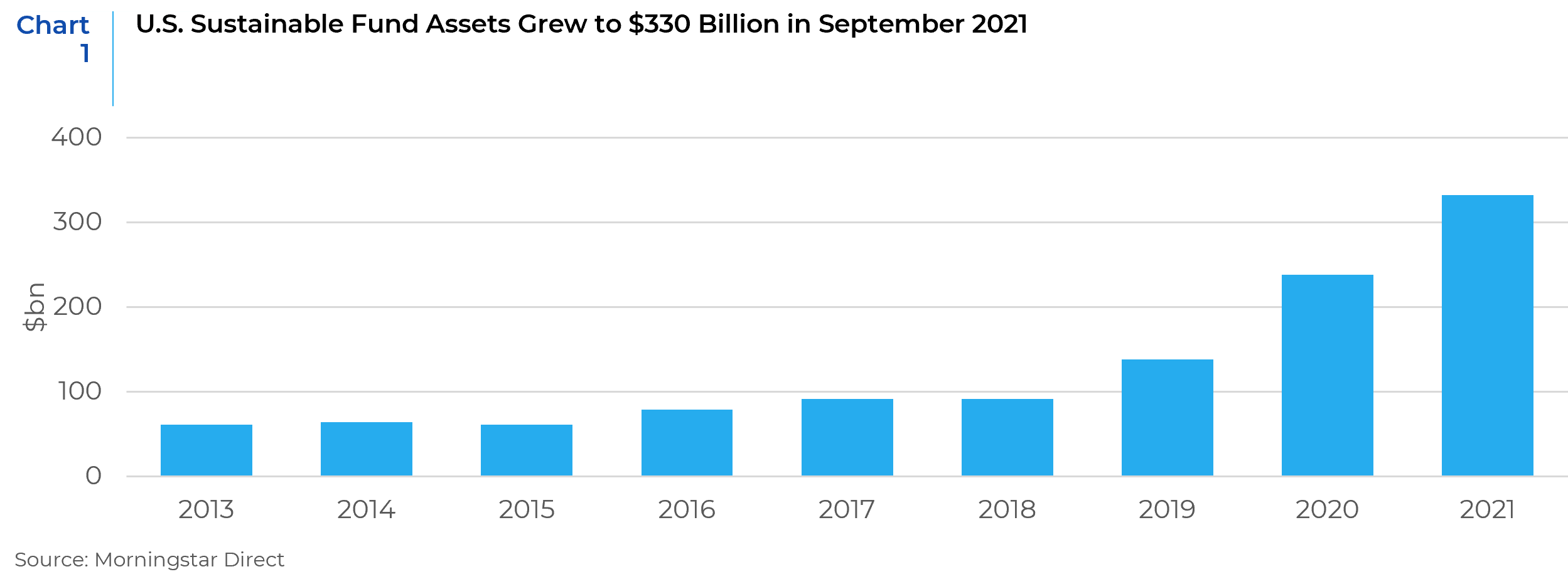

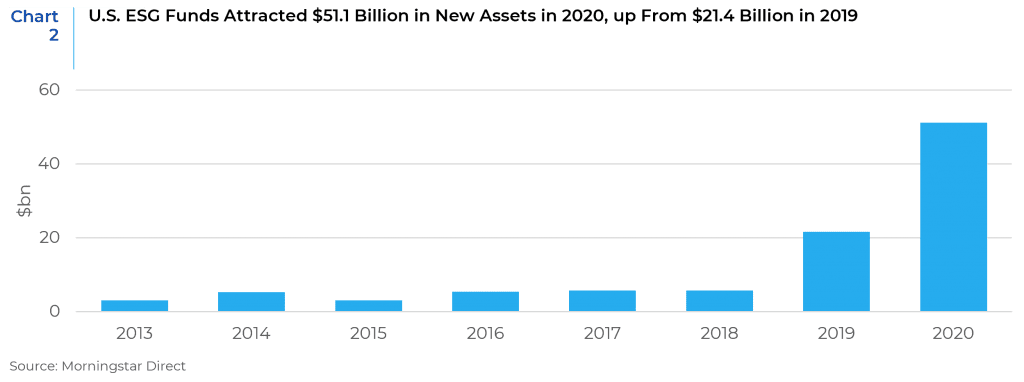

Environmental, Social, and Governance (ESG) investing has been one of, if not the most topical strategies in the financial markets this year. While various forms of responsible investment have been utilized by asset managers for almost four decades, over the past year an increasing number of market participants have begun to focus on improving the structure, transparency, and opportunity set within the space.

