Eastern Equilibrium: Opportunities for Active Management in Japan

In recent years, the investment landscape has been significantly influenced by unprecedented monetary and fiscal stimuli, leading investors to focus on changes in inflation. But the front lines for significant government and central banks’ war against inflation have significantly diverged. Compared to its European, UK, and US counterparts, Japan is experiencing a welcome resurgence of inflation and consumer spending that is drawing renewed attention to the world’s third-largest equity market. Japan’s different starting position has allowed them to avoid the extreme swings observed in the West. A key factor in Japan’s current “equilibrium” is the inflation rate being near the BoJ’s target, with near-normal economic activity. Japan’s position is particularly noteworthy when compared to the policy needle other governments are trying to thread.

In this research note, we argue that policy divergences as well as local market dynamics favor Japanese equities. While export-centric firms, constituting roughly 60% of the MSCI Japan index, have thrived due to a cheaper Yen, the returns for USD investors have been subdued due to currency impact. As we possibly transition into a phase of Yen appreciation, USD investors stand to benefit. The economic landscape in such a scenario would likely bode well for the 40% of the Japanese markets that would benefit from escalating local demand. Stock selection amongst the potential divergence in corporate earnings growth will be crucial for US investors hoping to benefit from the tailwinds of Yen appreciation.

Inflation Expectations

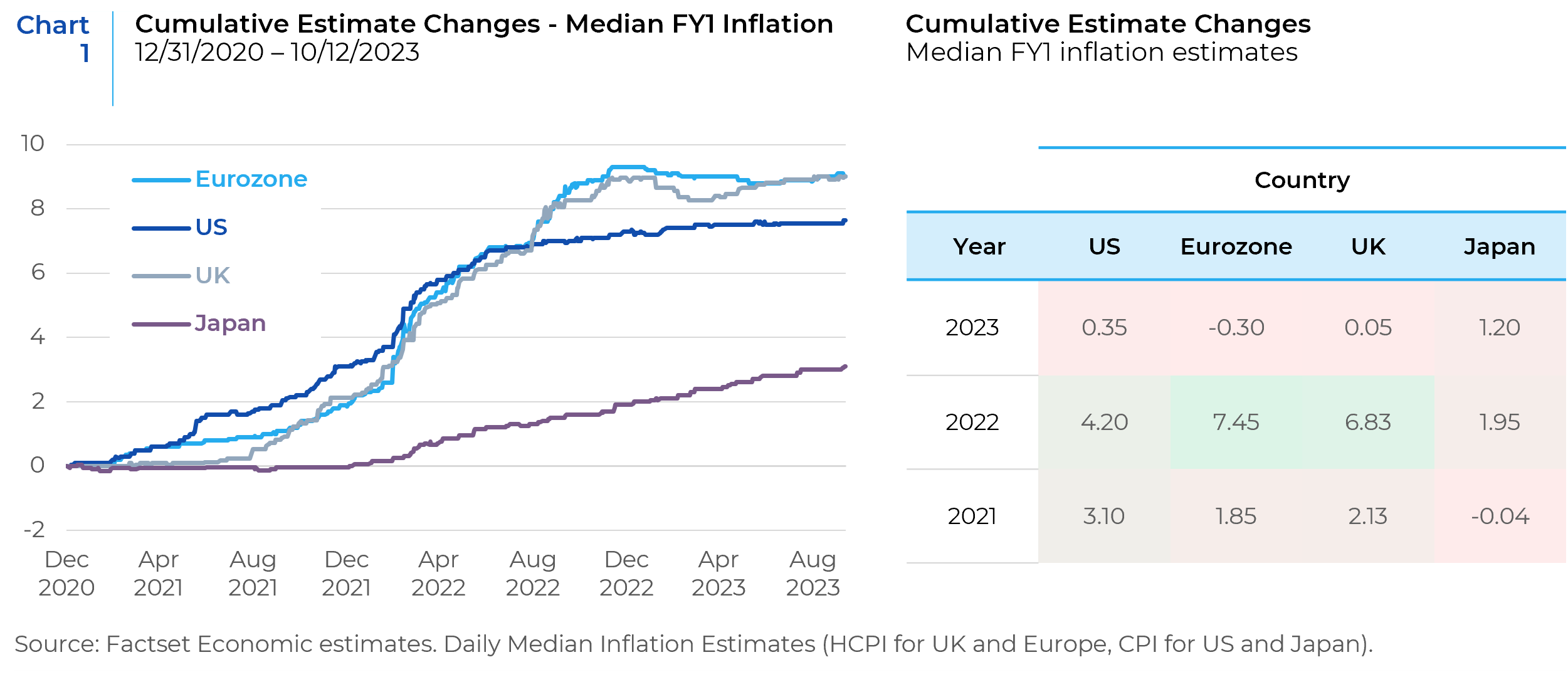

Instead of merely examining observed inflation, which is backward-looking and subject to base effects, we focus on the changes in inflation expectations of market participants (as per Factset economic estimates).

The Bank of Japan (BOJ) continues to uphold its unique easing policies, aiming to reach the elusive 2% inflation target. As Japan moved into the post-pandemic phase, it had been battling deflationary pressures for over 30 years, since the outset of the “Lost Decade” of the 1990s. Many of the policies adopted by other Central Banks to combat deflation following the GFC were from the BoJ playbook (ZIRP, QE, Asset Purchases, etc.). Under the governorship of Haruhiko Kuroda, the BoJ continued to experiment with extreme easing measures the past decade (QQE, Yield Curve Control, Negative Interest Rate policy). While there has been a battle against deflation globally, nowhere was the deflationary mindset so dangerously entrenched than Japan. Given this context, it’s logical to see a difference in policy outlook and market responses between the BOJ and the central banks of other major developed markets. The story that market forecasts are telling about the monetary response to inflation is more challenging in western markets.

