The New Normal

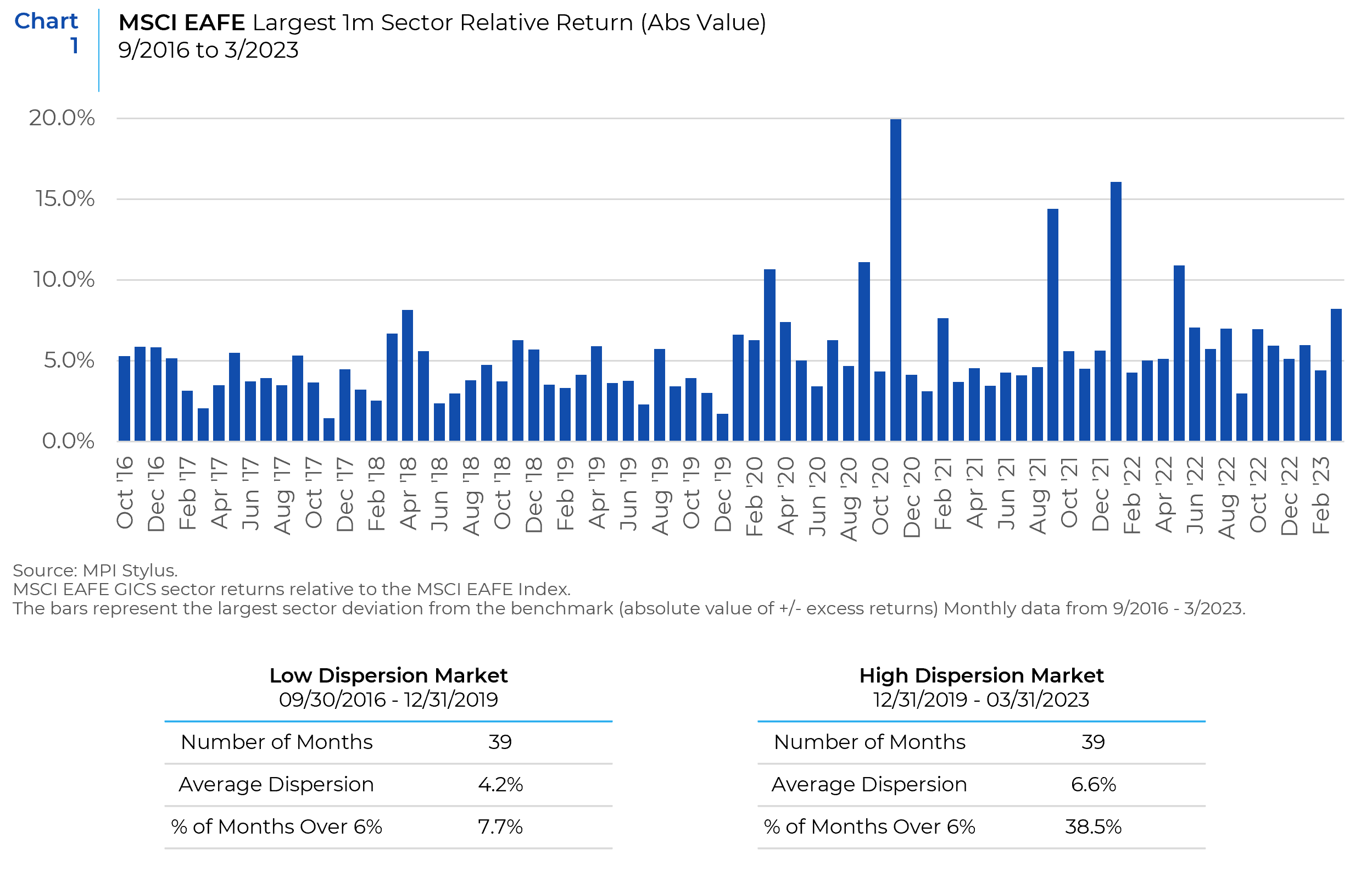

Since the COVID-19 pandemic, macro and geopolitical risks have become pivotal in shaping active managers’ performance, with profound sector implications. Escalating regime changes, driven by exogenous factors, exemplify this transformation. Chart 1 highlights the largest 1-month relative returns for all EAFE sectors, revealing a striking uptick in Q1 2020 and persistently elevated levels. This sector skew is mainly driven by events like Tech, Healthcare, and Consumer Staples benefiting from lockdowns, or Energy and Materials sectors gaining amid geopolitical tensions and global inflation pressure.

