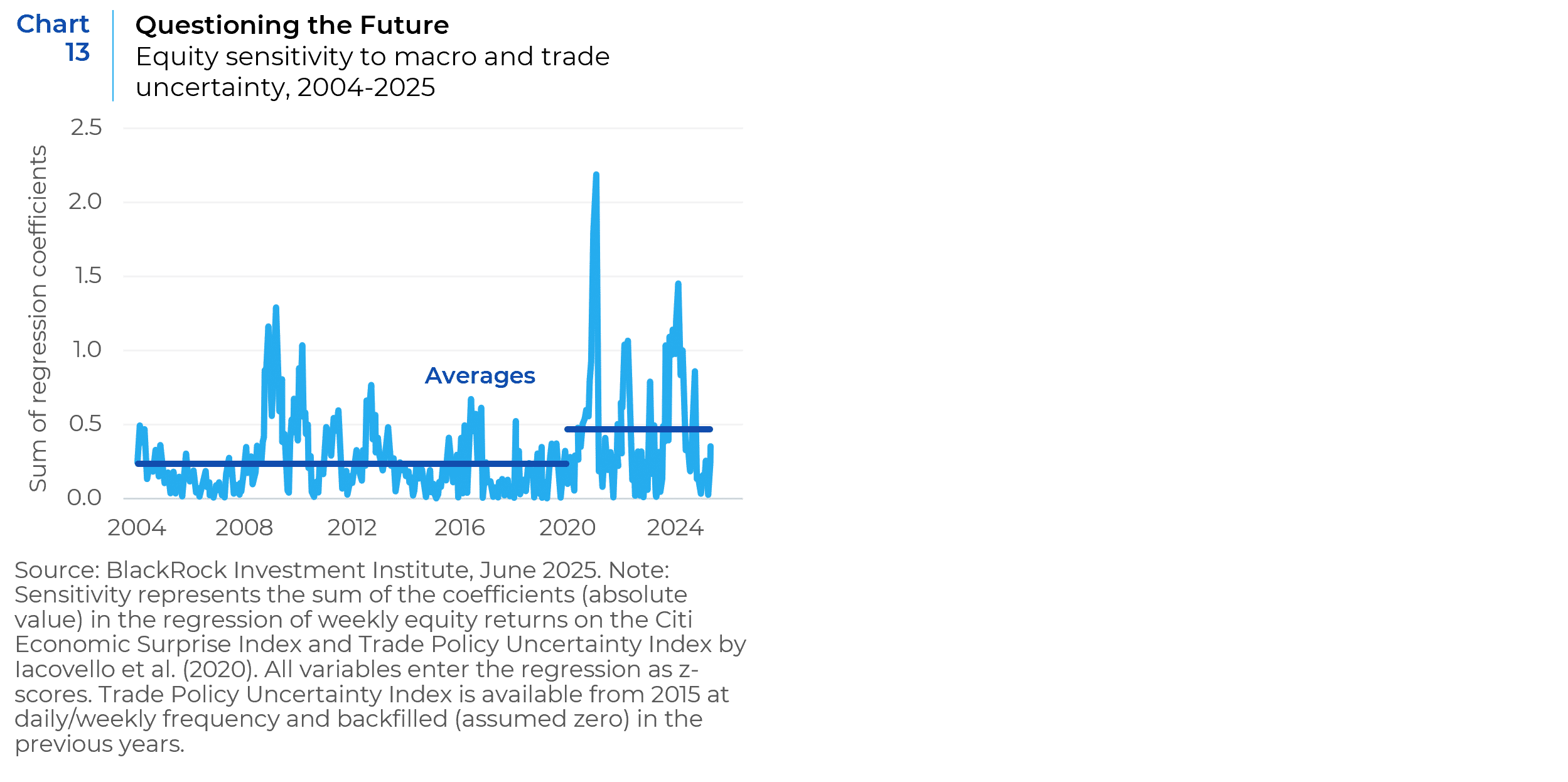

Investors, businesses, and consumers have had to weigh the impact of tariffs implemented, paused, de-escalated, and court challenged this year. The worst-case scenarios proposed in early April may be currently off the table, but trade uncertainty remains. Some progress has been made toward trade deals, but there is more work ahead. The next steps are complicated, and this likely extends uncertainty for businesses and for the economic outlook. However, if markets are any gauge, it appears that investors may be becoming desensitized to tariff news. While the economy may have yet to feel the full economic bite of the tariffs, their market bark is fading. However, tariff risk is rising and appears underpriced. With key exemptions expiring August 1st and the US economy giving President Trump little urgency for new trade deals, renewed protectionism could trigger a “Liberation Day” style aftershock. To this point, Chart 13 shows that equity sensitivity to trade uncertainty has risen since 2020.