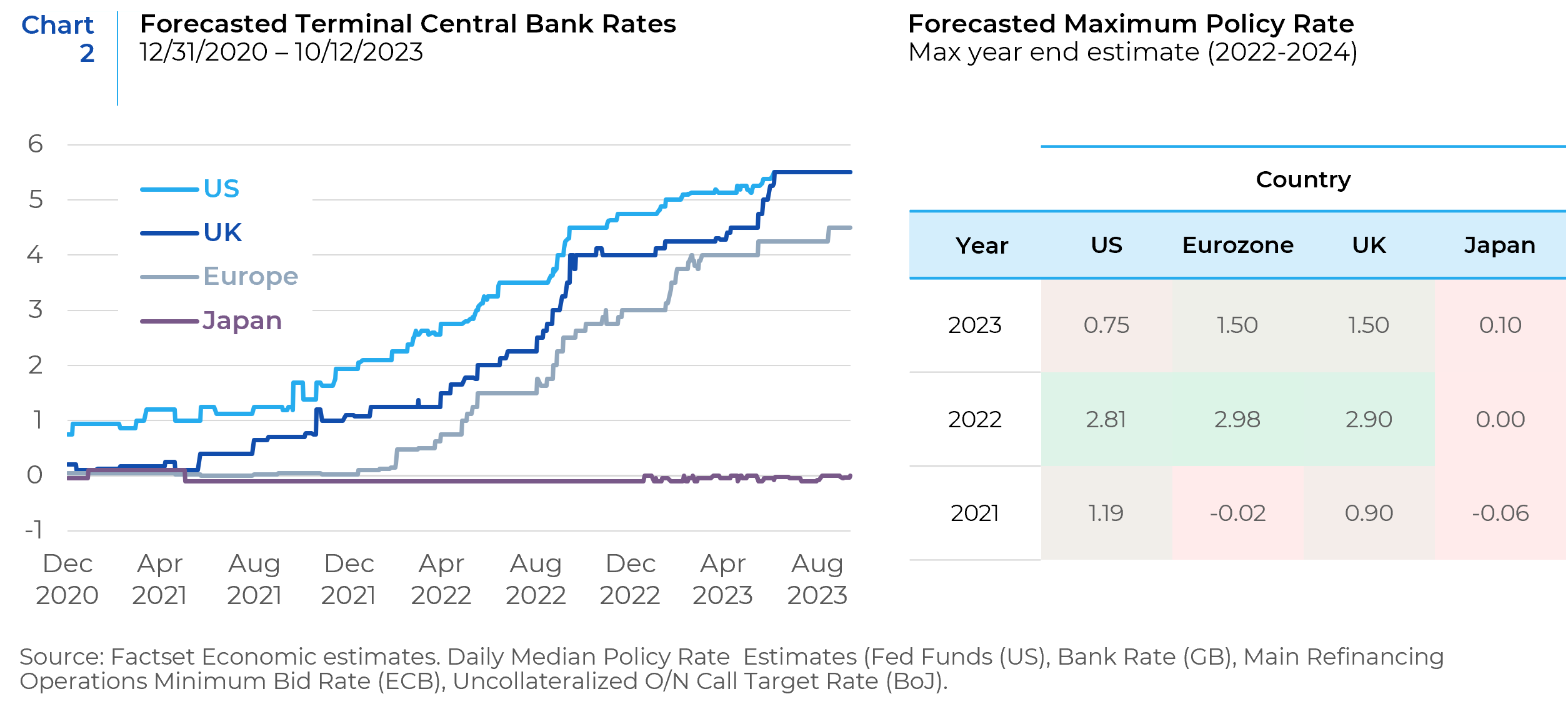

Over the last three years, forecasts regarding the necessary policy rates to curb inflation have been consistently underestimated for Western economies, often resulting in heightened market volatility (e.g., Value vs Growth, Large vs Small). On the flip side, Japan’s more moderate onset of inflation provided the Bank of Japan (BOJ) a clearer picture. With a transparent mandate of fostering inflation—especially wage inflation—rather than suppressing it.