Sector Volatility Alters Opportunity Sets

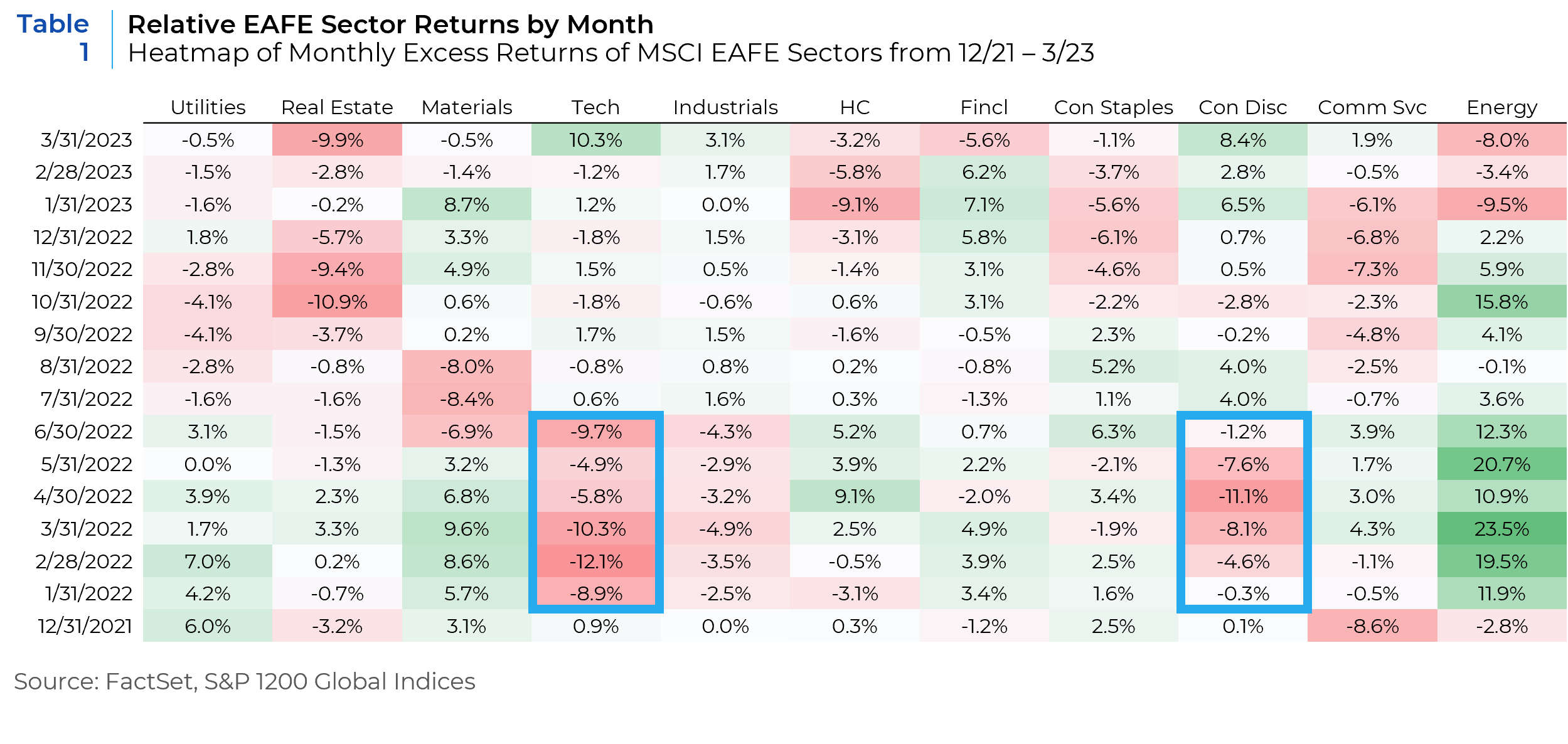

In the current investment landscape, sector returns show considerable skew, leading to surprising dynamics in allocator decision-making. When interest rates rose in early 2022, growth-oriented sectors like Consumer Discretionary and Technology underwent aggressive revaluation, resulting in underperformance (Tech by 42% and Discretionary by 29% as shown in Table 1).

