The Secondary Losers (and Winners) of the Credit Suisse Collapse

The graveyard of once legendary business franchises has just added one more new member to its ignominious fraternity. The hastily arranged acquisition of Credit Suisse by its chief Swiss rival UBS in March 2023, ended the 166-year run of the global symbol of Swiss banking largesse. Credit Suisse was once the 15th largest bank in the world with offices in 50 countries and assets of over $1 trillion USD. Its demise, especially coming on the heels (and perhaps partly because) of the collapse of a couple of small U.S. regional banks, casts a long shadow over today’s fragile market. But this shadow is perhaps longest among two groups of niche investors in the market: AT1 bondholders and oil-rich Middle Eastern investors. The fallout from the losses absorbed by these two disparate groups may have further secondary effects on markets for years to come, representing both potential opportunities and risks to investor portfolios.

The UBS acquisition of Credit Suisse was an all-share offer equivalent to roughly USD $3.2 billion. The result is a loss of about 75% of Credit Suisse’s equity value, which was roughly $12 billion at the start of 2023. With equity holders losing most, but not all of the value of their shares, basic rules of capitalism would lead most market observers to thus expect bondholders to be made whole, or at least to not yet incur losses as those debts would be absorbed by the acquirer. However, bondholders are in fact expected to absorb even more losses than shareholders, to the tune of approximately $17 billion in a niche part of the bond market known as “AT1s”.

An Alphabet Soup of Losses

Additional tier one (AT1) bonds, also known as contingent convertible (“coco”) bonds (terms which will be used interchangeably for the remainder of this article), were a post GFC innovation that allowed banks to support their ailing balance sheets, without further diluting shareholders or senior bondholders. These bonds are junior debt that pay higher yields, but convert to a subordinated class of equity in the event of bank insolvency. Coco bonds are now used by most systemically important banks around the world with a total estimated market size of around USD $270 billion. As such, Credit Suisse’s (pre-collapse) 6.3% share of this market made it one of the larger issuers globally.

The write-down of Credit Suisse’s AT1 bonds, orchestrated by the Swiss Financial Market Supervisory Authority (FINMA), occurred on March 19, 2023.1 At the time, the AT1 bonds constituted approximately 10% of Credit Suisse’s total debt issuance. While the likelihood of lawsuits over these government-imposed losses mean it will likely be many years before we can assess the full scope of damages to Credit Suisse bondholders, some bond managers are already reeling from mark-to-market losses.