The Earnings Picture

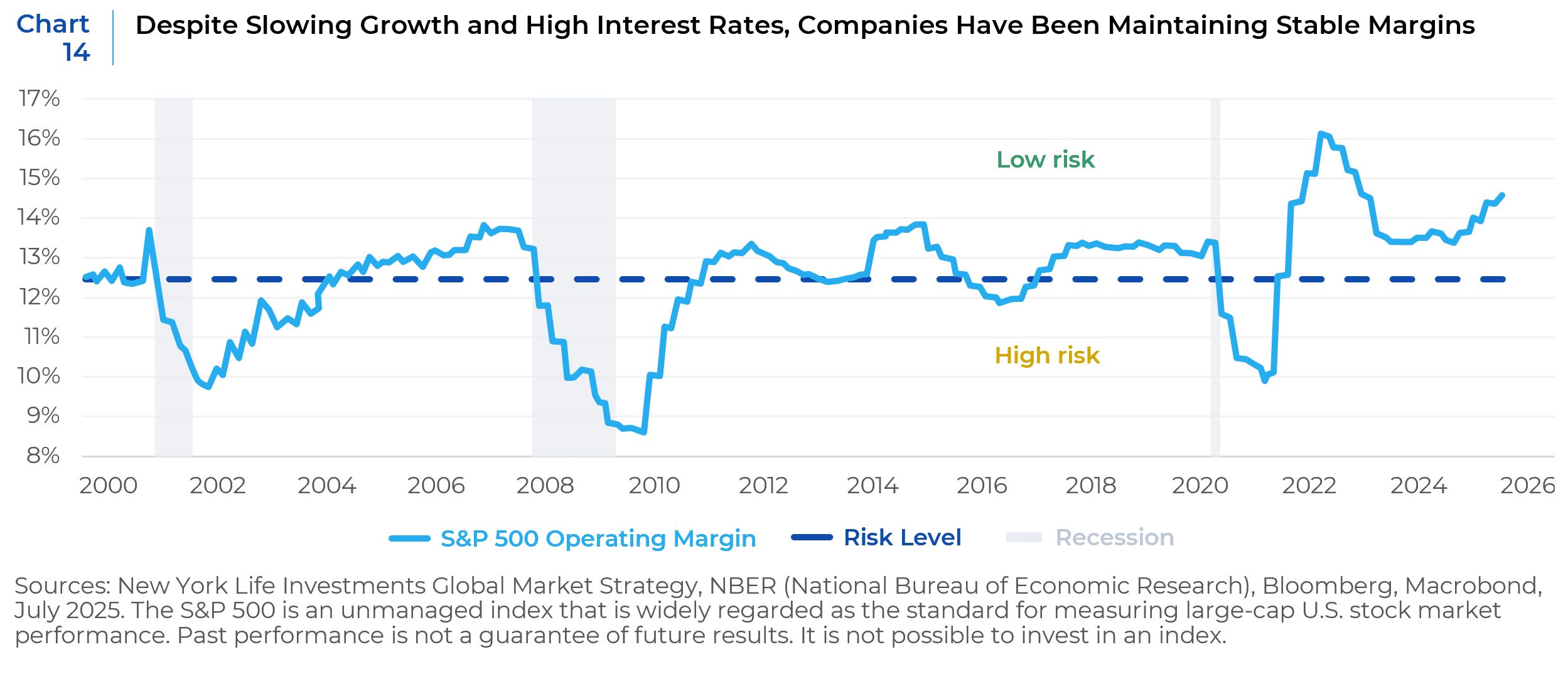

Corporate America’s earnings have been surprisingly solid, and the outlook for the second half of 2025 is cautiously optimistic. According to FactSet, Q2 2025 earnings are on track to rise about 5% YoY. This would be the slowest growth since 2023, as analysts pared estimates due to macro headwinds, but still a positive gain. Companies have been maintaining healthy margins. Currently, S&P 500 operating margins are well above 12.5%, the level at which falling margins have historically become a concern (Chart 14). Technology-driven productivity improvements could support margin expansion in the medium term, but consumer spending and inflation are likely to dominate the near-term story.