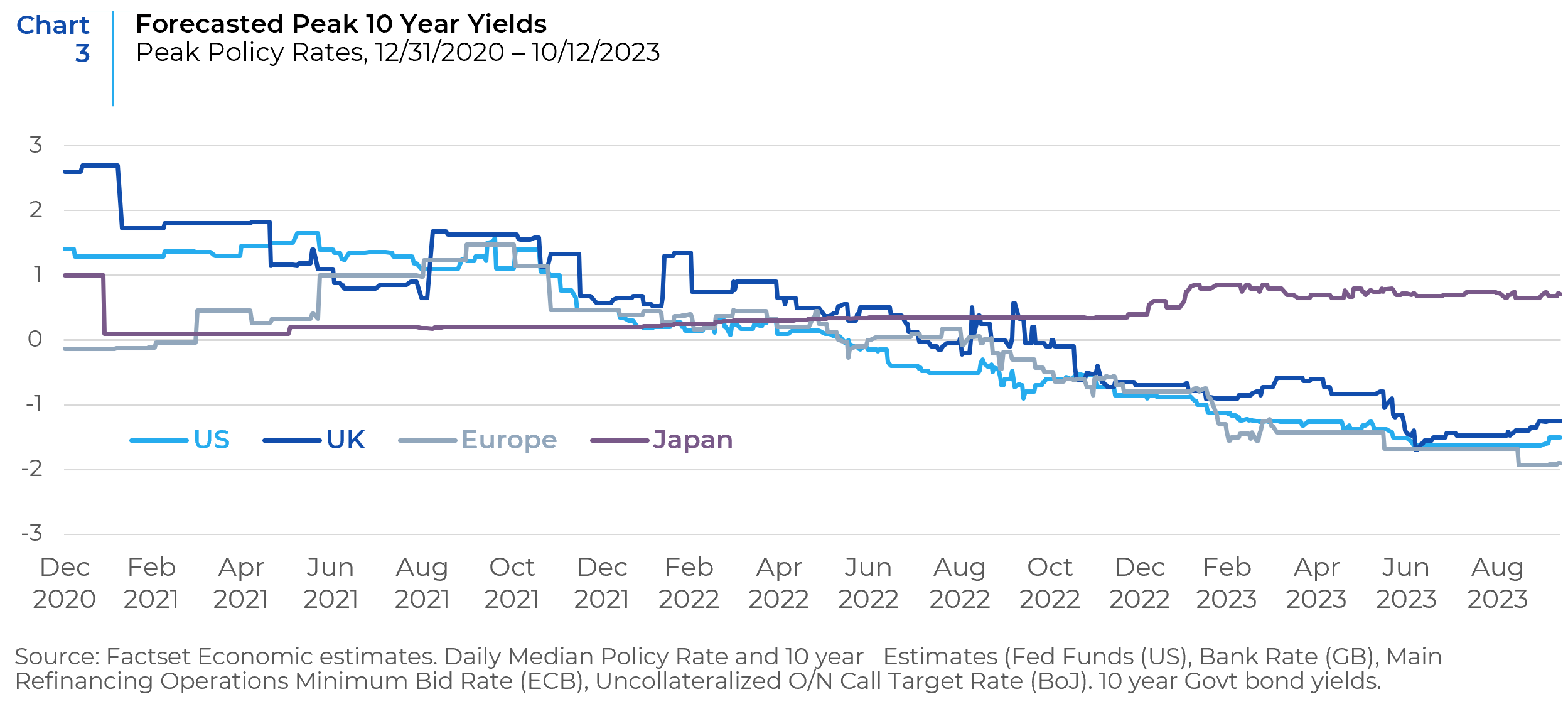

Western countries have consistently underestimated the “terminal” 10-year rate. Expectations have continued to rise over the past three years amid the challenges of post-pandemic economic recovery and evolving fiscal and monetary strategies. In contrast, the forecasts for Japan have seen minor upward revisions due to both market dynamics and revised guidance from the Bank of Japan (BOJ) regarding their Yield Curve Control policy.

In Western economies, persistently high inflation pressures have necessitated aggressive policy responses. The self-reinforcing inflationary dynamics driven by tight labor markets and robust wage growth have necessitated further policy tightening to “break” the inflationary spiral through slower growth (and subsequent easing). Consequently, at the end of the 3rd Q, the yield curve in the US has remained inverted for a historically long 452 days. In Europe (Germany), the yield curve has been inverted for 323 days. The disparity between the forecasts for peak 10-year yields vs policy rates highlights the magnitude of this issue, and how the Japanese economy is differently positioned.

