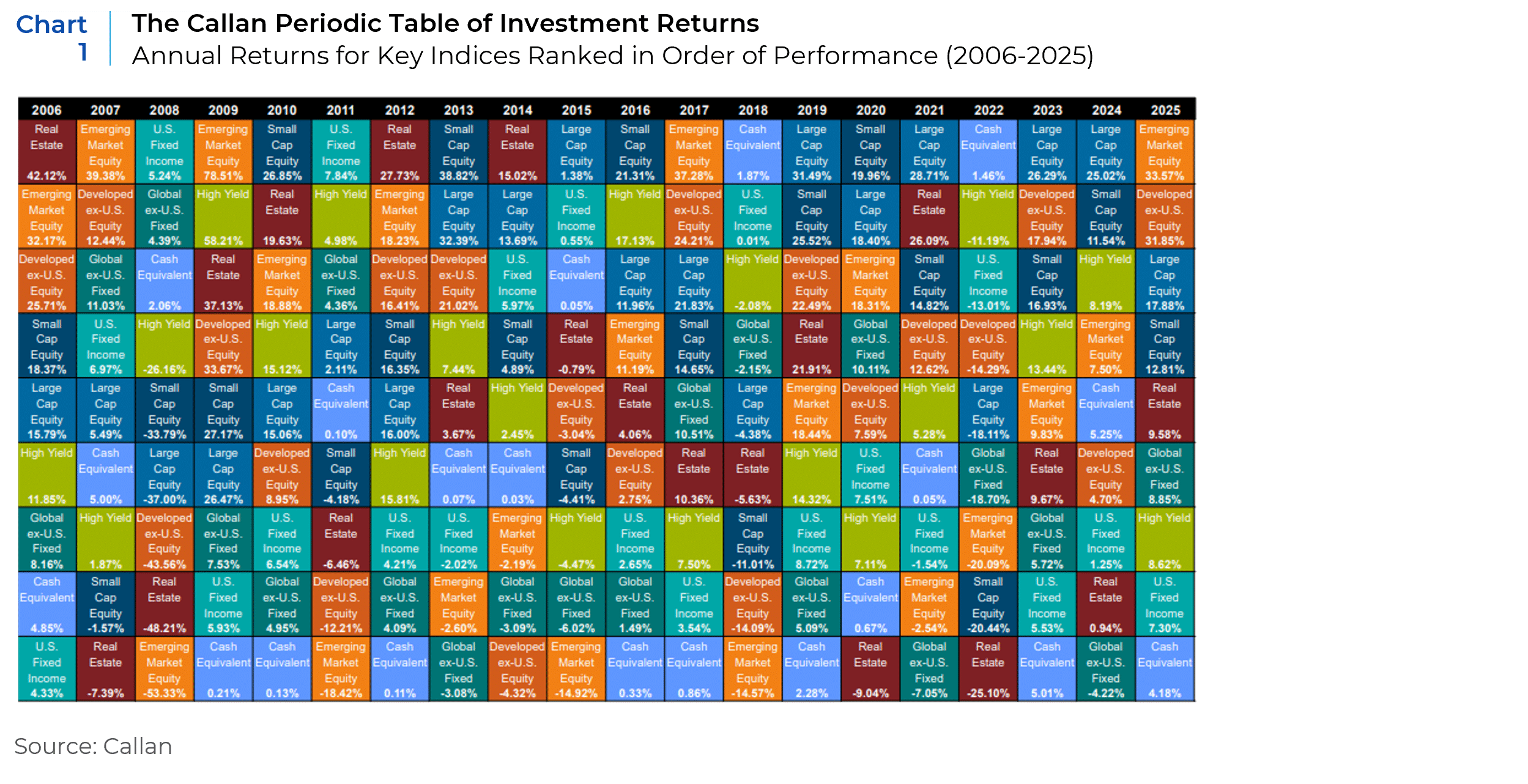

Global risk assets had an unambiguously stellar year in 2025 with double digit gains almost across the board among major global bourses. Aberrantly, and for the first time since before the GFC, non-US markets outperformed the U.S. by double digits, led by emerging markets (see Callan Periodic Table of Investment Returns). In turn the standout region within emerging markets in 2025, was Latin America, which gained +55% overall with the “worst” performing country within the region (Brazil) still up +50%. This was nearly 30% better than the U.S. market, 25% ahead of the Mag 7, and 20% better than the rest of emerging markets or developed x-US markets. Latin America even outperformed AI/tech superstar Nvidia by 15% in 2025!