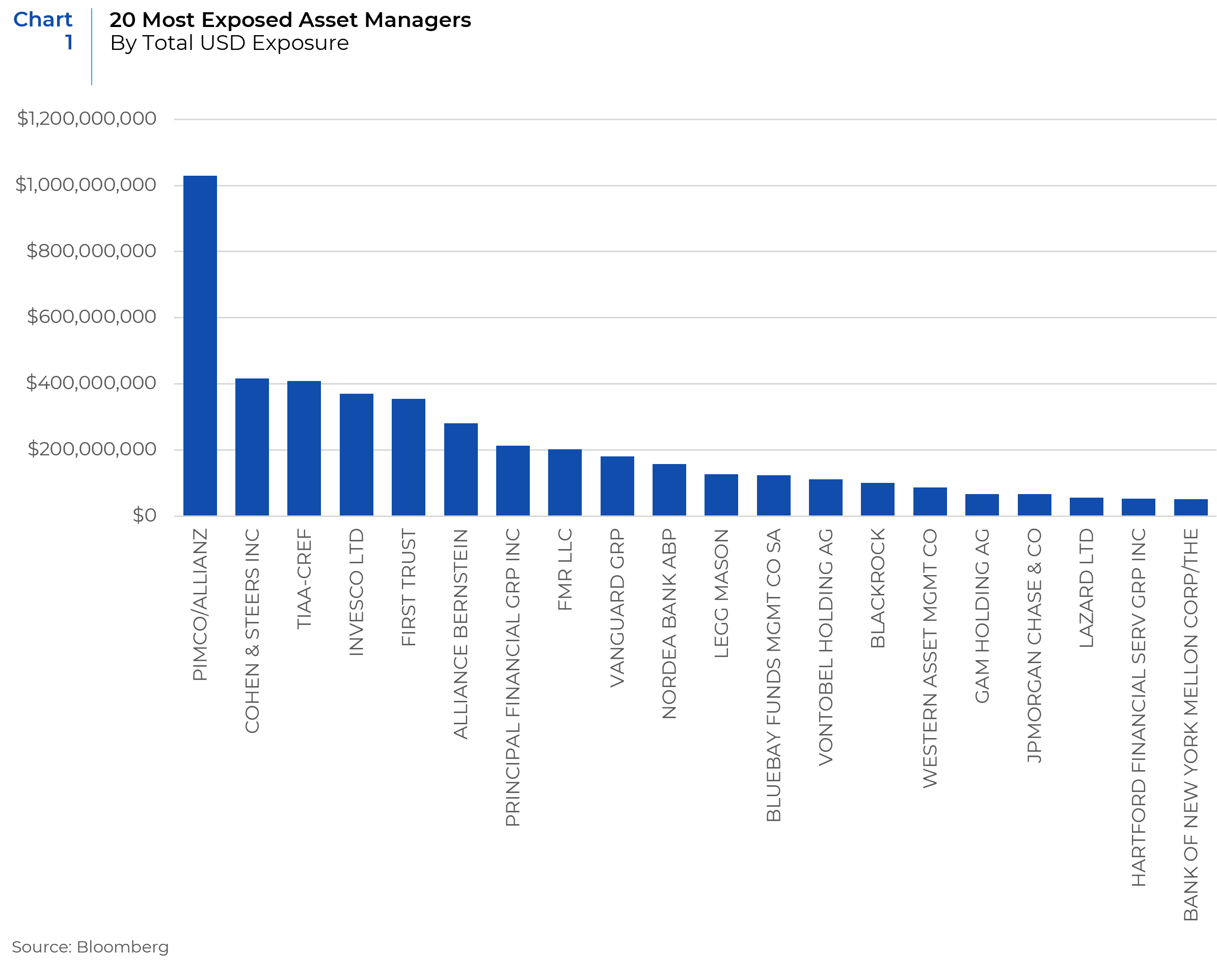

According to news reports, PIMCO and Invesco were the biggest losers in Credit Suisse’s AT1 write-down.2 Chart 1 shows the fund managers with the most exposure to Credit Suisse’s coco bonds according to Bloomberg reported data. As one would expect, PIMCO, the world’s largest active bond manager, tops the list by far. However, while PIMCO may face the largest absolute dollar losses incurred across an array of funds (and probably managed accounts as well, but for which data is unavailable), it is also had by far the most broad exposure to coco bonds globally. PIMCO’s exposure to Credit Suisse’s AT1 bonds was a mere 10% of their estimated exposure to all coco bonds globally. This is still overweight Credit’s Suisse’s estimated 6% market weight (by issuance), but less of an outlier in the context of PIMCO’s large asset base. Invesco also makes the top four, but behind Cohen & Steers and TIAA-CREF, so it’s unclear (other than brand recognition), why Invesco was singled out ahead of them by media outlets.