Opportunity for Active Management in Japan

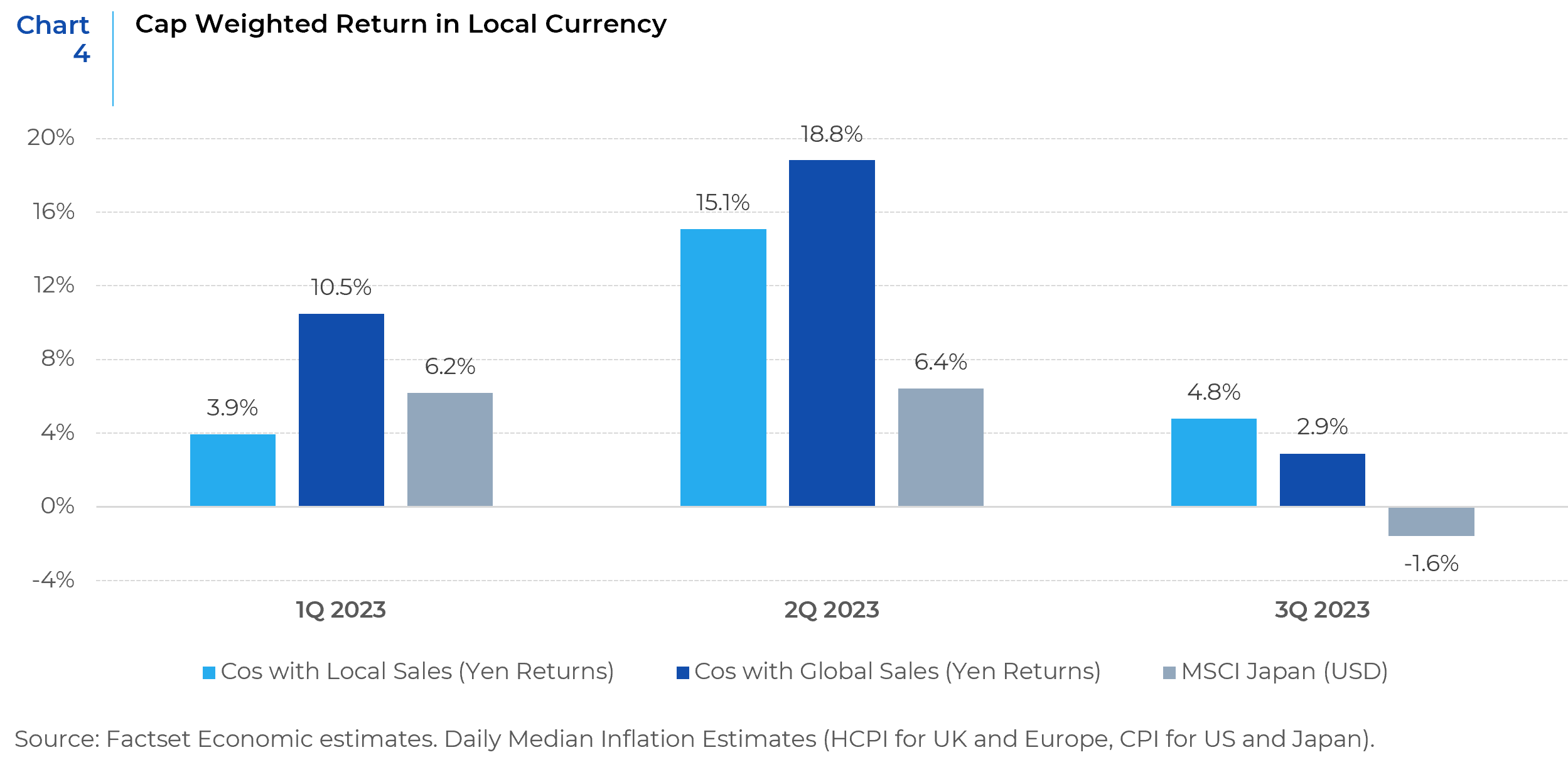

The end of the deflationary pressures should provide some excellent opportunities for active managers should the macro environment continue its current trajectory. A notable factor underpinning the need for active management is the implications of Yen movements for US investors. About 60% of the MSCI Japan index comprises companies with over 50% of sales generated from foreign markets. These firms have found an advantage in the Yen depreciation, making their products more competitively priced on the global stage.

During the first half of 2023, globally oriented stocks reaped substantial benefits from a weakened Yen, although US investors saw much of these gains eroded due to currency translation effects. Interestingly, as the last quarter unfolded, Japanese companies with a majority of their sales from the domestic market began to show an uptick in performance, notwithstanding the ongoing weak Yen.