So, after a historic year of outperformance, what’s next for Latin American markets in 2026? Will these traditional “hot money” markets give back their gains or is this a turning point for these former investor darlings turned market minnows? To answer these questions, we will dissect 2025’s big year for the region’s largest equity markets, assess where things stand now, and examine the expectations and positioning for the year ahead. While the region is often discussed as a monolith in the media, it is in fact rarely traded as such by investors. Local investors have little intra-regional portfolio flows, but are major players in their own domestic markets, while foreign investors either tend to evaluate each country or individual stocks separately, or they target specific sector-country combinations (e.g. Brazilian banks, etc.). And indeed, while 2025’s top-line returns for the region suggest a unified story, the bottom-up picture is in fact quite different.

Based on the analysis below, we are most positive on Chile, optimistic in Brazil, and broadly indifferent in Mexico. What does unify all these markets, is the material re-pricing of political risk in the United States, which we have discussed at length in many recent thought pieces. The increase in the risk premium in the U.S. has effectively reduced the risk premium for the rest of the world, which was a key factor in driving many non-US markets higher in 2025, especially those available at historically low valuations. Despite the recent U.S. intervention in Venezuela, we think the political economy of Latin America’s largest equity markets remains unchanged at worse and improved in some cases.

Brazil

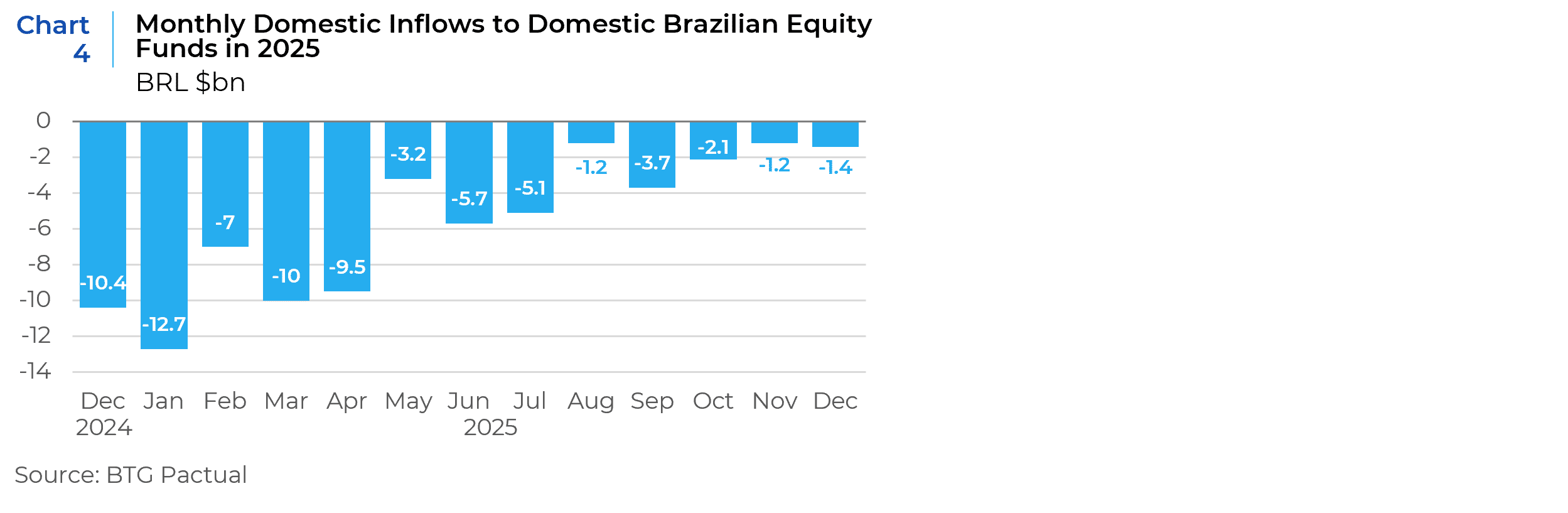