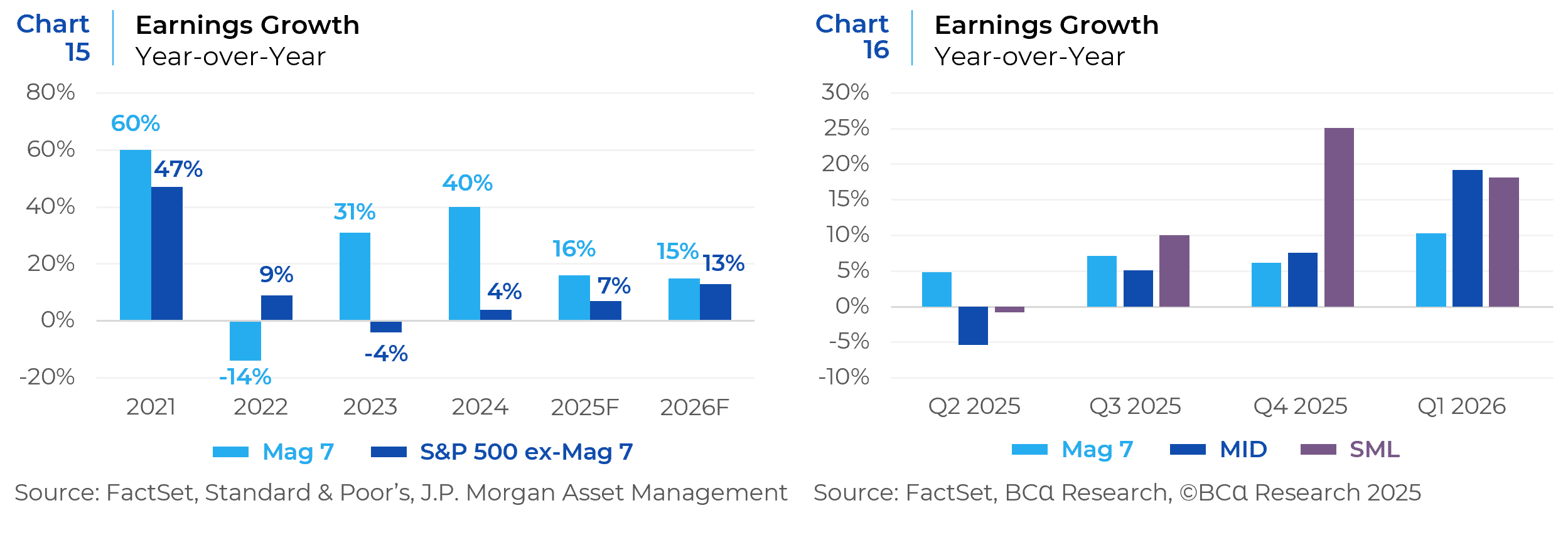

In 2025, the Magnificent 7 have been leading earnings growth in a repeat performance of the past 2 years, benefiting from strong demand and improved cost efficiencies (Chart 15). Earnings of Small and Mid-cap companies are expected to contract in Q2, but may rebound later in the year, overtaking the S&P 500 (Chart 16).

However, the current environment remains fraught with policy and macro uncertainty along with high long-term rates. The number of companies in the S&P 500 Index with downward earnings revisions to future quarters recently rose to a level comparable to the Global Financial Crisis and the COVID-19 pandemic.