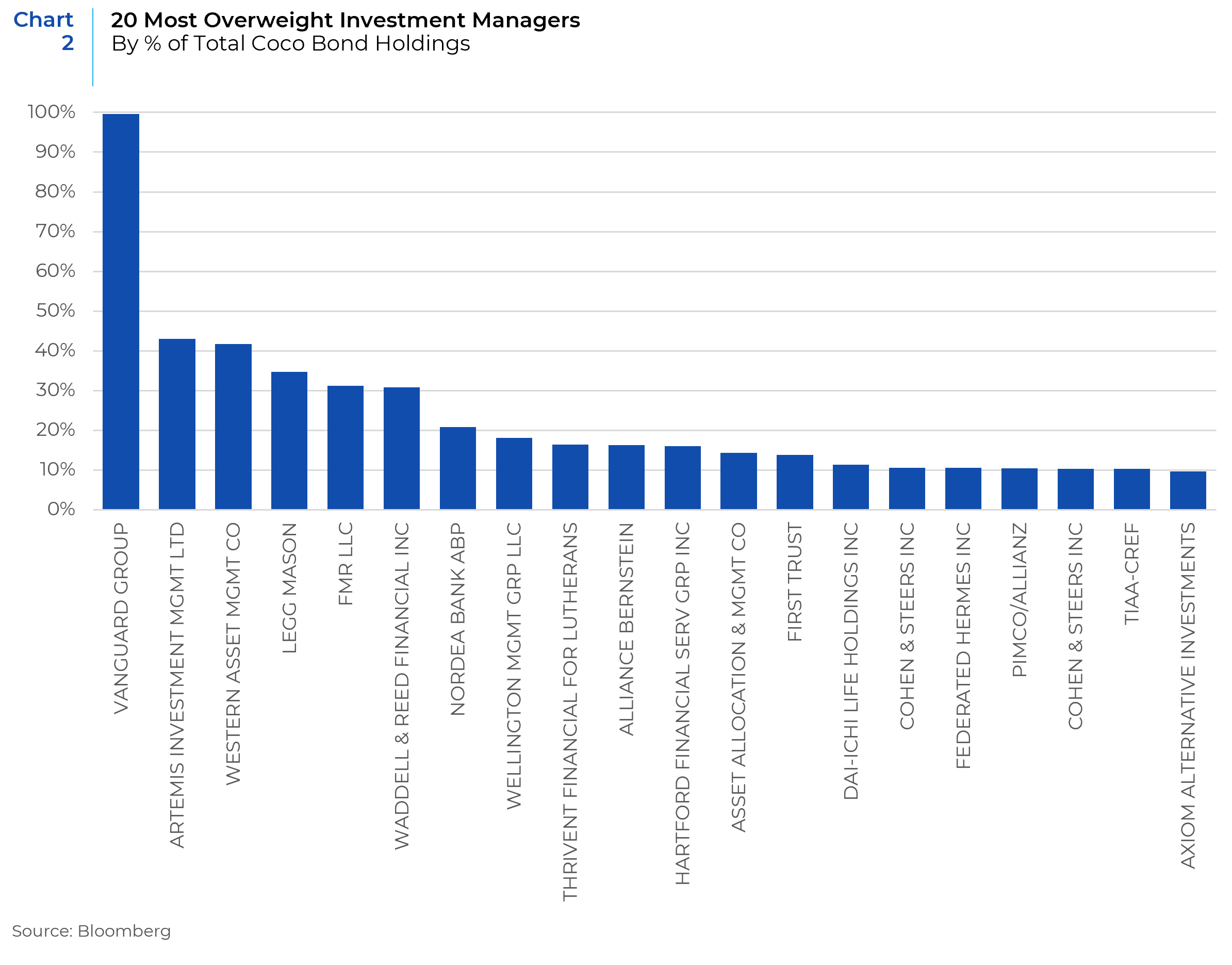

Another way to assess the fallout from Credit Suisse’s coco collapse is to examine investment managers’ security selection or risk management within their overall AT1 books. In this context, a very different picture emerges. Chart 2 takes the list of all coco bond holders in Bloomberg, looks at just those investment managers with over USD $100 million in total global coco bond exposure, and looks at the percentage of their coco bond portfolios represented by Credit Suisse’s AT1 securities. PIMCO is now 16th on the list and Invesco doesn’t even make the top 20.3 Instead, we see that Vanguard stands far above (below?) its peers in having put nearly all its AT1 eggs in the Credit Suisse basket. Its estimated USD $180 million holdings of Credit Suisse coco bonds represented 99.5% of all AT1 bonds it held across all of its various funds (for which Bloomberg had data), all of which was held within their High Yield Corporate Fund (VWEAX/VWEHX). Not only were Credit Suisse’s AT1 bonds the only such coco bonds in this fund, they were the 5th largest position in the fund as of 12/31/22 (ignoring Treasuries/cash).4 While there were a handful of other managers with undiversified bets on Credit Suisse’s coco bonds, the next such manager with more than 50% of their coco bond portfolio in Credit Suisse had a mere $13m in total exposure.

In our almost 3 decades of experience with portfolio managers, we have found that those investment teams most likely to do the most post-mortem soul searching after incurring steep losses are those that were burned more from the tails of their portfolios than the core. The further out of context steep losses are felt, the more likely it is to beg questions about the decision-making that led to such seemingly aberrant concentrations of risk. To this end, while we expect that nobody with exposure to Credit Suisse (in any instrument) was in a particularly good mood on March 19, we would expect to see the most fallout within investment teams from the top managers in Chart 2, instead of Chart 1, as the investment media might have one believe.