In Latin America’s largest market, the outlook at the beginning of 2025 was negative. Foreign investors’ sentiment on Brazil was bad, interest rates were stiflingly high, economic growth was meek, and Brazilian investors were at their lowest level of allocation to domestic equities in 25 years. This situation deteriorated in 2025 after Brazil was assailed with high tariffs, interest rates increased, the economy stalled, corporate earnings surprised to the downside—all of which led to the largest outflows by local investors from domestic equities in over 20 years! And yet, the market surged +50%. Welcome to the conundrum of Brazil. As a local investment advisor put it “if Brazil[ian] equities can do this well when things aren’t apparently improving, imagine if they actually do!”1

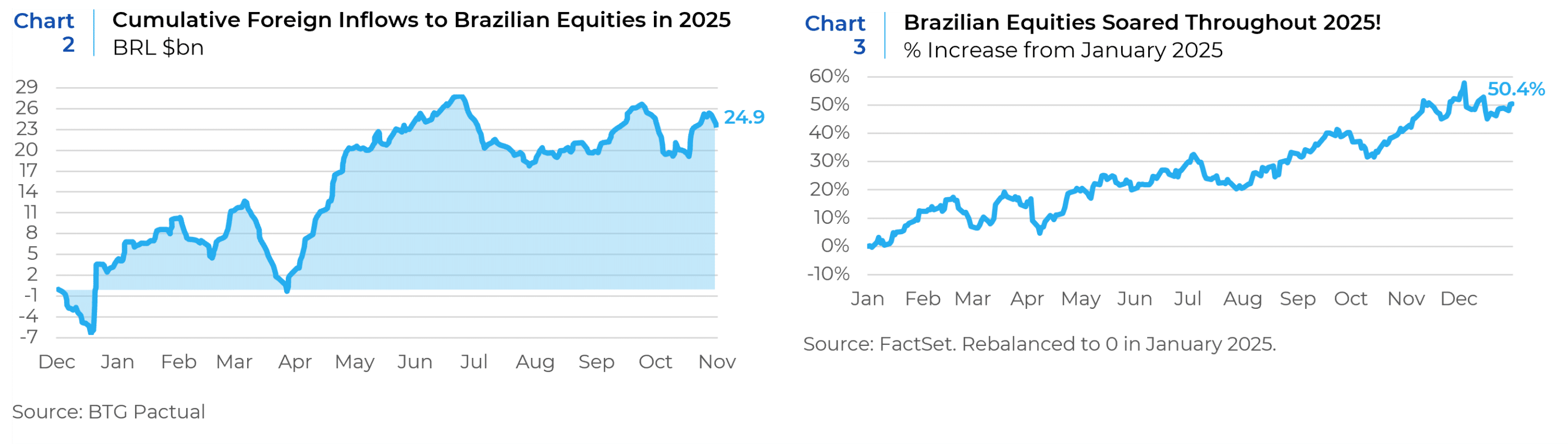

The catalyst for Brazilian equities massive return: President Trump’s now infamous “Liberation Day” in April 2025 (see Chart 2). Following a year of outflows in 2024, and amid very low market valuations, foreigners were already rediscovering Brazil in early 2025 before reversing those flows in the run-up to President Trump’s tariff package, expecting that relatively protectionist Brazil might fare among the worst penalized markets globally. When Trump’s “reciprocal tariffs” shocked the world, leaving Brazilian goods with the lowest possible level of tariffs, foreign investors rushed into Brazilian equities. More importantly, the decline in the USD, boosted Brazilian (and all non-US) equities by both mechanically increasing the value of non-USD assets and reducing the debt burdens for corporate borrowers with USD-denominated debt, thereby increasing their long-term earnings and de-risking their balance sheets. Most of the price gains accrued in the second half of 2025 (see Chart 3) despite a lack of meaningful new flows by local or foreign investors into the market (see Chart 4). Brazilian equity markets’ experience in 2025 thus reminds us that while fundamentals and flows can drive markets, what in fact always drives prices is simple supply and demand.