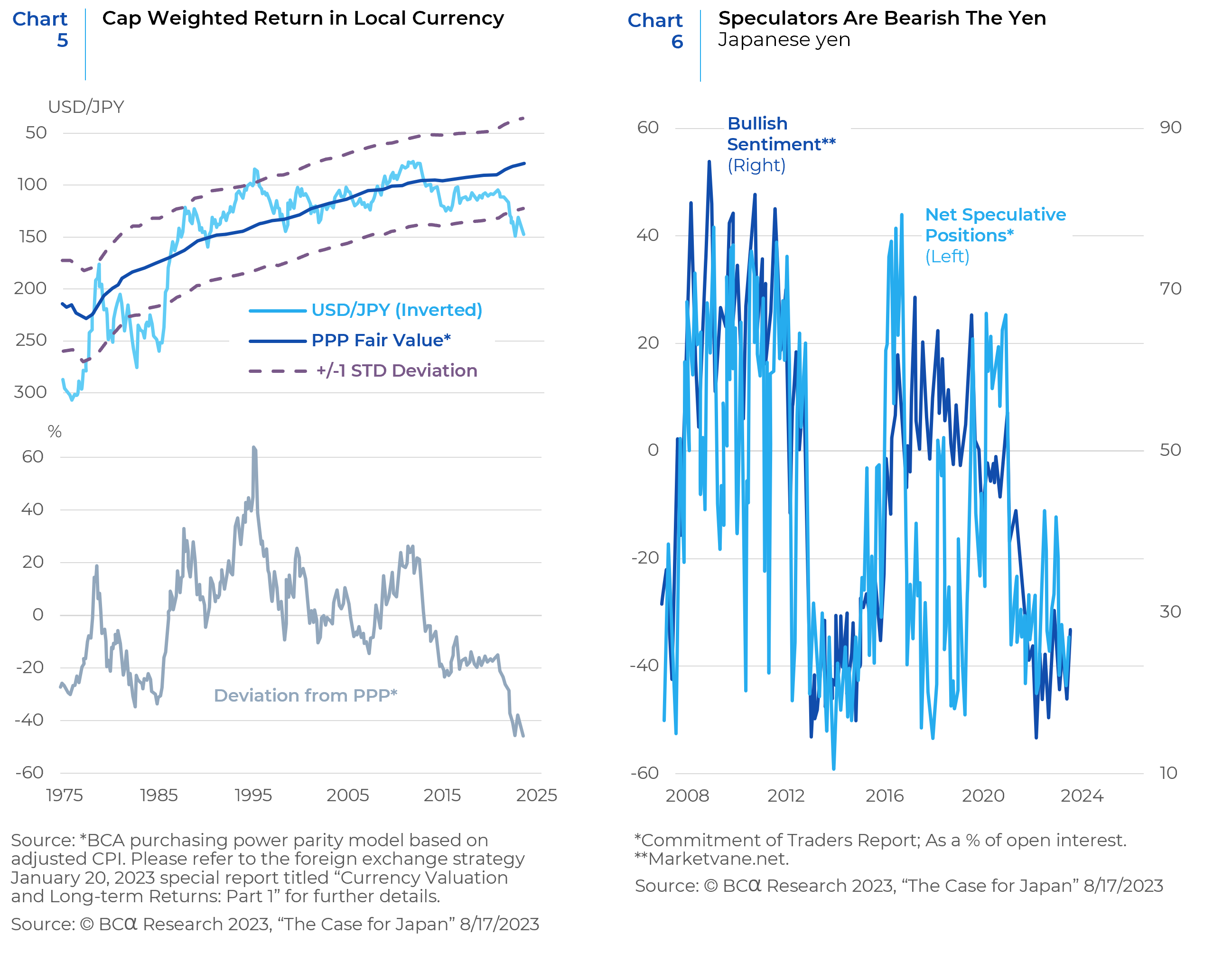

Currently, the Japanese Yen is significantly undervalued, trading at a marked discount against its Purchasing Power Parity (PPP) exchange rate. The extent of this deviation is unparalleled, with the Yen trading 46% below its PPP rate (see chart 5). This valuation scenario is further echoed by a highly bearish sentiment and a net short speculative positioning towards the currency (see chart 6). The valuation discount indicates potential for appreciation over the long term, particularly if the anticipated inflation and interest rate environment materialize as projected.

Regardless of Yen appreciation, the discernible shift away from deflation will likely be a catalyst for bolstering local spending within Japan. The uptick in inflation is likely to coax the Japanese consumer away from the propensity to delay purchases in favor of savings, especially in a scenario where wage growth propels inflation.

Our recommendation leans towards active management to capture the opportunity brewing in Japanese equities. While export-centric firms, constituting roughly 60% of the MSCI Japan index, have thrived due to a cheaper Yen, the returns for USD investors have been subdued due to currency impact. As we possibly transition into a phase of Yen appreciation, USD investors stand to benefit. The economic landscape in such a scenario would likely bode well for the 40% of the Japanese markets that would benefit from escalating local demand. Stock selection amongst the potential divergence in corporate earnings growth will be crucial for US investors hoping to benefit from the tailwinds of Yen appreciation.

1 BCA Research “The Case for Japan” August 17th, 2023

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.