It is important to note that we only have comprehensive data on those Credit Suisse bondholders that have to report holdings, which is mostly regulated investment funds. By our estimates, this is less than half of the overall picture. As legal filings begin to pile up, the ultimate universe of bondholders will likely become clearer, but a material pool of such investors can apparently be found among some newly dissatisfied private wealth clients in Asia. Wall Street Journal reporting out of Hong Kong claims that “many private bankers in Asia pushed AT1 bonds from various banks to their clients in recent years.”5 Worse still, according to the former CIO of Morgan Stanley in Asia, is that “leveraged bets on AT1 securities [had] been among the favorite pitches of relationship managers at private banks in Asia.”6 To compound the irksome with the ironic, reportedly it was wealth managers at Credit Suisse rival turned acquirer, UBS, that was one of the leading houses pushing Credit Suisse’s coco bonds.

Early indications are that these losses are tarnishing the Swiss banking brand in Asia. This is especially bad news for UBS, as Credit Suisse’s Asia business had been one of the few areas of growth for the business over the past decade of scandals and declines, and was where there was the least overlap with existing UBS business.7 This includes the $115 billion fund-management joint venture between Credit Suisse and China’s largest bank (by assets), the Industrial & Commercial Bank of China Ltd. ICBC Credit Suisse Asset Management is the largest (by assets) mutual-fund joint venture between a Chinese and a foreign institution.8 But if the prevailing mood among Asian investors becomes widespread, decades of brand building by Credit Suisse and UBS may already be at risk. As one Taiwanese investor said “I don’t feel safe putting my assets in Swiss institutions now. It seems that the regulators there can do whatever they want.”9