At the beginning of 2026, Brazilian equities are now only slightly below their historical valuations compared to their own history or their emerging market peers. As such, we see little reason for foreign investors to add to their Brazilian positions absent an upgrade in earnings prospects. But this may indeed occur. Consensus earnings forecasts already expect 15% earnings growth, holding constant FX rates, commodity prices, and local interest rates. Yet the outlook for all three offer upsides for Brazil. Medium-term expectations for the USD remain muddled at best, tailwinds for commodity prices abound, and local interest rates are widely expected to fall in 2026, which provide other potential positive catalysts. Then there’s politics. Brazil will elect a new president in 2026, and the most likely winners are incumbent President Lula – who would enter his fourth (non-consecutive) term and is a politician the market already knows extremely well – or someone to his right that would likely be viewed even more positively by investors. There appears to be little chance of a credible left-wing challenger to Lula that could roil the Brazilian political economy in 2026.

For our outlook, this leaves us sanguine on Brazil over the next 2-3 years. However, we are conscious that last year’s rally was buoyed more by relative global opportunities than improved local fundamentals, and so the risk of those recent trades being unwound remains until local conditions improve.

Mexico

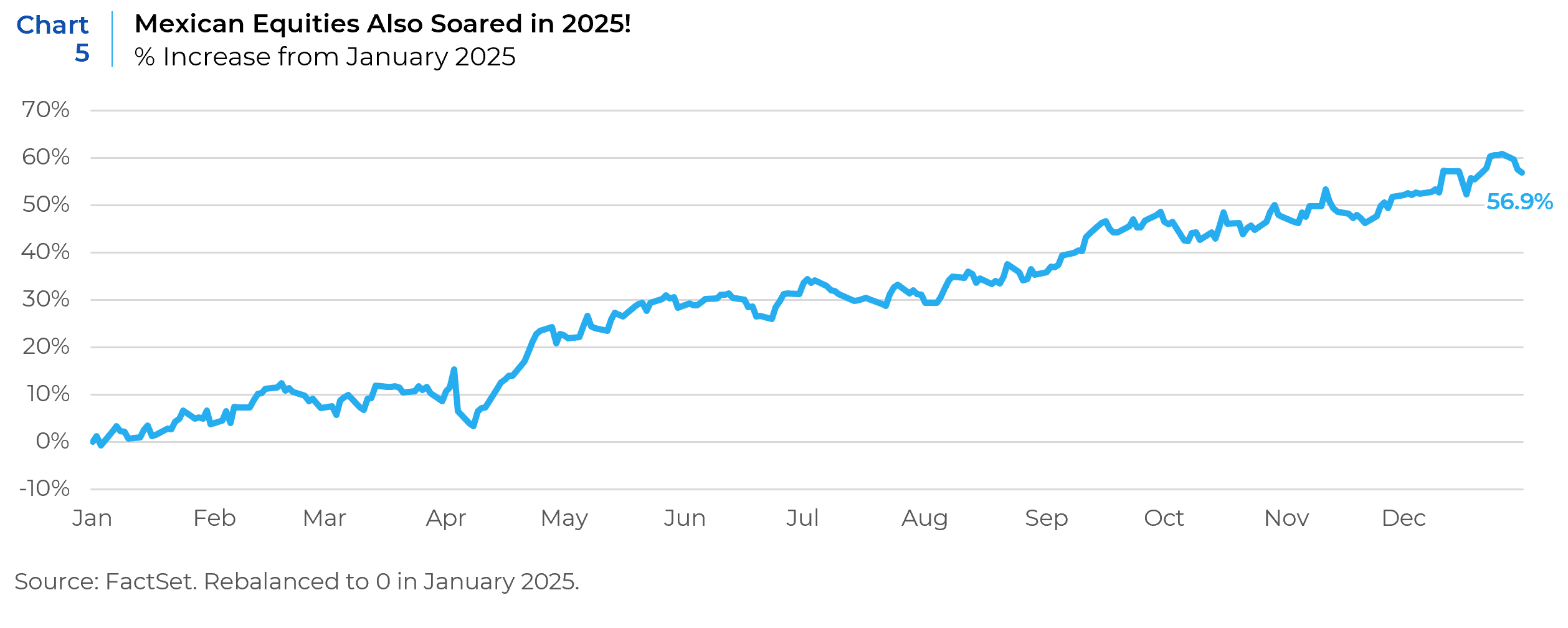

Like Brazil, Mexico entered 2025 with lots of risks and little upside. Growth and earnings expectations were subdued and expectations that Trump would again renegotiate his own renegotiated NAFTA hung over Mexican assets. These doubts combined with lingering policy uncertainty from Mexico’s 2024 presidential election weighed on Mexican equities, which entered 2025 at historic bottoms in terms of percentage of portfolio exposure from domestic and foreign investors. From there, things got worse. U.S. tariff policy, political pressure on immigration, slower growth, earnings weakness all led to a deteriorating backdrop for Mexican assets. The fundamental story of Mexico in 2025 was so meager, that the best that can be said of the year by one sell-side analyst was “on the plus side, Mexico averted a recession.”2

Nonetheless, 2025 was a banner year for Mexican equities, surging +57%. Like Brazil, the combination of USD weakness, less-bad-than-expected tariff news, and a global shift in risk preferences amid rock bottom valuations led to an influx of foreign capital, especially in April 2025 (see Chart 5). A dissection of the Mexican market’s performance reveals a divergence in sectoral drivers before and after “Liberation Day.” In Q1 2025, consumer staples constituted just over half of the overall market’s 6% rally. For the next three quarters, however, materials led the rally (as they did worldwide), contributing over 60% to the rest of the year’s market returns.

