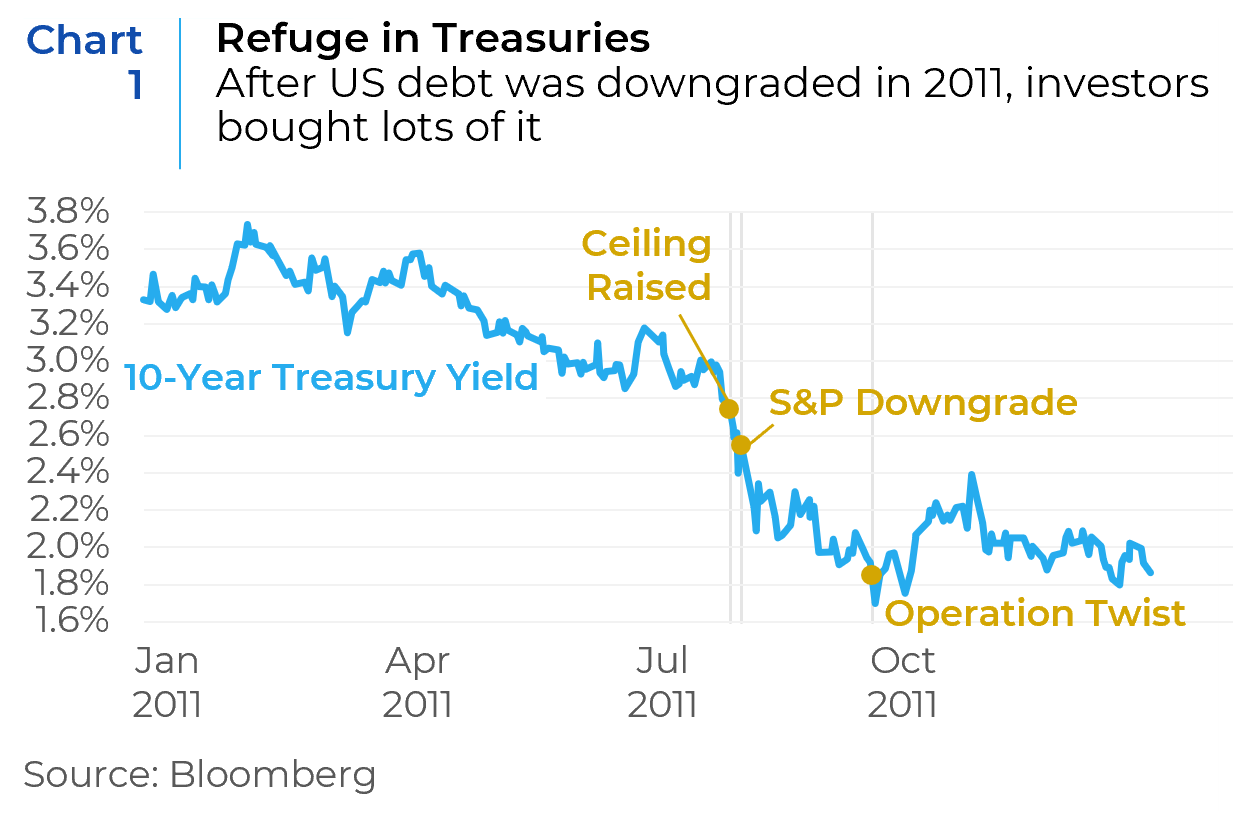

A century later, we are once again facing a high-stakes game of brinkmanship in which Congress is refusing to raise the debt limit to pay for previously legislated expenditures. The United States reached its debt limit in January. Secretary Yellen has warned that the U.S. Treasury will have exhausted the headroom created by “special measures” in June. Because a default would be unprecedented, its exact consequences are difficult to predict. The last close call was in 2011, when the United States came within days of defaulting after Republicans and Democrats struggled to reach an agreement on increasing the debt ceiling. After Standard & Poor’s downgraded the U.S. debt rating, global stocks slouched, and emerging-market countries’ bond prices fell as Washington inched closer to a default. Relative to 2011, the escalating showdown could be even more damaging. First, the amount of debt the U.S. must refinance is about twice as large as in 2011. Unlike in 2011, inflation is higher than it has been in four decades, and interest rates have reached a 15-year high. Against 2011’s relatively benign macro backdrop, the FOMC had the policy flexibility to implement “Operation Twist,” which further anchored treasury bond yields. (Chart 1). I agree with the market consensus that the parties will likely get to a compromise – but only in the eleventh hour. Unfortunately, we are even more polarized than we were in 2011 – heightening the possibility of an unforced error into technical default. If the US economy avoids recession, Republicans will likely be staring down the barrel of a Democratic victory in 2024. The Biden Administration wants Congress to raise the debt limit without any conditions so that the government does not cut spending ahead of the 2024 election. Under the misguided belief that a technical default would produce market volatility without permanently damaging the faith and credit of the United States, hard right Republicans may be willing to undertake extreme risks to put the brakes on economic growth.