Petrodollar Recycling Hits a Snag

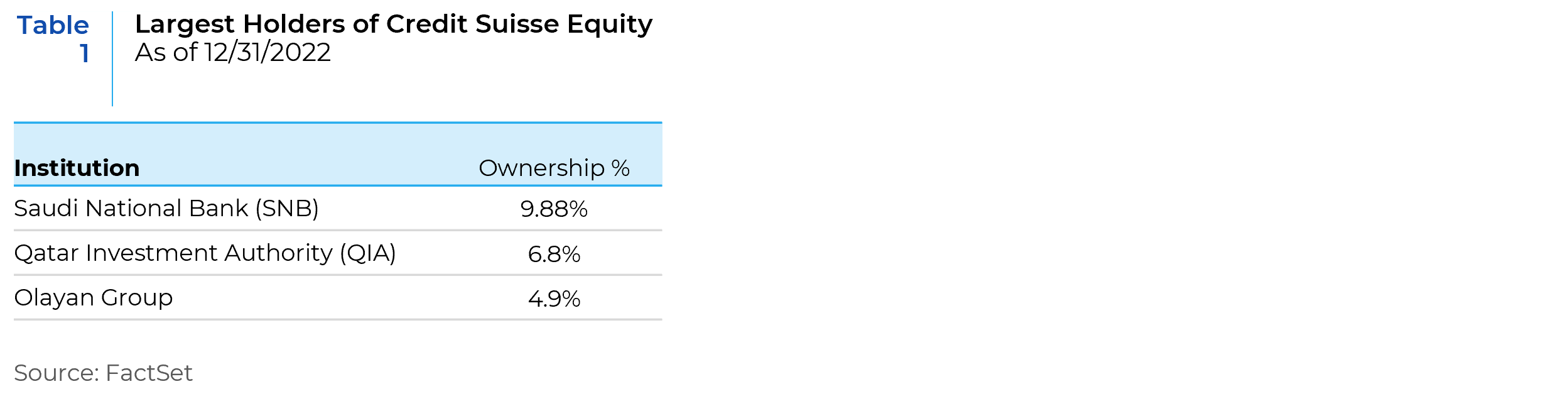

The mood on the other side of Asia may be just as sour. All of Credit Suisse’s top three equity holders were large Middle Eastern investors, for a total of nearly 22% of equity. While they did not get completely wiped out like the AT1 bondholders, their 75% loss of capital remains very material. Worse still, two thirds of these losses came following substantial investments made just in the past six months. The Saudi National Bank (SNB), the largest state-owned bank in Saudi Arabia, acquired all of its 9.9% stake in the Fall of 2022. Meanwhile, the Qatar Investment Authority (QIA), the sovereign wealth fund of Qatar, nearly doubled its shareholding in Credit Suisse at the same time. Meanwhile the Olayan Group, a large Saudi conglomerate/family office, also nearly doubled its stake in Credit Suisse last Fall, having been a long-time strategic shareholder and board member in Credit Suisse going back to 1998, including a brief stint in 2016 when its stake surpassed the 10% threshold.

At the time, SNB CEO Ammar Al-Khudairy called the purchase “a steal”.10 Six months later, Mr. Al-Khudairy was out of a job. Indeed, most observers attribute al-Khudairy himself to having caused, or at least accelerated Credit Suisse’s collapse. On March 15, following the collapse of a few small banks in the U.S. and ensuring pressures across financial stocks globally, Mr. al-Khudairy was asked by a Bloomberg reporter whether the bank would consider increasing its stake in Credit Suisse. His reply was “absolutely not, for many reasons outside the simplest reason, which is regulatory and statutory.”11 Bloomberg ran the quote with the headline of “Credit Suisse Reels After Top Shareholder Rules Out Raising Stake”12 and “absolutely not” became the buzzword for a panicky market. Four days later, the 166-year old franchise melted into the alpine frost.

At the time of SNB’s investment, SNB had said in a more carefully worded statement, “SNB has no current plans on going beyond a 9.9 per cent shareholding in Credit Suisse and any future investment would be appraised individually at the time by carefully considering the merits of such investment based on financial impact, capital treatment and long-term shareholder value creation.”13 Whether a greater modicum of diplomacy by Al-Khudairy at that critical moment might have saved Credit Suisse (or his own job), will never be known. What seems more certain is that the long-time Saudi banking executive’s missteps will have surely reinvigorated the stature of corporate public relations firms and investor relations executives in C-suites around the world.

For SNB itself, the Credit Suisse debacle seems otherwise less consequential. The losses amount to less than 0.5% of total SNB assets and less than 2% of SNB’s investment portfolio.14 As of April 15, SNB shares are already trading above their February 2023 levels. For its part, the QIA manages over USD $500 billion in assets, and so their estimated USD $500 million losses may not even amount to their largest monthly detractor in their portfolio. Olayan will be much harder hurt, as it is thought to be closer to USD $10 billion in assets, but as a private entity there is presently little information on the fallout there.

The investments by SNB and QIA into Credit Suisse come on the heels of generations of petrodollar recycling by the oil rich gulf sovereigns, which has accelerated to new heights following Russia’s invasion of Ukraine and the global surge in oil prices. Anecdotally, we hear from our managers based in or frequenting the region that airports are newly filled with American and European venture capital and private equity executives eager to find new sources of capital as higher interest rates have hamstrung sales back home. The consensus is that the Saudi and Qatari investors in particular (but to a lesser extent the Emiratis as well) all simply have so much money they need to put to work in overseas investments that the Credit Suisse debacle should do little to dry up the broad petrodollar pipeline to Europe and the U.S. that already includes significant stakes in so many other high profile investments including Volkswagen, the Empire State Building, Heathrow Airport, Cathay Pacific, the London Stock Exchange, the UK National Grid, and an array of European football clubs.

However, the managers we’ve spoken to all also believe that recent events are likely to cool sentiment towards further forays into European and American financials, at least in the near-term. This assessment has been echoed in the financial press as well, with one analyst at EFG Hermes assessing that “SNB is now unlikely to pursue its dreams of establishing itself as a global player in investment banking.”15 Pulling such a pivotal pool of potential investors out at a time of general fragility for the sector could prove painful if further banks find themselves under pressure before memories fade.

Isn’t it Ironic, Don’t You Think?