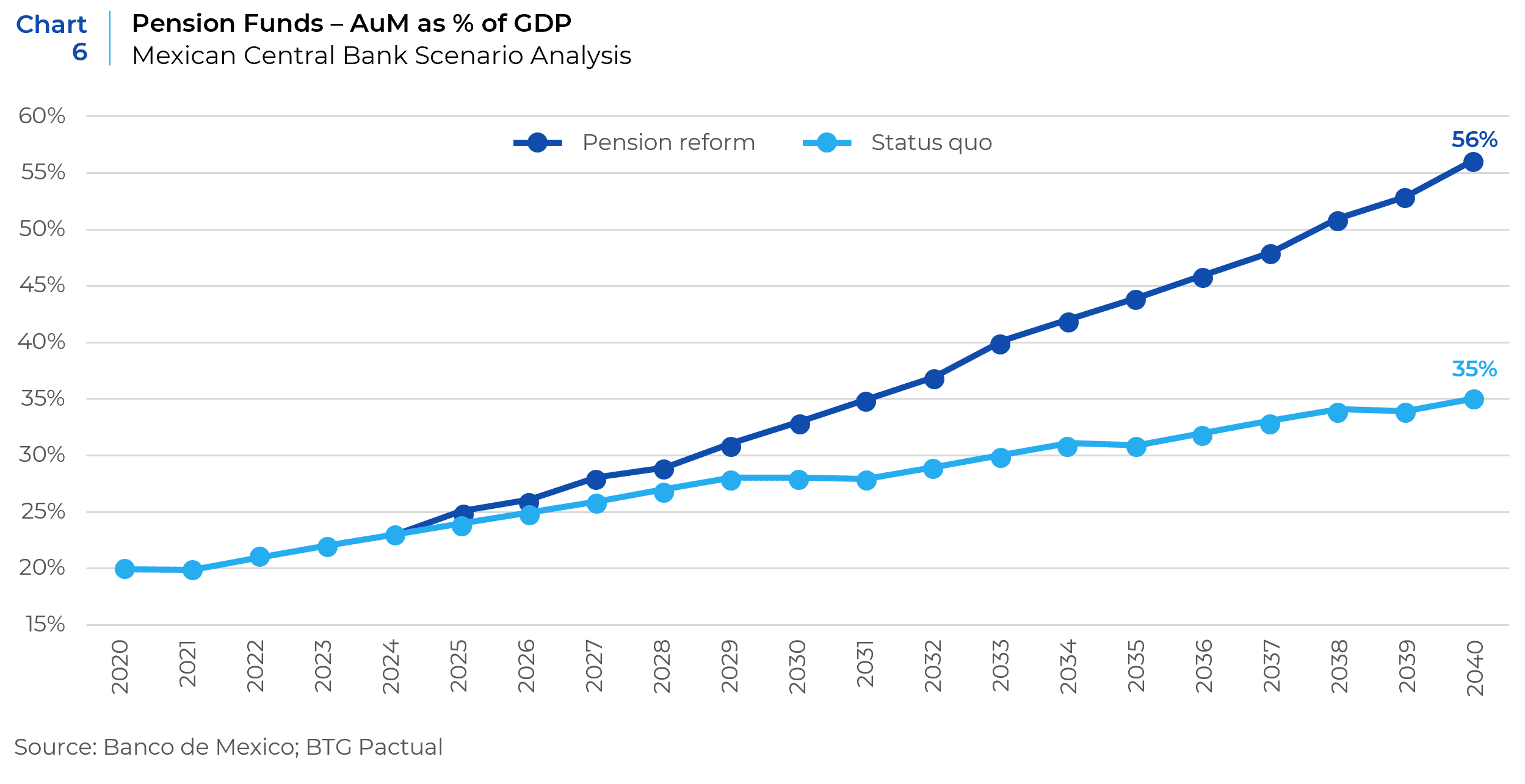

Earnings improvements for Mexican stocks were modest, so multiples expanded accordingly (from 10x forward P/E to 12.5x). The notable difference to Brazil’s experience was the participation of local investors. While Mexican investors did not increase their allocations to Mexican equities in 2025, total pension assets and savings grew steadily throughout the year, which kept local buyers in the market year-round. Pension reforms passed in 2023 led to higher retirement contributions (from 6.5% of salary to 15% of salary, gradually by 2030). Over the next 15 years, this is expected to yield a 60% increase in assets under management in Mexico as a % of GDP (see Chart 6), and thus contribute a steady flow of buyers to the market.

Entering 2026, Mexico’s macroeconomic and fundamental drivers remain modest. Real GDP growth of around 1% (4.5% nominal) is expected to yield around 4-5% aggregate earnings growth on top of a roughly 4% dividend yield for the market, which is roughly in line with local bond yields. Moreover, while Mexican equities remain slightly cheaper than their history or EM peers, they are no longer obvious candidates for re-rating. With fewer obvious positive catalysts in Mexico than Brazil, we find this market less attractive. Though it is worth noting that the pension reforms should yield a constant bid on local assets even without considering the possibility of a demand shift for domestic equities from local investors, where positioning remains at historic lows providing an asymmetrically positive market risk. Thus, any market weakness in Mexican risk assets should be seen as potential opportunities to buy the dip.

Chile

The Chilean story is quite different from its Latam peers. As we summarized in our July 2025 paper discussing historic market dislocations caused by changes in the political economy, in 2024 Chile was just emerging from one of the world’s sharpest dislocations in the past 50 years. To review, nationwide political protests in 2019-20 led to an historic redrafting of Chile’s constitution with a constitutional assembly dominated by left wing and socially focused activists with conservative economic and business interests in the minority. But two successive elections rejected the new constitution, amid resurging growth and a surge in global copper and lithium demand, which buoyed the Chilean economy. The political environment also became more business-friendly with the election of libertarian Antonio Kast to the presidency in December 2025.