The Treasury Secretary and Federal Reserve Chair are, for now, reluctant to publicly disclose details about their contingency planning. This is almost certainly due to concerns that the knowledge of such contingency plans would embolden politicians to push the government into default. There is speculation that the President could declare a failure to pay public debt unconstitutional and order the Treasury and Fed to take emergency actions to make payments on the basis of section IV of the fourteenth amendment, which says “the validity of the public debt of the United States … shall not be questioned.” But such a response would almost certainly be challenged in the courts, which would engender further uncertainty. The Treasury could also initiate a messy and painful prioritization of principal and interest payments on U.S. debt obligations, sacrificing other expenditures, such as social security checks. That is the playbook that was outlined in the transcript from a 2011 FOMC conference call.

The United States derives tremendous geopolitical power from the dollar’s status as the world’s leading currency. Unfortunately, irrespective of whether a last-minute deal is obtained, this latest imbroglio feeds into a gradual corrosion of the U.S.’ global standing as a well-functioning democracy.

The geopolitical stakes are even higher. Unfortunately, irrespective of whether a last-minute deal is obtained, this latest imbroglio feeds into a gradual corrosion of the U.S.’ global standing as a well-functioning democracy. The United States derives tremendous geopolitical power from the dollar’s status as the world’s leading currency. About half of all international trade is invoiced in U.S. dollars and half of all international loans and global debt securities are denominated in dollars. The U.S. dollar accounts for 58 percent of all allocated reserves globally, with the next closest currency—the euro—accounting for 20 percent of all reserves. Because most international trade is in U.S. dollars, the United States can print money to pay for goods it buys from abroad, allowing it to finance a large international trade deficit without worrying that it will run out of cash. The strength of the dollar allows American households, businesses, and governments at all levels to fund themselves far more cheaply than would otherwise be the case. At least so far, it has also conferred on the United States the unique capacity to absorb a shock, such as the 2011 downgrade of the United States’ credit rating, without seeing the country’s borrowing costs rise or U.S. currency fall in value. Dollar primacy also gives the U.S. government the singular power to deliver an economic shock to an adversary, by excluding it from the dollar-based global financial system through sanctions. That’s why the U.S. has been able to orchestrate the most severe economic sanctions campaign in history against Russia. Washington may need to employ an even more consequential sanctions campaign against Beijing in the event it attacks Taiwan or gives Moscow lethal support for the war in Ukraine. But these sanctions which effectively weaponize the U.S. dollar’s primacy, may also prove to be a double-edged sword as the U.S. faces increasing geopolitical competition from China and Russia, both of whom have made clear their desire to challenge the U.S.-led international order.

Over the past 2 decades, the dollar’s share of the global currency landscape has declined from 66 percent to 58 percent.

Both Beijing and Moscow are openly taking steps to raise the attractiveness of alternative currencies for international economic and reserve purposes, building multinational financial infrastructures to promote trade and investment in renminbi and rubles. Moreover, several bilateral payment structures have emerged that bypass the U.S. dollar (especially among the BRIC countries). In other words, both the geopolitical incentive and operational capacity to reduce exposure to dollars are on the rise, and another debt ceiling drama needlessly gives other countries further justification to consider alternatives. Additionally, foreign holdings of U.S. government bonds are up $2.5 trillion since 2011 to $7 trillion; of these holdings, at least $1.5 trillion are held by governments that are not members of the G-7 and may have a geopolitical motivation to pare their exposure to dollars. A severe debt-ceiling crisis would provide another touch point to for other countries to further diversify their foreign exchange reserves and accelerate efforts to identify alternative payment infrastructures. Already, anti-dollar bankers globally are emboldened by the current turmoil, adding fuel to their arguments for currency diversification. During the 2011 crisis, the global share of foreign currency reserves held in U.S. dollars decreased by 1.4 percent —more than four times the average annual decline since the beginning of the millennium. Over the past 2 decades, the dollar’s share of the global currency landscape has declined from 66 percent to 58 percent.