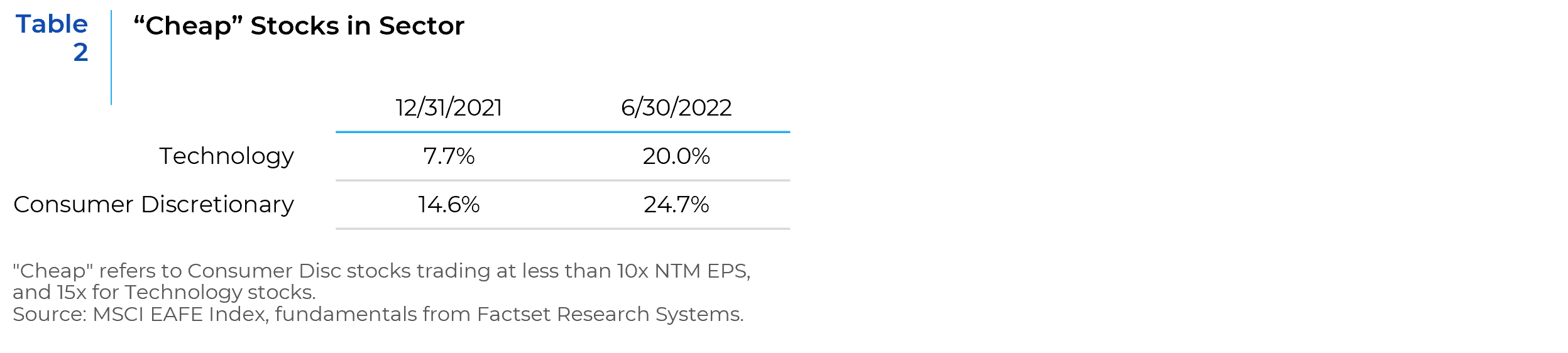

Consequently, unique value opportunities emerged within these sectors. As Table 2 demonstrates, Value managers found a richer opportunity set in sectors they hadn’t considered before. This overlap of holdings between Value and Growth managers, though surprising, remains consistent with both philosophies. Regardless of the logic it presented allocators with unexpected sector concentrations.