The three main segments of responsible investing include ESG, Social Responsibility, and Impact. ESG focuses on the environmental, social and governance practices of an investment that may materially impact the performance of that investment. ESG is practiced in conjunction with traditional financial analysis to provide more robust due diligence in the process of selecting investments with the highest projected returns. Socially Responsible Investing (SRI) involves negatively screening out investments that conflict with specific ethical guidelines. The SRI approach is more absolute relative to ESG as the screening function disregards the magnitude of an investment’s involvement in an adverse sector or the financial implications of that involvement in favor of a hard and fast exclusion. Impact investing, sometimes referred to as thematic investing, focuses on the specific outcome or impact that derives from an investment. Here, the focus is on proactively allocating capital in an investment that is expected to produce a specific and measurable positive outcome.

Across asset classes, equity markets have attracted the lion’s share of attention, investment and resources as it pertains to ESG. With an extremely large investable universe, ample reporting/disclosure requirements and the power of the proxy vote, investors have been able to establish and build out ESG approaches more aggressively relative to other asset classes. While the growth of ESG investing within fixed income has been slower relative to the pace of that in equities, over the past two years there has been a meaningful expansion of assets, resources, and opportunities which is enabling fixed income investors to catch up to their equity counterparts.

Before we delve into the current state of ESG investing in fixed income, let’s take a step back and review some of the natural overlap that exists between the spheres of fixed income and ESG investing. One of the primary concepts fixed income investors must keep in mind is that of asymmetric returns. The vast majority of fixed income assets are issued at par with a maturity date in the future that coincides with a repayment of the initial principal invested. Between issuance and maturity investors earn all of their return in the form of coupon payments that are a small percentage of par. An event of default not only halts this income stream but also tends to permanently impair the investor’s capital, both of which provide a serious drag on investment returns. To not only maximize, but simply to protect returns fixed income investors routinely screen out investments that they deem to have too much default risk.

One precursor to elevated default risk that can at times be elusive to investors is that of poor governance. While traditional fixed income investors routinely review a company’s leverage, interest coverage and cash flow, analyzing a company’s governance practices, especially those of investment grade rated companies, can at times be left out of the diligence process. Governance failures can lead to a swift demise once exposed, despite a higher credit rating (see Enron). As we go further down the path of risk analysis from an ESG perspective, we will find that many of the risks we encounter double as red flags to both ESG-focused investors and traditional fixed income investors alike.

This leads us to recognize the supplementary nature of ESG analysis to that of traditional credit analysis. In both processes, the primary goal is risk mitigation. Another goal is to identify operational trends that have developed or will develop over time and can be detrimental to an investment’s financial profitability. In addition to the governance risk we highlighted previously, both environmental and social risks that may be uncovered in the research process can be detrimental to the financial prospects of a given investment. As we analyze an investment from the ESG perspective, concerns that we uncover will double as concerns for a credit investor in almost every instance. For example, a company that utilizes socially unacceptable labor practices could likely experience labor shortages, company boycotts from customers, or reduced employee productivity as a byproduct of low employee morale. Each of these effects translate into financial headwinds over time if the “S” concern remains unaddressed. Lastly, understanding how ESG factors are anticipated to improve or worsen over time can be beneficial to a credit investor who is deciding between securities with varying maturity dates from the same issuer.