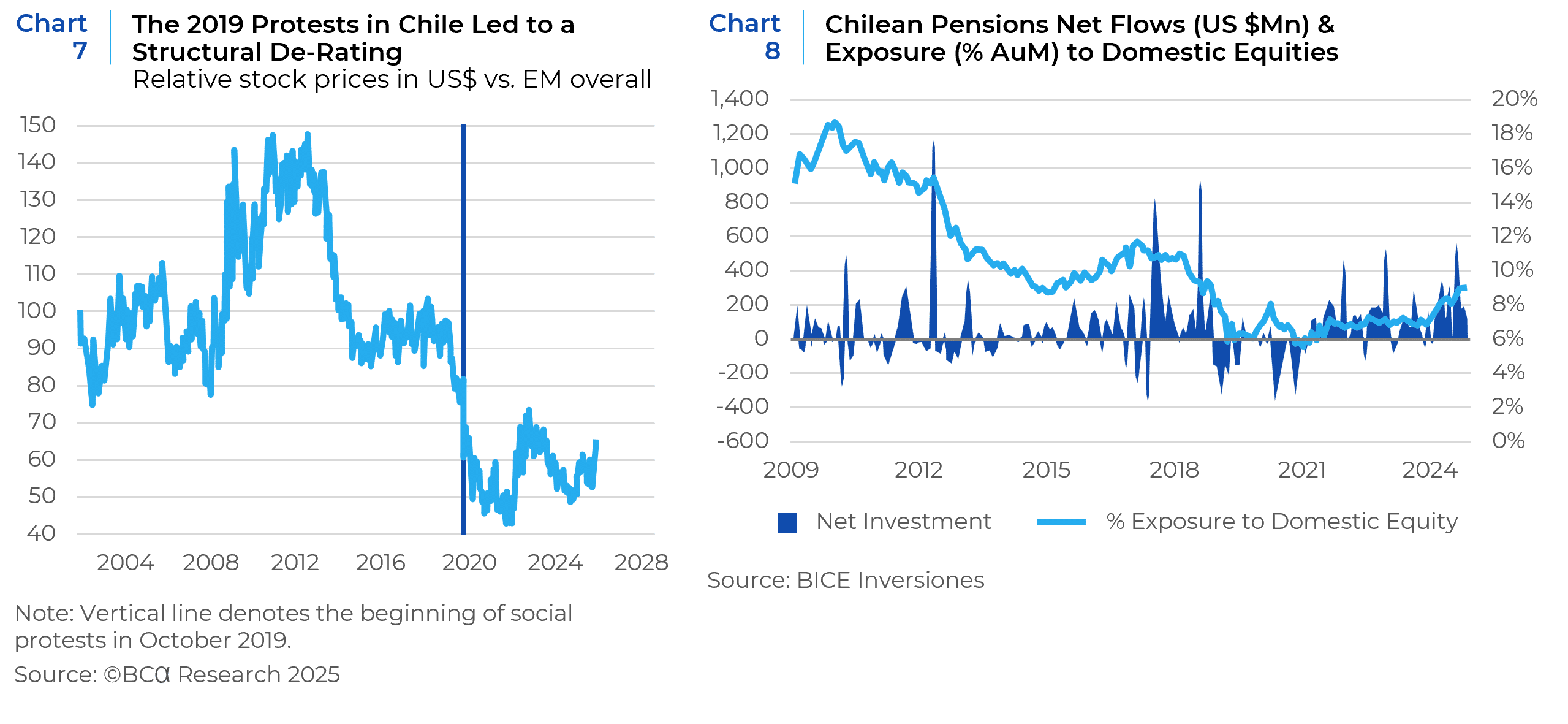

From 2018 to 2023, Chilean equities substantially underperformed their EM and Latin American peers by -56% and -47% respectively (see Chart 7). For most of the 15 years prior to this period, Chilean equities traded at a meaningful 1.5-2x premium to other emerging markets but reached a trough of a 60% discount to global emerging markets amid the political upheaval.

So when the political tides began to turn in late 2024 and early 2025, there were few sellers left of Chilean risk assets and markets surged, largely on buying from Chilean institutional investors, who finished the year with 50% more exposure to their local market than they began (see Chart 8).

While multiple expansion formed the bedrock of this renewed optimism, with forward P/E for the market rising from 9.3x to 12.5x in 2025 and P/B rising from 1.1x to 1.5x, fundamentals also played a role, with corporate earnings also surging 30% in 2025 led by retailers and airlines. What did not play a meaningful role in Chile last year was foreign investors, who – unlike in Brazil or Mexico – remained largely on the sidelines in 2025.