Portfolio Construction Impact

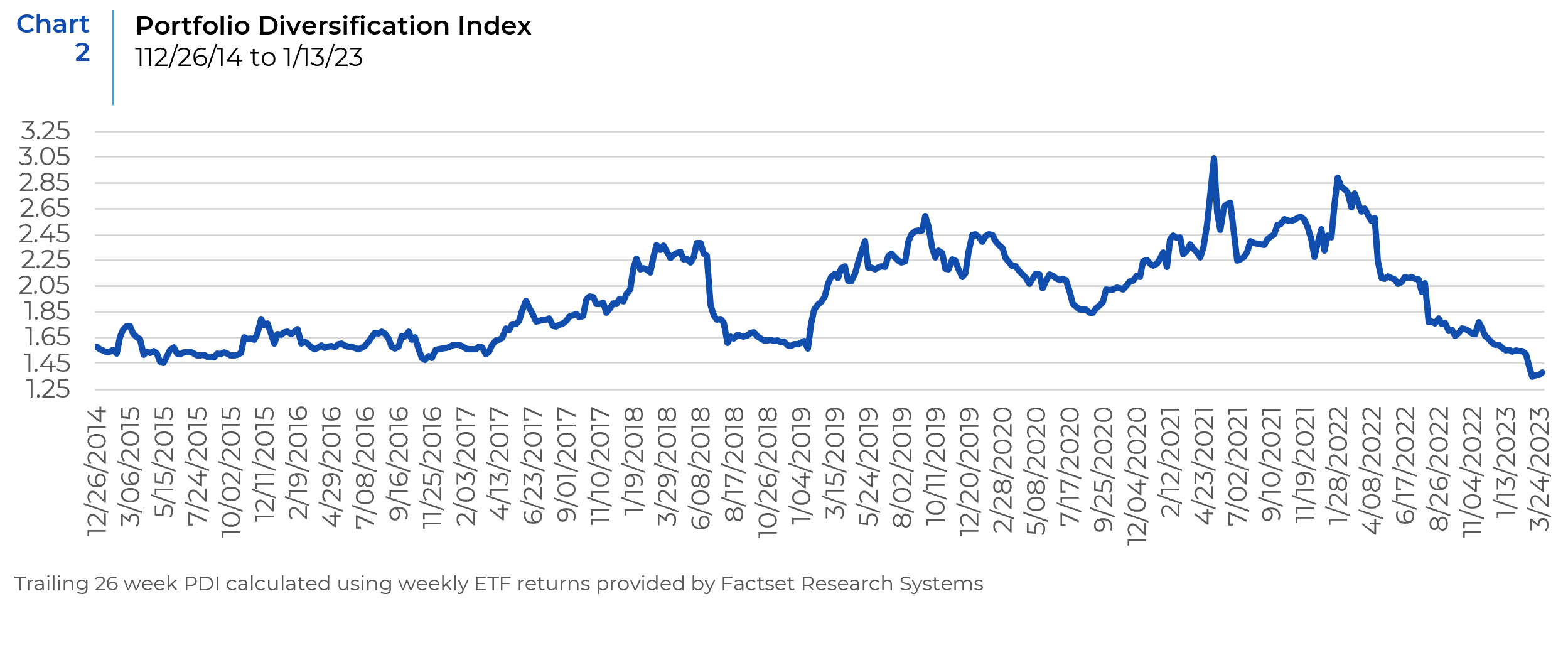

Active managers and allocators like Xponance have faced diversification challenges as macro risks overshadow markets. The “Portfolio Diversification Index (PDI)1“ offers a way to assess market return drivers by using Principal Component Analysis2 to estimate a portfolio’s independent risks. You can think of it as the number of independent decision points available to a manager that will impact their relative performance. The higher the PDI, the more diversified a set of assets is. To estimate the potential diversification in the EAFE markets we analyzed the weekly returns of 12 smart beta ETFs representing major style factors in non-US markets (including: Value, Growth, Quality, Momentum, Yield and Low Volatility) reveals a sharp decline in the PDI (independent return drivers) since early 2022, as shown in Chart 2.

To navigate overwhelming macro risks, it’s crucial to insulate portfolios from undesired exposure to key macro factors, including inflation, interest rates, economic growth, and credit quality/liquidity. Stress testing a portfolio for many recent risks can be challenging to do with historical data. The risk factors seen in the past 3 years have often been without precedent (Global Pandemic) or have only occurred far enough in the past that the market structure has significantly changed (Potential Stagflation).

Thoughtful qualitative scenario analysis and creative stress-testing of portfolios can help portfolio managers navigate the risks from such exogenous factors.

While diversification may offer limited value during periods of overwhelming top-down risks, it’s often an opportune time to diversify portfolios to take advantage of future opportunities. We believe that the increasingly frequent nature of recent market shocks and sharp and rapid market reactions create outsized opportunities for fundamental managers with strong conviction, valuation discipline, and a willingness to take contrarian positions.