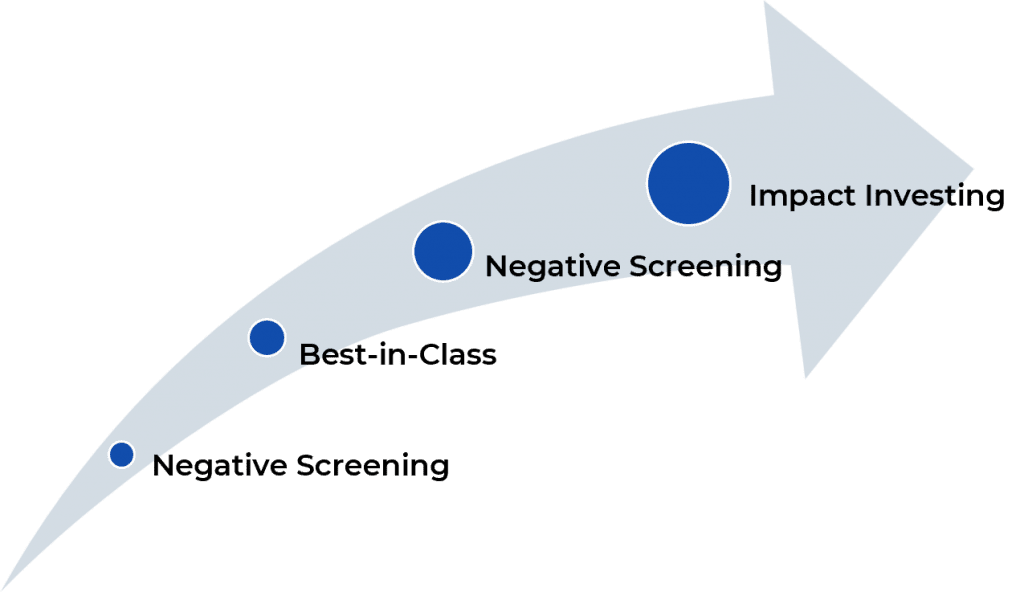

Currently, within fixed income there are four primary approaches to ESG investing: negative screen, best-in-class, thematic exposure, and impact investing. Negative screening is the most simplistic approach whereby the manager reduces ESG exposure by screening out securities with undesirable characteristics (industry, company product set, etc). Here, for example, a client or manager may have an aversion to tobacco-related investments and simplify remove any associated securities from their investable universe. Conversely, the best-in-class approach allows the investor to keep a broad investment universe, but within a given asset class or sector, the investor selects the highest rated securities on an ESG-rated basis (or securities whereby the issuer is making meaningful inroads in improving their ESG risk profile). In this case, the investor may invest in a tobacco company, but only the highest rated company within the sector. In utilizing the thematic exposure approach, the investor focuses on securities that align with a specific ESG-related theme (affordable healthcare, low carbon, etc). This approach tends to create a more concentrated portfolio which features a set of securities that rate highly in a given ESG factor. Finally, impact investing is the most aggressive form of ESG investing within fixed income whereby the investor looks for securities that will produce a specific ESG-related impact utilizing the funds raised through the given security. Investors applying this approach will look for securities where the issuer has a targeted use of proceeds and plans to track the impact of the ESG-related investment relative to its original goal. In terms of ESG scoring or risk evaluation, we favor methods that are more robust and holistic. As with traditional credit analysis, we believe it’s also important to consider an issuer’s momentum and trajectory with regards to ESG risk and value. In addition to considering a company’s operating sector and current ESG practices, we find it beneficial to also consider planned capital expenditures, divestures, and ESG policy changes. Investing in an ESG improvement story is akin to investing in a credit improvement story in that we would anticipate outperformance over time.

Considering all the positive effects ESG investing has on fixed income investors, there are two primary drawbacks that we believe investors should take note of. Firstly, ESG-labeled securities tend to trade at a spread premium relative non-ESG securities. Currently, the premium (also known as a “greenium”) is approximately 4 basis points for bond pairs within the corporate bond universe. Projecting this premium forward would imply that the total returns to maturity should be lower ESG-labeled securities. However, there is the potential for this premium to grow and for the market to also appreciate (i.e. place a valuation premium on) ESG-labeled securities even more in the future as ESG factors translate into more salient operating and financial performance improvements from a given issuer. Secondly, the topic of greenwashing has been a concern of investors. Greenwashing is a process whereby an entity provides a misleading or false impression of a product’s ESG-related impact relative to its actual impact. On a positive note, both investors and regulators have increased surveillance in response to greenwashing claims, which is forcing entities leveraging the ESG space to provide more detailed reporting and a higher level of transparency with regards to ESG-related initiatives.

Xponance has always been a firm believer in ESG practices and within the fixed income platform we have utilized various ESG-investing approaches in the past, namely negative screening and impact investing via the purchase of green bonds. We are excited about the growth of both ESG-related resources and ESG-labeled securities that have become available to fixed income investors in recent years. This year alone ESG Investment Grade bond issuance has increased over 70% versus the same period last year. We anticipate this trend to continue as both investors, issuers, and capital markets desks continue to search for opportunities in the ESG space. We have begun to explore ESG incorporation into our investment process on the fixed income platform here at Xponance, utilizing third-party data and research to evaluate investment opportunities on an ESG-basis. We believe that identifying and considering the impact of ESG factors within investment opportunities can lead to a more robust investment process and act as another risk-mitigant for us as fixed income investors. One important step within the ESG investment process for all investors is deciding what ESG investing means to them. As the sustainable investing space is quite broad and also open to interpretation in many ways, understanding where one wants to be within the continuum of ESG involvement is a crucial stepping stone. We look forward to continuing the ESG conversation and helping our clients find the right solution for their needs.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.