A loss of faith in Swiss financials among Middle Eastern investors appears to have been the opposite of the intent of Swiss authorities in orchestrating the Credit Suisse takeover by UBS at the expense of AT1 bondholders. Reporting in the London Telegraph claimed that “Experts speculate that the decision [to wipe out bondholders in favor of partial equity losses] was taken to appease the Saudis and stop them pulling business from other Swiss lenders.”16 One CEO of a London-listed bank went even further in saying “I’m absolutely convinced it [the Swiss regulatory decision] was politically motivated.”17 Taken together with the fallout from AT1 bondholders, it seems the Swiss regulator may have made enemies on all sides. Between likely-to-sue American bond managers and heavily disillusioned Asian private wealth clients, the fallout from this episode may be no less than the long-term brand impairment of Swiss banking itself. Actions over the past 10 years to crack down on tax evasion, money laundering, and then to participate in global financial sanctions (as with the freezing of Russian central bank assets in 2022), had already cut into some of the allure of the Swiss financial system for many of its historical users. But insolvency and regulatory uncertainty (real or perceived) could be the last straw.

A long-term secular decline in Swiss financials emanating from frostier attitudes in the Middle East and Asia, would most likely benefit a mix of blue chip local wealth managers as well as those few global competitors already on the ground. We expect to see an uptick in liftouts of wealth management teams and investment bankers from UBS and the former Credit Suisse in east Asia in particular. As for the market in AT1s, we expect to see some abandonment of AT1 securities in general, especially by those yield chasers at the top end of the distribution in Chart 2. This should lead to higher yields in this asset class in general, which should prompt some national regulators to clarify their potential treatment of AT1s within the bond stack in order to lure investors back in. Higher yields and further complexity is the sweet spot for credit hedge funds, which is where we would expect the slack in this market to eventually be picked up over time. Most immediately, however, we expect higher volatility in financials stocks, greater intra-sector dispersions, and a talent search for stock-picking expertise in a difficult-to-master sector.

- https://www.finma.ch/en/news/2023/03/20230323-mm-at1-kapitalinstrumente

- https://www.bloomberg.com/news/articles/2023-03-20/pimco-invesco-face-losses-in-credit-suisse-at1-debt-writedown#xj4y7vzkg

- In fact, half of Invesco’s total exposure to Credit Suisse’s AT1 bonds came from their AT1 ETF, which is a passive index tracking vehicle. Source: Bloomberg.

- https://investor.vanguard.com/investment-products/mutual-funds/profile/vwehx

- https://www.wsj.com/articles/credit-suisses-risky-bond-wipeout-hurts-asias-rich-a502ce

- Ibid.

- https://www.wsj.com/articles/ubs-faces-tough-choices-as-it-weighs-up-credit-suisses-asian-business-dc881ae3

- Ibid.

- https://www.wsj.com/articles/credit-suisses-risky-bond-wipeout-hurts-asias-rich-a502ce

- https://www.cnbc.com/2022/10/31/credit-suisse-shares-are-a-steal-say-new-saudi-backers-snb.html

- https://www.bloomberg.com/news/articles/2023-03-15/credit-suisse-top-shareholder-rules-out-more-assistance-to-bank-lf9gfhbr#xj4y7vzkg

- Ibid.

- https://gulfnews.com/business/banking/saudi-national-bank-picks-strategic-99-stake-in-credit-suisse-for-15b-1.1667110411667

- https://www.cnbc.com/2023/03/20/saudi-national-bank-loses-over-1-billion-on-credit-suisse-investment.html

- https://www.msn.com/en-us/news/world/how-credit-suisse-lured-and-then-burned-the-saudi-crown-prince/ar-AA19lja9

- Ibid.

- Ibid.

This report is neither an offer to sell nor a solicitation to invest in any product offered by Xponance® and should not be considered as investment advice. This report was prepared for clients and prospective clients of Xponance® and is intended to be used solely by such clients and prospective clients for educational and illustrative purposes. The information contained herein is proprietary to Xponance® and may not be duplicated or used for any purpose other than the educational purpose for which it has been provided. Any unauthorized use, duplication or disclosure of this report is strictly prohibited.

This report is based on information believed to be correct but is subject to revision. Although the information provided herein has been obtained from sources which Xponance® believes to be reliable, Xponance® does not guarantee its accuracy, and such information may be incomplete or condensed. Additional information is available from Xponance® upon request. All performance and other projections are historical and do not guarantee future performance. No assurance can be given that any particular investment objective or strategy will be achieved at a given time and actual investment results may vary over any given time.