Investment Implications

In 2011, most of the financial and economic impact was short-lived, vanishing after Congress lifted the debt ceiling that August. In fact, after the credit rating downgrade, borrowing costs fell and the dollar strengthened—a result of the exorbitant privilege of issuing U.S. government bonds, the asset of choice for any investor seeking haven from risk, plus the good fortune of there being no plausible alternative to U.S. dollars. Also, Europe was descending into its debt crisis at the time, Japan was mired in stagnation, China had yet to meaningfully open its onshore capital markets, and digital assets had not gone mainstream.

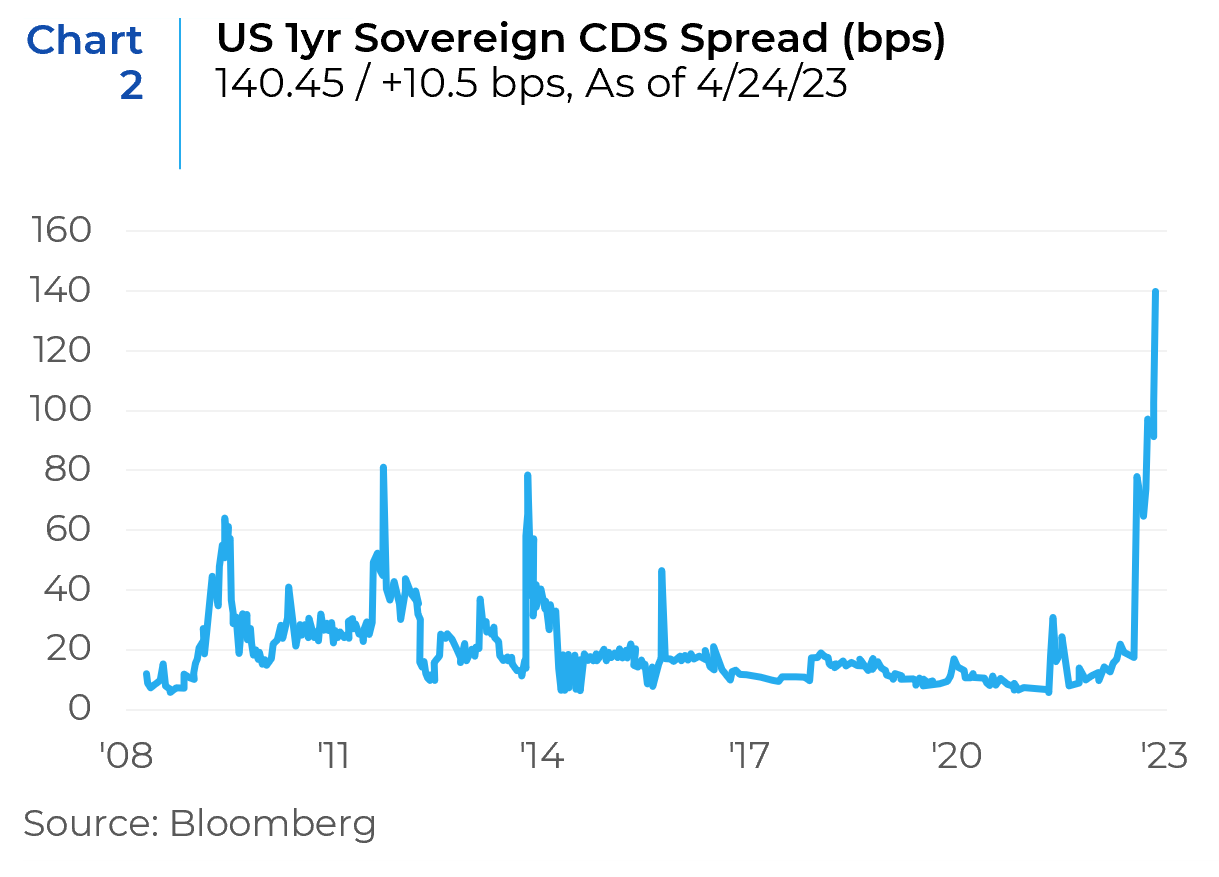

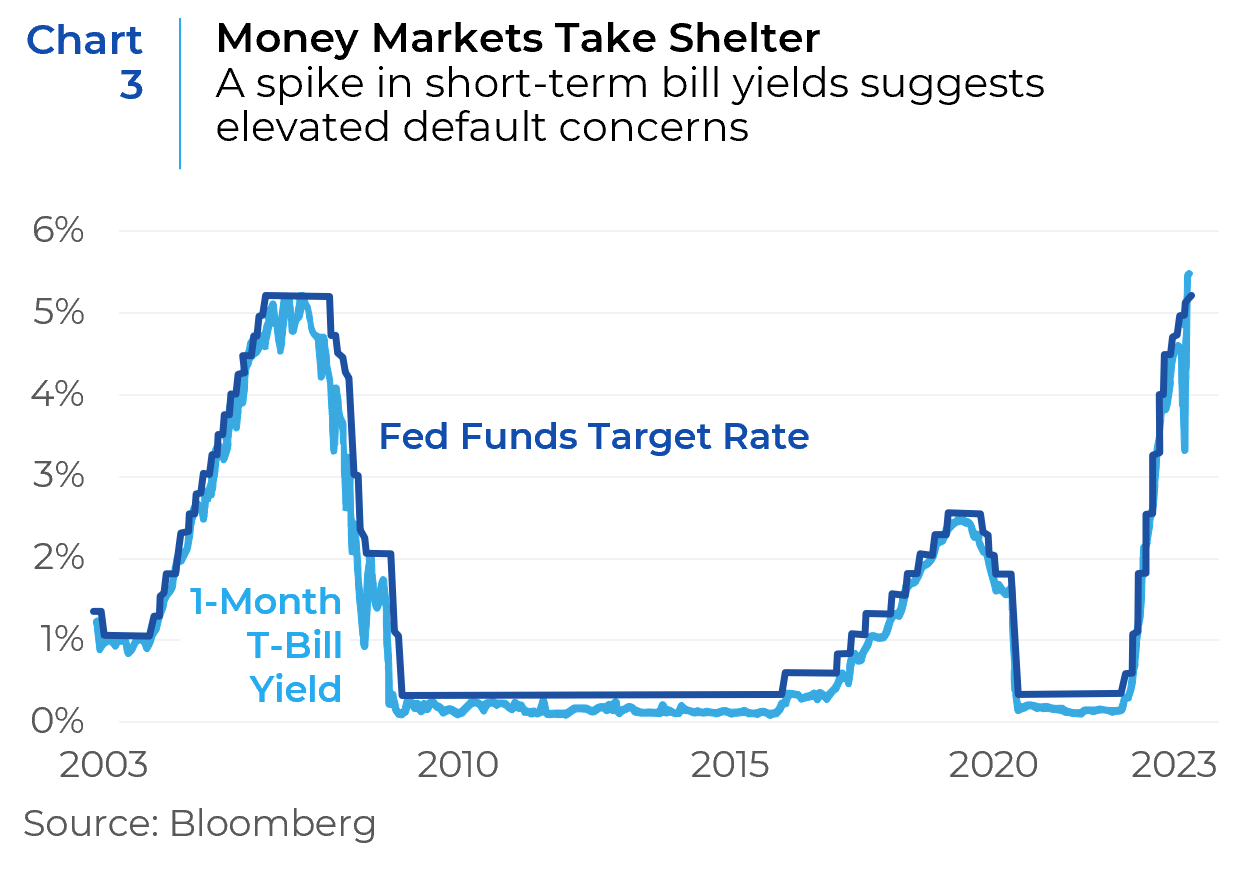

Investors are gradually waking up to the real possibility of a default. Accordingly, Credit Default Swaps, which measure the cost of insuring against a U.S. default, have surpassed their 2011 level. (Chart 2). The yield on the one-month Treasury bill, generally considered the world’s safest investment option, is now higher than even before the Global Financial Crisis. (Chart 3). In the short term, investors should brace for higher T-bill rates and lower bond yields as the debt limit approaches. If the debt limit debate is not resolved before the “X-date” is reached, we would expect long-dated Treasury yields to fall again as the debt limit approaches. This is because long-dated Treasury yields will be more sensitive to the risk of fiscal drag stemming from the Treasury Department ceasing spending operations than they will be to any potential increase in the fiscal risk premium. As in 2011, global equities – which from the beginning of May to the end of the crisis, in July, decreased by seven percent cumulatively—would again be expected to swoon. The U.S. dollar would also temporarily come under pressure. In 2011, it depreciated by almost 4.0 percent against the Japanese yen and 2.5 percent against the Chinese yuan.

With great humility in the track record of such declarations, we do believe that this time is different. Just as the pandemic accelerated trends in online shopping, digital payments, and remote work, a U.S. debt crisis today runs the risk of accelerating the already nascent trends of de-dollarization. As of the writing of this note, Fitch, one of the three major credit rating agencies, has warned of a credit downgrade. Standard & Poor’s never restored the U.S. to its pre-2011 AAA status. Both actions reflect an unfortunate perception that the dysfunction stunningly displayed by the debt ceiling crisis has become structural, which will ultimately increase the risk premia required for U.S. assets and thus challenge their relatively favorable valuations. May the wisdom and spirit of Alexander Hamilton finally prevail over our leaders.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospects for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct, but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.