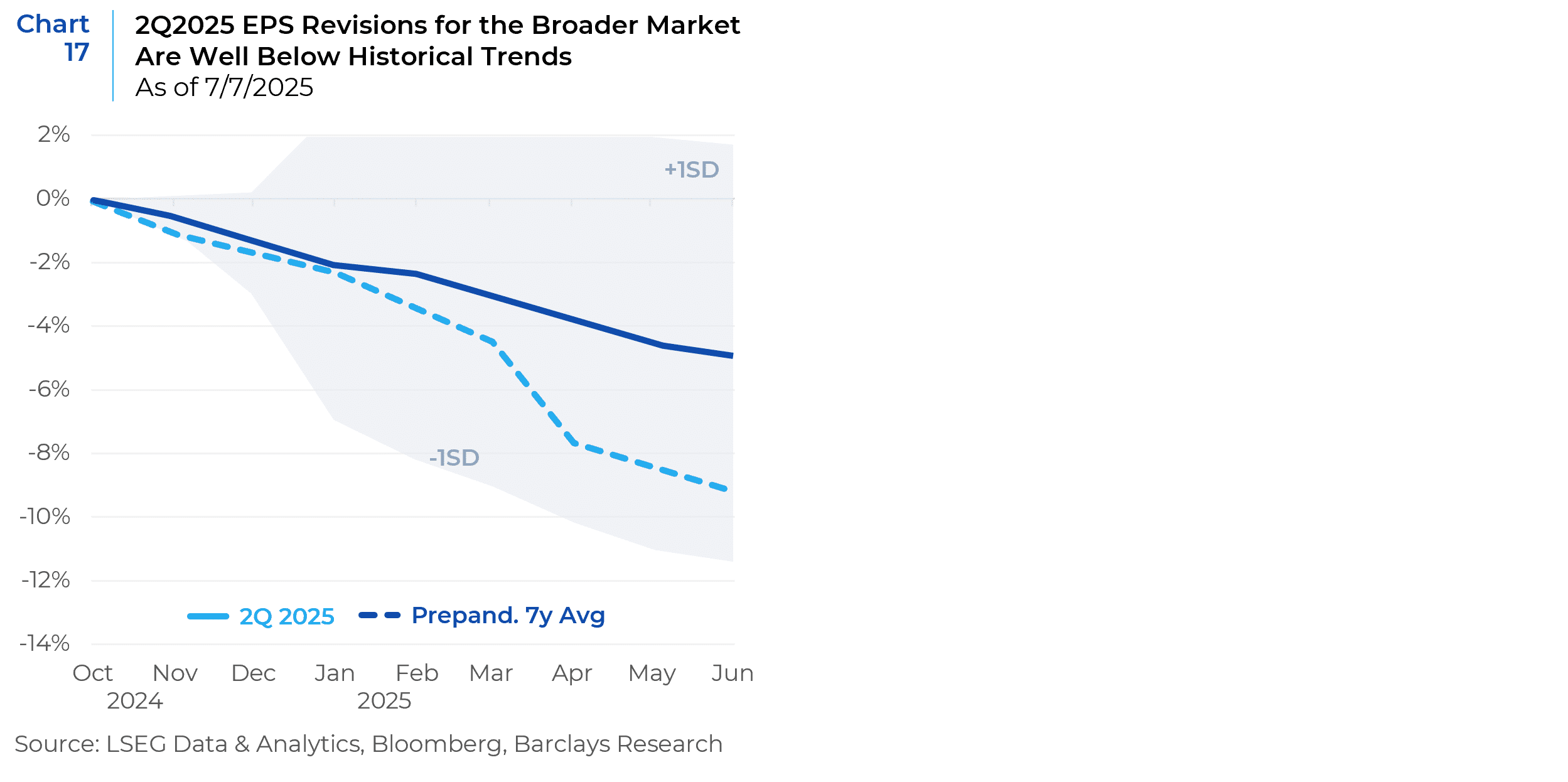

Despite a strong Q1 season, macro conditions and global uncertainty have caused earnings estimates to fall for the remainder of the year (Chart 17). With companies unable to confidently forecast their cost structures, it’s more difficult for earnings expectations to stand on solid footing. Moreover, with a backdrop of already lofty valuations, a disappointing Q2 earnings season would require valuations to extend even further to maintain current index levels. In the Q1 reporting season, more companies cited “tariffs” in their earnings calls than any quarter over the past ten years. As we begin the third quarter, the potential for additional trade deals has been heightened by the looming August 1st deadline. More clarity of any sort will be welcomed by corporate America.

Conclusion

U.S. equities are priced for a scenario of moderating inflation, mild growth, and eventual Fed easing. The major indexes could grind higher if that outlook materializes, albeit at a slower pace given the strong year-to-date gains. Sector-wise, technology and growth-oriented companies look attractive for the second half of the year. However, some rotation into more cyclical or value sectors could occur if bond yields fall.

A few key risks could upset the constructive outlook: (1) Earnings shortfall – if second half corporate results come in below forecasts, stocks would reprice lower, given current high valuations. (2) Interest rate surprise – if inflation flares up and the Fed delays or skips rate cuts, it will pressure equity multiples and particularly hit high-P/E tech names. (3) Geopolitics and trade policy – any re-escalation of U.S.–China trade tensions or other geopolitical shocks could spike volatility and send investors to safe havens. Thus far in 2025, markets have looked through such risks, but they bear watching.

After the gloom of the spring when trade war angst and recession fears were rampant, sentiment measures improved. At the same time, there is no extreme euphoria; the recent tariff scare keeps a lid on excessive greed. In other words, investors are optimistic but still hedging their bets. The consensus outlook is for mid-to-high single digit equity returns in 2025, which implies only modest upside from current levels. If some adverse surprise hits, sentiment could swing quickly and amplify a sell-off. Barring unforeseen shocks, the outlook is for modest equity returns with periodic bouts of volatility – a climate where disciplined, long-term investors can still find opportunity even as the post-pandemic boom moderates into a more mature phase of the cycle.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.