Looking ahead for 2026, consensus earnings forecasts call for 10% EPS growth, which could surge to 15% if the new presidential administration’s proposed tax cuts are ratified. This is also absent material changes in key commodity prices (copper and lithium, mostly) or a further re-rating in the market. Chilean equity market valuations remain about 25% below pre-2019 historical averages on either an absolute or peer relative basis.

For all these reasons, we think the Chilean rally is both durable and has more potential room to run with several catalysts in play and the past rally supported by previously under-allocated local investors. That Chile did not attract more foreign investors in 2025, unlike in Brazil and Mexico, is likely due to liquidity. Many global investors use simple liquidity screens to assess what is investible for their funds, with the two most commonly applied cutoffs set at trailing 6-month Average Daily Trading Volume (ADTV) of USD $10m or USD $5m. As of the end of 2024, only two stocks in Chile had greater than $10m ADTV and 6 stocks had greater than $5m, which is undoubtedly a major reason why foreign investors sat on the sidelines for most of 2025. Whereas by the end of 2025 5 Chilean stocks had greater than $10m ADTV and 12 stocks had greater than $5m ADTV, effectively doubling the investible universe for international funds. This reset of the investible universe for Chile should put it on the research agenda for a greater number of active global investors to pay attention to the market this year. Meanwhile local investors remain buyers in the market, which leads us to expect that any further positive market news which buoys the market’s fundamentals (such as tax cuts, de-regulation, etc.) have the strong potential to catalyze outsized market returns, though we do not expect another year quite like 2025.

Argentina, Peru, Colombia…and…Venezuela?!?

We will summarize the rest of the region in short. After a huge re-rating in 2024, there were few buyers left for Argentina in 2025 and indeed Argentina spent most of the year trading down until a surprise legislative result in October returned the market back to neutral, gaining +5% in 2025. On a 2-year basis, Argentina’s equity market is broadly in-line with its peer set. Today, it trades at roughly the same valuations as Chile, with substantially more risk and less obvious upside. Unlike Brazil and Mexico, Peru lagged in breaking out until the rally in materials stocks kicked into higher gear through the summer and Fall. Peru will hold presidential elections in April 2026, with a conservative candidate expected to win, but with local valuations at 14x forward earnings (up from just 9.9x at the end of 2024), meaningfully above their 10-year history of 12.3x, we think further market rallies are unlikely to come from greater multiple expansion. Indeed, given the recent history of political volatility in Peru (the prior three presidents were all impeached and removed from office), caution seems warranted. Colombia will also hold presidential elections in May 2026, where the polling is much tighter between a libertarian-style candidate and the next-man-up from the left-wing incumbent coalition. Colombia is certainly not expensive at 9.8x forward earnings, which is below its regional and EM peers, but that is also roughly in line with its own history over the past 10 years. The surest bet is to expect volatility.

Lastly, we must talk about Venezuela. The shocking removal of former President Nicolas Maduro from power by U.S. special forces provides capacious fodder for pundits and talk shows to portend a new dawn in Venezuela and global supply shift in oil markets. We think neither is likely. While the justification for removing Maduro from power is dubious at best, and the precedent highly likely to embolden other regional powers to meddle in their respective spheres of influence in the Middle East (Iran, Yemen, Sudan, Libya), Africa (Congo, Niger, Somalia, Mali), Europe (Belarus, Hungary, Ukraine, Georgia) or Asia (Kazakhstan, Nepal, Cambodia, North Korea, Taiwan) it must be said that President Trump chose pragmatic stability over grand ideology in leaving the same Venezuelan regime in power. The lessons of Iraq, Afghanistan, Somalia, South Vietnam and many others is that total regime change is long, hard, and messy, at best. However, President Trump will not get “control” over Venezuela, nor will Venezuela be able to increase its oil production in a market-relevant timeframe. What President Trump will get is a more compliant Venezuelan regime, a weakened Cuban regime, and an expanded defense bill. What markets will get, thus far appears limited to possibly supporting the profit margins of some gulf coast oil refineries, and another catalyst for global defense stocks.

- Brunel Advisors

- BTG Pactual

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.