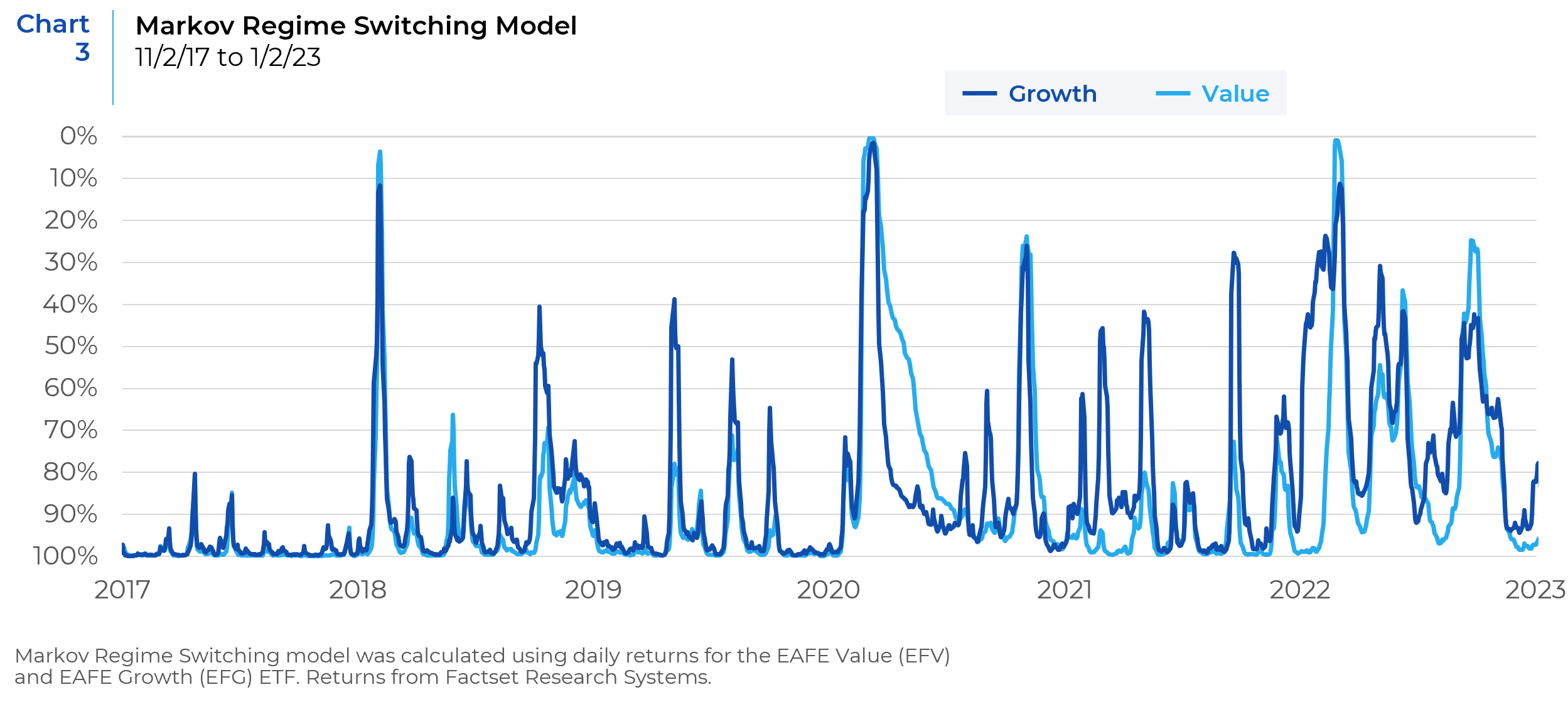

One way to illustrate the frequency of these regime changes is with a Markov Regime Switching Model. This statistical approach is used to capture changes in the behavior of daily asset returns over time. The model assumes that the returns can be driven by different market “regimes,” which are characterized by distinct statistical properties like mean return and volatility. Chart 3 shows the probability of the Value and Growth factors are in a single, stable regime. Spikes in the series, represent an increased probability that the factor is experience a regime change to a higher risk regime. Prior to 2020, we only experienced on brief period when the value or growth factor displayed a probability of entering a high risk regime above 40%. Since 2020, these spikes in probability have occurred far more frequently.

In conclusion, the dynamic investment landscape demands that active managers adapt to an environment where macro and geopolitical risks drive performance, with special consideration to changing sector dynamics. The unprecedented pace of regime changes also requires a new perspective on portfolio management from allocators. To thrive in this challenging climate, investors can implement the following:

- Insulate portfolios from key risks (inflation, interest rates, economic growth, and credit quality/liquidity) by avoiding unintended directional positions. Conduct stress tests, when possible, but always through a thoughtful forward looking lens.

- Embrace diversification as much as possible, the time to diversify is when top-down risks are dominating returns and diminishing the benefit of the practice.

- Build a portfolio to seize the opportunities created by market shocks and rapid reactions. This can be done with independent minded managers that build high conviction portfolios, show some valuation discipline, and display a willingness to take contrarian positions.

With these strategies in mind, active managers and allocators can better navigate the ever-evolving investment landscape and achieve success in an increasingly macro driven market.

- Rudin, A. M., & Morgan, J. S. (n.d.). The Portfolio Diversification Index (PDI) is a measure designed to assess the level of diversification within an investment portfolio, taking into account the correlations between assets and their respective weights. A higher PDI value signifies greater diversification

- Principal Component Analysis (PCA) is a statistical technique used to simplify complex datasets, like asset returns, by identifying the most important patterns or trends. It does this by transforming the original data into a smaller set of linearly uncorrelated variables (principal components), which capture the majority of the variation in the data. In the context of asset returns, PCA helps reveal the main driving factors that influence a group of strategies.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.